Surface Drilling Rig Market Research: 2032

The Global Surface Drilling Rig Market Size was valued at $2.2 billion in 2022, and is projected to reach $3.6 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032. Based on volume, the market was 2,872 units in 2022, and is projected to reach 4,870 units by 2032, registering a CAGR of 4.3% from 2023 to 2032. Surface drilling rigs are land-bound industrial drills used for drilling deep boreholes in the earth’s crust. These drills sit stationary on the earth’s surface, and their drilling head penetrates the earth’s surface. Surface drilling rigs are used for drilling boreholes for water wells, pile foundations for buildings, blasting in mines, geotechnical surveys, oil exploration, and various others. These drills find their application in industries such as mining, quarrying, construction, and dimension stone industry.

Surface Drilling Rig Market Dynamics

Rise in demand for metals and minerals is driving demand for surface drilling rigs. Minerals, such as iron ore, copper, gold, silver, zinc, nickel, bauxite, and many more, are in high demand owing to rise in industrialization driven by economic growth in many countries such as India, China, Mexico, Brazil, South Africa, and others.. Furthermore, copper, gold, and silver are extensively utilized in electronics & electrical industry for manufacturing transformers, wires, cables, smart devices, and various other products.

For instance, the International Copper Association India reported that the demand for copper in India increased by about 27.5% during the fiscal year 2022. The demand in India increased from 0.978 million tonnes in the fiscal year 2021 to 1.25 million tonnes in the fiscal year 2022. In addition, according to the Silver Institute the demand for silver increased by 17% between 2021 and 2022. Furthermore, there is an anticipated rise in demand for bauxite mining. Moreover, the market for surface drilling rigs is driven by a rise in construction activities including private, public, and infrastructural developments.

Their typical application includes drilling holes for tunneling applications and for geotechnical inspections to inspect the earth’s crust for scientific purposes, and also before constructing any building or other infrastructure over a piece of land. In the past 50 years, the construction sector gained rapid growth in the countries such as Brazil, South Africa, China, India, and Vietnam, owing to the increase in disposable income, as well as increase in population and urbanization across the world. According to the United Nations, the global population is expected to reach 8.5 billion by 2030, and 9.5 billion by 2050, a significant increase from 8 billion in 2023. Asia and Africa are anticipated to be the key contributors to the global population growth.

Thus, major economies are infusing money into their infrastructure construction sector. For instance, the Indian government in its Union Budget 2022-23, allocated $26.04 billion for the road and highway infrastructure. Similarly, in September 2022, China allocated $42 billion for infrastructure project development in the country. In addition, in the coming 30 years, China and India are projected to contribute significantly to the growing urbanization. Furthermore, surface drilling rigs are also used for the stone mining to produce aggregate, gypsum, crushed sand, dimension stones, and other such materials which are essential for the construction of any building or infrastructure project.

However, factors such as high operation costs and carbon emission norms associated with surface drilling rigs are anticipated to restrain the surface drilling rig market growth. In addition, the lack of skilled labor in countries such as the U.S., Canada, European countries, and Australia is negatively affecting the construction sector in these nations. Moreover, surface drilling rigs are not entirely safe. The drilling and blasting operations often lead to flying debris, dust cloud, and shock waves from a blast.

Thus, to ensure workers’ safety, governments across the world have introduced rigorous safety guidelines on drilling and blasting operations, which is discouraging drilling contractors from opting for such drilling operations, especially for quarrying activities. For instance, in 2014, Europe introduced BS EN 16228 drilling and foundation equipment, which also regulates surface drilling rigs. Such guidelines make quarrying operations expensive. Therefore, companies move towards safer and relatively inexpensive methods of querying such as Rip-and-Load. In Rip-and-Load involves chipping off the rock, to produce desired-sized aggregates. Such factors are restraining market growth.

Moreover, technological developments in the surface drilling rig industry is a surface drilling rig market opportunity for players in the market. Various companies involved in manufacturing surface drilling rigs have been developing automated surface drill rigs to lower the operation cost and make the drilling operation safer. For instance, in September 2021, Sandvik AB, a Sweden based manufacturer of advanced surface drill rigs launched AutoMine® Surface Drilling AutoCycle to enable better performance of automated surface drill rigs and mining equipment. The AutoMine® will work in companies existing offering ‘Leopard™ DI650i iDrill rigs.

The demand for surface drilling rigs decreased in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic led to shutdown of the construction and mining industry across the world, leading to a halt in demand for surface drilling rigs. This hampered the growth of the surface drilling rig market significantly during the pandemic. The major demand for surface drilling rigs was previously noticed from major mining countries, including China, the U.S., Australia, Brazil, and Peru, and other countries having large population bas such as India.

These countries were negatively affected by the spread of coronavirus, thereby halting demand for surface drilling rigs. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic reduced significantly. This has led to the full-fledged reopening of businesses involved in the surface drilling rig market and led to increased activities in the construction sector. Furthermore, it has been more than two and a half years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Contrarily, during the beginning of 2023, the number of COVID-19 cases surged again, especially in China, which may have an unfavorable impact on the surface drilling rig market for a short duration. Thus, businesses involved in manufacturing and sales of surface drilling rigs must focus on protecting their workforce, operations, and supply chains to respond to any looming threat of COVID-19. For instance, as of April 2023, COVID-19 cases are rising in India. In addition to COVID-19, another global event; worldwide inflation, driven by Ukraine-Russia war and quantitative easing done in some parts of the world during COVID-19 has also negatively affected the construction and mining sector.

Surface Drilling Rig Market Segmental Overview

The surface drilling rig market is segmented on the basis of type, application, commodity, sales type and region. By type, the market is categorized into, rotary drills, and boom drills. By application, it is divided into mining, quarrying, construction, and others. By commodity, the market is classified on the basis of gold, copper, coal, iron ore, bauxite, limestone, granite, infrastructure, and others. By sales type, the market is bifurcated into new sales, and aftermarket. Region wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

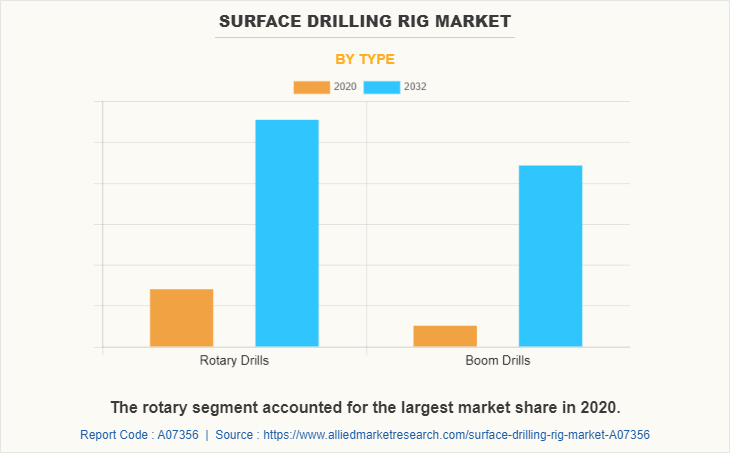

By Type:

The surface drilling rig market is categorized into rotary drills, and boom drills. In 2022, the rotary drill segment accounted for a larger surface drilling rig market share, in terms of revenue, and the boom drills segment is expected to grow with a higher CAGR during the forecast period. The high sales of the rotary drills segment is attributed to its high energy efficiency, longer life span, and capability of accurate drilling. In addition, its large-scale use in the mining sector is also a major factor in its high sales. Furthermore, boom drills are used in underground mining for tunnel creation or mining. Its growth is attributed to an increase in infrastructure segment.

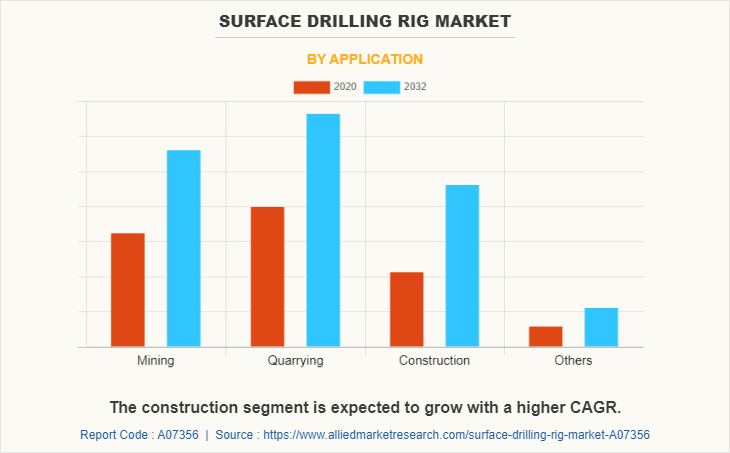

By Application:

The surface drilling rig market is divided into mining, quarrying, construction, and others. The quarrying segment accounted for a higher market share in 2022. Gravel, aggregate, sand, and other similar minerals that are acquired via quarrying activity are witnessing increased demand due to the rapid growth of the construction sector mainly driven by urbanization and population growth. Furthermore, the construction segment is anticipated to grow with a higher CAGR during the forecast period. Residential and non-residential construction is growing at a substantial rate across the world, attributed to increasing demand for housing, commercial buildings, and urban infrastructure such as roads, bridges, and others.

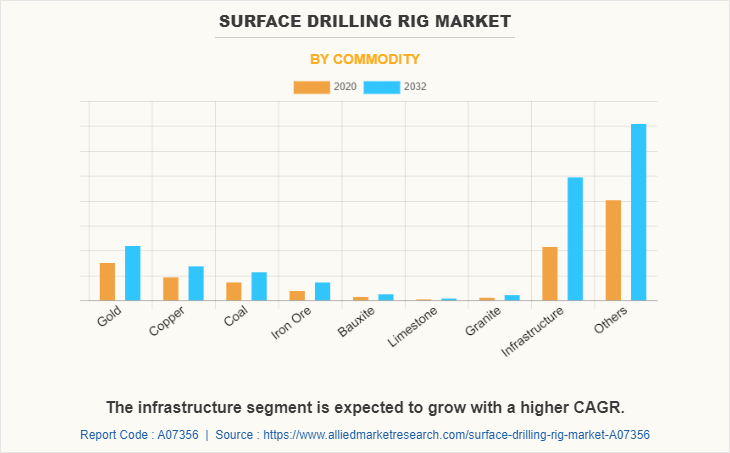

By Commodity:

The surface drilling rig market is divided into gold, copper, coal, iron ore, bauxite, limestone, granite, and others. The others segment accounted for a higher market share in 2022; however, the infrastructure segment is expected to witness a higher CAGR throughout the forecast period. The materials included in the other segments are phosphate rock, gypsum, nickel, cobalt, and others. These materials are largely mined from open-pit mines which substantially make use of surface drilling rigs. Asia-Pacific, especially China, Russia, India, and Australia is among the major producers of commodities sourced from surface mining operations.

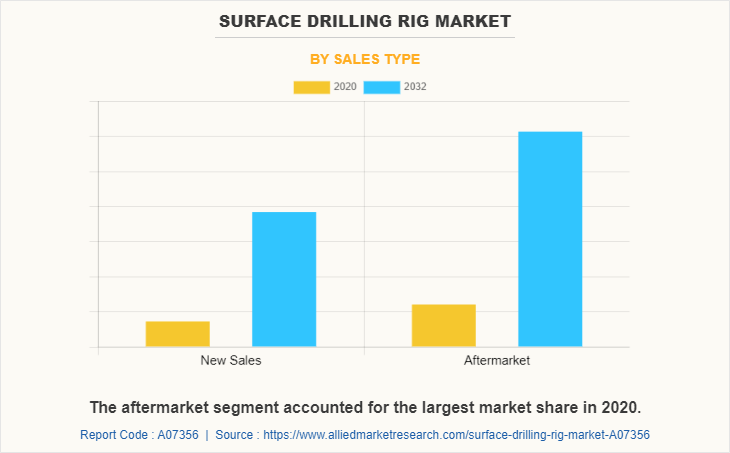

By Sales Type:

The surface drilling rig market is divided into new sales, and aftermarket. The aftermarket segment accounted for a higher market share in 2022; and the same segment is expected to witness a higher CAGR throughout the forecast period. There are various manufacturers of surface drilling rigs including Sandvik AB, which offers Pentra DP1100i, Leopard DI650i, and various other surface drilling rigs. Furthermore, Epiroc AB offers SmartROC CL rigs, FlexiROC T45, and others. Moreover, surface drilling rigs are mechanical machines and are subjected to frequent maintenance, owing to damage from excessive force, pressure, weather conditions such as rain, snow, and others. Thus, companies offer various aftermarket services, and parts & components.

By Region:

In 2022, Asia-Pacific garnered highest share and is anticipated to secure the leading position during the forecast period. This growth is attributed to a large mining sector which mines coal, bauxite, iron ore, nickel, zinc, limestone, manganese ore, gold, and others in the countries such as China, Australia, and India. For instance, in December 2022, Indian mineral production increased by 9.8% when compared to December 2021. Moreover, rapidly growing population in countries such as China, India, Vietnam, and Indonesia is a major factor for the growth of the construction sector in Asia-Pacific. In addition, the rapid economic growth of these countries is playing an instrumental role in the growth of construction and mining sectors; thereby, positively influencing the growth of the surface drilling rig market.

Competition Analysis

Competitive analysis and profiles of the major players in the surface drilling rig market are provided in the report. Major companies in the report include, Arctic Drilling Company Oy Ltd, BARKOM GROUP, Boart Longyear Group Ltd., Epiroc AB, Gill Rock Drill Co., Inc., HARDAB AB, HAWE Hydraulik SE, Revathi Equipment Limited, Sandvik AB, Sunward Intelligent Equipment Co., Ltd., Caterpillar Inc., and Komatsu. Major players to remain competitive adopt development strategies such as product development, product launch, and others. For instance, in March 2023, Epiroc AB launched SmartROC T25 R a radio-remote surface drilling rig; and SmartROC T40 top hammer rig for quarrying and construction.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging surface drilling rig market trends and dynamics.

- In-depth surface drilling rig market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the surface drilling rig market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The surface drilling rig market forecast analysis from 2023 to 2032 is included in the report.

- The key players within the surface drilling rig market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the surface drilling rig industry.

Surface Drilling Rig Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.6 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2020 - 2032 |

| Report Pages | 350 |

| By Sales Type |

|

| By Type |

|

| By Application |

|

| By Commodity |

|

| By Region |

|

| Key Market Players | Komatsu Ltd., Revathi Equipment Limited, HARDAB AB, Arctic Drilling Company Oy Ltd., HAWE Hydraulik SE, Sunward Intelligent Equipment Co., Ltd., BARKOM GROUP, Boart Longyear Group Ltd., Epiroc AB, Gill Rock Drill Co., Inc., Sandvik AB, Caterpillar Inc. |

Analyst Review

According to the insights of the top-level CXOs, the surface drilling rig market has witnessed significant growth in the past few years owing to a rise in demand for quarried products such as stones, aggregates, sand, and other materials, fueled by the increasing construction activities such as buildings, and infrastructure projects. Moreover, surface drilling rigs are also used widely in the mining sector.

The demand for different types of surface drilling rigs is dependent on the activities to be performed. Surface drilling rigs along with mineral mining and drilling holes in the construction sector are also used in dimension stone industries for precisely cutting stones in dimension stone industry. Commonly extracted dimension stones are marble, granite, slate, and sandstone, and other types including limestone, basalt, gabbro, travertine, and tufa. The U.S. Geological Survey said in its "Mineral Commodity Summaries" report, which was released in January 2023, that the value of dimension stones sold in the U.S. in 2022 was roughly $520 million, a considerable increase from 2018, which was $437 million. In addition, with increasing industrialization, demand for steel, copper, nickel, zinc, and others in rising, which in turn positively affects the surface drill rig market growth.

Moreover, rising demand for renewable energy, energy storage, and the rapid rise of battery manufacturing is anticipated to increase demand for aluminum, copper, lead, lithium, manganese, nickel, silver, steel, zinc, and rare earth minerals including indium, molybdenum, and neodymium. These are therefore key minerals and metals that are important for sustainable development. The World Bank anticipates the demand for aluminum, cobalt, iron, lead, lithium, manganese, and nickel to increase substantially in coming years if the global warming levels are to be kept under 2°C.

The CXOs further added that workers’ safety during the drilling operation cost is one of the core factors driving the adoption of technologically advanced surface drilling rigs that can perform automatically at a lower operating cost. Contrarily, high operation cost which includes maintenance cost as well is anticipated to restrain the market growth to a certain extent.

Rise in construction activities, and rise in mineral mining industry are among the upcoming trends of Surface Drilling Rig Market in the world.

Quarrying is the leading application of Surface Drilling Rig Market.

Asia-Pacific is the largest regional market for Surface Drilling Rig in 2022.

The global surface drilling rig market was valued at $2,228.5 million in 2022.

The top companies to hold the market share in Surface Drilling Rig are, Arctic Drilling Company Oy Ltd, BARKOM GROUP, Boart Longyear Group Ltd., Epiroc AB, Gill Rock Drill Co., Inc., HARDAB AB, HAWE Hydraulik SE, Revathi Equipment Limited, Sandvik AB, and Sunward Intelligent Equipment Co., Ltd., Caterpillar Inc., and Komatsu Ltd.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Rotary drill segment held the major market share of the Surface Drilling Rig Market in 2022.

The global surface drilling rig market is projected to reach $3,590.7 million by 2032, registering a CAGR of 4.8% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...