Surgical Gloves Market Size Projections and Insights, 2032

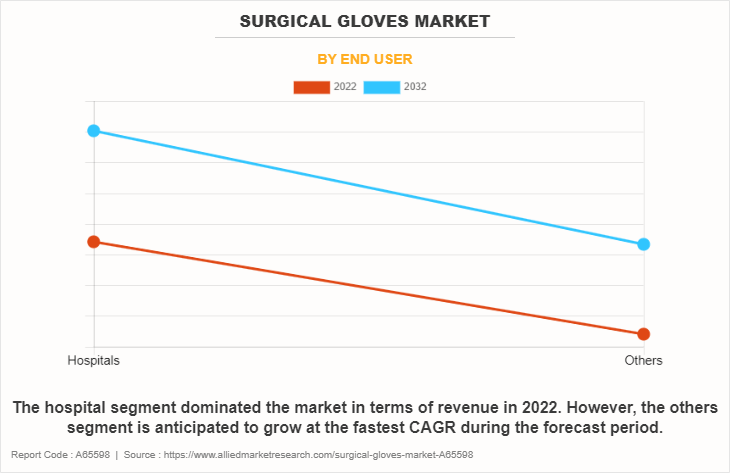

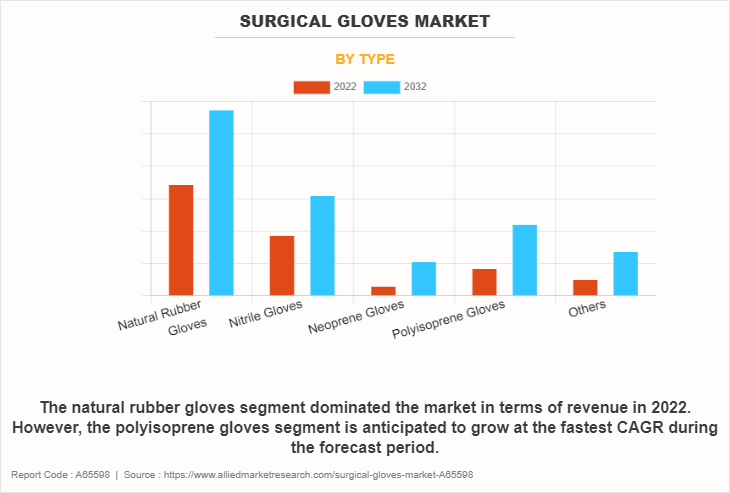

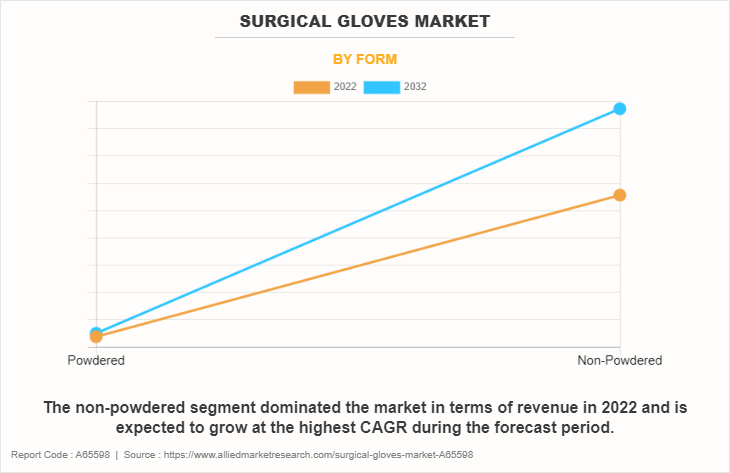

The global surgical gloves market size was valued at $1.2 billion in 2022, and is projected to reach $1.8 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032. The natural rubber gloves segment dominated the market in terms of revenue in 2022. The non-powdered segment dominated the market in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period. The hospital segment dominated the market in terms of revenue in 2022. However, the other segment is anticipated to grow at the fastest CAGR during the forecast period. The North America region dominated the surgical gloves market in terms of revenue in 2022.

Surgical Gloves Market Growth Drivers

Surgical gloves, which are intended to preserve sterility and avoid contamination, are an essential component of personal protective equipment (PPE) used in medical procedures. By acting as a barrier between medical personnel and patients, these gloves shield both parties from illnesses that may be contracted through contact with hazardous materials, microbes, and bodily fluids. Surgical gloves are often constructed of latex, nitrile, or neoprene. They are designed to be sterile, disposable, and come in a range of sizes to guarantee a proper fit. They play a crucial role in maintaining a sterile and safe operating environment by reducing the possibility of cross-contamination during surgeries and other invasive medical procedures.

The surgical gloves market share is experiencing robust growth due to increasing awareness of infection control and hygiene standards in healthcare settings. Key trends include the rising adoption of advanced materials, such as nitrile and synthetic polymers, which offer enhanced protection and comfort compared to traditional latex gloves. Additionally, there is a growing demand for gloves with improved tactile sensitivity and barrier protection.

Drivers of the surgical gloves market include heightened global health concerns, especially following the COVID-19 pandemic, which has increased the emphasis on personal protective equipment (PPE). Additionally, regulatory mandates and standards in various countries are pushing for higher safety and quality measures in healthcare environments.

Challenges faced by the surgical gloves market include fluctuating raw material costs and supply chain disruptions, which can affect glove availability and pricing. Moreover, there is growing concern over the environmental impact of disposable gloves, driving a push for sustainable and biodegradable alternatives.

Market opportunities lie in the development of innovative glove technologies, such as antimicrobial coatings and eco-friendly materials. Expanding into emerging markets and increasing the availability of high-quality gloves in both developed and developing regions also presents significant growth potential.

Industry Highlights

- The demand for surgical gloves is driven primarily by the need for enhanced infection control and hygiene in medical and healthcare settings. Their role in preventing cross-contamination and protecting both patients and healthcare professionals fuels their widespread use.

- The growing focus on personal protective equipment (PPE) due to health crises, such as the COVID-19 pandemic, has significantly increased the demand for surgical gloves.

- The development of advanced materials, such as nitrile and synthetic polymers, is expanding their application beyond traditional latex gloves, improving comfort and barrier protection.

- North America remains the leading regional market for surgical gloves due to its advanced healthcare infrastructure, stringent regulatory requirements, and high demand for safety and hygiene products.

Surgical gloves are valued for their critical role in maintaining sterile environments and preventing infections. Innovations such as antimicrobial coatings and biodegradable materials are gaining prominence, addressing both effectiveness and environmental concerns. Premium gloves with advanced features or unique protective technologies are highly sought after, reflecting their importance in safeguarding health and enhancing safety in medical practices. The continued evolution of glove technology and increased emphasis on hygiene practices solidify their essential role in healthcare settings.

Key Areas Covered in the Report

- Natural rubber gloves are traditionally used due to their high flexibility and comfort, but their use is declining due to concerns about latex allergies.

- Nitrile gloves are gaining popularity due to their high resistance to punctures, chemicals, and allergens. They are especially favored in the healthcare industry for their durability and safety.

- Powdered gloves were traditionally used to facilitate easier donning, but their popularity is waning due to concerns over the risk of powder-induced allergic reactions or infections.

- North America and Europe remain key markets due to established healthcare systems and regulations. Asia-Pacific is experiencing rapid growth due to rising healthcare needs and infrastructure development. LAMEA is also seeing gradual growth as healthcare access improves.

The global surgical gloves industry is experiencing significant growth driven by various trends and demands. With increasing emphasis on infection control and hygiene in medical settings, the demand for high-quality surgical gloves continues to rise. This growth is fueled by advancements in materials and manufacturing technologies, leading to the development of gloves that offer superior barrier protection, comfort, and dexterity.

One major trend in the surgical gloves market share is the shift towards nitrile gloves. Nitrile gloves are gaining preference over traditional latex gloves due to their hypoallergenic properties and enhanced resistance to punctures, chemicals, and contaminants.

Sustainability is also becoming a key consideration in the surgical gloves market. There is a growing interest in eco-friendly and biodegradable glove options as part of a larger shift towards environmental responsibility in healthcare practices. Companies are investing in research and development to create gloves that not only meet safety standards but also align with sustainability goals.

The rise of e-commerce and online distribution channels is further boosting the accessibility and availability of surgical gloves. Healthcare facilities and professionals are increasingly purchasing gloves through online platforms, which offer convenience and a wide range of product options.

Topics discussed in the report

- Analysis of surgical gloves market trends, drivers, and opportunities across key segments.

- Competitive landscape and strategic initiatives of key market players.

- Regional analysis highlighting the dominance of North America in the global surgical gloves market.

- Insights into the role of nitrile gloves and advanced technologies in the future of the industry.

- Growth prospects for non-powdered gloves due to concerns over powder-related complications.

Surgical Gloves Market Segment Overview

The global surgical gloves industry is segmented into type, form, end user, and region. On the basis of type, the market is categorized into natural rubber gloves, nitrile gloves, neoprene gloves, polyisoprene gloves and others. On the basis of form, the market is categorized into powdered and non-powdered. On the basis of end user, the market is segregated into hospitals and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

The natural rubber gloves segment accounted for the largest share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period owing to the strong performance of natural rubber gloves in terms of elasticity, comfort, and tactile sensitivity, making them preferred choices in surgical and medical settings. In addition, The non-powdered segment accounted for the largest share in terms of revenue in 2022 and is expected to witness fastest CAGR during the forecast period. This is attributed to the guidelines set forth by the FDA. Non-powdered surgical gloves are favored for their lower risk of causing allergic reactions and particulate contamination. They align with the growing emphasis on infection control and safety in healthcare environments, making them the preferred choice.

Comparative Matrix of Key Segments

Parameters | Natural Rubber | Nitrile Gloves | Neoprene Gloves | Polyisoprene Gloves |

Market Share | Significant share due to historical use and cost effectiveness | Rapidly growing due to superior protection and comfort | Niche segment, growing due to enhanced properties | Increasing due to latex-free demand and superior comfort |

Distribution Channels | Hospitals, clinics, and traditional medical supply distributors | Hospitals, clinics, online platforms, and medical supply distributors | Hospitals, clinics, specialty health stores | Hospitals, clinics, online platforms, and specialty health stores |

Challenges | Allergic reactions, latex sensitivities, and variable quality | Less flexible and comfortable compared to natural rubber latex gloves | Higher cost, less widespread use compared to nitrile and latex | Higher cost, limited availability compared to nitrile gloves |

Key Players | Adventa Berhad, Ansell Ltd., Cardinal Health | Dynarex Corporation | Ansell Ltd., Cardinal Health, Medline Industries Inc. | Adventa Berhad, Ansell Ltd. |

Regional Dynamics and Competition

The global surgical gloves market is experiencing diverse regional dynamics driven by varying healthcare needs, regulatory environments, and economic conditions.

North America leads the market, particularly in the U.S., where the demand for surgical gloves is propelled by stringent infection control standards and a high prevalence of advanced medical procedures. The region benefits from a well-established healthcare infrastructure, with hospitals and surgical centers requiring high volumes of gloves. Additionally, the presence of major manufacturers and suppliers in the U.S. contributes to its dominant market position.

Europe is also a key player in the surgical gloves market, with countries such as Germany, the U.K., and France at the forefront. The European market is characterized by rigorous regulations and high standards for medical devices, driving the demand for superior-quality gloves. Innovations in materials and manufacturing processes are prevalent, as European countries prioritize both functionality and safety in surgical gloves.

The Asia-Pacific region offers significant growth potential due to its large population base and expanding healthcare sector. Countries like China, India, and Japan are major contributors, driven by increasing healthcare investments, rising awareness of infection control, and growing demand for medical supplies. The region's rapid industrialization and expansion of healthcare facilities are fueling the demand for surgical gloves. Moreover, advancements in local manufacturing capabilities and the rise of contract manufacturing organizations (CMOs) are supporting market growth.

Latin America and the Middle East are emerging markets with promising potential. In Latin America, countries like Brazil and Mexico are seeing increased adoption of surgical gloves due to the expansion of healthcare infrastructure and rising healthcare expenditures. Similarly, the Middle East is witnessing growth driven by investments in healthcare facilities and a focus on improving medical standards. The increasing prevalence of chronic diseases and a push for better infection control measures contribute to the rising demand for surgical gloves in these regions.

Some of the major players analyzed in this report are Kossan Rubber Industries Bhd, Medline Industries Inc., ANSELL LTD., TOP GLOVE CORPORATION BHD, Narang Medical Limited, Dynarex Corporation., Adventa Berhad, Hartalega Holdings Berhad, Cardinal Health, Harps Global Pte. Ltd.

Surgical Gloves Market News Release

- In September 2023, HARPS Global Pte Ltd, a successful producer of high-quality nitrile gloves, acquired Semperit AG Holding. This transaction makes HARPS a major global branded provider and expands its reach into new markets around the world, as it harnesses Sempermed's surgical glove expertise and opens new channels of growth with an expanded product portfolio.

- In May 2023, Ansell Limited, a global leader in protection solutions, announced that it has received the highest recyclability certification from Institute Cyclos-HTP (CHI), a globally recognized organization that assesses and certifies the recyclability of packaging and goods, confirming a AAA rating for the SMART Pack packaging for surgical gloves.

- In December 2022, Ansell Limited, a global leader in protection solutions, announced a new $80 million investment in greenfield projects. Its newest plant became operational by supplying the world's fast-growing surgical and life sciences market. This new plant in India contributes to Ansell's production capabilities, especially in emerging markets, and strengthens its global multi-sourcing strategies.

- In September 2022, Cardinal Health announced plans to build a second state-of-the art surgical glove manufacturing plant in Rayong, Thailand. The new facility, which will be 720,000 square feet in its initial phase, will expand Cardinal Health's surgical glove manufacturing footprint in Rayong to more than 1.3 million square feet of manufacturing space.

- In June 2021, Medline Industries, Inc., the nation’s largest privately held manufacturer and distributor of healthcare supplies, announced that it has entered into a definitive agreement, through which it will receive a majority investment from a partnership comprised of comprising funds managed by Blackstone, Carlyle, and Hellman & Friedman.

- In January 2021, Ansell Limited, a global leader in protection solutions, announced the acquisition of the Primus brand and related assets that constitute the Life Science business belonging to Primus Gloves and Sanrea Healthcare Products (“Primus”). In addition, Ansell and Primus have entered into a long-term supply partnership.

- In January 2020, Top Glove Corp Bhd, announced that it expects its production of nitrile gloves to grow rapidly, with volume firmly surpassing that of low-margin latex gloves by the end of the year.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surgical gloves market analysis from 2022 to 2032 to identify the prevailing surgical gloves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surgical gloves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surgical gloves market trends, key players, market segments, application areas, and market growth strategies.

Surgical Gloves Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.8 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 269 |

| By End User |

|

| By Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | Dynarex Corporation., Harps Global Pte. Ltd., Hartalega Holdings Berhad, Cardinal Health, Narang Medical Limited, ANSELL LTD., Adventa Berhad, Kossan Rubber Industries Bhd, Medline Industries Inc., TOP GLOVE CORPORATION BHD |

Analyst Review

The surge in demand for surgical gloves and the concurrent increase in cases of hospital-acquired infections (HAIs) are anticipated to present lucrative opportunities for market growth. Additionally, the favorable initiatives undertaken by governments and increased investment in infection control have captured the attention of several companies, encouraging them to embark on the development of surgical gloves.

The increase in number of key players offering a diverse range of surgical gloves such as natural rubber gloves, polyisoprene, powdered and powder free are expected to boost the growth of market. Moreover, the rising number of surgical procedures performed worldwide each year drives the demand for surgical gloves, contributing significantly to the market's expansion.

Furthermore, North America accounted for largest share in terms of revenue in 2022 and is expected to remain dominant during the forecast period owing to rise in number of surgical procedures and presence of major players offering surgical gloves. Additionally, the region's aging population leads to an increased number of surgical procedures. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in implementation of infection control measures, rise in number of surgical site infections and availability of wide range of surgical gloves products, thereby driving the growth of market during the forecast period.

Surgical gloves are protective, disposable hand coverings primarily used by healthcare professionals during medical procedures to maintain a sterile environment and prevent the transmission of infections.

The major factor that fuels the growth of the surgical gloves market are surge in number of surgeries ,technological advancements in manufacturing surgical gloves and growth in government initiatives for infection prevention and control drive the growth of the global surgical gloves market .

The natural rubber glove segment is the most influencing segment in surgical gloves market.This is attributed to strong performance of natural rubber gloves in terms of elasticity, comfort, and tactile sensitivity, making them preferred choices in surgical and medical settings.

Top companies such as Top Glove Corporation BHD, Ansell Ltd., Cardinal Health and Adventa Berhad. held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The base year is 2022 in surgical gloves market .

The forecast period for surgical gloves market is 2023 to 2032

The market value of surgical gloves market in 2032 is $1,835.84 million

The total market value of surgical gloves market is $1,179.77 million in 2022.

Loading Table Of Content...

Loading Research Methodology...