Structural Steel Market Research, 2032

The Global Structural Steel Market Size was valued at $106.4 billion in 2022, and is projected to reach $177.4 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032.

Market Introduction and Definition

Structural steel is widely used in a variety of building tasks. Structural steel is available in a variety of forms, offering architects and civil engineers creative latitude in their designs. Warehouses, aircraft hangars, stadiums, steel and glass structures, industrial sheds, and bridges are all constructed with structural steel.

Furthermore, structural steel is employed entirely or partially to create residential and commercial structures. Structural steel is a versatile and convenient building material that delivers structural strength without adding unnecessary weight, from commercial to residential to road infrastructure.

Market Dynamics

The need for stainless steel, a major structural steel component, is increasing as the industrial industry grows. The recyclability of structural steel corresponds to the desire for green building construction, thus growing its market share. Countries such as India and China, which are rapidly developing in terms of building and infrastructure, contribute to growing the structural steel market. The government's initiatives to improve housing conditions increase demand for structural steel in construction activity.

Furthermore, the huge rise in residential and non-residential structures across the globe, in addition to the usage of structural steel in their construction, is regarded as the primary driver of the structural steel market. The rise of manufacturing industries generates demand for flat items such as stainless steel, which might boost the market.

The growing demand for green building development is expanding the market for structural steel, which is completely recyclable. Furthermore, expanding building activities and infrastructure development in nations such as India and China have the potential to significantly enhance the structural steel market.

The government drive to improve housing conditions in several nations has raised the demand for structural steel in the construction sector. For Instance, in July 2022, APL Apollo Tubes introduced revolutionary steel building solutions in front of 200 construction industry influencers, including architects, structural experts, contractors, and developers.

These APL Apollo tubes are utilized in a variety of significant structures, including hospitals, residences, factories, warehouses, cold storage facilities, shopping malls, commercial offices, oxygen plants, data centers, and food parks. APL Apollo tubes are utilized to create seven hospitals in various sites in New Delhi. Structural steel is widely used for huge facades, walls, and other materials. Real estate developers are building several office buildings, which serve as a growth driver for the structural steel industry. These variables boost the structural steel market profits.

Increased population in growing economies such as China, India, and other developing countries has contributed to urbanization, which is expected to stimulate residential construction and demand for structural steel. According to the United Nations (UN), over 68% of the world's population is expected to live in cities by 2050. This is anticipated to lead to an increase in construction activity in residential, infrastructural, and non-residential sectors globally.

Market Segmentation

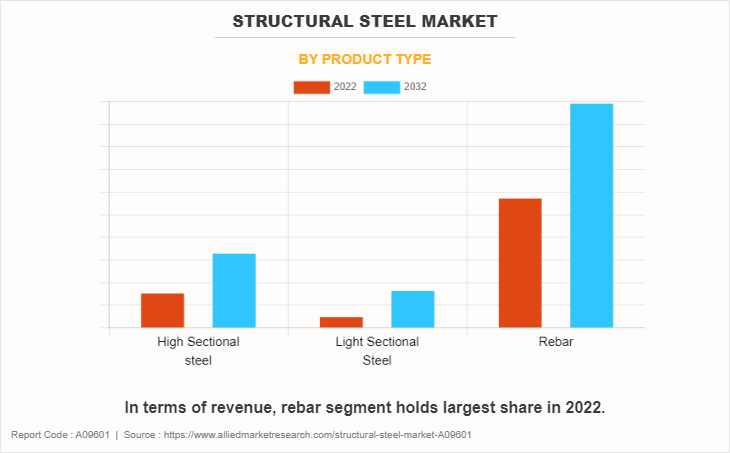

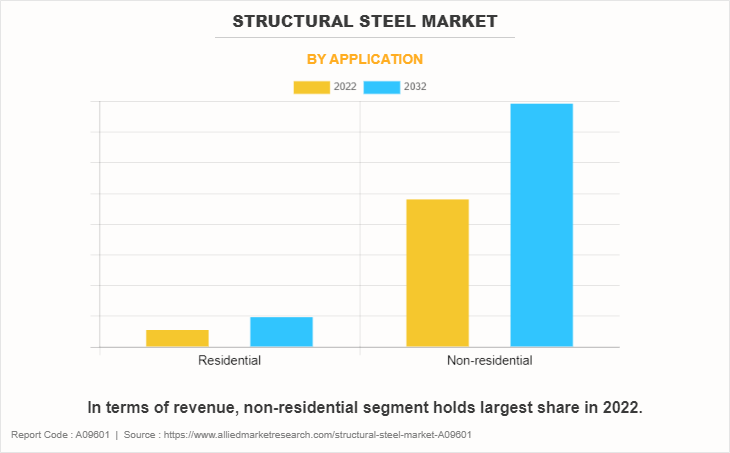

The structural steel market is segmented on the basis of product type, type, application, and region. By product type, the market is categorized into high sectional steel, light sectional steel, and rebar. Depending on type, it is fragmented into hot-rolled steel, and cold-rolled steel. On the basis of application, it is categorized into residential, and non-residential. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and MEA.

On the basis of product type, the rebar segment registered highest revenue in 2022. The heavy sectional steel sector has grown in the market owing to its strength, load-bearing capability, and ability to carry enormous loads while maintaining structural stability. It is widely used in situations where structural integrity and endurance are important. Their hollow construction ensures high strength-to-weight ratios, making them ideal for multi-axis loading applications.

On the basis of application, the Hot-Rolled Steel segment generated highest revenue in 2022. This is attributed to rising government investments in residential, non-residential and infrastructure activities. For instance, in august 2021, Indian government has announced $1.4 trillion investment for infrastructure development. The non-residential segment controls the market and is frequently impacted by the development of commercial buildings, industrial facilities, and institutional structures. Structural steel is used in many applications owing to its high strength, adaptability, and capacity to sustain vast spans and heavy loads.

The coronavirus (COVID-19) swiftly spread throughout several nations and regions in 2019, having a massive influence on people's lives and the general community. It started as a human health issue and has now grown into a major danger to global trade, the economy, and finance. The COVID-19 pandemic caused lockdowns, which halted manufacturing of various items in the construction steel industry.

Asia-Pacific region dominated the market in 2022, accounting for the highest structural steel market share, and is anticipated to maintain this trend throughout the forecast period. This is attributed due to expansion of mining and construction sectors in countries such as India, China, and Japan.

Moreover, increasing government investment in infrastructure development is accelerating the Structural Steel market growth in the region. For instance, According to World Steel Association AISBL steel usage is rise by 0.4% in 2022, reaching 1840.2 Mt. Steel consumption is expected to increase by 2.2% in 2023 to 1,881.4 million tons. China, India, Japan, and the U.S. are the major four countries that contribute to economic growth and manufacturing. Thus, all such factors are expected to drive the structural steel market.

Competition Analysis

Key companies profiled in the structural steel industry include Arcelor Mittal S.A., Baogang Group, Evraz plc, Gerdau S.A, Nippon Steel Corporation, JSW Steel Limited, Tata Steel Limited, SAIL, Wuhan Iron & Steel (Group) Corp and Baosteel Group Corporation.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging structural steel market trends and dynamics.

In-depth structural steel market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

Extensive analysis of the structural steel market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing structural steel market opportunity.

The global structural steel market forecast analysis from 2022 to 2032 is included in the report.

The key players within the structural steel market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the structural steel industry.

Structural Steel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 177.4 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 254 |

| By Product Type |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Arcelor Mittal |

Analyst Review

he structural steel market growth is driven by an increase in infrastructural development such as roads, highways, and bridges by governments, majorly in developed countries such as India, U.S., China, and Germany. In addition, expansion of residential and non-residential sector is another factor that drives growth of the structural steel market. Toughness describes a material's capacity to absorb energy. Structural steels have high hardness characteristics thus, they are ideal for building applications. They are both durable and ductile. It additionally needs to be mentioned that the key difference between mild and structural steel is that structural steels are stiffer, allowing them to withstand heavier weights without drooping. Moreover, increasing government investments in infrastructure and industrial construction sectors. However, a lack of skilled & qualified operators is projected to hinder market growth. Moreover, a decrease in new construction activity is one of the factors that can negatively impact the structural steel market growth.?

Major companies in the market have adopted strategies such as business expansion, product launch, acquisition, and partnership to offer better products and services to customers in the structural steel market. For instance, in February 2022, Trimble, a global construction technology company, announced that Zamil Steel, a global engineering and manufacturing company that produces a variety of high-quality steel products and is the Middle East's?supplier of pre-engineered steel buildings and structural steel products, has chosen its software, including Tekla PowerFab, to transform steel fabrication in its factories in India, Saudi Arabia, Egypt and Vietnam. furthering the long-term strategic cooperation between the two parties. Such factors drive the structural steel market growth.?

The market is expected to reach $177.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2032.

Growth in infrastructure development and increase in metal industry are the upcoming trends of Structural Steel Market.

Infrastructure buildings is leading application of Structural Steel Market

Asia Pacific is the largest regional market for Structural Steel Market

Arcelor Mittal S.A., Baogang Group, Evraz plc, Gerdau S.A, Nippon Steel Corporation, JSW Steel Limited, Tata Steel Limited, SAIL, Wuhan Iron & Steel (Group) Corp and Baosteel Group Corporation.

The product launch is key growth strategy of Structural Steel industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...

Loading Research Methodology...