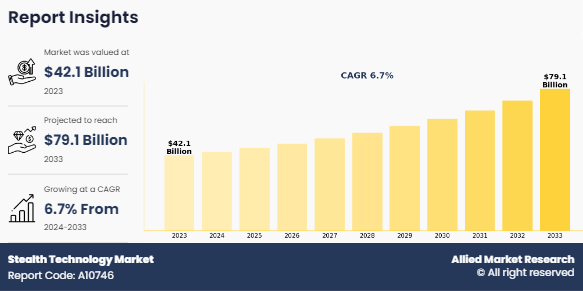

The global stealth technology market was valued at $42.1 billion in 2023, and is projected to reach $79.1 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Stealth technology, also known as low observable technology, refers to a set of techniques and design principles used to make military assets such as aircraft, ships, submarines, and vehicles less detectable by radar, infrared, sonar, and other detection methods. Techniques include shaping surfaces to deflect radar waves, using materials that absorb radar energy, and minimizing heat and noise signatures. These technologies primarily focus on reducing radar cross-section, as well as addressing acoustics, thermal signatures, and other detection methods. The simplest form of stealth is visual camouflage, which involves using paint or materials to break up the lines and color of a vehicle or person. Most stealth aircraft utilize matte paint and dark colors, and they typically operate only at night. Stealth technology includes any military technology designed to make vehicles, aircraft, or missiles nearly invisible to enemy radar and other electronic detection systems.The stealth technology industry is rapidly advancing, developing innovative solutions to enhance the invisibility of military assets.

Key Takeaways

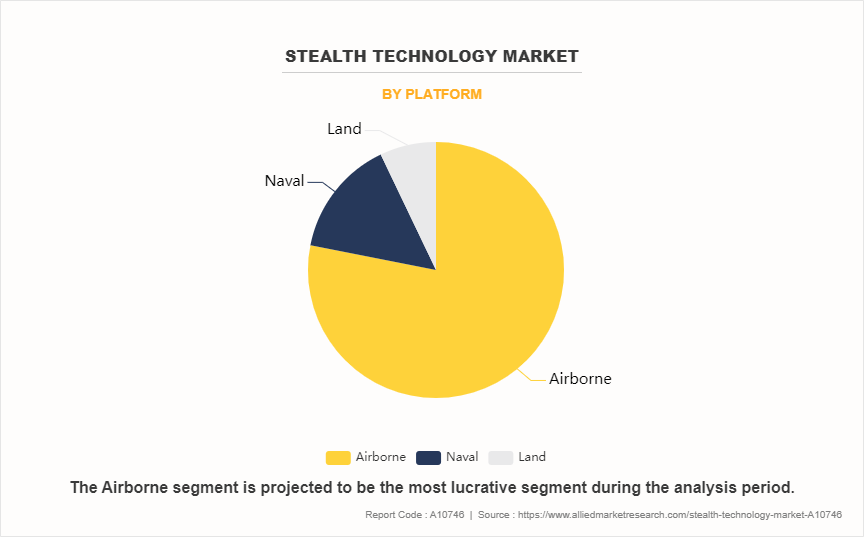

- On the basis of platform, the airborne segment held the largest share in the stealth technology market in 2023.

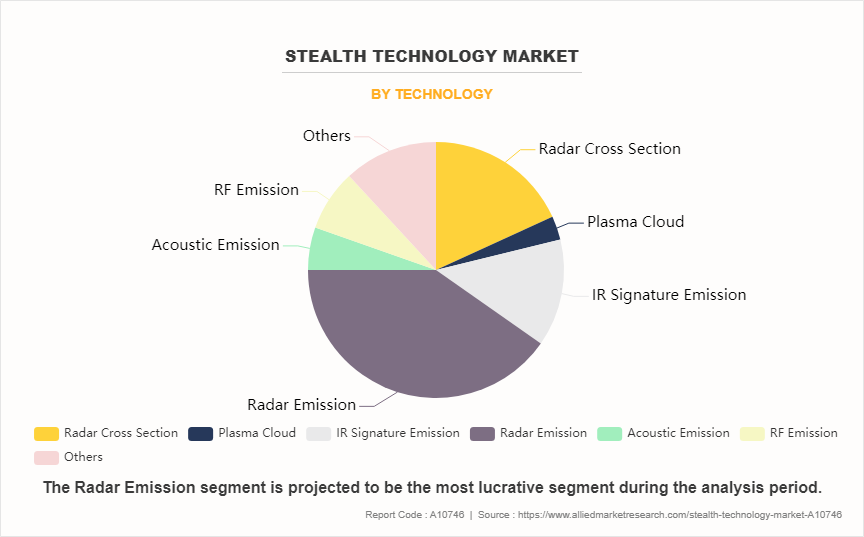

- By technology, the radar emission segment held the largest share in the market in 2023.

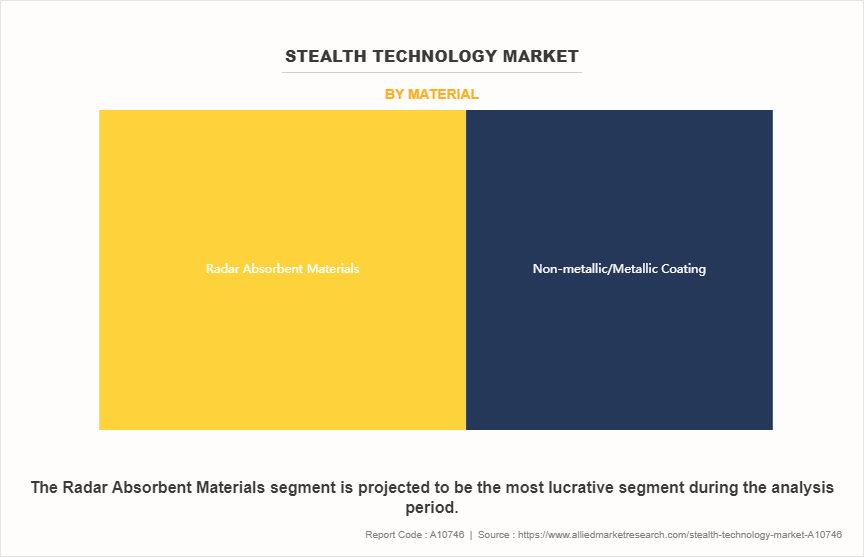

- On the basis of material, the radar absorbent material segment held the largest market share in 2023.

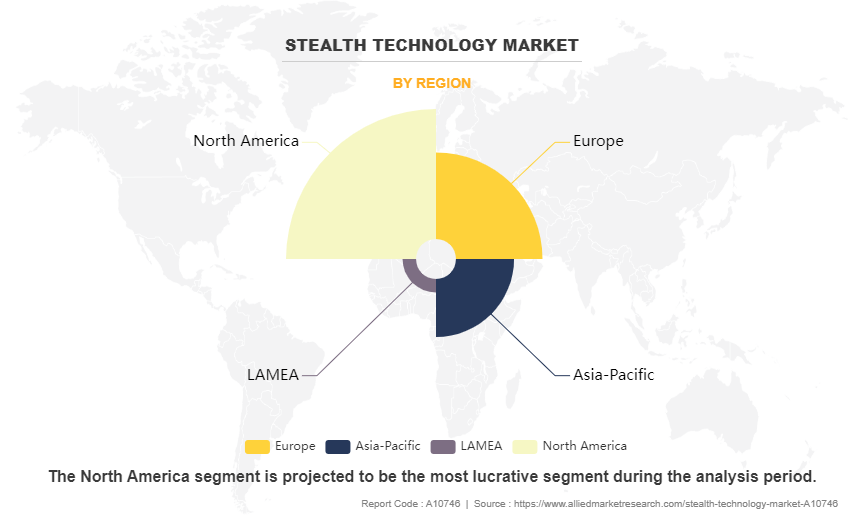

- On the basis of region, North America held the largest market share in 2023.

Continuous advancements in materials science, sensor technology, signal processing, and aircraft design have led to the development of more effective stealth technologies. Increased defense spending by governments globally, driven by evolving security threats and geopolitical tensions, provides a significant impetus for investment in stealth technology. Major defense spenders, including the U.S., China, Russia, and NATO countries, allocate substantial budgets for the development and acquisition of stealth-enabled military platforms. The stealth technology market share is dominated by a few key players who lead in the development and deployment of cutting-edge stealth systems for military applications. The demand for stealth-enabled aircraft, ships, submarines, and ground vehicles is on the rise due to their ability to operate in contested environments with reduced risk of detection and engagement by enemy forces. Military modernization programs, such as the procurement of fifth-generation fighter jets, stealth bombers, and naval vessels, contribute to the expansion of the stealth technology market. The stealth technology market size is projected to grow significantly in the coming years, driven by increasing defense expenditures and advancements in radar-evading technologies.

The surge in defense budget, increase in demand for enhanced survivability and effectiveness in combat, and rise in geopolitical tension are driving the stealth technology market. However, high development and maintenance costs and technical challenges and limitations hinder the growth of the market. Furthermore, development of green hydrogen ecosystem, proactive government initiatives toward hydrogen powered aircraft technological advancements provides growth opportunities for the players operating in the market.

Segment Review

The global stealth technology market is segmented into platform, technology, material. On the basis of platform, it is classified into airborne, naval, and land. Depending on technology, it is fragmented into radar cross section, plasma cloud, IR signature emission, radar emission, acoustic emission, RF emission, and others. By material, the market is divided into radar absorbent materials and non-metallic/metallic coating. Regionwise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Platform

On the basis of platform, the airborne segment generated maximum revenue in 2023, owing to the growing demand for advanced stealth aircraft to maintain or gain air superiority in contested environments. For instance, The U.S. Air Force (USAF) is making significant progress in the development and production of the B-21 Raider stealth bomber, The USAF has disclosed that the B-21 was undergoing flight testing at Edwards Air Force Base since its formal unveiling in December 2022. The aircraft is steadily advancing in its testing phase, with the goal of gradually replacing the existing B-1B Lancer and B-2 Spirit aircraft currently in service.

By Technology

On the basis of technology, the radar emission segment generated maximum revenue in 2022, owing to increase in the need for radar emission solutions that can provide superior stealth characteristics across a range of defense platforms, including aircraft, ships, and ground vehicles. Stealth aircraft are primarily designed to minimize their Radar Cross Section (RCS) in the X-Band frequency range. For instance, in March 2023, Rostec, a Russian state corporation, through its subsidiary Ruselectronics holding, developed a new stealth material designed to significantly enhance the radar invisibility of aircraft.

By Material

On the basis of material, the radar absorbent materials segment was the highest revenue contributor to the market in 2033, owing to rise in the adoption of the radar absorbent material technologies that can effectively reduce the radar cross-section (RCS) of these platforms. The surge in demand for advanced stealth solutions across various defense platforms, including aircraft, ships, and ground vehicles is expected to drive the adoption of radar absorbent materials. For instance, BAE Systems specializes in the manufacturing of stealth materials, particularly microwave materials used in radome design and production. These materials are crucial for reducing the radar signature of aircraft and other military platforms, enhancing their stealth capabilities.

By Region

Based on region, North America dominated the stealth technology market in 2023 owing to continuous investments in the stealth industry to ensure air superiority and strategic benefits are reflected in the development of fifth-generation fighters. Innovations in radar-absorbent materials (RAM) & low observable (LO) technologies have significantly improved the effectiveness of stealth aircraft. For instance, the Lockheed Martin F-22 Raptor is one of the most advanced fighter jets primarily due to its pioneering use of cutting-edge technology, including stealth capabilities.

Competitive Analysis

Some of the major companies that operate in the global stealth technology market are BAE Systems, Northrop Grumman Corporation, Saab AB, Boeing, General Dynamics Corporation, Raytheon Company, Leonardo S.p.A, Thales Group, FACC AG., Lockheed Martin, Krartos, Baykar, and Sukhoi.

Surge In Defense Budget

A significant increase has been witnessed in government defense expenditure and military modernization programs across the globe. This is majorly attributed to evolving geopolitical landscapes, increase in security concerns, and advancements in military technology. In 2023, global military expenditure surged to $2,443 billion, marking a real-term growth of 6.8% as compared to 2022. This increase represented the most significant year-on-year increase since 2009. Notably, the top 10 spenders, spearheaded by the U.S., China, and Russia, all boosted their military spending during this period. Governments across the globe are recognizing the need to bolster their defense capabilities to ensure national security and protect their interests in the world. The stealth technology market share is expected to expand as more countries invest in advanced defense capabilities to maintain strategic advantages.

For instance, on March 9, 2023, the Biden-Harris Administration in the U.S. presented to Congress a Fiscal Year (FY) 2024 Budget proposal for the Department of Defense (DoD), seeking $842 billion. This reflects a $26 billion rise from FY 2023 and a $100 billion increase as compared to the FY 2022 levels. In 2022, the U.S. assigned $295 billion for military operations and maintenance, $264 billion for procurement and R&D, and $167 billion for military personnel. Moreover, the total military expenditure for countries in Asia and Oceania amounted to $575 billion, showing a 2.7%increase from 2021 and a substantial 45% rise compared to the figures recorded in 2013. Therefore, rise in military spending often translates to increased funding for R&D activities, including the development of advanced technologies such as stealth. Government defense agencies and contractors allocate more resources to research and innovate stealth technology, leading to the creation of more sophisticated and effective stealth systems. Morover, the stealth technology market size is expected to witness substantial growth, fueled by significant investments in research and development within the defense sector.

Increase in demand for enhanced survivability and effectiveness in combat

The stealth technology market growth is anticipated to accelerate due to rising geopolitical tensions and the continuous modernization of military forces. Stealth technology enables military assets such as aircraft, ships, and ground vehicles to operate with reduced detectability by enemy radar, infrared sensors, and other detection systems. This reduced detectability enhances survivability by minimizing the risk of detection and subsequent targeting by adversaries, thereby increasing the likelihood of mission success and the safety of military personnel. Stealth technology enhances survivability and provides a tactical advantage by enabling military platforms to penetrate deep into enemy territory without being detected. This allows for covert operations, precision strikes, and the element of surprise, thereby increasing the effectiveness of offensive operations.

Stealth technology involves the use of advanced materials and design features that reduces the radar cross-section as well as provides additional protection against enemy threats such as missile attacks and electronic warfare. For example, stealth aircraft are designed to deflect and absorb radar waves while also incorporating features such as low-observable coatings and radar-absorbent materials to further enhance protection. Therefore, the increase in demand for enhanced survivability and effectiveness in combat is a key driver for the growth of the stealth technology market.

High Development and Maintenance Costs

The development and maintenance of stealth technology systems entail significant initial expenses for research, design, prototyping, testing, and manufacturing. Furthermore, ongoing costs for maintenance, upgrades, and lifecycle support further strain government budgets, especially amidst competing demands for public spending and tight defense budgets. The exorbitant cost of procuring and maintaining stealth technology systems renders them unattainable for numerous smaller countries with constrained defense budgets. The high cost of stealth technology systems can hinder export opportunities for defense contractors, particularly in regions where potential buyers have limited financial resources or prefer more affordable alternatives.

Technical Challenges and Limitations

The development of successful stealth technology demands expertise spanning various fields, such as aerodynamics, materials science, radar engineering, and electronic warfare. The integration of these disciplines into a unified system poses significant technical hurdles, frequently leading to extended development periods and heightened expenses. Maintenance and upkeep are crucial for preserving the effectiveness of stealth systems. This involves meticulous care to uphold their stealth properties and operational efficiency. Regular inspection, repair, and replacement of specialized coatings, materials, and components are necessary to address degradation and sustain optimal stealth performance. These maintenance demands are technically intricate and resource-heavy, adding to the overall lifecycle expenses for operators, which is expected to hamper the growth of the market.

Technological Advancement

The stealth technology market opportunity is driven by ongoing advancements in materials science and sensor technology. Progress in materials science, sensor technology, and signal processing is driving the creation of advanced and efficient stealth solutions. Novel materials such as metamaterials and nanocomposites, which possess superior radar-absorbing qualities, are enhancing stealth capabilities. Moreover, technological breakthroughs are streamlining the miniaturization and integration of stealth components into current and upcoming platforms. This enables the incorporation of smaller, lighter stealth systems into aircraft, ships, ground vehicles, and unmanned aerial vehicles (UAVs), broadening the reach of stealth technology across diverse military and civilian domains.

There is rise in R&D of advanced stealth technology such as adaptive aeroelastic wings to actively change the aircraft shape in response to aerodynamic forces. These wings take advantage of aeroelasticity, which is the interaction between aerodynamic forces and structural elasticity. BAE Systems has been at the forefront of testing fluidic control systems in unmanned aircraft. They have tested two unmanned aerial vehicles (UAVs) that utilize fluidic controls. The technological advancements drive innovation, expand the capabilities of stealth technology, and open new opportunities for growth in both defense and commercial markets. The stealth technology market forecast suggests significant expansion propelled by a such continual advancements in radar-evading technology.

Recent Developments in the Stealth technology Industry

• In February 2024, Saab developed Supersonic Stealth Loyal Wingman drone concept, part of its Future Combat Air System (FCAS) program. It is designed for high-speed, low-observable missions with sleek, blended wing/body configuration optimized for supersonic efficiency. The aerodynamic evolution of the loyal wingman design prioritizes radar signature reduction and structural optimization.

• In January 2024, Boeing together with U.S. Defense Advanced Research Projects Agency (DARPA) to developed & produce an aircraft that utilizes pressurized air rather than physical surfaces for control, a revolutionary design with the potential to reshape the future of aviation and military stealth technology. It is equipped with the control of revolutionary aircraft with novel effectors (CRANE) program technology that specially aligns with the evolution of stealth aircraft. It helps to improve the performance of combat aircraft & become more affordable and stealthier.

• In December 2023, Lockheed Martin Corporation received a contract from South Korea to purchase 20 stealth fighter jets. Through this strategy, it purchased F-35A stealth fighter jets, one of the world's most advanced stealth aircraft. This aircraft has high-performance radar and stealth capabilities, enabling it to carry out long-range strategic strikes without being noticed by the enemy.

• In December 2022, Lockheed Martin Corporation developed and delivered low observables (VLO) known as stealth technology, to over 1,000 aircraft. This technology was assembled in F-117, F-22, F-35 and RQ-170, the first American operational stealth unmanned aircraft system (UAS).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the stealth technology market analysis from 2023 to 2033 to identify the prevailing stealth technology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stealth technology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stealth technology market trends, key players, market segments, application areas, and market growth strategies.

Stealth Technology Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 79.1 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 299 |

| By Platform |

|

| By Technology |

|

| By Material |

|

| By Region |

|

| Key Market Players | RTX, BAE Systems, Saab, Kratos Defense & Security Solutions, Inc., Sukhoi, Lockheed Martin Corporation, Thales, BAYKAR TECH, Boeing, Northrop Grumman, General Dynamics Corporation, FACC AG, Leonardo S.p.A. |

The stealth technology market was valued at $42,064.6 million in 2023 and is estimated to surpass $79,122.6 million by 2033, exhibiting a CAGR of 6.7% from 2024 to 2033

The top companies to hold the market share in stealth technology are BAE Systems, Northrop Grumman Corporation, Saab AB, Boeing, General Dynamics Corporation, Raytheon Company, Leonardo S.p.A, Thales Group, FACC AG., Lockheed Martin, Krartos, Baykar, and Sukhoi.

The largest regional market for stealth technology is North America

The leading technology of stealth technology market is radar emission.

The upcoming trends of stealth technology market in the world are technological advancements.

Loading Table Of Content...

Loading Research Methodology...