Subscriber Data Management Market Insights, 2031

The global subscriber data management market was valued at USD 4.9 billion in 2021, and is projected to reach USD 25.5 billion by 2031, growing at a CAGR of 18.4% from 2022 to 2031.

Factors such as growing digitalization and rising adoption of cloud-based services across the world are positively impacting the growth of the market. In addition, the increase in adoption of subscriber data management solutions to enhance operation & productivity, strengthens the growth of the subscriber data management market. Furthermore, communications service providers are investing in 5G networks, a trend that is expected to continue to provide lucrative growth opportunities for the market during the forecast period. Moreover, the growing number of mobile devices and NFV and IP system deployments, combined with increasing demand for advanced network technologies such as LTE and VoLTE, has led to significant growth in the subscriber data management market trends. However, security & privacy concerns related to the data hamper the growth of the subscriber data management industry.

Subscriber data management facilitates the evolution of 5G and cloud infrastructure. It stores essential data used by diverse services, simplifying the network upgrade path by continuing to support legacy network elements while enabling innovative next-gen services. SDM provides robust and scalable single-point data storage for 4G as well as 5G subscriptions. It efficiently manages SIM services and subscriber data crucial for 5G. Furthermore, it also helps CSPs unlock new revenue streams through partnerships and collaborations that enable advanced 5G services such as IoT, eMBB, M2M, URLLC, and more. Thus, it provides lucrative opportunities for the subscriber data management market growth in the upcoming years.

Moreover, 5G creates new needs for the types of data stored and managed in the core network as well as for new services that need to be authenticated and authorized. SDM serves these functions by ensuring stored data is available on-demand in real-time while gatekeeping access and ensuring security. 5G also increases complexity in the control plane, as different services have varying requirements across multiple devices and domains. This complexity is handled with ease through SDM’s unified platform. On the other hand, the cloud-native architecture of SDM efficiently supports different deployment modes to serve diverse use cases for network slicing and edge computing, while ensuring the low total cost of ownership (TCO), CAPEX, and OPEX. These factors are expected to create numerous growth opportunities for the market during the forecast period. The subscriber data management market is segmented into Solution, Network Type, Deployment Model, Enterprise Size and Application Type.

Segment Review

The subscriber data management market is segmented into solution, network type, deployment model, enterprise size, application type, and region. By solution, it is classified into subscriber data repository, subscriber policy management, subscriber identity management and subscriber location and device information management. Depending on the network type, it is divided into mobile networks and fixed networks. Based on deployment model, it is divided into on-premises and cloud. On the basis of enterprise size, the market is bifurcated into small & medium-sized enterprises and large enterprises. As per application type, the subscriber data management market is classified into mobile, voice over internet protocol (VoIP) and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

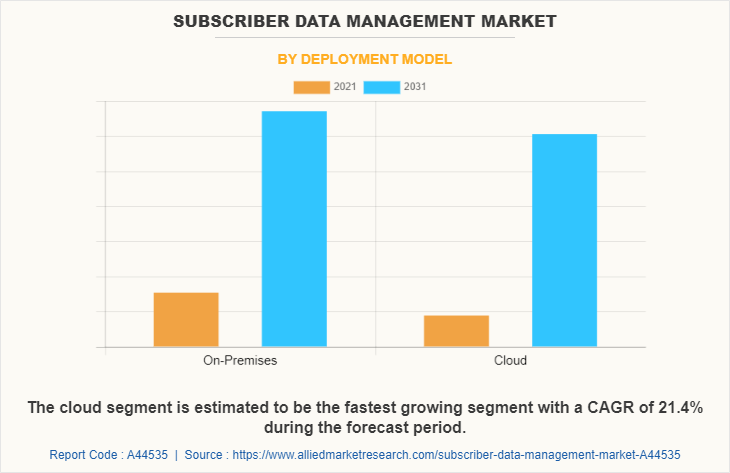

On the basis of deployment model, the on-premises segment dominated the global subscriber data management market in 2021 and is expected to maintain its dominance in the upcoming years. This is attributed due to the numerous advantages offered by the on-premise deployment such as a high level of data security and safety. Industries prefer on-premise models owing to high data security and less data breaches as compared to cloud based deployment models, which further drive the demand for on-premise deployment models within the sectors. However, the cloud segment is expected to witness the highest growth in the upcoming years. Factors such as rise in the adoption of cloud-based SDM due to low cost and easier maintenance, offer better security & real-time updates.

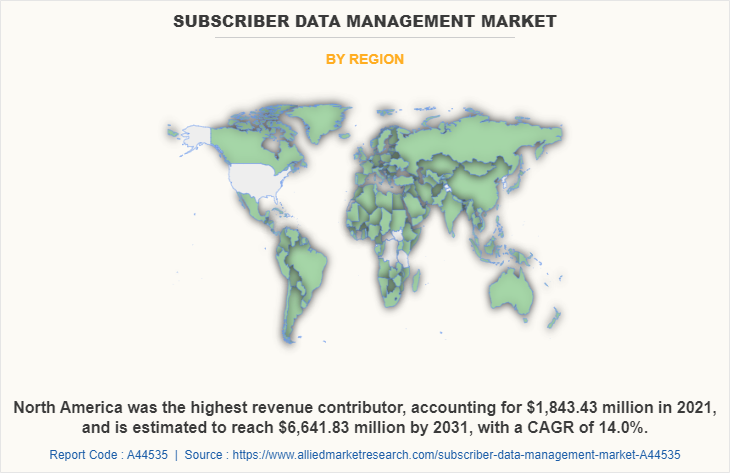

By region, North America dominated the market share in 2021 for the subscriber data management market. Increase in investment in advanced technologies such as AI, ML, IoT, big data, 5G and cloud computing to improve businesses and the customer experience is expected to drive market growth in this region. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of connected technology.

Key Strategies/Development:

- In February 2023 - Huawei released storage solution to build subscriber data infrastructure in the multi-cloud era. Huawei offers a full series of products and solutions for data production, backup, and archiving to cover all scenarios and provide tiered storage of hot, warm, and cold data. The proportion of cold data exceeds 70%, requiring low-cost archiving. In response, Huawei launched the Blu-ray storage, which has a longer service life and reduces the total cost of ownership (TCO) by 70%.

- In November 2022 - Cisco System, Inc. enhanced its subscriber data management and subscriber identity management and released security updates for vulnerabilities affecting Cisco Identity Services Engine (ISE) by stopping attacker to exploit vulnerabilities to bypass authorization and access system files.

- In January 2022 - Telefonaktiebolaget LM Ericsson authentication security module enabled customer service point to augment security for markets and use cases that have more strict security requirements as 5G is changing the security landscape. Ericsson takes measures to effectively address a surge in new use cases, new devices and the move beyond consumer mobile broadband to industries and enterprises by managing and securing subscriber data.

Top Impacting Factors -

Growth in need for consolidating data:

Subscriber data is a core asset for operators today. More OTT services are directly delivered to subscribers, resulting in a change in consumer spending patterns. For telcos to remain competitive and differentiate themselves, they must leverage their relationship with their subscribers. And this means leveraging subscriber data, including their online persona, demographics, behavioral patterns, personal preferences, and more. To fully benefit from this data, telcos need to get a single view of the subscriber. With the proliferation of services, subscriber data is stored and managed in separate silos. This siloed data is accessed by incompatible APIs. And now, big data from cloud, social, location-based, and other new apps have its own unique requirements.

To facilitate the high-value CX-driven use cases that 5G offers, service providers need to upgrade their legacy core so it can support 4G and 5G (and private 5G) networks, managing legacy as well as next-gen services. SDM is integral to the 5G Core (5GC), integrating data from all these sources on a single convergent platform, providing a single and monetizable view of the subscriber. Such factors are expected to drive the growth of the subscriber data management market forecast.

Increase in adoption of cloud-based services:

Organizations are increasingly adopting cloud-based models by distributing their resources across environments. Cloud-based SDM solution has gained popularity as it provides flexibility, scalability, and low-cost benefits. It also helps organizations centrally analyze data generated from various locations and collect data from different software or platform, making it easy to gather and analyze data. Furthermore, SDM providers such as Nokia Corporation, Optiva Inc., among others have launched SDM offerings to cater to the business demand for across region, owing to transition to cloud. The major factors that boost the growth of the subscriber data management market include a rise in the need to improve the productivity of the organization by deploying advanced technology to meet business needs.

COVID-19 Impact Analysis

The global COVID-19 pandemic has drastically affected businesses across the world. It has positively impacted the adoption of the SDM market. Furthermore, businesses are investing more money on SDM solutions due to the growing trend of personalized business operation as a way to enhance the customer experience. In addition, the solution offers firms a number of benefits, including the ability to control budget and help to enhance financial revenue management. Furthermore, growth in migration of businesses toward cloud and digital transformation initiative across world is expected to create opportunities for the SDM market in the upcoming year.

Moreover, the pandemic has introduced considerable challenges for companies, which are trying to execute key processes, report accurately with data spread over multiple locations, and operate complex systems. Hence, a greater number of companies are investing in SDM solutions. SDM solution provides limitless scalability and continual enhancement of functionalities, which are critical in accomplishing digital transformation, thus boosting growth of the market post pandemic. Moreover, subscriber data management is advancing quite rapidly, owing to the rise in adoption of SDM solution is expected to increase investments in this market. Such a factor is anticipated to create numerous opportunities for the subscriber data management market growth during the forecast period.

Key Benefits for Stakeholders

- The study provides an in-depth subscriber data management market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the subscriber data management market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the subscriber data management industry.

- The quantitative analysis of the global subscriber data management market for the period 2021–2031 is provided to determine the subscriber data management market potential.

Subscriber Data Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 25.5 billion |

| Growth Rate | CAGR of 18.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 505 |

| By Solution |

|

| By Network Type |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Application Type |

|

| By Region |

|

| Key Market Players | Hewlett Packard Enterprise Company, Optiva, Inc., Nokia Corporation, ZTE Corporation, Huawei Technologies Co., Ltd., Cisco System, Inc., Oracle Corporation, Telefonaktiebolaget LM Ericsson, Amdocs Inc., Computaris International |

Analyst Review

According to CXOs of the leading companies, over time, businesses have seen various changes in the business processes, operations, and industrial automation. Moreover, businesses are shifting toward the digital platform and an increase in implementation of Industry 4.0 to cope with ongoing tough business competition creates the need for seamless solutions to meet these requirements. This eventually escalates the adoption of subscriber data management in various industries rapidly. The adoption of SDM has increased over the period to provide reliable and consistent experiences for their subscribers. In addition, the ability of SDM solution to provide various opportunities for businesses to gain new insights to run the business efficiently is increasing its popularity among end users. Furthermore, businesses are investing in SDM solutions to increase security and reduce expenses in organizations, which in turn fuels the growth of the market.

Furthermore, increased usage of internet-based services along with cloud computing services among organizations have significantly fueled the demand for market across the world. The presence of a large number of providers in the global SDM market increases the competitive rivalry among the key players. Therefore, SDM providers are differentiating themselves from competitors and driving revenue growth by incorporating new digital business technologies such as 5G networks to gain a competitive edge and retain their market position.

The market is considerably concentrated with major players consuming significant market share. The degree of concentration will remain the same during the forecast period. The vendors operating in the market are taking several initiatives such as new product launches and partnership to stay competitive in the market and to strengthen their foothold in the market. For instance, in August 2022, Nokia Corporation announced that Jazz, Pakistan’s largest mobile operator, has selected Nokia’s latest Subscriber Data Management (SDM) software to enhance HLR/HSS network resiliency and accelerate new product and services for Jazz customers. As part of a phased expansion and deployment strategy, the network will gradually modernize to fully cloud based SDM architecture in the upcoming years. In addition, Nokia SDM’s software will reduce the provisioning time for new subscribers, services and functionalities. The cloud transformation of the SDM network will allow Jazz to use network automation for zero-touch capacity scaling. In addition, Nokia NetAct will provide a consolidated view of multi-domain, multi-technology networks for ensuring the best network experience. Such emerging enhancement will create notable opportunities for market expansion during the forecast period.

The global Subscriber Data Management Market was valued at USD 4.9 billion in 2021, and is projected to reach USD 25.5 billion by 2031

The global Subscriber Data Management Market is projected to grow at a compound annual growth rate of 18.4% from 2022-2031 to reach USD 25.5 billion by 2031

The key players that operate in the Subscriber Data Management Market such as Oracle Corporation, Huawei Technologies Co., Ltd., Cisco System, Inc., Optiva, Inc., Telefonaktiebolaget LM Ericsson, Amdocs Inc., Nokia Corporation, ZTE Corporation, Computaris International, Hewlett Packard Enterprise Company

By region, North America dominated the market share in 2021 for the subscriber data management market.

Growth in need for consolidating data & Increase in adoption of cloud-based services

Loading Table Of Content...

Loading Research Methodology...