Surgical Power Tools Market Research, 2031

The global surgical power tools market size was valued at $2,275.2 million in 2021, and is projected to reach $3,783.7 million by 2031, growing at a CAGR of 5.2% from 2022 to 2031. Surgical power tools are handheld devices that use electrical, pneumatic, or ultrasonic energy to cut, remove, shape, or ablate bone, soft tissue, and other materials during surgical procedures. These tools are designed to reduce the time and effort usually required to perform a given procedure, as well as to reduce patient trauma and recovery time. Examples of surgical power tools include drills, saws, and chisels. These tools are used in orthopedic procedures, neurosurgery, Ear, Nose, Throat (ENT) surgery, plastic surgery, and arthroplasty procedures. Surgical power tools provide more accuracy and control than manual cutting tools, allowing for more precise cuts and a more favorable outcome. Surgical power tools can save time during operations since they are faster and more efficient than manual tools. This can help to minimize the duration of a procedure, reduce costs, and reduce the risk of complications.

Historical overview

The surgical drill market was analyzed qualitatively and quantitatively from 2021 to 2031. The surgical drill market experienced growth at a CAGR of around 4.4% from 2022 to 2031. Most of the growth during this period was derived from North America owing to the rise in the number of surgical power tools industry that provide surgical power tool, increase in number of surgical procedures as well as the well-established presence of domestic companies in the region.

Market Dynamics

Growth of the global surgical power tools market is majorly driven by rise in prevalence of chronic diseases, increase in number of surgical procedures, and surge in geriatric population. Increase in number different surgeries such as orthopedic surgery, cardiothoracic surgery, neuro and spine surgery and others are anticipated to drive the surgical power tools market growth. Surgical power tools are used in various orthopedic, neurological, plastic, and reconstructive surgeries to perform intricate and delicate tasks. They are used to cut, shape, and remove bone, cartilage, and soft tissues. They are also used to insert screws and plates into bone, as well as to perform delicate tasks such as drilling and reaming.

Surgical power tools are often used in orthopedic surgeries such as knee replacement and hip replacement surgery to cut and shape the bone and remove damaged cartilage. The surgeon will use the power tools to drill holes into the bone and insert screws and plates to secure the prosthetic joint in place. The tools may also be used to remove any excess bone or cartilage, and to smooth out the edges of the bone to ensure a secure fit for the prosthetic. Thus, rise in number of knee replacement and hip replacement surgeries is attributed to drive the growth of the market. For instance, according to Personalized Orthopedics of Palm Beaches, in November 2021, knee replacement surgery, a popular procedure, was estimated to have been performed about 800,000 times annually in the U.S. Moreover, according to the Agency for Healthcare Research and Quality, more than 450,000 total hip replacements were reported to have been performed each year in the U.S.

In addition, surgical power tools are commonly used in cardiac surgeries such as in coronary artery bypass graft (CABG) cardiac surgery. The tools are used to cut open the chest cavity and to open the arteries and veins in the heart. The tools are then used to perform delicate tasks such as suturing and stapling. They may also be used to clean and shape the vessels, as well as to attach grafts to the vessels. Thus, rise in number of CABG surgeries is attributed to drive the growth of the market. For instance, according to National Library of Medicine, in August 2022, almost 400,000 CABG surgeries were reported to have been performed each year making it the most performed major surgical procedure in the U.S. Thus, rise in number of orthopedic surgeries such as knee replacement, hip replacement and increase in the number of cardiovascular surgeries such as CABG are attributed to fuel the growth of the market.

Moreover, increase in the prevalence of chronic diseases such as cardiovascular diseases, orthopedic diseases, cancer and others is attributed to rise in number of major surgical procedures. Thus, this factor is anticipated to drive the growth of the surgical power tool market. Rise in prevalence of orthopedic diseases such as arthritis is anticipated to boost the demand for surgical power tool for surgical intervention. This, in turn, fuels the growth of the market. For instance, in some cases, arthritis may require surgical intervention. This is usually done when the arthritis has advanced to the point where the joint is severely damaged, or the pain is too severe for other treatments to be effective. Surgery may involve replacing a damaged joint with an artificial one or repairing damaged tissue in the joint. Moreover, according to Center for Disease Control and Prevention, in 2021, about 1 in 4 US adults (23.7%) or about 58.5 million people were reported to have doctor-diagnosed arthritis. Arthritis is more common in women (23.5%) compared with men (18.1%).

Moreover, coronary artery bypass graft (CABG) surgery is typically recommended for people with severe coronary artery disease (CAD). It is also used to treat people with aortic stenosis, congestive heart failure, and other diseases of the heart. Thus, rise in prevalence of cardiac diseases is anticipated to rise in number of cardiovascular surgical procedures and fuel the demand for surgical power tool. Thus, this factor is anticipated to drive the growth of the market. For instance, according to Center for Disease Control and Prevention, (CDC), coronary heart disease is the most common type of heart disease, cause of death for 382,820 people in 2020 in U.S. Moreover, about 20.1 million adults aged 20 and older have coronary heart disease.

In addition, rise in prevalence of brain tumor and spine tumor is attributed to drive the growth of the surgical power tool market. Brain and spine tumors may require surgery depending on the type, size, and location of the tumor. Surgery may be used to remove the tumor or to reduce pressure on the brain or spinal cord. It may also be used to access the tumor for biopsy or to perform radiation therapy. Surgical power tools, such as drills and saws, are used to access and remove brain tumors. These tools can be used to create a window into the skull to allow the surgeon access to the tumor. The power tools are also used to cut away the tumor and surrounding tissue. The tools may also be used to remove bone or tissue to create an opening for radiation therapy. Thus, rise in prevalence of brain tumor and spinal tumor is attributed to drive the demand for surgical tool and boost the growth of the market. For instance, according to American Cancer Society, in 2021, a total of 83,570 individuals were diagnosed with brain and other central nervous system (CNS) tumors in the U.S. Among these cases, 24,530 malignant tumors and 59,040 nonmalignant tumors are reported in 2021. As per the same source, 18,600 number of deaths are also reported due to cancer in 2021.

On the other hand, surgical power tools are expensive, and many small hospitals and medical facilities may not be able to afford them. High acquisition and maintenance costs of these devices, especially reusable devices, are limiting the adoption of these instruments among surgeons. Thus, this factor is attributed to restrain the growth of the market. For instance, approximate cost of battery operated ortho drill and saw, is $916.65. Moreover, high cost of orthopedic, cardiology, and neurology surgical procedures is attributed to hamper the growth of the market. For instance, the coronary artery bypass graft cost ranges between $4,000 to $5,000. Thus, high cost of surgical power devices and high cost of surgeries are attributed to boost the growth of the market.

The COVID-19 pandemic has stressed healthcare systems globally. A lot of number of clinics and hospitals across the globe were restructured to increase the hospital capacity for the patient diagnosed with COVID-19. Decrease in the number of elective surgeries during COVID-19 pandemic due to lockdown is anticipated to decrease the demand for surgical power tool and have negative impact on market growth. For instance, World Journal of Orthopedic, in 2020, states that there was an observed reduction in the total number of orthopedic admissions by 55% during the pandemic and elective orthopedic interventions were observed to have been declined by 72% in Poland. The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global surgical power tool market.

Segmental Overview

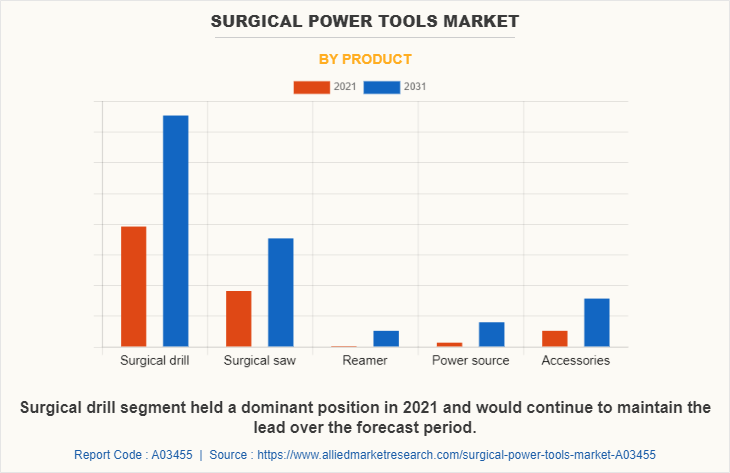

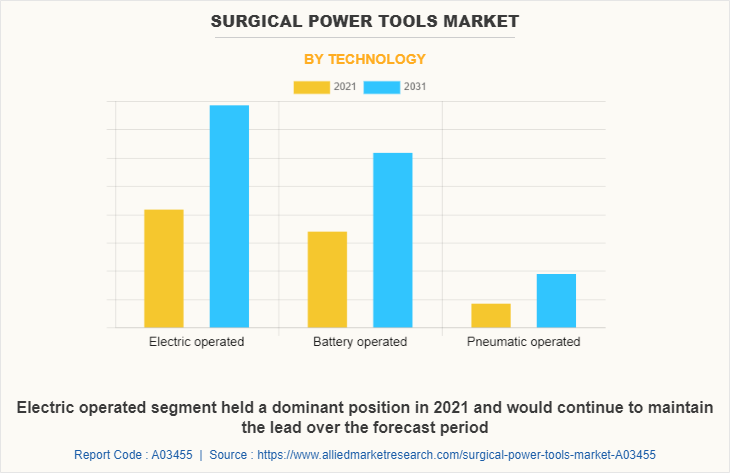

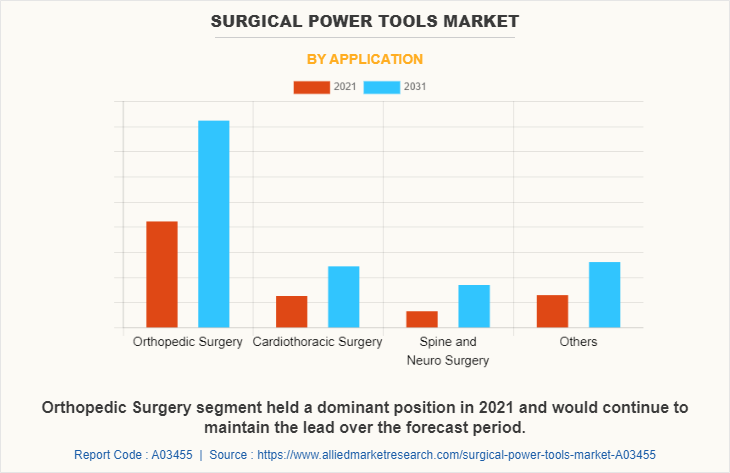

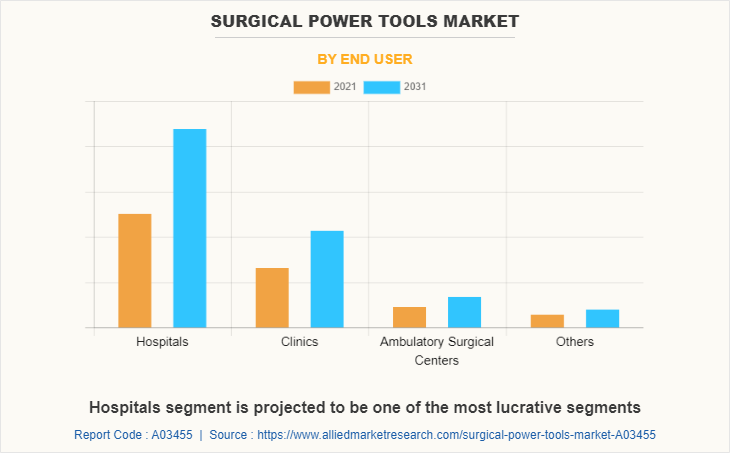

The surgical power tools market is segmented into Technology, Product, Application, End User and Region. By product, the market is divided into surgical drill, surgical saw, reamer, power source and accessories. By technology market is classified into electric operated, battery operated and pneumatic operated. By application, the market is categorized into orthopedic surgery, cardiothoracic surgery, spine and neurosurgery and others. The others segment includes traumatology surgery, oral/maxillofacial, ENT surgery, plastic surgery. By end user, the market is divided into hospitals, clinics, ambulatory surgical centers, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on product, the market is divided into surgical drill, surgical saw, reamer, power source and accessories. The surgical drill segment dominated the market in 2021 and is expected to remain dominant during the forecast period owing to rise in the prevalence of chronic diseases and increase in the adoption of surgical power tools for surgical purpose.

Based on technology, the market is classified into electric operated, battery operated, and battery operated. The battery-operated segment was the highest revenue contributor to the market in 2021 and is projected to be the fastest growing segment during the forecast period, as it offers greater speed and accuracy, and more convenience.

Based on application, the market is classified into orthopedic surgery, cardiothoracic surgery, spine and neurosurgery, and others. The others segment includes traumatology surgery, Oral/maxillofacial, ENT surgery, and Plastic surgery. The orthopedic surgery was the largest growing segment in 2021 and is projected to be the fastest growing segment during the forecast period owing to increase in prevalence of orthopedic disorders and rise in demand for orthopedic procedures.

Based on end user, the surgical power tools market share is classified into hospitals, clinics, ambulatory surgical centers, and others. The hospital segment was the largest growing segment in 2021 and is projected to be the fastest growing segment during the forecast period owing to rise in the expenditure by government to develop healthcare infrastructure.

Region wise, North America has the highest surgical power tools market share share in 2021, and is expected to maintain its lead during the forecast period, owing to increase in prevalence of sport injuries, rise in number of surgical centers, rise in availability of well-developed healthcare infrastructure, and strong presence of market surgical power tools Industry in this region. However, Asia-Pacific is expected to exhibit fastest growth during the surgical power tools market forecast period, owing to high prevalence of aging population with an increase in need of orthopedic surgeries, improvement in healthcare awareness, rise in prevalence of neurological diseases, and surge in healthcare expenditure.

COMPETITION ANALYSIS

Some of the major companies that operate in the surgical power tools market size include Arthrex, Inc., B Braun Melsungen AG, CONMED Corporation, GPC Medical Ltd., Johnson & Johnson, Medtronic plc, Portescap Inc., Sharma Orthopedic, Stryker Corporation, and Zimmer Biomet Holding Inc.

Some examples of product launch in the market

In November 2021, DePuy Synthes a subsidiary of Johnson and Johnson has launched the UNIUM System as the newest Power Tool. This system is highly reliable and efficient in the trauma setting and can be used across small bone, sports medicine, spine and thorax procedures. The launch of UNIUM System will help the company to strengthen its surgical power tools portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surgical power tools market analysis from 2021 to 2031 to identify the prevailing surgical power tools market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surgical power tools market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surgical power tools market trends, key players, market segments, application areas, and market growth strategies.

Surgical Power Tools Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.8 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Technology |

|

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Stryker Corporation, Zimmer Biomet Holding Inc., B. Braun SE, Johnson & Johnson, Altra Industrial Motion Corp., CONMED Corporation, Arthrex, Inc., GPC Medical Ltd., Sharma Orthopedic, Medtronic plc |

Analyst Review

This section provides various opinions of the top-level CXOs in the global surgical power tools industry. In accordance to several interviews conducted, the surgical power tools market is expected to witness growth with the rise in the research and development for minimally invasive surgical power tools. In addition, increase in number of surgical procedures leads to high adoption of surgical power tools which is expected to significantly boost the growth of the surgical power tools market.

In addition, in August 2021, Arbutus Medical expanded its product range of orthopedic drills and surgical power tools to help hospital and trauma centers perform skeletal traction in sterile and effective way. For instance, in June 2021, Joimax, a German-based company launched its new generation shrill, the Shaver Drill System. This system is used for soft tissue and bone removal and it is highly effective in treatment of degenerative spine condition, stenosis. Thus, such product launches are projected help the company to gain strong foothold in the surgical power tools market.

The top companies that hold the market share in surgical power tools Market are include Arthrex, Inc., B Braun Melsungen AG, CONMED Corporation, GPC Medical Ltd., Johnson & Johnson, Medtronic plc, Portescap Inc., Sharma Orthopedic, Stryker Corporation, and Zimmer Biomet Holding Inc.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop healthcare sector, increase in prevalence chronic disorders, and surge in the number of geriatric populations.

The key trends in the surgical power tools Market are rise in number of surgical procedure, and increase in the number of market players who manufacture surgical power tools.

The base year for the report is 2021.

Yes, surgical power tools companies are profiled in the report

The total market value of surgical power tools Market market is $2,275.2 million in 2021 .

The forecast period in the report is from 2022 to 2031

Major restraints in the surgical power tools market are high cost of surgical power tool coupled with increased risk of infection.

Loading Table Of Content...