Styrene Butadiene Latex Market Research, 2033

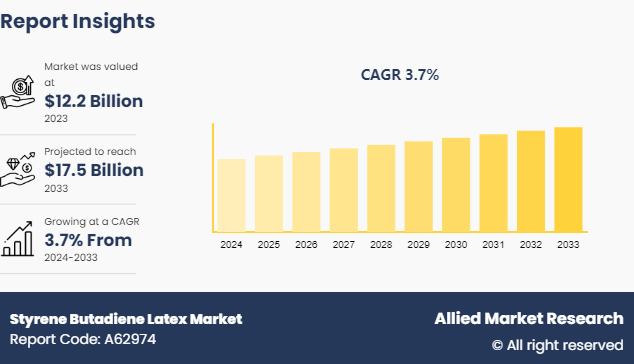

The global styrene butadiene latex market was valued at $12.2 billion in 2023, and is projected to reach $17.5 Billion by 2033, growing at a CAGR of 3.7% from 2024 to 2033.

Market Introduction and Definition

Styrene butadiene latex, commonly known as SBL, is a synthetic polymer emulsion primarily composed of styrene and butadiene monomers. This versatile material finds extensive application across various industries due to its excellent adhesive properties, durability, and water resistance. In the construction industry, SBL serves as a key ingredient in formulating adhesives for bonding diverse substrates such as wood, concrete, and plastics. Its ability to form strong, flexible bonds makes it ideal for applications such as carpet backing, tile adhesives, and waterproof coatings. Moreover, in the paper and packaging industry, SBL is utilized as a coating agent to improve paper strength and printability. In addition, it plays a crucial role in the manufacturing of coated fabrics, automotive parts, and medical devices. The widespread adoption of SBL underscores its significance as a cost-effective and reliable solution for enhancing product performance in various industrial sectors.

Key Takeaways

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

The styrene butadiene market is fragmented in nature among prominent companies such as Trinseo, BASF SE, Zeon, OMNOVA Solutions, Styron, The Dow Chemical Company, Fosroc International Ltd., General Industrial Polymers, Hansol Holdings, JSR Corp., Jubilant Industries Ltd.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

Latest trends in global styrene butadiene market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.?

More than 3, 200 styrene butadiene-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global styrene butadiene market.

Key Market Dynamics

Styrene butadiene latex (SBL) is extensively utilized in the construction sector for its adhesive properties and durability. The surge in construction activities worldwide, driven by urbanization, infrastructure development, and housing projects, serve as a primary driver for the SBL market. According to a report published by the National Investment Promotion and Facilitation Agency of India in 2023, the construction industry in India is expected to reach $1.4 trillion by 2025. Moreover, the shift toward environmentally sustainable construction materials has led to increased adoption of SBL-based products due to their low volatile organic compound (VOC) emissions and eco-friendly characteristics.

Advancements in latex formulation techniques have emerged as a significant driving force behind the rise in demand for styrene butadiene latex (SBL) in various industrial applications. The continuous evolution and refinement of latex formulation methods have propelled SBL to the forefront of industries seeking versatile, cost-effective, and high-performance materials. In addition, the progress in latex formulation techniques has contributed to the creation of water-based coatings with improved performance characteristics. The ability to tailor the latex composition enables the production of coatings that exhibit enhanced adhesion, flexibility, and resistance to environmental factors. All these factors drive the demand for styrene butadiene latex.

However, the growth of the styrene butadiene latex market is significantly hampered by technological barriers that impede innovation within the industry. These barriers include challenges related to the development of novel production processes, the enhancement of product performance, and the exploration of new applications. The complexity of these technological challenges poses a substantial hurdle for industry players aiming to advance and stay competitive in the market. In addition, formulating styrene butadiene latex with improved properties, such as higher stability, durability, or specific functional characteristics, presents a technological challenge. All these factors hamper the growth of styrene butadiene latex market.

On the contrary, rise in demand for paper coating presents significant opportunities for the styrene butadiene latex (SBL) market, as this versatile material finds increasing applications in the paper industry. SBL, a synthetic latex with excellent adhesive and binding properties, has become a preferred choice for coating applications, contributing to improved printability, durability, and overall quality of paper products. In addition, the demand for coated papers has been on the rise, driven by the need for high-quality printing surfaces in packaging, labels, magazines, and promotional materials. Styrene butadiene latex, with its ability to form stable emulsions and create uniform coatings, plays a pivotal role in meeting this demand. All these factors are anticipated to offer new growth opportunities for the cstyrene butadiene latex market during the forecast period.

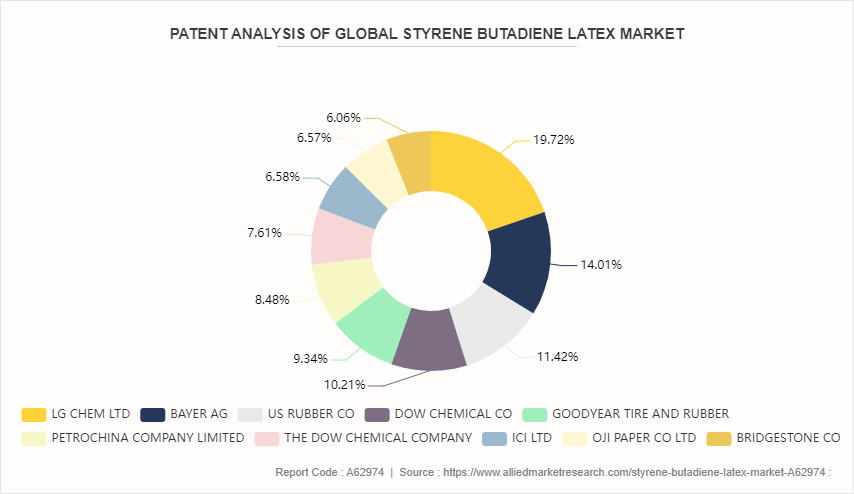

The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future outlook within the styrene butadiene latex market. Patent filings related to styrene butadiene latex have shown a steady increase over the past decade, indicating growing interest and investment in styrene butadiene latex R&D. The majority of patents focus on paper processing, fiber processing, and other applications.

Market Segmentation

The styrene butadiene latex market is segmented on the basis of butadiene content, application, and region. By butadiene content, the market is classified into low, medium, and high. By application, the market is categorized into paper processing, fiber processing, glass fiber processing, mortar additives, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In the Asia-Pacific region, styrene butadiene latex market experiences robust growth driven by rapid industrialization, urbanization, and infrastructure development. The region's expanding construction, automotive, textiles, and paper industries create substantial demand for SBL in applications such as emulsion polymerization, synthetic rubber production, coated paper, and latex products. The construction industry in Asia-Pacific is one of the largest and fastest-growing in the world. Countries such as China, India, and Southeast Asian nations are investing heavily in infrastructure projects, commercial buildings, residential complexes, and industrial facilities. According to a report published by Construction Industry Development Council (CIDC) in December 2023, the construction sector in India grew by 13.3% from July to September 2022 as compared to same period in 2021. SBL finds extensive use in various construction applications, ranging from bonding materials to waterproofing and surface coatings, driving its demand in the region's construction sector.

Furthermore, the Asia-Pacific region is a hub for automotive manufacturing and consumption. According to a report published by International Trade Administration in 2023, China continues to be the world’s largest vehicle market by both annual sales and manufacturing output, with domestic production expected to reach around 35 million vehicles by 2025. With increasing vehicle production and sales, there is a rising demand for lightweight materials, adhesives, and sealants in automotive assembly processes. SBL-based adhesives and sealants offer excellent bonding strength, vibration damping properties, and corrosion resistance, making them ideal for automotive applications such as interior trim, gaskets, and soundproofing. These factors altogether have led the styrene butadiene latex market to witness a significant growth in Asia-Pacific region.

Competitive Landscape

Key players in the styrene butadiene latex market include Trinseo, BASF SE, Zeon, OMNOVA Solutions, Styron, The Dow Chemical Company, Fosroc International Ltd., General Industrial Polymers, Hansol Holdings, JSR Corp., Jubilant Industries Ltd. Other players in the styrene butadiene latex market include Apcotex, Dycon Chemicals, Arihant Solvent and Chemicals, BRP, Taprath Elastomers, and Triveni Chemicals.

Industry Trends:

In March 2024, Buckman Laboratories Inc. produced formula for fire resistant styrene butadiene resin made through Flamebloc technology. This strategic product development has boosted the adoption of fire-resistant styrene butadiene across high-temperature applications in various end-use sectors.

In May 2023, researchers from India have developed unique high molecular weight styrene butadiene latex made from nano emulsion process. This novel product possess various special properties as compared to conventional styrene butadiene latex, thus, increasing the utilization of high molecular weight styrene butadiene latex for specialty purposes.

Public Policies

The Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) Regulation 40 (9) states that manufacturers and importers of SBL must register the substance with the European Chemicals Agency (ECHA) if they produce or import it in quantities exceeding one ton per year. Moreover, registrants are required to submit detailed information on the properties, uses, and hazards of SBL, as well as assess its risks and implement risk management measures to ensure safe handling and use.

In the U.S., the Occupational Safety and Health Administration (OSHA) sets regulations to protect workers from occupational hazards, including exposure to chemicals found in SBL. OSHA's permissible exposure limits (PELs) and standards for substances such as styrene and butadiene, which are components of SBL, establish maximum allowable concentrations in the workplace to prevent adverse health effects.

SBL-based materials intended for use in food packaging or coming into contact with food must comply with regulations such as the FDA (Food and Drug Administration) regulation number 886/3600 in the U.S. or equivalent regulations in other jurisdictions.

Key Sources Referred

National Promotion and Facilitation Agency

Coatings World

U.S. Development Authority

Willey Online Journal

U.S. Food and Drug Administration

International Trade Administration

Press Information Bureau

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing styrene butadiene latex market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the styrene butadiene latex market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global styrene butadiene latex market trends, key players, market segments, application areas, and market growth strategies.

Styrene Butadiene Latex Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 17.5 Billion |

| Growth Rate | CAGR of 3.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Butadiene Content |

|

| By Application |

|

| By Region |

|

| Key Market Players | Styron, BASF SE, Omnova Solutions, Fosroc International Ltd., Trinseo S.A., Zeon, General Industrial Polymers, The Dow Chemical Company, Hansol Holdings, JSR Corp., Jubilant Industries Ltd. |

Loading Table Of Content...