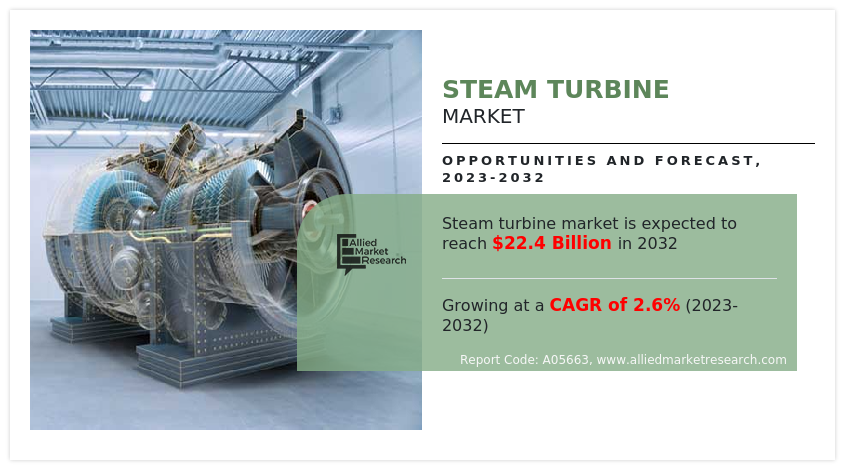

Steam Turbine Market Research, 2032

The global steam turbine market was valued at $17.5 billion in 2022, and is projected to reach $22.4 billion by 2032, growing at a CAGR of 2.6% from 2023 to 2032. The surge in demand for electricity generation, coupled with advancements in steam turbine technology, significantly drives the demand for steam turbines in the energy sector. As populations expand and economies develop, the need for reliable and efficient power sources intensifies, particularly in emerging markets.

Key Report Highlighters:

- The steam turbine market has been analyzed in terms of value ($million) and volume (MW), covering more than 15 countries.

- The global steam turbine market is fragmented in nature with many players such as Toshiba Corporation, Elliott Group, Mitsubishi Power Americas, Inc., Doosan Skoda Power s.r.o., Chola Turbo Machinery International Pvt. Ltd., Arani Power Systems Ltd., General Electric, Siemens Energy AG, TURBOCAM, Inc., Turbine Generator Maintenance Inc.

- More than 20 countries are included in the report which cover market volume as well as market value for all the countries of the steam turbine market.

- Covered the detailed list of manufacturers by application of the steam turbine market. It covers the product information, application, and geographical presence of the companies.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of the steam turbine market to understand the market trends, growth factors, pricing, and key players competitive strategies.

Introduction

A steam turbine is a mechanical device that converts the thermal energy of steam into mechanical work. It operates by directing high-pressure, high-temperature steam onto a series of rotating blades or vanes. As the steam passes through these blades, it expands and loses energy, causing the turbine's rotor to spin. This rotational motion is used to drive generators, pumps, or other machinery. Steam turbines are commonly used in power plants to generate electricity and in industrial processes requiring mechanical power or heat. Their efficiency and reliability make them essential in both conventional and renewable energy systems.

The demand for power increased at a rate of 4% and the share of electricity in global energy consumption will reach 24% by 2040. With growing electricity requirements, the demand for steam turbines is expected to increase simultaneously, which is likely to drive the growth of the global steam turbine market. Furthermore, most electric power is produced from steam electric power plants, globally. With the exponential increase in population, the demand for electricity is anticipated to escalate significantly, which eventually will foster the demand for steam turbines.

Market Dynamics

As population increases and urbanization expands, especially in emerging economies, the demand for reliable and consistent electricity surges. According to the International Energy Agency, worldwide energy utilization increased by 5% in 2021, and is expected to escalate by 4% in 2022. The expansion of power generation facilities was driven by an increase in demand for warming and cooling systems in certain locales. Utilization of petroleum products secured 70% of worldwide energy generation, and sustainable power sources contributed to around 25%of worldwide energy development. The demand for power increased at a rate of 2.1% per year and the share of electricity in global energy consumption reached 20% in 2020. All these factors are expected to drive the demand for the steam turbine market during the forecast period.

With growing electricity requirements, the demand for steam turbines is expected to increase simultaneously, thus contributing to the growth of the global market. Moreover, maximum electricity is generated from steam electric power plants, globally. With the exponential increase in population, the demand for electricity is anticipated to surge significantly, which, in turn, will boost the need for steam turbines. In addition, an increase in demand for district & local heating & cooling systems especially in cold regions such as Europe and North America has driven the demand to set up geothermal power plants. This factor is expected to further increase the need for steam turbines. Hence, a rise in the use of steam turbines is expected to contribute toward the steam turbine market growth.

However, steam turbines are expensive; for instance, in a steam turbine combined heat & power (CHP) plant, the installed cost of only CHP plant is around $5,000/kW or higher. In addition, steam turbines are less effective than reciprocating motors at part load activity. Furthermore, steam turbines have longer startup times when compared to gas turbines and reciprocating engines. Thus, all these factors are expected to hamper the growth of the market, as they limit the use of steam turbines. On the contrary, the global steam turbine market is yet to explore its full potential. Government regulations are playing an important role in accelerating the growth of the market.

For instance, the International Organization for Standardization (ISO)—an overall alliance of national guidelines bodies, universal associations, and legislative & non-legislative staffs, in contact with ISO—take part in the development of several industries. ISO along with all associated organizations work together to encourage the supply of steam turbines and gas extension turbines for mechanical applications, which is anticipated to offer remunerative opportunities for the expansion of the global market during the forecast period.

According to the Central Electricity Authority India, power generation demand from thermal, hydro, and nuclear plants is expected to grow by 9.83% in 2022 in India. Total generation from thermal, hydro, and nuclear plants has been around 1,356 million units in 2020–2020. As demand for power increases, the requirement for steam turbines is anticipated to escalate significantly, as they help in power generation. This factor is likely to contribute to the growth of the steam turbine market.

The growth in biomass and waste-to-energy (WtE) plants presents significant opportunities for steam turbine manufacturers and suppliers. Biomass and WtE plants utilize organic materials such as agricultural waste, wood, or municipal solid waste to produce energy. These facilities generate steam by burning biomass or waste, which in turn drives steam turbines to generate electricity. As global attention shifts toward sustainable energy solutions and reducing landfill waste, biomass and WtE plants are becoming an increasingly preferable option for both power generation and environmental management. All these factors are anticipated to offer new growth opportunities for the steam turbine market during the forecast period.

Segments Overview

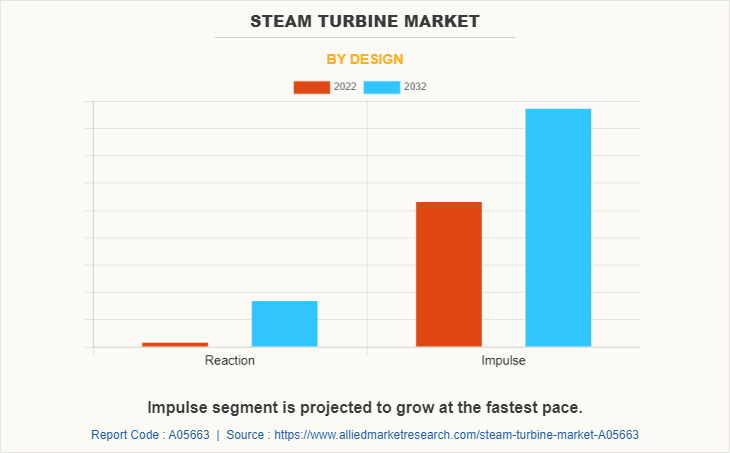

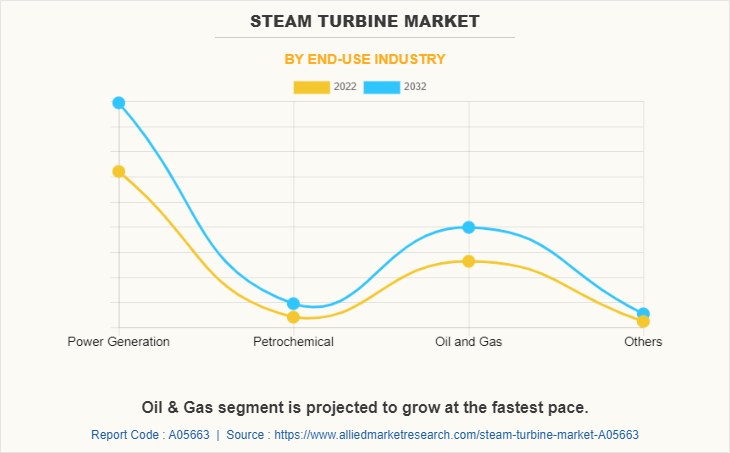

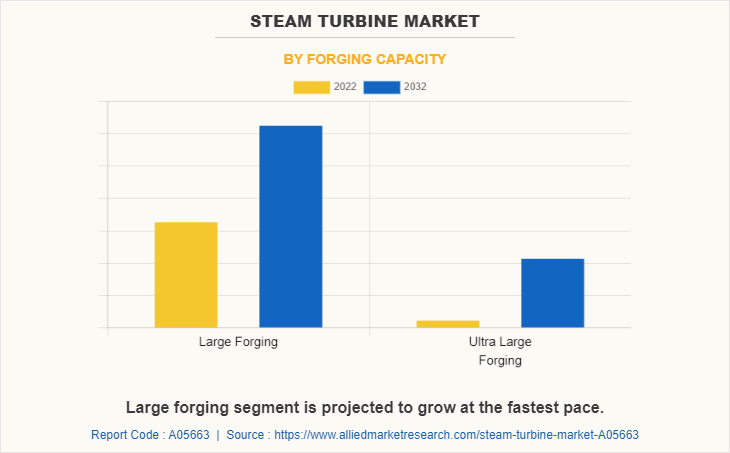

The steam turbine market size is segmented into design, end-use industry, forging capacity, and region. By design, the market is bifurcated into impulse and reaction. By end-use industry, the market is fragmented into power generation, petrochemical, industrial, and others. By forging capacity, the steam turbine market is divided into large forgings and ultra large forgings. Region-wise, the steam turbine market analysis is done across North America, Europe, Asia-Pacific, and LAMEA.

By Design

By design, the market is bifurcated into impulse and reaction. A reaction turbine has channels formed in the top surface of a disc to create nozzles. This kind of turbine utilizes reaction force produced by steam that moves through the nozzles formed by the rotor. Steam is directed onto the rotor by fixed vanes or nozzles of the stator. It leaves the stator as a stream to fill the whole circuit of the rotor. A weight drop happens over both the stator and the rotor, with steam moving through the stator and decelerating through the rotor.

By End USe Industry

In terms of the end-use industry, it is fragmented into power generation, petrochemical, industrial, and others. Steam turbine-driven generators majorly find their application in solar electric power plants, coal, geothermal, atomic, and flammable gas control plants. In a steam turbine-driven generator, heat is produced from a source such as a boiler. It is equipped with a heater, which contains water, and the heat is utilized to change the water into steam, which is of high temperature and high weight. Steam generation relies upon the stream rate and surface area of the heat transfer and the heat of combustion utilized. This steam from the heater is pushed into the turbine through nozzles, which turn the cutting edges mounted on a pole.

By Forging Capacity

By forging capacity, the steam turbine market is divided into large forgings and ultra large forgings. Large forgings play a vital role in the manufacturing of steam turbines for power generation. Steam turbines used in power plants require robust and reliable components that can withstand high temperatures, pressures, and rotational forces. Large forgings offer the necessary strength, integrity, and durability to meet these demanding operating conditions. Large forgings are commonly used in various components of steam turbines, including rotor shafts, casings, blades, and diaphragms. These components need to be able to withstand the mechanical stress and thermal cycles experienced during operation.

By Region

Region-wise, the steam turbine market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. The North America steam turbine industry is analyzed across the U.S., Canada, and Mexico. The growth of the steam turbine market in North America is driven by a surge in demand for combined cycle projects. Combined cycle power plants include gas and steam turbines. These gas turbines are used to generate electricity by utilizing natural gas, while steam turbines generate electricity, using waste heat from the gas turbine. Furthermore, the shift in preference toward combined cycle power plants is encouraged by low gas prices, stringent regulations on the use of coal plants, and the integration of a growing amount of renewable power.

Technology Trend Analysis

High-efficiency steam turbines utilize advanced materials and design techniques to maximize energy conversion from steam, reducing fuel consumption and greenhouse gas emissions. Innovations such as improved blade aerodynamics, enhanced heat transfer mechanisms, and advanced cooling technologies are contributing to the overall efficiency of steam turbine systems. This trend is crucial as energy producers seek to comply with increasingly stringent environmental regulations and sustainability goals.

In addition, surge in on hybrid systems combine steam turbines with renewable energy sources. This trend reflects the increasing need for flexibility in energy generation, where steam turbines complement intermittent renewable sources such as wind and solar. By integrating steam turbines into combined heat and power (CHP) systems or waste-to-energy plants, energy producers create more resilient and sustainable energy systems. All these technology trends indicate a dynamic evolution in steam turbine design and operation, positioning them as essential components in the transition towards a more sustainable energy during the forecast period.

Competitive Analysis

The players operating in the global steam turbine market include General Electric (GE) Co., Turbine Generator Maintenance Inc., Toshiba Corporation, Siemens AG, Arani power systems, Elliott Group, TURBOCAM, Doosan Škoda Power, Chola Turbo Machinery International Pvt. Ltd., and Mitsubishi Power. Among these, General Electric (GE) Co., Turbine Generator Maintenance Inc., Toshiba Corporation, Siemens AG, and Mitsubishi Hitachi Power Systems Americas Inc. hold a significant steam turbine market share. These players have been adopting various strategies to gain a higher share or to retain leading positions in the market. A merger is the key strategy majorly adopted by companies to strengthen their foothold in the competitive market. For instance,

- Elliott Group announced the merger of Ebara International Corporation, which is based in Sparks, Nevada. Effective from April 1, 2020, the merged entity became one of the four business units within Elliott Group.

- Elliott Group announced the opening of Elliott Gas Services Saudi Arabia (EGSSA), which is the product of a joint venture between Elliott and GAS Arabian Services. This offers inspection and repair services for both Elliott and non-Elliott equipment including single- and multi-stage steam turbines and compressors, process expanders and associated equipment, and rotor assemblies.

- Elliott Group launched a new wireless turbine sensor specifically designed for Elliott single-stage (YR) steam turbines. The sensor allows plants to modernize their turbine monitoring capabilities at a fraction of the cost of conventional instrumentation.

- Toshiba America Energy Systems Corporation signed an asset purchase agreement with GP Strategies Corporation to acquire EtaPRO business. This agreement enabled the EtaPRO business to innovate faster and more globally.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the steam turbine market forecast from 2022 to 2032 to identify the prevailing steam turbine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the steam turbine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global steam turbine market trends, key players, market segments, application areas, and market growth strategies.

Steam Turbine Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 22.4 billion |

| Growth Rate | CAGR of 2.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 428 |

| By Design |

|

| By End-Use Industry |

|

| By Forging Capacity |

|

| By Region |

|

| Key Market Players | Siemens Energy AG, Mitsubishi Power Americas, Inc., Doosan Skoda Power s.r.o., General Electric, Elliott Group, TURBOCAM, Inc., Chola Turbo Machinery International Pvt. Ltd., Toshiba Corporation, Turbine Generator Maintenance Inc., Arani Power Systems Ltd. |

Analyst Review

According to the insights of CXOs of leading companies, the global steam turbine market is expected to exhibit high growth potential during the forecast period, owing to surge in supply–demand gap of electricity, rapid industrialization & urbanization, and increase in demand for captive power systems.

The steady decline in costs of steam turbines, higher efficiency of steam turbines compared to reciprocating engines, and reduced fuel utilization are a few advantages associated with steam turbines, which are expected to boost their use for generating energy. Several developments are ongoing in the market, and these include expanding efficiencies up to 48%. For instance, the U.S. Department of Energy invested $53 million to cooperate with 32 manufacturers for the manufacturing of improved ultra-supercritical steam turbines. These steam turbines are utilized for gaining efficiencies of 55–60% that depend on kettle tube materials, which can withstand weights of up to 5,000 psi.

The CXOs further added that to accomplish the above-mentioned objectives, research is progressing in materials, with proper plan and development. Steam valve advancement is one such ongoing progress. Furthermore, research is in progress to re-establish and improve the efficiency of existing steam turbines through improved burning frameworks and boilers. In addition, market players have developed a strong interest in waste heat recovery, biomass-energized power, and CHP plants

The rise in demand for energy and the reduction in fossil-based energy generation are the upcoming trends of Steam Turbine Market in the world.

Power Generation is the leading end-use industry of the Steam Turbine Market.

The estimated industry size of Steam Turbine by 2032 is $22.4 billion.

Asia-Pacific is the largest regional market for Steam Turbine.

General Electric (GE) Co., Turbine Generator Maintenance Inc., Toshiba Corporation, Siemens AG, Arani power systems, Elliott Group, TURBOCAM, Doosan Škoda Power, Chola Turbo Machinery International Pvt. Ltd., and Mitsubishi Power are the top companies to hold the market share in Steam Turbine.

Loading Table Of Content...

Loading Research Methodology...