Student Travel Insurance Market Research, 2032

The global student travel insurance market size was valued at $2.8 billion in 2023, and is projected to reach $15.5 billion by 2032, growing at a CAGR of 21.1% from 2024 to 2032. Student travel insurance is a specialized policy that provides coverage for students traveling abroad for education. It typically includes protection against medical emergencies, trip cancellations, lost luggage, and other unforeseen events during their stay.

Market Introduction and Definition

Student travel insurance is a specialized insurance plan designed to provide coverage for students traveling abroad for studies, internships, vocational training, working holidays, volunteering, or other educational pursuits. This insurance is essential for students to safeguard themselves against unexpected medical or travel-related expenses that may arise during their time abroad.

Student travel insurance typically covers a range of benefits, including reimbursement for medical expenses in case of illness or accidents, coverage for trip interruptions, delays, or cancellations, protection against loss, theft, or damage of personal belongings, emergency evacuation, and personal liability coverage. It offers financial protection in situations such as medical emergencies, flight delays, lost baggage, or other unforeseen events that could disrupt their study abroad experience.

Key Takeaways

The student travel insurance market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major student travel insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The student travel insurance market is driven by rise in awareness among students and educational institutions about the importance of having comprehensive insurance coverage while studying abroad. This awareness arises from the recognition of the potential risks and uncertainties associated with international travel, such as medical emergencies, trip interruptions, or loss of belongings. Furthermore, the mandatory requirement of student travel insurance by many countries and universities further propels the student travel insurance market growth, ensuring that students are financially protected and have the ability to access necessary assistance during their time abroad. In addition, rise in the trend of students participating in various educational programs, internships, and volunteer opportunities overseas, creates a higher demand for tailored insurance solutions that cater to the specific needs of student travelers, therby drives the growth of student travel insurence market.

However, the age limit imposed by insurance providers may exclude older students from accessing student travel insurance benefits. This limitation can hinder the student travel insurance market reach and accessibility to a broader demographic of students. Moreover, the potential complexity and exclusions in insurance policies, such as limitations on coverage for pre-existing conditions or specific activities are expected to deter some students from investing in comprehensive insurance plans. On the contrary, the potential for enhanced coverage options, improved accessibility, and tailored solutions, thereby propels growth during the student travel insurance market forecast period.

Parent Market Overview

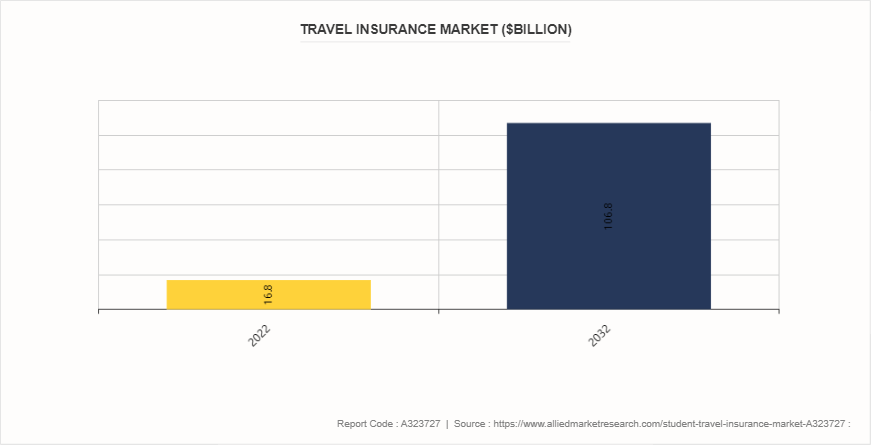

The travel insurance market, which is a parent market of student travel insurance market, is a type of insurance coverage that covers unexpected occurrences that may occur before or during a trip. It typically provides coverage for travel cancellations, interruptions, and delays, as well as medical expenses, emergency evacuation, and lost or stolen items.

The revenue of the global travel insurance market is predicted to be nearly six times larger in 2032 than it was in 2022. Sized at approximately $16.8 billion in 2022, the market is expected to reach the size of around $106.8 billion by 2032. The global travel insurance market is experiencing significant growth, driven by the increasing number of international travelers, rising awareness of travel-related risks, and the expanding demand for coverage across various regions. This growth is also supported by the increasing availability of online travel insurance policies.

Market Segmentation

The student travel insurance market outlook is segmented into type, coverage, distribution channel, and region. On the basis of type, the market is divided into domestic travel and international travel. On the basis of coverage, the market is bifurcated into single trip coverage and annual multi-trip coverage. On the basis of distribution channel, the market is categorized into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, LAMEA.

Regional/Country Market Outlook

In a survey by the U.S. Travel Insurance Association, 59% of respondents said they are likely to purchase travel insurance for their next trip, and 21% said they are more likely to purchase travel insurance.

However, according to a survey by InsureMyTrip, younger travelers are more likely to purchase travel insurance than older travelers, with 62% of Millennials and 58% of Gen Z reporting they have bought travel insurance for a trip.

According to a survey done by the Student and Youth Travel Association (SYTA), in the U.S., 86,662 students took part in domestic and international student group travel. However, this number is 2.7 times smaller than the number of students expected to travel in 2021. In 2021, there were changes in the key attributes of both domestic and international trips. Students traveled in smaller groups for longer periods of time.

Industry Trends

According to a survey done by the Student and Youth Travel Association (SYTA) in 2021, the number of students taking international trips continued to decline, with a 4% drop over 2020. This y-o-y drop was smaller than domestic travel, due to a sharper drop in international travel between 2019 and 2020 (a drop of 84%) . However, student tour operators anticipated a slower recovery for international travel than for domestic travel. They saw 29% of pre-pandemic booking levels in 2022 and 46% in 2023.

A few Indian insurance companies are in the process of redesigning their overseas student travel products to keep up with the times, especially post COVID-19 pandemic, for those aspiring to fly out to the U.S. and UK for further studies. Numerous universities in the U.S. and the UK have expressed concerns about the coverage provided in the overseas student travel policies offered by Indian insurers. Recognizing these concerns, three prominent Indian general insurance companies are taking proactive steps to reassess and restructure their product offerings. This includes rise in the medical evacuation cover and offering higher sums insured at a lower premium.

Competitive Landscape

The major players operating in the student travel insurance market include TATA AIG General Insurance Company Limited, Bajaj Allianz General Insurance Company, Zurich American Insurance Company, HDFC ERGO General Insurance Company Limited, Future Generali India Insurance Company Ltd., AXA Partners Holding SA, Tokio Marine HCC, Travel Guard, Allianz, and Reliance General Insurance. Other players in the student travel insurance market include MetLife, Mapfre Asistencia, Hanse Merkur, Pin An, and others.

Recent Key Strategies and Developments in Student Travel Insurance Industry

In April 2024, SingSaver, a leading personal finance comparison platform in Singapore and a subsidiary of MoneyHero Group entered a preferred partnership with Allianz Partners Singapore to introduce Allianz Travel Hero, an innovative travel insurance solution that allows customers to tailor their insurance plans and enjoy dynamic coverage.

In April 2024, TATA AIG General Insurance Company Limited, a leading general insurance provider, launched “Travel Guard Plus”, a comprehensive travel insurance product that redefines complete coverage for travelers with an array of bundle plans. TATA AIG’s Travel Guard Plus has been designed to meet people’s diverse travel needs with a wide range of plans where 41 different types of covers have been packaged to meet the needs of customers.

Key Sources Referred

Federal Trade Commission

Insurance Regulatory and Development Authority of India

World Health Organization

European Union

U.S. Department of Education

U.S. Department of State

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the student travel insurance market analysis from 2024 to 2032 to identify the prevailing student travel insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the student travel insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global student travel insurance market trends, key players, market segments, application areas, and market growth strategies.

Student Travel Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.5 Billion |

| Growth Rate | CAGR of 21.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 357 |

| By Type |

|

| By Coverage |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Tokio Marine HCC, MetLife, HDFC ERGO General Insurance Company Limited, Mapfre Asistencia, Bajaj Allianz General Insurance Company, Reliance General Insurance, Future Generali India Insurance Company Ltd., AXA Partners Holding SA, TATA AIG General Insurance Company Limited, Zurich American Insurance Company, Allianz, Travel Guard |

Student travel insurance is a policy designed to protect students studying abroad from financial losses due to unforeseen events like medical emergencies, trip cancellations, or lost baggage.

The forecast period for student travel insurance market is 2024 to 2032.

The base year is 2023 in student travel insurance market.

The total market value of student travel insurance market is $2.8 billion in 2023.

The market value of student travel insurance market in 2032 is $15.5 billion.

Loading Table Of Content...