Surgical Sponge Market Research, 2032

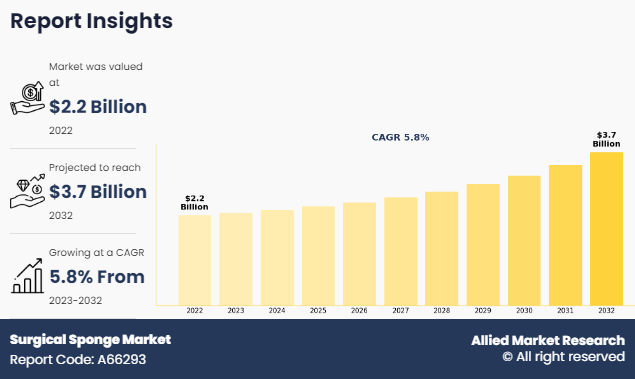

The global surgical sponge market size was valued at $2.2 billion in 2022, and is projected to reach $3.7 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032. A surgical sponge is a sterile or non-sterile absorbent pad used in surgical procedures to absorb fluids and maintain a clean and dry surgical field. Surgical sponges are made of mesh or yarn and have x-ray detectable and undetectable variants. They come pre-washed or unwashed, and with or without radiopaque handles. The absorbent nature of the surgical sponge, also called a lap sponge, helps to efficiently collect and manage fluids, minimizing the risk of contamination and keeping the surgical site clear. The availability of x-ray detectable and undetectable variants ensures that surgical sponges can be easily tracked and identified post-surgery, aiding in the detection of any potential retained sponges and preventing associated complications.

Regulatory agencies, such as the FDA (Food and Drug Administration) in the U.S. and the European Medicines Agency (EMA) in the European Union, impose strict rules and quality standards on surgical sponge products to ensure patient safety. Compliance with these requirements is prompting manufacturers to spend on R&D initiatives to improve product safety and efficacy. The ongoing rise in global healthcare expenditure, combined with the expansion of healthcare infrastructure in emerging economies, is driving up demand for surgical sponge. Healthcare providers are investing in modern surgical equipment and accessories to accommodate the increase in demand for surgical services while also improving patient care standards. All these factors are anticipated to drive the surgical sponge market growth in the upcoming years.

Advances in medical technology have led to the development of alternative products such as hemostatic agents and sealants, which can reduce the need for traditional surgical sponges. This trend may pose a challenge to the growth of the surgical sponge market. Healthcare providers are under constant pressure to reduce costs while maintaining quality patient care. Therefore, they may seek lower-cost alternatives to traditional surgical sponges, impacting market growth for premium products. Reimbursement policies for surgical sponge products vary across different regions. In some cases, reimbursement may be limited or not available, leading to decreased demand among healthcare providers.

Continuous advancements in materials science and manufacturing technologies offer opportunities to develop innovative surgical sponge products with improved performance characteristics such as better absorbency, reduced risk of retention, and enhanced biocompatibility. Incorporating technologies like RFID (Radio Frequency Identification) tagging for better tracking and detection of retained sponges can also improve patient safety. The growing preference for minimally invasive surgical techniques presents an opportunity for manufacturers to develop specialized surgical sponge products tailored to these procedures. These sponges may need to be smaller in size, more flexible, and designed to navigate through narrower surgical incisions while still effectively managing fluids. These factors are anticipated to drive the surgical sponge industry expansion in the upcoming years.

The key players profiled in this report include W. L. Gore & Associates. Inc. (U.S.), Boston Scientific Corporation (U.S.), Mölnlycke Health Care AB (Sweden), Medical Devices Business Services, Inc. (U.S.), BD (U.S.), TEPHA INC. (U.S.), Medtronic (Ireland), LifeCell International Pvt. Ltd. (India), B. Braun Melsungen AG (Germany), and Betatech Medical (Turkey). Investment and agreement are common strategies followed by major market players. For instance, in January 2019, Hofmann-La-Roche Ltd launched COBAS PRO, an integrated solution within the Serum Work Area, marking a significant milestone in laboratory diagnostics. This innovative system has the capability to conduct 2,200 tests per hour, representing a remarkable advancement in high-throughput testing capabilities.

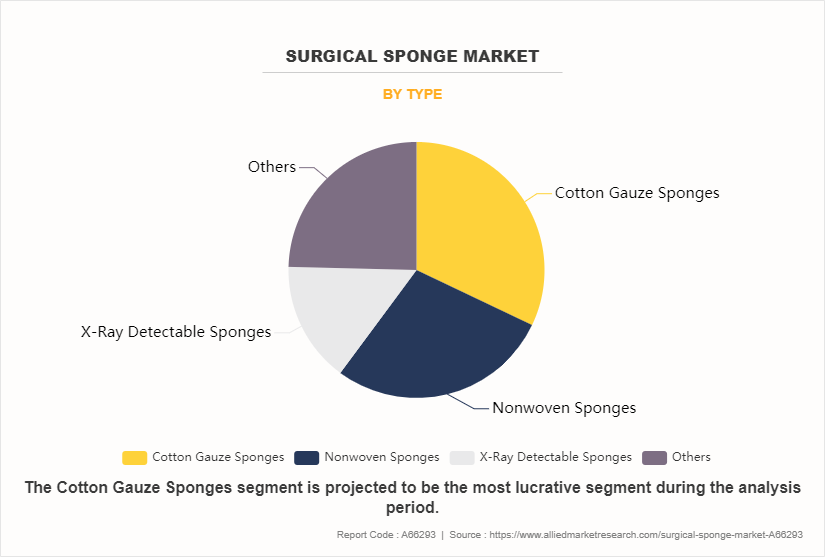

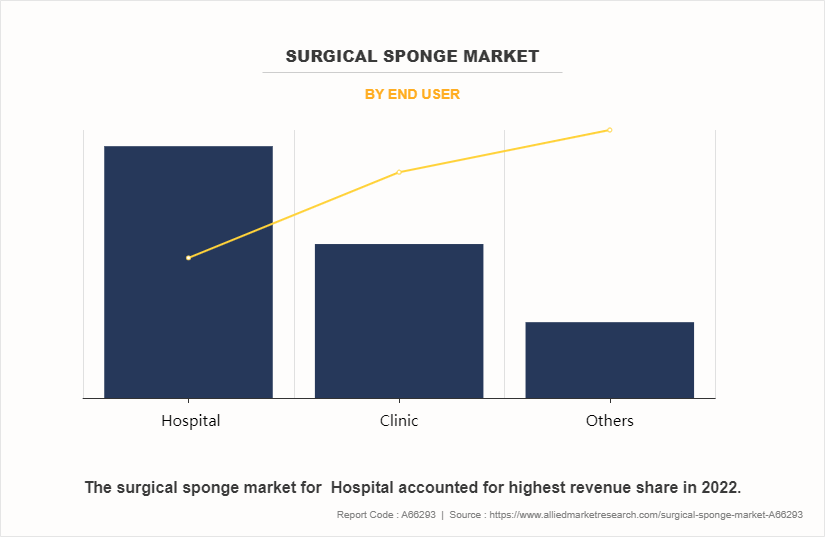

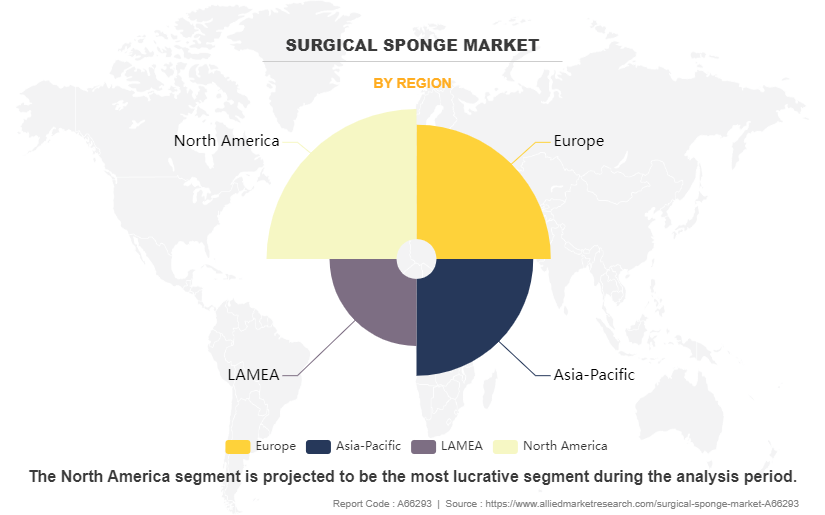

The surgical sponge market is segmented on the basis of type, end user, and region. By type, the market is divided into cotton gauze sponges, nonwoven sponges, x-ray detectable sponges, and others. By end user, the market is classified into hospital, clinic, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

The cotton gauze sponges sub-segment dominated the global surgical sponge market share in 2022. Cotton gauze sponges are versatile and effective for various medical applications, including wound cleaning, dressing, and absorption of fluids during surgical procedures. Their ability to conform to different wound shapes and sizes makes them a preferred choice among healthcare providers. Cotton gauze sponges are generally more cost-effective compared to other types of surgical sponges.

Hospitals and healthcare facilities often prioritize cost-efficient solutions without compromising patient care, driving the demand for cotton gauze sponges. There are opportunities for manufacturers to innovate and enhance the performance and features of cotton gauze sponges. This may include developing sponges with improved absorbency, reduced linting, enhanced durability, or incorporating antimicrobial properties for infection control. Cotton gauze sponges can be tailored for specialized medical applications, such as wound care in specific patient populations (e.g., pediatric, geriatric) or for use in niche surgical procedures. Targeting these specialized applications can open up new market segments and revenue streams.

By End User

The hospital sub-segment dominated the global surgical sponge market share in 2022. Hospitals conduct a wide range of surgical procedures, ranging from routine surgeries to complex interventions. The sheer volume of surgeries performed in hospitals drives the demand for surgical sponges. With advancements in medical technology and techniques, hospitals are able to perform more complex surgeries. These procedures often require a larger number of surgical sponges, contributing to market growth. Hospitals prioritize patient safety and infection control measures during surgical procedures. High-quality surgical sponges are essential for maintaining a sterile surgical environment and reducing the risk of postoperative complications.

By Region

North America dominated the global surgical sponge market size in 2022. The demand for surgical sponges is largely related to the number of surgical procedures performed. As the geriatric population increases, the number of surgeries conducted is projected to rise, creating a demand for surgical disposable medical supplies such as sponges. Improvements in healthcare infrastructure, such as the availability of advanced surgical procedures and equipment, help to drive the surgical sponge industry. Hospitals and surgical centers are likely to invest in high-quality surgical sponges to ensure patient safety and the best surgical outcomes.

Manufacturers have an opportunity to differentiate their products through innovation. Creating antimicrobial surgical sponges, using biodegradable materials, or incorporating RFID monitoring for better inventory control is projected to improve market competitiveness. While North America is a major market for surgical sponges, there may be potential to expand into underserved or emerging areas. Targeting locations with developing healthcare infrastructure and increased surgery numbers is predicted to result in additional revenue streams.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the surgical sponge market analysis from 2022 to 2032 to identify the prevailing surgical sponge market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the surgical sponge market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global surgical sponge market trends, key players, market segments, application areas, and market growth strategies.

- Based on region, North America registered the highest market share in 2022 and is projected to maintain its position during the surgical sponge market forecast period.

Surgical Sponge Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.7 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Type |

|

| By End user |

|

| By Region |

|

| Key Market Players | B. Braun Melsungen AG, TEPHA INC., Ethicon Inc, Betatech Medical, Medtronic, Medical Devices Business Services, Inc., W. L. Gore & Associates. Inc., Boston Scientific Corporation, LifeCell International Pvt. Ltd., Mölnlycke Health Care AB |

The primary factor driving the surgical sponge market growth is the rising number of surgical procedures worldwide. This is driven by various factors such as the aging population, increasing prevalence of chronic diseases, advancements in surgical techniques, and the expansion of healthcare infrastructure in emerging markets. Emerging economies with a growing healthcare infrastructure and rising number of surgical procedures provide significant opportunities for market expansion.

The major growth strategies adopted by surgical sponge market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global surgical sponge market in the future.

W. L. Gore & Associates. Inc. (U.S.), Boston Scientific Corporation (U.S.), Mölnlycke Health Care AB (Sweden), Medical Devices Business Services, Inc. (U.S.), BD (U.S.), TEPHA INC. (U.S.), Medtronic (Ireland), LifeCell International Pvt. Ltd. (India), B. Braun Melsungen AG (Germany), and Betatech Medical (Turkey) Limited are the major players in the surgical sponge market.

The cotton gauze sponges sub-segment of the type segment acquired the maximum share of the global surgical sponge market in 2022.

Hospitals and surgical centers are major customers of the surgical sponge industry. They purchase surgical sponges in large quantities to support various surgical procedures conducted within their facilities.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global surgical sponge market from 2022 to 2032 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...