Sterile Medical Packaging Market Research, 2033

The global sterile medical packaging market size was valued at $55.0 billion in 2023, and is projected to reach $156.7 billion by 2033, growing at a CAGR of 11% from 2024 to 2033. The growth of the sterile medical packaging market is driven by the rising demand for sterilized medical products due to increasing healthcare-associated infections (HAIs) and the growing prevalence of chronic diseases. Advancements in packaging technologies, including materials offering enhanced barrier properties, further support market expansion. In addition, stringent regulatory requirements for the safety and sterility of medical products, coupled with increasing healthcare expenditure and the growth of the pharmaceutical and biotechnology industries, are key factors boosting the demand for sterile medical packaging solutions.

Market Introduction and Definition

Sterile medical packaging is a critical component in the healthcare industry, ensuring the safety, efficacy, and sterility of medical devices, pharmaceuticals, and other healthcare products. It protects contents from contamination by microorganisms, moisture, and physical damage, maintaining product integrity until the point of use. Common materials used include plastics, paper, foil, and composites, which are chosen for their durability, barrier properties, and compatibility with sterilization methods such as ethylene oxide, gamma irradiation, and autoclaving. Popular formats include pouches, blister packs, bottles, and trays, tailored to specific applications. The growing demand for advanced medical devices, an aging population, and stringent regulatory requirements drive the expansion of this market. In addition, increasing surgical procedures and infection control measures further boost demand. Innovations such as bio-based materials and eco-friendly designs are gaining traction, aligning with sustainability goals. Sterile medical packaging remains indispensable in delivering safe and effective healthcare worldwide.

Key Takeaways

- The sterile medical packaging market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major sterile medical packaging industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

According to sterile medical packaging market forecast analysis the key factors driving the growth of the market are rising demand for infection control, growth in the pharmaceutical industry and advancements in packaging materials. The rising demand for infection control is a significant driver for the sterile medical packaging market. This demand stems from the increasing prevalence of healthcare-associated infections (HAIs) and heightened awareness of the importance of maintaining strict hygiene standards in medical settings. Sterile medical packaging plays a crucial role in preventing contamination of medical devices, pharmaceuticals, and surgical instruments, ensuring patient safety. The surge number of surgical procedures, coupled with the global focus on infection prevention is expected to contribute significantly in the sterile medical packaging market growth.

According to sterile medical packaging market opportunity analysis The growth of the pharmaceutical industry significantly drives the sterile medical packaging market, primarily due to the rising demand for safe and effective drug delivery systems. The increasing production of pharmaceuticals, driven by factors such as the global rise in chronic diseases, aging populations, and expanding access to healthcare, necessitates robust packaging solutions to maintain the sterility and integrity of pharmaceutical products. Furthermore, advancements in biologics and personalized medicines have heightened the need for specialized sterile packaging to ensure product stability and efficacy. Regulatory requirements mandating stringent packaging standards further propel growth of sterile medical packaging market size, as pharmaceutical companies strive to meet compliance while safeguarding product quality during storage and transportation.

Advancements in packaging materials have significantly driven the sterile medical packaging market growth by ensuring better protection, sustainability, and functionality. The development of advanced materials such as bio-based plastics, multi-layer films, and high-barrier composites has enhanced the ability of packaging to maintain sterility, extend shelf life, and resist contamination. Innovations in materials with antimicrobial properties and moisture resistance have further improved the safety and effectiveness of sterile packaging solutions. In addition, the incorporation of eco-friendly materials, such as biodegradable polymers and recyclable options, aligns with increasing environmental concerns and regulatory requirements, boosting their adoption. These advancements cater to the growing demand for more robust packaging solutions in healthcare settings, where the integrity of medical products is critical for patient safety. Furthermore, material innovations have facilitated the design of user-friendly packaging that supports ease of use and storage, addressing practical concerns in healthcare logistics.

Contamination Trends

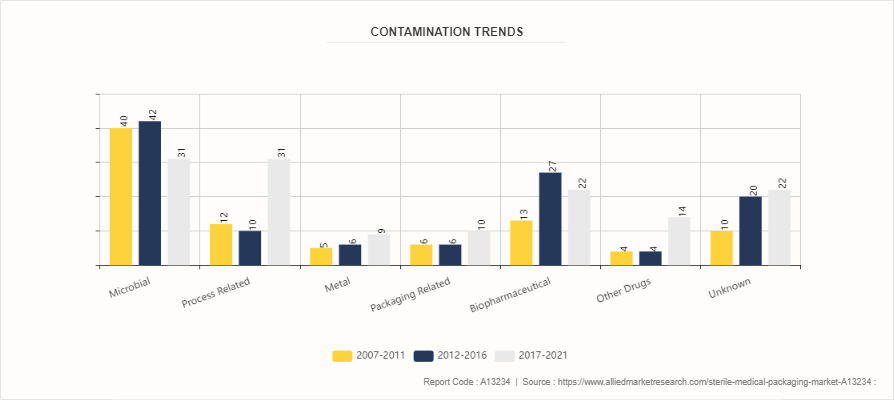

The rise in contamination in pharmaceutical products has significant implications for the sterile medical packaging market. Data from 2007 to 2021 indicates a shifting landscape in the sources of contamination, underscoring the critical need for advanced packaging solutions. Microbial contamination, although reduced from 40 cases in 2007–2011 to 31 cases in 2017–2021, remains a leading concern. Meanwhile, process-related contamination has risen sharply, from 12 cases in 2007–2011 to 31 cases in 2017–2021, signaling the need for enhanced process controls and robust packaging that can minimize risks during manufacturing.

Metal and packaging-related contamination have also seen an uptick, with packaging-related contamination increasing from 6 cases to 10 cases across the same periods. This growth highlights the necessity for packaging that offers better integrity and resilience to external factors. Biopharmaceuticals, a rapidly growing segment, saw a peak in contamination cases in 2012–2016, followed by a slight decline. The increasing focus on biopharmaceutical products places additional demands on sterile packaging to ensure the safety of these sensitive formulations.

In addition, contamination incidents linked to "other drugs" surged from 4 cases in earlier periods to 14 cases by 2017–2021, reflecting broader challenges across pharmaceutical categories. The rising number of unknown sources of contamination, from 10 cases to 22 cases, further stresses the importance of comprehensive packaging solutions that can safeguard against unpredictable risks.

This trend in contamination has driven demand for sterile medical packaging innovations, such as improved barrier films, tamper-evident designs, and antimicrobial packaging technologies. Manufacturers in the sterile packaging market are likely to benefit from these increased requirements, as pharmaceutical companies seek to ensure product safety and regulatory compliance. The data reinforces the critical role of sterile packaging in mitigating contamination risks and safeguarding public health.

Market Segmentation

The sterile medical packaging industry is segmented on the basis of material, product, sterilization method, application and region. By material, the market is classified into plastic, glass, metal, and others. By product, the market is classified into thermoform trays, sterile bottles & containers, bags & pouches, blisters & clamshells, vials & ampoules, prefilled syringes, wraps, and others. By sterilization method, the market is divided into chemical sterilization, radiation sterilization and high temperature/pressure sterilization. By application, the market is divided into pharmaceutical & biologics, surgical & medical instruments, in-vitro diagnostics products, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the Sterile Medical Packaging market share in 2023. This is attributed to well-established healthcare facilities, stringent regulatory requirements, and presence of major key players in North America. However, Asia-Pacific is expected to register the highest CAGR. The region is experiencing a rising incidence of chronic diseases, growing pharmaceutical and medical devices industry, and favorable government initiatives.

- According to the 2021 article by European Environmental Bureau, 24% of the global pharmaceutical products is consumed in Europe.

- According to the 2021 article by European Environmental Bureau, China produces 80-90% of antibiotic APIs and Indian companies lead the production of finished dose products.

- According to 2024 article by Invest India, India is a major exporter of Pharmaceuticals, with over 200+ countries served by Indian pharma exports. Furthermore, India supplies over 50% of Africa’s requirement for generics,

- India is one of the biggest suppliers of low-cost vaccines in the world and is the largest provider of generic medicines globally, occupying a 20% share in global supply by volume.

Industry Trends

- According to 2021 article by European Environmental Bureau, over 100, 000 tons of pharmaceutical products are consumed globally every year.

- According to Invest India, the pharmaceutical industry in India is currently valued at $50 billion as of in financial year 2023-2024.

- According to a study by The International Society for Pharmaceutical Engineering, pharmaceutical product recall due to packaging related contamination has increased by 66.7% in 2021 as compared to 2016.

Competitive Landscape

Sterile medical packaging market report summarizes top key players overview as DuPont De Numors Inc., Amcor Plc, Berry Global Inc., Sonoco Products Company. West Pharmaceutical Services, Inc., Billerud AB, SteriPack Group, Wipak Oy, Placon Corporation, Riverside Medical Packaging Co., Ltd. Other players in the sterile medical packaging market are Oracle Packaging Nelipak Corporation, Oliver Healthcare Packaging Company, and Orchid Mps Holdings, Llc.

Recent Key Strategies and Developments

- On May 9, 2024, Berry Global Group invested in additional assets and manufacturing capabilities to increase its healthcare production capacity by up to 30% across three of its European sites. Berry’s Offranville site specializes in the manufacture of best-in-class standard and custom solutions for pharmaceutical packaging and drug delivery devices, such as ophthalmic & nasal products, and Rispharm multi-dose eye dropper. Investments at the Osnago site, which manufactures throat spray actuators, and Sirone site, which manufactures accompanying bottles, will support a growing demand for prescription and over the counter orally administered solutions for the prevention and treatment of infections and respiratory diseases driven by rising air pollution levels.

- In February 2024, Eris Lifesciences acquired Swiss Parenteral to expand in the sterile injectable industry. The Swiss Parenteral has a portfolio of over 100 dossiers across 190 molecules to offer across Asia-Pacific, Latin America, and Africa.

- In November 2023, Coveris launched thermoforming film for medical packaging which is a recyclable and flexible thermoforming film solution.

- In January 2023, Amcor announced an agreement to acquire Shanghai-based MDK to strengthen its presence in the Asia-Pacific medical packaging market mainly in China, India, and Southeast Asian countries.

- In January 2023, Amcor entered into an agreement to acquire Shanghai-based MDK. MDK generates annual sales of approximately $50 million and is a leading provider of medical device packaging. The addition of MDK strengthens leadership in the Asia-Pacific medical packaging segment, which now comprises four manufacturing sites serving China, India, and Southeast Asia markets.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sterile medical packaging market analysis from 2024 to 2033 to identify the prevailing sterile medical packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sterile medical packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sterile medical packaging market trends, key players, market segments, application areas, and market growth strategies.

Sterile Medical Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 156.7 Billion |

| Growth Rate | CAGR of 11% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Materials |

|

| By Product |

|

| By Sterilization Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | SteriPack Group, DuPont, Berry Global Inc, Amcor PLC, West Pharmaceutical Services, Inc, Sonoco Products Company, Placon Corporation, Riverside Medical Packaging Co., Ltd, Wipak Oy, Billerud AB, |

The total market value of Sterile Medical Packaging market is $55.0 billion in 2023

The market value of Sterile Medical Packaging market is projected to reach $156.7 billion by 2033

The forecast period for Sterile Medical Packaging market is 2024-2033.

The base year is 2023 in Sterile Medical Packaging market

The Sterile Medical Packaging market growth is driven by rising demand for infection control, growth in the pharmaceutical industry and advancements in packaging materials

Loading Table Of Content...