Stethoscopes Market Research, 2033

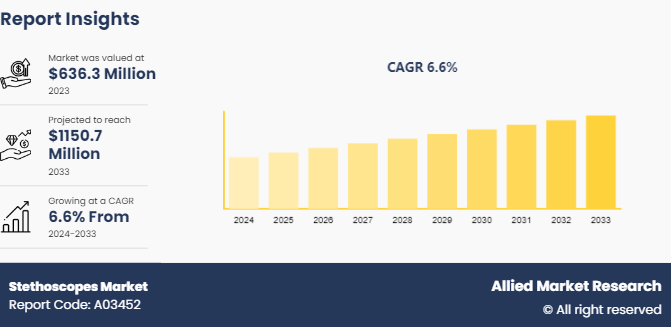

The global stethoscope market size was valued at $636.3 million in 2023, and is projected to reach $1150.7 million by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Market Definition and Overview

A stethoscope is a medical instrument used by healthcare professionals to listen to internal sounds in the human body, such as heartbeats, lung sounds, and bowel movements. It typically consists of a chest piece with a diaphragm (a flat, circular piece) or a bell (a smaller, cup-shaped piece) , tubing to carry sound, and ear tips that the user places in their ears.

The term "stethoscope" comes from the Greek words "stethos" (chest) and "skopein" (to look at or examine) . It symbolizes the practice of auscultation, a key method in diagnosing various health conditions and monitoring patient health. By using a stethoscope, healthcare providers can detect abnormal sounds or changes that might indicate an underlying health issue, like a heart murmur, lung infection, or other conditions.

Key Takeaways

- The stethoscope market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major stethoscope industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The integration of artificial intelligence (AI) , digital sensors, and telehealth capabilities into stethoscopes is driving opportunities in the stethoscope market size. Cardiovascular diseases (CVDs) and respiratory disorders are leading causes of morbidity and mortality worldwide. Stethoscopes play a crucial role in the diagnosis and monitoring of these conditions by enabling healthcare providers to assess heart and lung sounds. The growing prevalence of CVDs and respiratory diseases drives demand for stethoscopes in clinical settings, including hospitals, clinics, and primary care facilities. All these factors are anticipated to drive the stethoscope market share

Digital and AI-equipped stethoscopes are generally more expensive than traditional models, which could limit adoption in resource-constrained settings or among individual practitioners. Obtaining regulatory approvals, like FDA clearance, can be a lengthy and costly process, potentially slowing stethoscope market growth.

The growing incidence of conditions such as asthma, chronic obstructive pulmonary disease (COPD) , pneumonia, and heart diseases like arrhythmia and heart failure necessitates the use of diagnostic tools like stethoscopes for early detection and ongoing monitoring. As healthcare systems strive to diagnose and treat these conditions effectively, there's a growing demand for precise diagnostic equipment. Stethoscopes, particularly those with advanced features like digital and AI-enhanced capabilities, are valuable tools for detecting abnormal heart and lung sounds. As healthcare transitions toward preventive and proactive care, stethoscopes play a critical role in regular check-ups and early detection of potential health issues. This shift toward prevention amplifies the need for effective diagnostic instruments.

Global Stethoscope Market Key Companies Overview

3M Littmann: 3M Littmann is a leading manufacturer of stethoscopes known for its high-quality products and innovative designs. The company offers a wide range of stethoscope models, including the Classic III, Cardiology IV, and Master Cardiology, catering to the diverse needs of healthcare professionals.

In January of 2024, Eko received FDA clearance for an algorithm that can detect the presence of suspected heart murmurs. The 3M Littmann CORE Digital Stethoscope can connect to Eko software, including its heart murmur AI1 and its telemedicine software, enabling enhanced in-person or remote patient care.

Eko Health, Inc: Eko Health, Inc. is a prominent digital health company that specializes in advancing the detection and monitoring of heart and lung diseases through its innovative digital stethoscopes and AI-powered software. Founded in 2013, Eko Health has rapidly become a leader in the integration of artificial intelligence (AI) with traditional stethoscope technology.

The UK's healthcare system is increasingly integrating AI technology, leading to the rising popularity of AI-equipped digital stethoscopes. In November 2023, Eko Health launched its AI-powered digital stethoscope in collaboration with Imperial College London, making these advanced diagnostic tools available to clinics throughout the United Kingdom.

Market Segmentation

The stethoscope market is segmented into technology type, sales channel, end use, and region. On the basis of technology type, the market is divided into electronic/digital, smart stethoscope, and traditional acoustic stethoscope. As per sales channel, the market is segregated into distributors, e-commerce, and direct purchase. On the basis of end use, the market is categorized into home healthcare, hospitals, clinics, nurse practitioners, EMT/ first responders, and veterinary. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North America stethoscope market generated the highest revenue in 2023 North America, particularly the United States and Canada, has a well-established healthcare system with a high adoption rate of advanced medical technologies. This infrastructure supports the demand for innovative stethoscopes. The prevalence of chronic diseases, such as cardiovascular and respiratory conditions, is relatively high in North America. This leads to increased use of stethoscopes for diagnosis, monitoring, and management. The North American market is a hub for medical technology innovation. Companies in this region are at the forefront of integrating artificial intelligence, digital features, and telehealth capabilities into stethoscopes, creating new opportunities for growth.

The U.S. stethoscope market share is projected to achieve the fastest CAGR during the forecast period. This growth is attributed to significant technological progress, characterized by a shift toward digital stethoscopes. These modern instruments often feature electronic amplification, noise reduction, and compatibility with electronic health records (EHRs) , indicating a clear move toward more advanced and interconnected diagnostic tools.

In April 2022, Sanolla launched its AI-ready VoqX infrasound stethoscope after receiving approval from the Food and Drug Administration (FDA) for clinical use in the United States.

In June 2021, HD Medical announced that its top-selling product, HD Steth, is now available online through Stethoscope.com, one of the largest online retailers for stethoscopes and other medical devices. HD Medical has also named Stethoscope.com as a key online distribution partner in the United States. The introduction and easy availability of stethoscopes, combined with the region's well-established healthcare infrastructure, are driving significant growth in the broader regional market.

Competitive Landscape

The major players operating in the stethoscope market analysis include 3M, Medline Industries, LP., Welch Allyn (Hill-Rom Holdings, Inc.) , Eko Health, Inc., GF Health Products, Inc., Rudolf Riester GmbH (Halma plc) , American Diagnostic Corporation, Cardionics Inc., PAUL HARTMANN AG, HEINE Optotechnik GmbH & Co. KG., and Others.

Recent Key Strategies and Developments

- In August 2022, telehealth platform company Caregility entered into an integration partnership with Eko, the maker of telehealth stethoscopes. This collaboration allows Caregility's cloud platform to connect with Eko's smart stethoscopes and software, enabling users of Caregility's iConsult app to perform high-quality auscultation during virtual physical exams.

- In April 2022, Israeli startup Sanolla Ltd. received 510 (k) clearance from the United States Food and Drug Administration (FDA) for its smart-infrasound stethoscope, Voqx. This AI-powered device is the first stethoscope to receive FDA clearance for detecting both infrasound and audible information, aiding in the identification of clinical conditions.

Industry Trends

- In November 2023, researchers at Imperial College London, with backing from a USD 1.3 million grant from the National Institute for Health and Care Research (NIHR) , rolled out the TRICORDER program. This initiative introduced AI-equipped smart stethoscopes to 100 General Practitioner (GP) clinics to boost heart failure diagnostic capabilities in primary care.

- Earlier, in June 2023, Eko Health, Inc. received FDA clearance for its advanced digital stethoscope, the Core 500, which employs artificial intelligence (AI) to detect abnormal heart rhythms. This state-of-the-art device combines AI technology with high-fidelity audio, a full-color display, and a 3-lead electrocardiogram (ECG) , signifying a substantial leap forward in cardiac monitoring technology.

Key Sources Referred

- Company Annual Reports

- American Lung Association.

- UNICEF 2018

- International Journal of Creative Research Thoughts (IJCRT)

- AHA journals

- American Journal of Cardiology

- IOSR Journal of Electronics and Communication Engineering (IOSR-JECE)

- Ai Health Highway India Pvt Ltd.

- arxiv

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the stethoscopes market analysis from 2024 to 2033 to identify the prevailing stethoscope market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the stethoscopes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Stethoscope industry player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global stethoscope market trends, key players, market segments, application areas, and market growth strategies.

Stethoscopes Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1150.7 Million |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 312 |

| By Technology Type |

|

| By Sales Channel |

|

| By End Use |

|

| By Region |

|

| Key Market Players | GF Health Products, Inc, American Diagnostic Corporation, Eko Health, Inc., HEINE Optotechnik GmbH & Co. KG., Cardionics Inc., Welch Allyn (Hill-Rom Holdings, Inc., Rudolf Riester GmbH (Halma plc), 3M, Medline Industries, LP., PAUL HARTMANN AG |

The stethoscope market was valued at $636.3 million in 2023 and is estimated to reach $1150.7 million by 2033, exhibiting a CAGR of 6.6% from 2024 to 2033.

The largest regional market for stethoscopes is North America, driven by advanced healthcare infrastructure, high healthcare expenditure, and significant adoption of technologically advanced medical devices.

The global stethoscopes market trends include technological advancements, increased telemedicine adoption, smart stethoscope integration, rising chronic disease prevalence, and growing demand for digital and electronic stethoscopes.

The top companies holding market share in stethoscopes include 3M, Welch Allyn, MDF Instruments, American Diagnostic Corporation (ADC), Heine Optotechnik, and Cardionics. These companies lead in innovation and quality.

The leading application of the stethoscopes market is in cardiovascular disease diagnosis, allowing healthcare professionals to detect and monitor heart-related conditions through auscultation of heart sounds.

Loading Table Of Content...