Global Steel Wire Market Research, 2040

The global steel wire market was valued at $54.6 billion in 2023 and is projected to reach $173.1 billion by 2040, growing at a CAGR of 7.1% from 2024 to 2040.

Introduction

Steel wire is an essential component in various industries such as construction, automotive, energy, and industrial manufacturing, owing to its mechanical strength, corrosion resistance, and flexibility. These wires are fabricated from carbon and stainless steel and are often treated or coated to suit specific applications. Steel wire is used extensively in the production of reinforcement bars, cables, fencing, fasteners, and springs, among others. The growing demand for durable and high-strength materials in infrastructural and industrial projects, particularly in emerging economies, is propelling the steel wire market globally.

Over the years, the steel wire industry has evolved with advancements in metallurgy and manufacturing processes such as wire drawing and coating. Increasing investment in renewable energy, rising automotive production, and demand for energy-efficient buildings have also contributed to the growth of the market. As the global economy continues to develop, particularly in Asia-Pacific and the Middle East, demand for construction and automotive products will also drive steel wire consumption upward.

Key Takeaways

- Market numbers include value ($Million), volume (KlioTon), CAGR (2024–2040), and segment-wise breakdown.

- The report provides segmentation by type and end-use industry.

- The report includes market dynamics (drivers, restraints, opportunities), Porter’s Five Forces Analysis, trade data, tariff analysis, and value chain insights.

- Prominent companies include Severstal, Andaluza de Trefileria y Galvanizado, The Leleu Company, Lambert Manufil, SadevInox, Codica, Socitrel, Birtex Sarl, ArcelorMittal, and Finkernagel GmbH.

- High growth potential is expected in smart manufacturing, telecom, and renewable energy sectors.

Market Dynamics

The global steel wire market is being propelled by rapid growth in construction and infrastructure activities, particularly in Asia-Pacific, Africa, and the Middle East. Urbanization, smart city developments, and mega infrastructure projects are driving the need for high-strength steel wire in construction, including in applications such as concrete reinforcement, scaffolding, and fencing. Moreover, the construction sector’s requirement for earthquake-resistant and corrosion-proof materials is fostering the adoption of advanced steel wire products.

The automotive industry is another major driver of the steel wire market. With increasing demand for electric vehicles and lightweight components, manufacturers are turning to high-tensile steel wires for use in tire reinforcement, seat springs, clutch wires, and suspension systems. The trend toward electric and hybrid vehicles has also pushed the requirement for improved efficiency and durability, thus driving demand for specialized steel wire forms.

However, the market faces significant challenges due to fluctuations in raw material prices, especially iron ore and scrap metal. The cost of steel production is heavily influenced by these materials, and price volatility can affect the profitability of steel wire manufacturers. Additionally, increasing concerns over carbon emissions and stringent environmental regulations in regions like Europe and North America are pushing producers to adopt cleaner, but costlier, production methods.

On the other hand, the steel wire industry is witnessing new growth avenues with the rise of renewable energy projects. High-tensile steel wires are increasingly used in solar panel frames, wind turbine structures, and transmission cables. Moreover, the adoption of Industry 4.0, smart manufacturing, and automation technologies is promoting demand for precision-engineered steel wire products. The integration of digital technologies in manufacturing processes is expected to increase efficiency and reduce production costs, thereby boosting the market.

Segment Overview

The steel wire market is segmented into type, end-use, and region. By type, the market is divided into cold heading quality wire, Spring Wire for Mattresses, Patented Wire, Annealed Wire, Black Wire Nails, and Black Tying wire. By end-use, it is segmented into construction, automotive, and industrial applications. By region, the market is analyzed across North America, Europe, the Middle East, South America, and Asia-Pacific.

Among these, cold heading quality wire held the dominant market share in 2023. It is widely used for making fasteners, screws, and bolts owing to its excellent ductility and strength. Its applications are critical in automotive, construction, and heavy engineering industries. The growth in demand for fasteners due to rising vehicle production and infrastructural development is fueling the segment’s growth.

Spring wire for mattresses is another key segment, characterized by its elasticity, fatigue resistance, and durability. The demand for durable bedding solutions and the expansion of the hospitality sector are contributing to this segment’s growth. Patented wire, including black and galvanized types, finds use in fencing, cable manufacturing, and various construction applications. Galvanized steel wires, in particular, are gaining popularity due to their resistance to corrosion.

Annealed wire, both black and galvanized, is primarily used in construction for binding reinforcement bars and forming wire meshes. Its flexibility and ease of handling make it suitable for residential and commercial projects. Black wire nails and tying wire are commonly used in household, agriculture, and packaging industries.

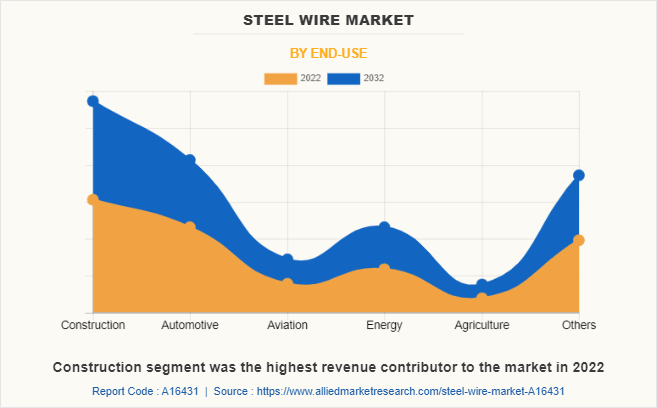

In 2023, the construction segment held the largest share of the market. Steel wire is a crucial material in reinforced concrete structures, scaffolding, and support systems. Rapid urbanization, public infrastructure expansion, and private sector investments are increasing the consumption of steel wires in this sector.

The automotive segment is the second-largest end-use category. Increasing demand for lightweight and energy-efficient vehicles is driving the adoption of high-strength steel wires in automotive applications. The industrial segment encompasses a range of uses including machinery, oil and gas, utilities, and telecommunications. Growing demand for reliable and durable components in manufacturing and energy transmission continues to boost this segment.

By Type

Cold heading quality wire is projected as the most lucrative segment.

Competitive Analysis

Key players operating in the global steel wire market are focusing on expanding their geographical presence and enhancing their product portfolios through mergers, acquisitions, and facility expansions. For instance, in 2023, Bekaert announced its expansion into India and Brazil by launching advanced patented wire production units to meet local and export demand.

In 2022, ArcelorMittal inaugurated a decarbonized production facility in Europe dedicated to manufacturing high-performance steel wires for the automotive industry. Similarly, Tata Steel and JSW Steel have invested in modernizing their wire production infrastructure to meet international quality standards and support sustainable construction practices.

The competitive landscape is characterized by a mix of global giants and regional players. Companies are increasingly investing in R&D to innovate in coatings, alloy compositions, and manufacturing techniques to produce stronger, lighter, and more durable steel wires.

Regional Insights

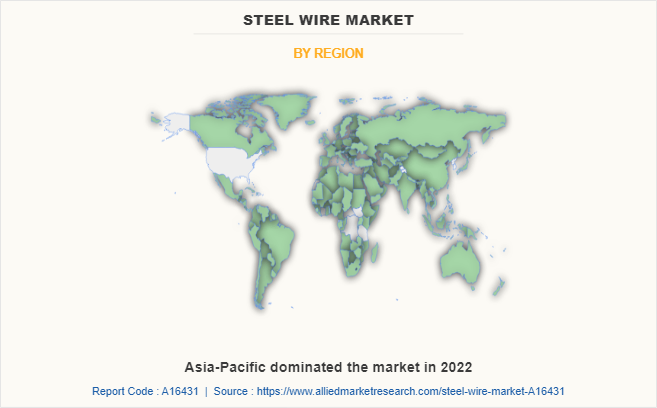

Asia-Pacific dominated the global steel wire market in 2023, with China and India being the major contributors. The region's high rate of urbanization, government infrastructure initiatives, and booming automotive sector are the key drivers of demand. In India, the "Make in India" and Smart Cities programs are further stimulating market growth.

Europe remains a vital market, with significant consumption in the automotive, industrial, and construction sectors. Environmental regulations and a push for sustainable building materials have influenced the adoption of galvanized and patented steel wires in this region.

North America, led by the U.S., has shown steady growth due to infrastructure renovation, especially in transport and energy sectors.

Latin America, the Middle East, and Africa are emerging markets for steel wire, with increasing investments in industrialization and infrastructure. These regions present lucrative opportunities for market players willing to establish local manufacturing and distribution networks.

Key Benefits for Stakeholders

- The report offers in-depth analysis of various segments and provides market estimates from 2015 to 2040.

- Comprehensive insights into the factors driving and restraining market growth.

- Porter’s Five Forces analysis highlights the competitive forces influencing the market.

- Market projections are based on key trends, industry developments, and expert validations.

- Profiles of major market players provide clarity on their strategic approaches.

- Detailed analysis of current trends and future outlook help identify potential investment opportunities.

Steel Wire Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 180.9 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 1291 |

| By Type |

|

| By End-Use Industry |

|

| By Key Market Players Profiled in the Report |

|

Analyst Review

According to the opinions of various CXOs of leading companies, the construction sector remains the dominant end-use industry, accounting for a significant share of global steel wire consumption. The demand for prestressed concrete steel wire, binding wire, and fencing wire is increasing due to the expansion of large-scale infrastructure projects in key economies, including China, India, the United States, and various European nations. Initiatives like high-speed railways, metro systems, expressways, and real estate developments continue to drive substantial demand for high-strength steel wire products. Moreover, government-backed smart city projects, sustainable urban development programs, and the modernization of energy transmission grids are further accelerating the adoption of galvanized and patented steel wires. These applications require steel wires that are durable, corrosion-resistant, and suitable for use in harsh environments.

CXOs also emphasize that while China continues to lead global steel wire production, countries like India, Vietnam, and Mexico are emerging as significant manufacturing hubs. These regions benefit from lower labor and energy costs, favorable government policies, and rising domestic demand, which encourage both local production and export opportunities. In contrast, developed regions such as Europe and North America have seen a shift toward eco-friendly, high-tensile steel wires for industrial and infrastructure applications where sustainability and compliance with environmental norms are increasingly prioritized.

However, raw material price volatility and environmental regulations present substantial challenges. The steel industry is heavily impacted by fluctuations in iron ore and coking coal prices, which affect production costs and margins. Additionally, stricter carbon emission standards are pushing manufacturers toward low-emission technologies such as electric arc furnaces (EAFs) and hydrogen-based steelmaking.

Despite these challenges, CXOs remain optimistic about the market’s future. Strong opportunities lie in renewable energy, defense, and advanced manufacturing. Strategic collaborations, investments in recycling and green technologies, and ongoing innovations in ultra-high-tensile steel wire are expected to maintain robust growth across regions and applications.

Rise in demand in construction and infrastructure development, rise in demand for steel wire in the automotive industry are the key factors boosting the steel wire market growth

The global steel wire market was valued at $54.6 billion in 2023 and is projected to reach $173.1 billion by 2040, growing at a CAGR of 7.1% from 2024 to 2040.

The major prominent players operating in the steel wire market include Severstal, Andaluza de Trefilería y Galvanizado, The Leleu Company, Lambert Manufil, SadevInox, Codica, Socitrel, Birtex Sarl, ArcelorMittal, and Finkernagel GmbH.

Annealed Wire is the dominating type of steel wire market.

The steel wire market is segmented into type, end-use, and region. By type, the market is divided into cold heading quality wire, Spring Wire for Mattresses, Patented Wire, Annealed Wire, Black Wire Nails, and Black Tying wire. By end-use, it is segmented into construction, automotive, and industrial applications. By region, the market is analyzed across North America, Europe, the Middle East, South America, and Asia-Pacific.

Volatility of raw material prices is the restraint factor of steel wire market.

Construction is the dominating segment based on end-use industry.

Loading Table Of Content...

Loading Research Methodology...