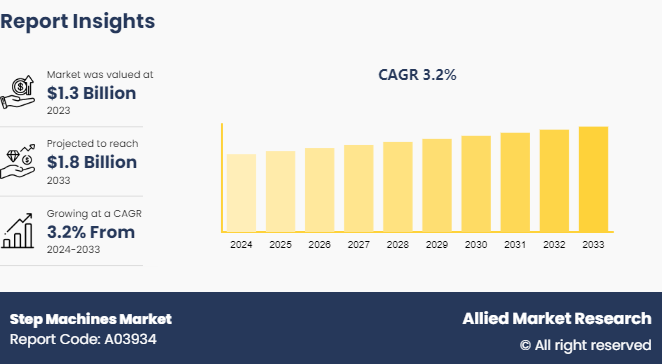

The global step machines market size was valued at $1.3 billion in 2023, and is projected to reach $1.8 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

Market Introduction and Definition

Step machines are a type of exercise equipment that is commonly used in home workouts, fitness centers, and gyms to simulate stair climbing and provide cardiovascular workouts. These machines help with weight control, muscular toning, and cardiovascular health with their low-impact aerobics training. Steppers, step mills, and stair climbers are just a few of the several models of step machines available on the market to accommodate a range of fitness levels and preferences. The market is growing owing to technological advancements including interactive fitness programs, resistance level adjustments, and digital displays. Step machines are becoming more popular as people become more health-concerned, fitness-conscious, and inclined to work out from home.

Key Takeaways

- The step machines market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literature, industry releases, annual reports, and other such documents of major step machines market participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

This section of the report provide step machines market overview. The importance and knowledge of health and fitness among people of all ages is one of the primary factors driving the growth of the market. Step machines are becoming more popular as they offer a good cardiovascular workout and help people lead healthier lifestyles. Furthermore, there has been a notable boost in the popularity of at-home fitness, especially after the COVID-19 pandemic, which has resulted in a notable rise in sales of home exercise equipment, such as step machines.

The dynamics of the market are also greatly influenced by technological developments. Modern step machines come with innovative features that improve user experience and engagement, such as digital displays, adaptable workout routines, and integration with fitness apps. These devices are becoming more popular since smart technology is built into them, enabling users to monitor their progress and establish fitness objectives. Furthermore, producers are being encouraged to innovate and provide more advanced products by the expanding trend of connected fitness ecosystems, which sync various devices and apps with one another.

However, the step machines market also faces specific challenges. The potential for market expansion may be restricted by the high cost of advanced step machines. Static cycles, elliptical machines, and treadmills are some of the alternatives to traditional exercise equipment that pose serious competition in the market.

North America and Europe are developed regions with strong penetration rates, but Asia-Pacific shows significant development potential owing to rise in disposable incomes and growing health-conscious population. Entry of new competitors and the development of established companies into previously untapped markets are expected to drive the step machines market growth. Thus, factors including health trends, technology advancements, geographical differences, and economic considerations, have an impact on the step machines industry and determine its future. This creates step machines market opportunity globally.

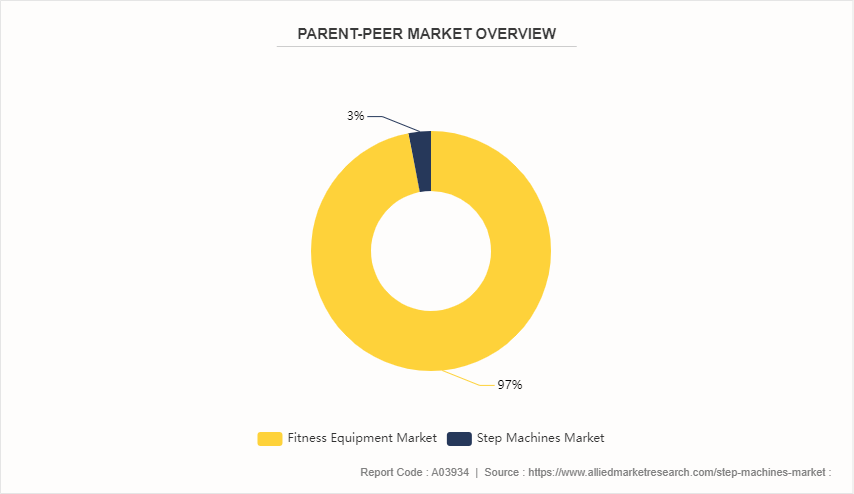

Parent Market Overview of the Global Step Machines Market

The step machines market globally is a subset of the larger fitness equipment market, which includes a range of products intended to improve wellness and physical fitness. Equipment including elliptical machines, treadmills, stationary bikes, and strength training equipment are part of this primary market. The market for fitness equipment has grown significantly due to factors such as rise in focus on health and fitness, technological developments, and the growing popularity of at-home workouts. There is fierce rivalry in the industry, with many well-known brands and emerging firms coming up with new ideas to meet the varied wants of their customers. Globally, consumers now have greater access to and customization of exercise due to the market expansion brought about by the widespread adoption of related fitness solutions and smart equipment integration.

Market Segmentation

The step machines market is segmented into type, application, and region. On the basis of type, the market is divided into mechanical step machines and electric step machines. On the basis of application, the market is bifurcated into household and commercial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Rise in fitness trends and health consciousness are driving considerable growth in the global step machine market. North America has a significant step machines market share, which is explained by its high standard of living, sophisticated fitness facilities, and robust wellness and health culture. The U.S. is a prominent market due to growth of home exercise equipment and the abundance of gyms and fitness facilities. The existence of significant manufacturers and cutting-edge product options, such as connected step machines with built-in fitness tracking and virtual coaching is further driving the step machines market growth.

In addition, the market is growing throughout Europe as well, with leading nations being France, Germany, and the UK. Market expansion is facilitated by the region's emphasis on physical fitness and by government initiatives that encourage active lifestyles. Step machine sales have surged due to the COVID-19 pandemic and the growing trend of at-home training. Step machines market demands are also driven by European consumers' inclination for innovative, environmentally friendly exercise equipment.

Furthermore, Asia-Pacific is expanding rapidly, propelled by factors such as growing disposable incomes, urbanization, and heightened health consciousness. Significant contributions come from China and Japan, where increase in number of middle-class people is embracing fitness routines. The prospects for the sector are improved by government programs that encourage physical activity and the growth of gym chains in metropolitan regions. Moreover, the growth of e-commerce platforms makes a wide range of step machines easily accessible, which increases sales in the region.

In addition, Brazil and Mexico are leading the way as the step machine business in Latin America steadily gains traction. The number of health clubs and exercise facilities in the region is rising, which is fueling the region's expanding fitness culture. The Middle East and Africa present significant prospects for these expanding markets with growing awareness of fitness and well-being. Countries such as South Africa and the United Arab Emirates are witnessing increase in step machines market demands, particularly step machines due to the growing middle-class population and growth in the fitness industry. Thus, with factors such as growing health consciousness, technical improvements, and government initiatives supporting the industry, the step machine market is therefore expected to rise in many areas in the future.

Industry Trends:

- In March 2023, Peloton launched a new line of smart step machines in response to rise in demand for at-home fitness options during the pandemic.

- In September 2023, Bowflex introduced a subscription-based business strategy for its step machines, which included live classes and customized training schedules.

- In April 2023, Xiaomi joined the step machine market, with models that were both reasonably priced and highly advanced technologically, thereby encouraging local manufacturing.

- Step machines became more popular in commercial gyms as a result of Fitness First's February 2023 expansion into Australia and Southeast Asia.

- In August 2023, Singapore-based company, Gymlink introduced environmentally friendly steppers that are constructed of recyclable materials in line with the expanding sustainability trends in the area.

Competitive Landscape

The major players operating in the step machines market include StairMaster, Sunny Health & Fitness, Stamina, Maxi Climber, Gazelle, Precor, Life Fitness, TechnoGym, Atlantis, and Playworld.

Recent Key Strategies and Developments

- In June 2023, step machines with VR compatibility were introduced by NordicTrack, improving user experience through virtual reality exercises.

- In January 2023, step machine sales surged as a result of a nationwide campaign conducted by the Chinese government to promote physical fitness.

Key Sources Referred

- Sports and Fitness Industry Association (SFIA)

- International Health, Racquet & Sportsclub Association (IHRSA)

- American Council on Exercise (ACE)

- Fitness Industry Suppliers Association of Australia (FISAA)

- Japan Sporting Goods Association (JASPO)

- European Health and Fitness Association (EHFA)

- China Sporting Goods Federation (CSGF)

- National Sporting Goods Association (NSGA)

- British Heart Foundation National Centre for Physical Activity and Health (BHFNC)

- Fitness Equipment Trade Association (FETA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the step machines market segments, current trends, estimations, and dynamics of the step machines market analysis from 2023 to 2033 to identify the prevailing step machines market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the step machines market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global step machines market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global step machines market trends, key players, market segments, application areas, and market growth strategies.

Step Machines Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.8 Billion |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | StairMaster, Stamina, Precor, Gazelle, Technogym, Maxi Climber, Life Fitness, Atlantis, Playworld, Sunny Health & Fitness |

Upcoming trends in the global Step Machines Market include a focus on compact, foldable designs, integration with smart technology, personalized workout programs, and increased demand for home fitness solutions.

The leading application of the Step Machines Market is in gyms and fitness centers, where they are primarily used for cardiovascular workouts and lower body strength training.

The largest regional market for step machines is North America, driven by high demand for fitness equipment, a strong fitness culture, and the presence of key market players.

The global step machines market was valued at $1.3 billion in 2023, and is projected to reach $1.8 billion by 2033, growing at a CAGR of 3.2% from 2024 to 2033.

The major players operating in the step machines market include StairMaster, Sunny Health & Fitness, Stamina, Maxi Climber, Gazelle, Precor, Life Fitness, TechnoGym, Atlantis, and Playworld.

Loading Table Of Content...