Starter Credit Cards Market Research, 2032

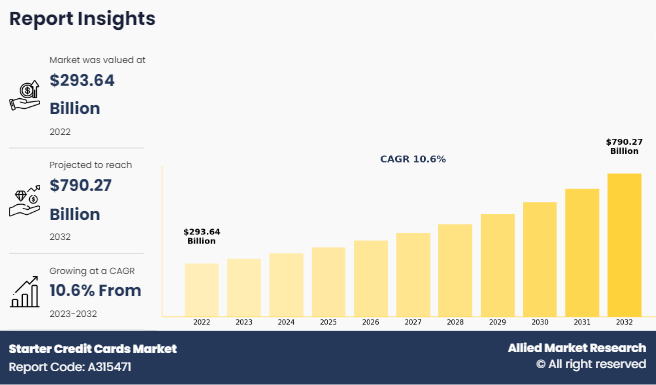

The global starter credit cards market size was valued at $293.6 billion in 2022, and is projected to reach $790.3 billion by 2032, growing at a CAGR of 10.6% from 2023 to 2032. Starter credit cards are financial tools designed for individuals with limited or no credit history. These cards have more lenient approval requirements compared to traditional credit cards and are aimed at helping users establish and build a credit profile. Starter credit cards come with lower credit limits and may have higher interest rates and fees as a means for financial institutions to mitigate risk associated with a borrower's limited credit history.

Key Takeaways

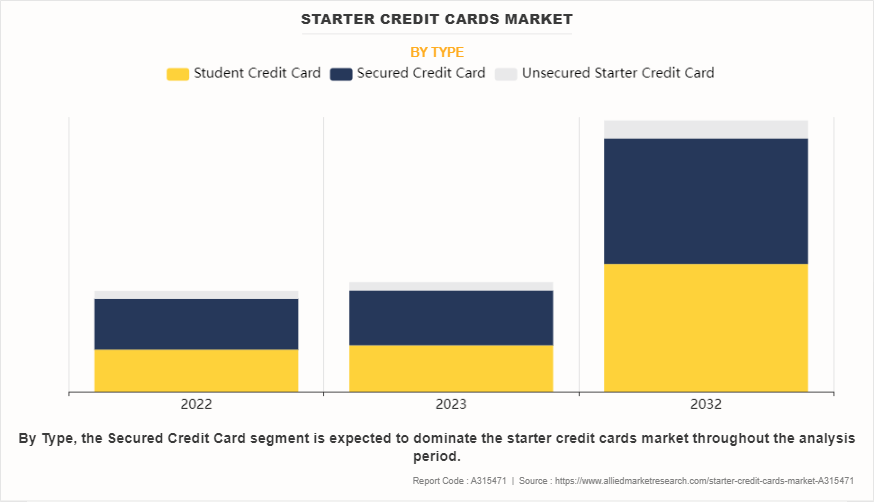

- By type, the secured credit card segment held the largest share in the starter credit cards market in 2022.

- By annual fee, the no annual fee card segment held the largest share in the starter credit cards market in 2022.

- By provider, the NBFCs segment is expected to show the fastest market growth during the starter credit cards market forecast period.

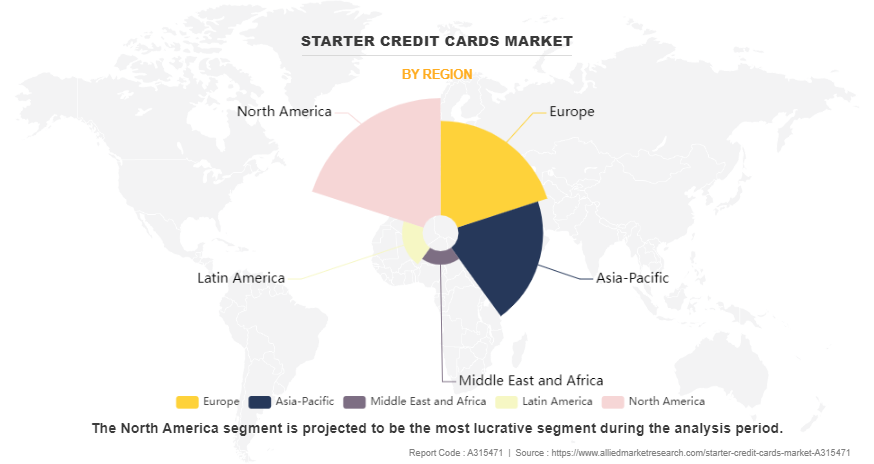

- Region-wise, North America held the largest starter credit cards market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Governments and financial institutions are working to integrate more individuals into the formal financial system, and starter credit cards serve as an accessible entry point for those with little or no credit history. This is especially significant for younger age groups or lower-income individuals who may not meet the requirements for traditional credit cards. The emphasis on financial inclusion expands the demand for starter credit cards, offering users a pathway to build credit and access broader financial services.

Furthermore, advancements in digital technology have also transformed the starter credit cards market. Online banking, mobile applications, and digital payment systems have made issuing and managing these cards more streamlined and user-friendly. These innovations enable faster application processes, immediate approvals, and effortless account management, allowing financial institutions to better meet the needs of first-time credit card users. The ease and accessibility of digital platforms align well with the preferences of tech-savvy consumers, fueling the starter credit cards market growth.

Segment Review

The global starter credit cards market outlook is segmented into type, annual fee, provider, and region. On the basis of type, the starter credit cards market is categorized into student credit card, secured credit card, and unsecured starter credit card. On the basis of annual fee, the starter credit cards market is bifurcated into no annual fee card and low annual fee card. On the basis of provider, the starter credit cards market is differentiated into banks, NBFCs, credit unions, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa

On the basis of type, the secured credit card segment acquired a major share in the starter credit cards market in 2022. This is attributed to their accessibility for individuals with limited or poor credit histories. These cards require a security deposit, which serves as collateral and minimizes the risk for lenders, making them more willing to extend credit to those with lower credit scores. As a result, individuals who have difficulty qualifying for traditional unsecured credit cards use secured cards to build or rebuild their credit.

Region-wise, North America dominated the starter credit cards market in 2022. This is attributed to the region's robust financial infrastructure and widespread availability of banking services that make it conducive for the proliferation of credit card products, including those tailored for individuals with limited credit histories. Furthermore, the prevalence of digital banking and fintech innovations in North America has facilitated easier access to credit products, allowing financial institutions to reach a wider audience and offer starter credit cards with competitive terms. However, Asia-Pacific is expected to be the fastest-growing region during the forecast period. This is attributed to the region's rapidly expanding middle class and increasing urbanization that led to rising consumer demand for financial products, including credit cards, to facilitate spending and lifestyle needs.

Competition Analysis

Competitive analysis and profiles of the major players in the starter credit cards market include Discover Bank, American Express Company, Capital One, Deserve, Credit One Bank, N.A., Citigroup Inc., Bank of America Corporation, JPMorgan Chase & Co., U.S. Bank, and OpenSky. These players have adopted various strategies to increase their market penetration and strengthen their position in the starter credit cards industry.

Recent News in the Starter Credit Cards Industry

- In September 2024, JPMorgan Chase started negotiations with Apple to potentially replace Goldman Sachs as the credit card partner for the tech giant.

- In September 2024, U.S. Bank announced cash back card to its collection – the U.S. Bank Smartly Visa Signature Card. The card purports to offer an industry-leading unlimited 4% cash back rate on all eligible purchases. Its base rate is an unlimited 2% cash back on every purchase, which is a solid rate offered by several competitors on the market.

- In March 2022, Zeta, a banking tech unicorn & provider of next-gen credit card processing to banks & fintechs, and Mastercard announced a 5-year global partnership. As part of the agreement, the firms were jointly to launch credit cards with issuers worldwide on Zeta’s modern, cloud-native, and fully API-ready credit processing stack. Mastercard has underscored the partnership by making a financial investment in Zeta.

- In December 2021, American Express in partnership with Nova Credit, expanded credit access to people from Brazil, Dominican Republic, Kenya, and Nigeria who have moved to the U.S. The growth of this first-of-its-kind digital capability enables newcomers from nine countries to use their international credit history to apply quickly and easily for personal American Express Cards.

Top Impacting Factors

Driver

Increasing in emphasis on financial inclusion

Rise in focus on financial inclusion globally is significantly boosting the starter credit cards market. Starter credit cards, designed for individuals with limited or no credit history, provide a stepping stone to financial independence by helping users establish and build credit profiles. Governments, financial institutions, and fintech companies are increasingly introducing initiatives to promote access to financial services for underserved populations, fueling the demand for these credit products. For example, in March 2022, Bank of America launched the Business Advantage Unlimited Cash Rewards Secured credit card, Business Advantage Secured Credit Line, and the Start a Business Center, its products and resources for entrepreneurs looking to start a small business or build their business’ credit history.

Further, the global push for digital banking and cashless economies in emerging markets, such as India and Africa where governments have launched initiatives to bring unbanked individuals into the formal financial system. For example, India's Pradhan Mantri Jan Dhan Yojana (PMJDY) aims to provide universal banking access, enabling millions to access basic banking facilities. A total of 540.5 million bank accounts have been opened under the government's flagship financial inclusion scheme Pradhan Mantri Jan Dhan Yojana (PMJDY) as of November 2024, according to the Inclusive Finance India Report 2024. The report noted the accounts have a total of ₹2.37 trillion in deposits. This widespread financial inclusion provides a strong foundation for introducing starter credit cards specifically designed for first-time users. Fintech companies are also leveraging technology to cater to the needs of financially excluded demographics.

Restraints

Limited credit limits

The starter credit cards market, designed primarily for individuals building or rebuilding their credit, faces a significant challenge due to limited credit limits. These cards typically offer low initial credit lines to minimize risk for card issuers. While this approach protects financial institutions from potential defaults, it restricts the usability and appeal of these cards for consumers. Limited credit limits often fail to meet the spending needs of users, making these cards less attractive as compared to other financial products like secured cards or co-signed credit options. Consumers with constrained credit limits may also find it difficult to maintain a low credit utilization ratio, a critical factor for improving credit scores. High utilization can negatively impact their credit profiles, counteracting the purpose

Opportunities

Rise in middle-class populations and smartphone penetration

Rise in middle-class population and increase in smartphone penetration are key drivers for the growth of the starter credit cards market. As millions of individuals move into the middle class, they experience improved financial stability and purchasing power. This demographic seeks access to credit to fulfill aspirations such as shopping, travel, and essential purchases, driving demand for entry-level credit products like starter credit cards. These cards provide an accessible gateway for individuals to build or improve their credit profiles, particularly in emerging economies where traditional banking is less prevalent.

Simultaneously, growing smartphone penetration enables easy access to digital financial services. Fintech apps and digital platforms simplify the process of applying for and managing credit cards, removing geographical and infrastructural barriers. With smartphones, individuals can quickly monitor transactions, set spending limits, and receive financial education. This ease-of-use fosters trust among first-time users and accelerates adoption. By targeting tech-savvy middle-class consumers, financial institutions can tap into this burgeoning market. Tailoring credit card offerings with flexible terms, low limits, and digital-first solutions ensures inclusivity and financial empowerment, driving future market expansion

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the starter credit cards market analysis from 2022 to 2032 to identify the prevailing starter credit cards market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the starter credit cards market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global starter credit cards market trends, key players, market segments, application areas, and market growth strategies.

Starter Credit Cards Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 790.3 billion |

| Growth Rate | CAGR of 10.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 291 |

| By Type |

|

| By Annual Fee |

|

| By Provider |

|

| By Region |

|

| Key Market Players | Credit One Bank, Bank of America Corporation, American Express Company, U.S. Bank, Capital One, JPMorgan Chase & Co., OpenSky, Citigroup Inc., Discover Bank, Deserve |

Analyst Review

The starter credit cards market plays a crucial role in driving financial inclusion, especially for young adults, students, and individuals with limited credit history. This market represents a significant opportunity to build customer loyalty and establish long-term relationships. The growing digitalization of financial services and rise in financial awareness among millennials and Gen Z are key factors driving the market growth.

The focus should be on tailoring products with features such as low credit limits, no annual fees, and rewards programs aligned with customer needs. Leveraging digital tools like AI-driven credit risk assessment ensures a seamless onboarding process while minimizing default risks. Collaboration with educational institutions and fintech platforms can further enhance reach and engagement with the target demographic. Regulatory compliance and ethical practices are the most important, as these cards often target vulnerable populations. Transparency in terms, such as interest rates and fees, can build trust and brand equity. In addition, integrating financial literacy initiatives with starter card offerings can empower customers to manage their finances effectively, driving retention and cross-selling opportunities. The competitive landscape demands them to invest in technology, data analytics, and customer-centric innovation to position their brand as a trusted partner in building financial futures

The size of the global starter credit cards market was valued at $293.64 billion in 2022 and is projected to reach $790.27 billion by 2032.

The key players operating in the global starter credit cards market include Discover Bank, American Express Company, Capital One, Deserve, Credit One Bank, N.A., Citigroup Inc., Bank of America Corporation, JPMorgan Chase & Co., U.S. Bank, and OpenSky.

Partnership and product launch are the key strategies opted by the operating companies in this market.

Leveraging advanced analytics and alternative data sources presents an opportunity for financial institutions to assess creditworthiness more accurately, potentially expanding the market reach of starter credit cards in the upcoming years.

The base year is 2022 in the starter credit cards market.

Loading Table Of Content...

Loading Research Methodology...