Surfactants Market Outlook, 2032

The global surfactants market size was valued at $37.7 billion in 2022, and is projected to reach $59.5 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032. The surfactants market is driven by rise in demand for surfactants from industries such as personal care, household cleaning, and industrial applications. Rise in awareness of hygiene and the need for effective cleaning agents boost their use in detergents and soaps. In the personal care sector, surfactants are essential in cosmetics, shampoos, and skincare products, fueled by a growing focus on grooming and skincare routines. In addition, the expansion of the food processing, oil and gas, and agricultural sectors, which use surfactants as emulsifiers, dispersants, and wetting agents, contributes to the market growth. Environmental concerns are also increasing the demand for bio-based surfactants.

Introduction

Surfactants are a class of compounds that play a crucial role in various industries and applications. Surfactants are characterized by their unique chemical structure, which has both hydrophilic (water-attracting) and hydrophobic (water-repelling) regions. This dual nature allows surfactants to lower the surface tension of a liquid and help it spread and interact with other substances.

Report Key Highlighters

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The surfactants market is fragmented in nature among prominent companies such as Clariant AG., Evonik Industries AG, Huntsman International LLC, Nouryon, Stepan Company, Lonza Group AG, BASF SE, Croda International Plc, Kao Corporation, and Dow Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions. Moreover, the report covers sub-segments that is studied across all the regions.

- Latest trends in global surfactants market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,500 surfactants-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global surfactants market.

Market Dynamics

The surfactants market is driven by various factors, including expanding applications in personal care, household cleaning, industrial processes, and others. One of the key drivers is rise in demand for personal care products, driven by increasing consumer awareness of hygiene and grooming. The market also benefits from the food processing industry, where surfactants are used as emulsifiers and stabilizers. Moreover, the agricultural sector uses surfactants in pesticides and herbicides, enhancing their effectiveness. Technological advancements have led to the development of bio-based surfactants, addressing environmental concerns and increase in demand for sustainable products. Governments globally are also promoting eco-friendly practices, further boosting the market.

However, the market faces restraints, mainly due to the fluctuating raw material prices. The primary raw materials for surfactant production, such as crude oil and natural fats, experience frequent price volatility, impacting production costs. In addition, environmental regulations regarding synthetic surfactants, which can be harmful to aquatic life, are becoming strict. Many countries, including India and those in the European Union, have implemented regulations limiting the use of certain surfactants in detergents and personal care products. This forces manufacturers to invest in R&D for eco-friendly alternatives, potentially increasing costs and limiting the market growth.

On the contrary, opportunities for the surfactants market lie in the growing trend toward sustainable and green products. Governments are supporting bio-based surfactants through subsidies and favorable policies, encouraging manufacturers to shift towards plant-based raw materials. For instance, the Indian government’s initiatives, such as the "Make in India" and "Green Chemistry" programs, promote the production of eco-friendly products. In addition, the growing use of surfactants in the pharmaceutical sector as drug delivery agents opens new avenues. Increase in demand for specialty surfactants in oil recovery, textiles, and agrochemicals also presents untapped potential, promising growth in various segments of the market.

Segments Overview

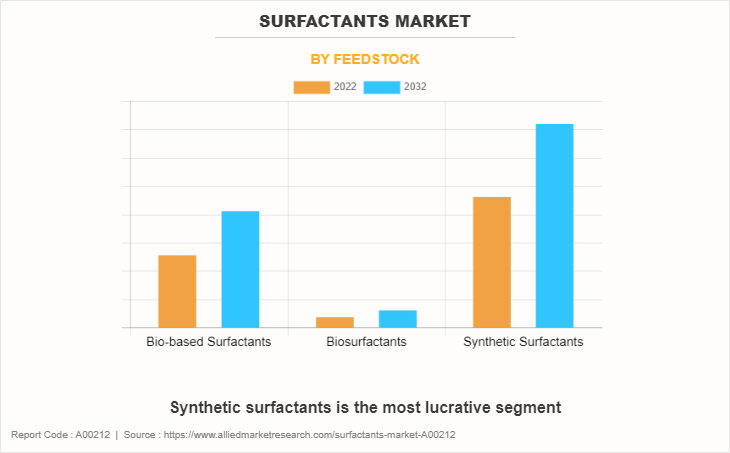

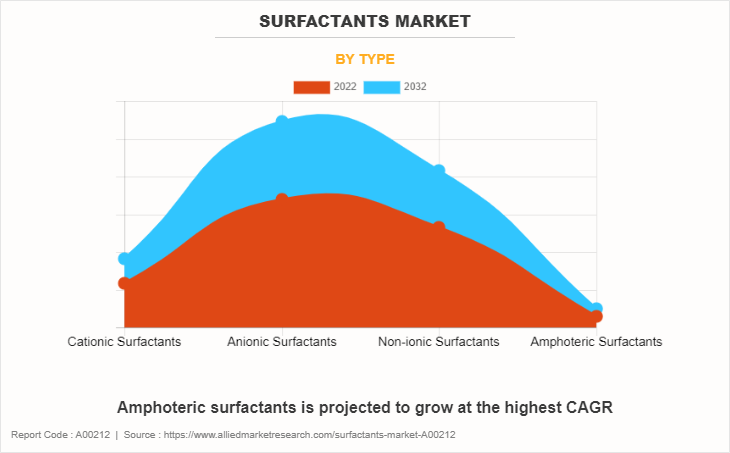

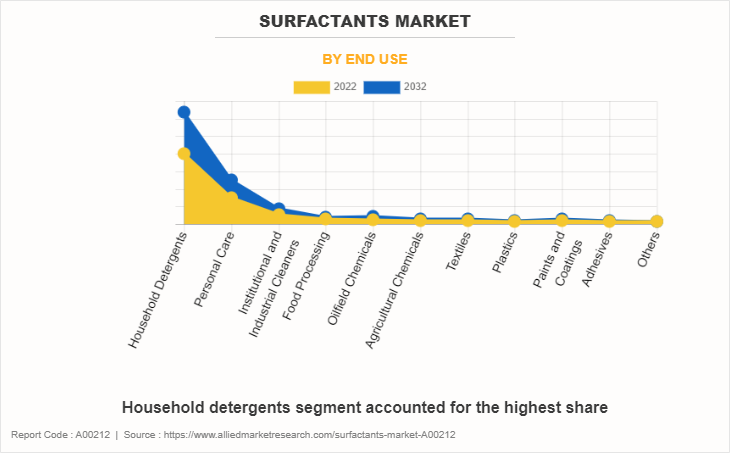

The surfactants market is segmented on the basis of feedstock, type, end use, and region. On the basis of feedstock, the market is categorized into bio-based surfactants, biosurfactants, synthetic surfactants, and others. On the basis of type, it is divided into cationic surfactants, anionic surfactants, non-ionic surfactants, and amphoteric surfactants. By end use, the market is categorized into household detergents, personal care, institutional and industrial cleaners, food processing, oilfield chemicals, textiles, plastics, paints and coatings, adhesives, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Surfactants Market By Feedstock

The synthetic surfactants segment was the largest revenue generator in 2022, and is anticipated to grow at a CAGR of 4.6% during the forecast period. Synthetic surfactants are integral components of many cleaning products, including laundry detergents, dishwashing liquids, surface cleaners, and personal care items like shampoos and body washes. As household and personal hygiene practices continue to evolve and expand, the demand for such products rises. Moreover, the industrial and institutional cleaning sector, including cleaning services, healthcare facilities, and food processing industries, relies heavily on synthetic surfactants to maintain cleanliness and hygiene. The growth of these sectors contributes to increase in demand for surfactants. In addition, synthetic surfactants are used in agriculture to improve the effectiveness of pesticides, herbicides, and other agricultural chemicals.

As global agricultural production increases to meet growing food demands, so does the use of surfactants in these applications. These factors are expected to increase the sales of synthetic surfactants among various end-use sectors; thus, fueling the market growth.

Surfactants Market By Type

By type, the anionic surfactants segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.9% during forecast period. Anionic surfactants are essential ingredients in many cleaning products, including laundry detergents, dishwashing liquids, and household cleaners. As consumers and industries prioritize cleanliness and hygiene, the demand for effective cleaning agents is on the rise. Moreover, anionic surfactants are widely used in personal care products such as shampoos, body washes, and toothpaste.

The personal care industry is continuously growing, with an emphasis on product innovation and performance, contributing to the demand for surfactants. Furthermore, anionic surfactants play a crucial role in emulsifying and stabilizing food products, especially in the food and beverage industry. They are used in various food applications to create stable emulsions, dressings, and spreads, which are in demand due to consumers' diverse food preferences. These factors are expected to drive the growth of the anionic surfactants segment.

Surfactants Market By End Use

By end use, the household detergents segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.8% during forecast period. There is a growing demand for eco-friendly and sustainable cleaning products. Many consumers are seeking household detergents with biodegradable ingredients, reduced packaging waste, and cruelty-free testing practices. Moreover, consumers are increasingly concerned about the ingredients used in household detergents, with a focus on avoiding harsh chemicals and allergens.

This has led to rise in demand for milder and hypoallergenic formulations. In addition, consumers are concerned about sanitizing and disinfecting their homes to prevent the spread of germs and viruses. These factors lead to the surfactants market growth for household detergents.

Surfactants Market By Region

The Asia-Pacific surfactants market size is projected to grow at the highest CAGR of 5.1% during the forecast period and accounted for 42.7% market share in 2022. The Asia-Pacific region is a major hub for the surfactants market, with significant growth potential. Growing population, urbanization, and industrialization contribute to increase in demand for surfactants across various sectors in the region. Furthermore, rapid industrialization and urbanization have resulted in a growing need for cleaning products, personal care items, and industrial chemicals, all of which rely on surfactants.

Competitive Analysis

The global surfactants market profiles leading players that include Clariant AG., Evonik Industries AG, Huntsman International LLC, Nouryon, Stepan Company, Lonza Group AG, BASF SE, Croda International Plc, Kao Corporation, and Dow Inc. The global surfactants market report provides in-depth competitive analysis as well as profiles of these major players.

Historical Market Trend

The historical trend of the surfactants market shows steady growth over the past few decades, primarily driven by rise in demand for surfactants from personal care, household cleaning, and industrial sectors. In the 1990s and early 2000s, synthetic surfactants dominated the market due to their cost-effectiveness and wide availability. During this period, global urbanization and increasing middle-class population in emerging economies, like China and India, further propelled the market.

In the 2010s, the market began shifting towards bio-based surfactants, influenced by environmental concerns and stricter government regulations on synthetic surfactants. Rise in awareness of the ecological impact of traditional surfactants, particularly their non-biodegradability and toxicity to aquatic life, led consumers and industries to prefer greener alternatives. This period also saw advancements in biotechnology, enabling the production of sustainable surfactants like alkyl polyglucosides (APG) and biosurfactants, such as rhamnolipids and sophorolipids. This green shift has continued to define the market trend, with consumers increasingly opting for eco-friendly products, promoting innovation and investment in bio-based surfactant production.

Government Initiatives for Promoting the Utilization of Surfactants

In U.S.:

Toxic Substances Control Act (TSCA, managed by the Environmental Protection Agency (EPA), requires the evaluation and registration of chemical substances, including surfactants. The TSCA Inventory lists chemicals allowed for commercial use. Manufacturers must comply with EPA guidelines for the production, use, and disposal of surfactants.

Clean Water Act (CWA) Section 311 of the CWA addresses the discharge of hazardous substances into U.S. waters, which includes specific regulations for surfactants that may affect water quality and aquatic life.

Code of Federal Regulations (CFR) Title 40, Part 721 includes requirements for specific chemical substances that might restrict the use of certain non-biodegradable surfactants.

In Canada:

Canadian Environmental Protection Act (CEPA) regulate the utilization of surfactants. New surfactants not on the DSL are subject to a New Substances Notification (NSN) under the New Substances Program.

Environmental Emergency Regulations (E2 Regulations): Part of CEPA, these regulations (SOR/2019-51) list surfactants that, if spilled, pose an environmental risk. Manufacturers must follow safety guidelines for handling and disposal.

Volatile Organic Compounds (VOC) Concentration Limits for Certain Products Regulations (SOR/2008-177): These limit VOC concentrations in products like household cleaners containing surfactants, aiming to reduce air pollution.

In Europe:

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) – Regulation (EC) No. 1907/2006: Managed by the European Chemicals Agency (ECHA), requires surfactant manufacturers and importers to register chemical substances. It includes evaluation, authorization, and restriction of chemicals, including surfactants, to ensure safety for human health and the environment.

Biocidal Products Regulation (BPR) Regulation (EU) No. 528/2012 governs the market placement and use of biocidal products containing surfactants. Manufacturers must obtain product authorization before placing biocidal surfactants on the market.

Detergents Regulation (EC) No. 648/2004 requires the biodegradability of surfactants in detergents. It mandates labeling of product contents and provides guidelines on testing the biodegradability of surfactants.

In Asia-Pacific

In China, measures for the Environmental Management of New Chemical Substances (MEP Order No. 12): This regulation, enforced by the Chinese Ministry of Ecology and Environment (MEE), requires registration of new chemical substances, including surfactants, before they are manufactured or imported.

In Japan, Chemical Substances Control Law (CSCL): Regulates the manufacturing and importation of chemical substances. Surfactants must be evaluated and classified, particularly for their biodegradability and potential environmental impact.

In India, manufacture, storage and import of Hazardous Chemical Rules (1989) classify and regulate the handling of hazardous chemicals, including surfactants, specifying requirements for storage, handling, and disposal to protect environmental and public health.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surfactants market analysis from 2022 to 2032 to identify the prevailing surfactants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surfactants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surfactants market trends, key players, market segments, application areas, and market growth strategies.

Surfactants Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 59.5 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 752 |

| By Feedstock |

|

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | BASF SE, Lonza Group AG, Nouryon, Dow Inc., Croda International Plc, Evonik Industries AG, Stepan Company, Kao Corporation, Clariant AG., Huntsman International LLC |

Analyst Review

According to the perspective of CXOs of the leading companies in the global surfactants market, development of end-user industries, changes in lifestyle in the developing economies, and easy availability of surfactants drive the growth of the market across the globe. However, volatility in raw material prices and environmental concerns of surfactants such as their toxic effects on aquatic organisms are expected to hamper the growth of surfactants market in the near future.

Moreover, CXOs in the surfactants market will place a strong emphasis on understanding the evolving needs and preferences of customers. They are to ensure that product development, marketing, and service strategies are aligned with these customer insights.

Furthermore, CXOs are expected to focus on innovation, ensuring the development of new, sustainable, and effective surfactant solutions. Innovations such as bio-based surfactants, specialty surfactants, or multifunctional surfactants are expected to cater to diverse industry needs.

In addition, to tap into emerging markets and meet the growing demand for surfactants, CXOs may lead efforts to expand the company's global presence through partnerships, acquisitions, or establishing new facilities. CXOs further added that sustained economic development coupled with rise in demand for household detergents is expected to augment the growth of the surfactants market.

Rise in demand from end-use industries, rise in demand for eco-friendly surfactants, extensive use of surfactants in household detergents, low prices and easy availability of surfactants, and low prices and easy availability of surfactants are the upcoming trends of surfactants market in the world.

Household detergents is the leading application of surfactants market.

Asia-Pacific is the largest regional market for Surfactants.

The surfactants market was valued at $37.6 billion in 2022 and is estimated to reach $59.5 billion by 2032, exhibiting a CAGR of 4.7% from 2023 to 2032

Clariant AG., Evonik Industries AG, Huntsman International LLC, Nouryon, Stepan Company, Lonza Group AG, BASF SE, Croda International Plc, Kao Corporation, and Dow Inc are the top companies to hold the market share in the surfactants market.

Loading Table Of Content...

Loading Research Methodology...