Surface & Field Analytics Market Research, 2031

The global surface & field analytics market was valued at $20.4 billion in 2021, and is projected to reach $49.9 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

Surface analysis is a technique used in geospatial analytics for analyzing different types of surfaces, which include elevation of the floor and slope of the floor. The analysis is used in the discovery of new materials and to enhance the performance of materials in use.

Rise in demand for work from home and sanitation trends during the period of the COVID-19 pandemic aided in propelling growth of global surface analytics and remote management solutions, hence empowering the demand for the overall surface & field analytics industry. However, data privacy and sharing challenges of third-party surface & field analytics platforms hamper the surface & field analytics market size. On the contrary, integration of advanced tools such as machine learning and surface analytics with surface & field analytics solutions suites is expected to offer remunerative opportunities for expansion of the surface & field analytics industry during the forecast period.

The report focuses on growth prospects, restraints, and analysis of the global surface & field analytics market trends. The study provides Porter’s five forces analysis to understand impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global surface & field analytics market share.

The surface & field analytics market is segmented into Offering, Deployment Model, Enterprise Size and Industry Vertical.

Segment Review

The surface & field analytics market is segmented on the basis of offering, deployment model, enterprise size, industry vertical, and region. On the basis of offering, the industry is divided into software and service. Depending on deployment mode, the market is classified into on premise and cloud. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. The industry vertical covered in the study include automotive and transportation, energy and utilities, government, defense and intelligence, smart cities, insurance, natural resources, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

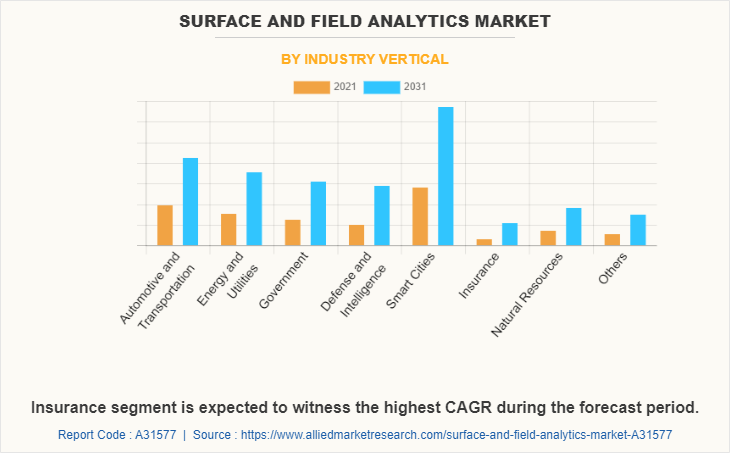

Depending on industry vertical, the smart cities segment dominated the surface & field analytics market share in 2021, and is expected to continue this trend during the forecast period, owing to growing need for effective planning and mapping solutions, incentivizing major governments to invest in effective surface & field analytics solutions for their organizations. However, the insurance segment is expected to witness highest growth in the upcoming years, owing to growing demand for solutions that enable analyzing and tagging customer data to their respective location (area/city).

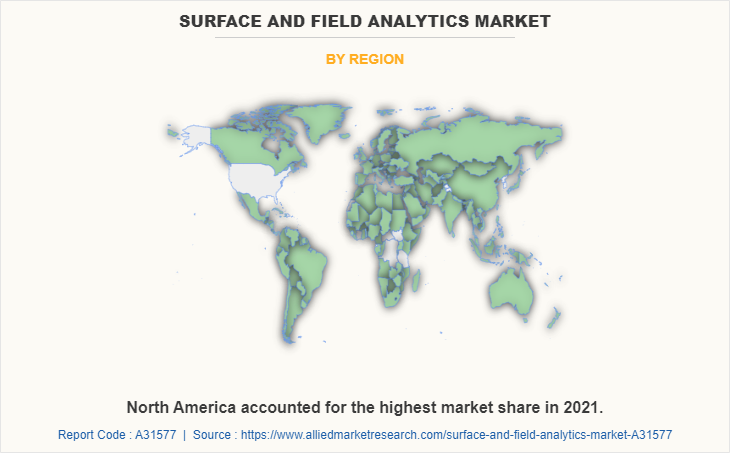

Region wise, the surface & field analytics market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of surface & field analytics vendors such as Nikon Corporation, Thermo Fisher Scientific, Inc., and Olympus Corporation, which is expected to drive the market for surface & field analytics technology within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region, which is expected to fuel growth of surface & field analytics solutions in the region in the coming years.

The key players profiled in the surface & field analytics market analysis are Bruker Corporation, Carl Zeiss AG, Danaher Corporation, Jeol Limited, Nikon Corporation, Olympus Corporation, Shimadzu Corporation, Thermo Fisher Scientific, Inc., ULVAN-PHI, and Waters Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

COVID-19 Impact Analysis

The global surface & field analytics market has witnessed stable growth during the COVID-19 pandemic, owing to the dramatically increase in need for disinfecting environmental surfaces that are more likely to be contaminated with the COVID-19 virus, which further fueled the demand for scientific instruments and solutions for molecular and materials research. Moreover, contamination and decontamination of inanimate surfaces became essential post the outbreak of the COVID-19 pandemic, as the spread between people occurs through touching surfaces or objects where the virus is present. This resulted in demand for surface and analytical tools such as testing instruments, communications solution, water quality systems, medical diagnostic solution, life science research tools, professional microscopes, product identification solution, sustainable packaging design solution, automation solution, and sensors and controls solution. Such factors propelled the growth of the surface & field analytics market during the pandemic period.

Top Impacting Factors

Increase in demand for surface & field analytics software in smart cities development and urban planning

Modern smart cities are data-driven and are highly dependent on sharing real-time data. Collecting data from thousands of IoT sensors and analyzing it by an enterprise-grade surface & field analytics solution to create visualization of the data on a map for immediate actionable insights. These insights can be used to track the delivery of city services and highlight areas where local council services need improvement. Moreover, location-based analysis of IoT data has further been used by local government to develop smarter parks, improve safety, and drive innovation. While developing smart cities projects, surface & field analytics solutions are implemented to create generalized location-enabled platform for use cases analysis in smart cities environments. These include automated natural hazard monitor web surface & field analytics with SMS warning, climate monitoring, urban design, intelligent transportation systems, and disaster management SDI. surface & field analytics software for smart city helps in site selection & land acquisition, planning, designing & visualization, construction & project management, and operations & reporting. Specialists apply surface & field analytics in urban planning for analysis, modeling, and visualization. By processing geospatial data from satellite imaging, aerial photography, and remote sensors, users gain a detailed perspective on land and infrastructure. These benefits of surface & field analytics are driving the surface & field analytics market growth.

Use of satellite monitoring to control the spread of COVID-19

Geographic understanding is crucial in detecting and responding to any infectious disease outbreak, particularly in case of pandemics such as COVID-19. Remote sensing software enables epidemiologists to map disease spread against different parameters such as demographics, geographies, environment, and past infections to understand spread pattern & intensity and origin of such outbreaks to implement surveillance, preventive, and control measures. Demand for remote temperature sensors such as infrared cameras is growing at fast pace during the pandemic. For instance, researchers at the University of South Australia (UniSA) partnered with DragonFly, an aerial services company, to deploy a drone to detect and monitor individuals with infectious respiratory conditions remotely. The drone would be fitted with a specialized computer vision & sensor system, along with remote sensing software tools that can monitor heart & respiratory rates, temperature, as well as detect people coughing and sneezing in crowd, airports, offices, aged care homes, cruise ships, and other places. Hence, rise in adoption of remote sensing software for such applications contributes toward the growth of the surface & field analytics market.

KEY BENEFITS FOR STAKEHOLDERS

- The study provides an in-depth analysis of the global surface & field analytics market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global surface & field analytics trend is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Surface & Field Analytics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 49.9 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 284 |

| By Offering |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

Analyst Review

Demand for surface & field analytics technologies has been on the rise for past few years and the market is expected to continue this trend in the coming years as well, owing to increased drive for sanitation and hygiene post the outbreak of the COVID-19 pandemic and rise in smartphone penetration. In addition, growth in internet penetration in many regions of the world provide promising new opportunities for growth of the surface & field analytics market.

Key providers of the surface & field analytics tool market such as Nikon Corporation, Thermo Fisher Scientific, Inc., and Olympus Corporation account for a significant share of the market. With larger requirements for surface & field analytics tools and services, various companies are establishing partnerships to increase their surface & field analytics capabilities. For instance, in October 2020, ZEISS International announced a strategic partnership with Microsoft Corporation to accelerate ZEISS’ transformation into a digital services provider that is embracing a cloud-first approach. Leveraging Azure high-performance compute, AI, and IoT services, ZEISS is expected to work with Microsoft to provide original equipment manufacturers (OEMs) with new quality management solutions, enable microchip manufacturers to build more powerful, energy-efficient microchips.

In addition, with increase in demand for surface & field analytics tools, various companies are expanding their current product portfolio with increasing diversification among customers. For instance, in April 2021, Nikon Corporation announced the launch of its next generation confocal microscope series, AX and AX R. This new confocal series has a redesigned scan head with 8K x 8K resolution 1, ultra-high speed resonant scanning and the world's largest 25 mm field of view 3.

The AX/AX R confocal series is designed to allow users to acquire data faster, with an unparalleled level of detail and ease, thanks to a modern user-friendly interface and advanced AI-based tools. With this microscopic system features of improved pixel density, sensitivity and speed.

Moreover, market players are expanding their business operations and customers by increasing their business reach. For instance, in July 2022, Thermo Fisher Scientific expanded their new clinical and research lab solutions at AACC. Thermo Fisher Scientific Inc., showcased innovative diagnostic technologies, assays, and a complement of solutions for researchers developing new diagnostics.

The surface & field analytics market is estimated to grow at a CAGR of 9.4% from 2022 to 2031.

The surface & field analytics market is projected to reach $49,863.88 million by 2031.

Increase in demand for surface & field analytics software for the development of smart cities and urban planning projects, use of satellite monitoring to control the spread of COVID-19, and the need for disinfecting and sterilization of environmental surfaces contribute toward the growth of the market.

The key players profiled in the report include Bruker Corporation, Carl Zeiss AG, Danaher Corporation, Jeol Limited, Nikon Corporation, Olympus Corporation, Shimadzu Corporation, Thermo Fisher Scientific, Inc., ULVAN-PHI, and Waters Corporation.

The key growth strategies of surface & field analytics market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...