Sustainable Finance Market Overview

The global sustainable finance market size was valued at $3650 billion in 2021, and is projected to reach $22485.6 billion by 2031, growing at a CAGR of 20.1% from 2022 to 2031. Growing demand for ESG-focused investments, increased adoption of green practices, and the need for skilled professionals to navigate complex criteria, ensuring stability and returns contribute to the growth of the market.

Market Dynamics & Insights

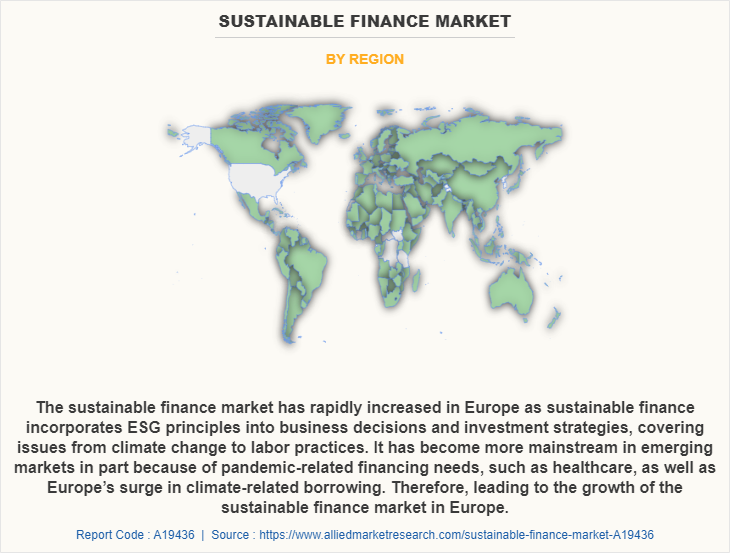

- The sustainable finance industry in Europe held a significant share of 39% in 2021.

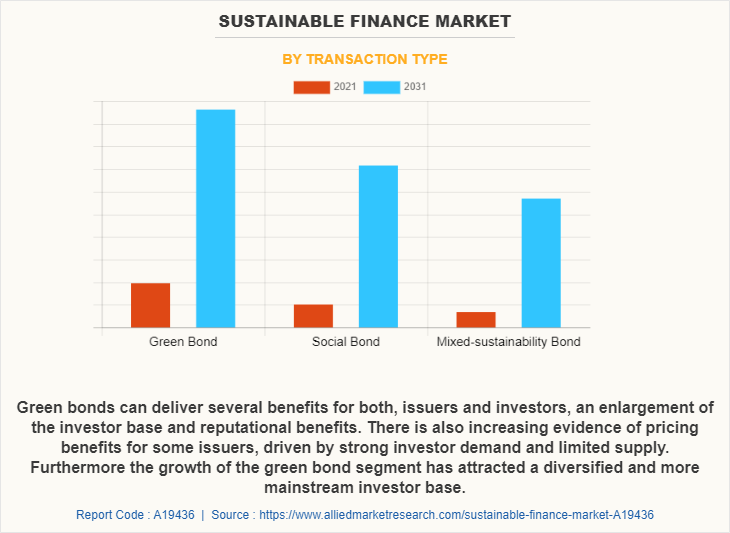

- By transaction type, the green bond segment dominated the segment in the market, accounting for the revenue share of 53% in 2021.

- By industry vertical, the utilities segment dominated the industry in 2021 and accounted for the largest revenue share of 21%.

Market Size & Future Outlook

- 2021 Market Size: $3650 Billion

- 2031 Projected Market Size: $22485.6 Billion

- CAGR (2022-2031): 20.1%

- Europe: dominated the market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by Sustainable Finance

Sustainable finance covers a range of activities, from putting cash into green energy projects to investing in companies that demonstrate social values, such as social inclusion or good governance by having, for instance, more women on their boards. Furthermore, sustainable finance has a key role to play in the world’s transition to net zero by channeling private money into carbon-neutral projects.

The sustainable finance market is expected to witness significant growth during the forecast period. This is attributed to a rise in demand for investments in businesses prioritizing sustainable practices. As ESG factors become central to operations, investors favor companies with strong sustainability efforts. The need for finance professionals with expertise in sustainable finance is increasing, driven by the complexity of ESG criteria and green investments. In addition, the increase in the adoption of sustainable finance, offering cost-cutting and risk mitigation through practices like energy efficiency and waste reduction, leading to better stability and returns on investment, support market expansion. These factors are expected to drive the growth of the sustainable finance market.

However, diversification issues of sustainable finance and its high operating costs are a major factors limiting the growth of the sustainable finance market.

On the contrary, growing awareness about sustainability among various sectors is expected to provide lucrative sustainable finance market opportunity in the upcoming years.

Type Insights

The sustainable finance market is rapidly growing, offering numerous opportunities for new players in the market, driven by a shift in preference toward environmental, social, and governance (ESG) principles in investment and financial decision-making. Sustainable finance refers to financial activities that support projects or initiatives that have a positive impact on the environment, society, or both. Several types of sustainable finance instruments and strategies are emerging, each playing a vital role in the market's development.

Green bonds are among the most notable instruments in the sustainable finance sector. These debt securities are issued by governments or corporations to finance projects that provide environmental advantages, such as renewable energy infrastructure or sustainable agriculture. Investors find green bonds appealing as they seek to align their investments with environmental sustainability objectives while still generating returns.

Social bonds and sustainability bonds are becoming increasingly significant. Social bonds are issued to fund initiatives that tackle social issues, such as affordable housing or healthcare access. In contrast, sustainability bonds integrate environmental and social goals, appealing to a wider range of investors who are keen to support projects that achieve a dual purpose. These bonds have seen a rise in popularity as more investors aim to make a positive impact on both society and the environment.

In addition, impact investing focuses on making investments that produce quantifiable social or environmental benefits in addition to financial gains. This investment approach is becoming more popular as investors expand their objectives beyond conventional financial targets to pursue both profit and purpose. Venture capital and private equity are progressively being allocated to sustainable startups, especially in sectors like clean technology, renewable energy, and social enterprises in sustainable finance market.

Moreover, sustainable ETFs (exchange-traded funds) have gained traction, offering investors an easy way to invest in a diversified portfolio of companies with strong ESG practices. These financial products enable individuals and institutions to direct capital into sustainable businesses, further driving demand for sustainable investment options.

Emerging Trends in Sustainable Business Practices and Investment Opportunities

The sustainable finance market is expected to witness several noteworthy trends in the market. Companies are increasingly seeking ESG advisory services to incorporate environmental, social, and governance considerations into their operations and financial disclosures. By embracing sustainable business practices, companies can sync their operations with methods that lower carbon emissions, reduce waste, and improve supply chain visibility. Furthermore, there is an increasing interest in sustainable products and services, like electric vehicles and renewable energy options, that appeal to environmentally aware consumers.

For instance, on December 21, 2024, Shriram Finance launched Shriram Green Finance to boost sustainable solutions. These new vertical aims to consolidate the company's green financing efforts, supporting initiatives such as electric vehicles, renewable energy products, and energy-efficient machinery. Shriram Finance targets achieving an Asset Under Management (AUM) of ₹5,000 crore within the next three to four years1. This initiative aligns with the company's vision of fostering sustainable growth and empowering stakeholders with financial solutions that support a greener economy.

Investors are more frequently looking for sustainable finance market opportunities that provide both financial gains and beneficial social or environmental outcomes. Social impact funds are addressing particular challenges like affordable housing, education, healthcare, and renewable energy. Moreover, there is increasing venture capital investment in sustainable startups that concentrate on clean technology, eco-friendly construction, and sustainable agriculture, showcasing a rising interest in backing companies that emphasize sustainability.

For instance, on February 24, 2025, DBS has been named the World's Best Bank for Sustainable Finance by Global Finance. This recognition highlights DBS's leadership in sustainable finance, including innovative solutions that support Asia's transition to a more sustainable future and empower small and medium-sized enterprises (SMEs) in their sustainability journeys12. This accolade underscores the bank's commitment to integrating environmental and social considerations into its business practices

Many companies are looking for ways to finance suppliers that adhere to ethical labor practices, environmental standards, and sustainability goals. Green supply chain financing, which involves providing capital to suppliers who adopt environmentally sustainable practices, presents a growing sustainable finance market opportunity for financial institutions.

Financial institutions can strengthen their commitment to responsible lending by providing offerings like eco-friendly mortgages, sustainable personal loans, and financing aimed at social impact. Moreover, fintech advancements are developing, with online platforms enabling investments in sustainable initiatives and offering loans and funding for enterprises dedicated to social responsibility.

Companies are increasingly pressured to report on their ESG performance, driving demand for ESG reporting tools and compliance services. This creates a lucrative market for sustainability reporting software, which provides solutions for tracking, managing, and reporting ESG data.

Investment in sustainable agriculture and food systems is growing, with a focus on companies or initiatives that promote sustainable farming practices, reduce food waste, and develop plant-based food alternatives. In addition, agri-tech innovations are attracting investment by helping farmers become more efficient, reduce water use, and improve soil health in an environmentally friendly manner, providing significant opportunities for sustainable finance market growth.

Investment in green technology and renewable energy innovations is expanding, with opportunities in startups and companies developing new technologies for clean energy, waste management, and sustainable agriculture. In addition, financing large-scale renewable energy infrastructure projects, such as solar farms and wind turbines, is becoming a significant sector in the sustainable finance market.

For instance, on June 27, 2024, Rupee112 has launched green loans to promote sustainable finance. This initiative aims to support environmentally friendly projects and businesses by providing financial solutions that align with sustainability goals. This move is part of a broader trend in the financial sector to integrate ESG criteria into lending practices, encouraging more responsible and sustainable business operations.

Sustainable Finance Market Segment Review

The sustainable finance market is segmented on the basis of investment type, transaction type, industry vertical, and region. By investment type, the sustainable finance market is segmented into equity, fixed income, mixed allocation, and others. By transaction type, the sustainable finance market is segmented into green bond, social bond, and mixed-sustainability bond. The mixed-sustainability bond is further divided into sustainability bonds, and sustainability linked-bonds. By industry vertical, the sustainable finance market is segmented into utilities, transport and logistics, chemicals, food and beverage, government, and others. By region, the sustainable finance market is analyzed across Europe, North America, Asia-Pacific, and LAMEA.

For instance, on October 3, 2024, Standard Chartered announced the launch of sustainable finance variants of Borrowing Base Trade Loans (BBTL) in the United States, UK, UAE, South Africa, Singapore, and Hong Kong, with further market launches expected. BBTL, a secured revolving credit facility, was designed to meet the financing needs of businesses, particularly in the commodity sector, by allowing them to obtain financing against collateral such as cash, inventory, or receivables. This structure enabled businesses to manage working capital more effectively, consolidate multiple transactions under a single loan, and leverage existing assets for secure and efficient funding.

By transaction type, the green bond segment attained the highest growth in the sustainable finance industry. This is attributed to the fact that green bonds can deliver several benefits for both issuers and investors, an enlargement of the investor base and reputational benefits. There is also increasing evidence of pricing benefits for some issuers, driven by strong investor demand and limited supply. Furthermore, the growth of the green bond in sustainable finance market has attracted a diversified and more mainstream investor base.

Region-wise, Europe attained the highest growth in 2021. This is attributed to the fact that sustainable Fintech incorporates ESG principles into business decisions and investment strategies, covering issues from climate change to labor practices. It has become more mainstream in emerging markets in part because of pandemic-related financing needs, such as healthcare, as well as Europe’s surge in climate-related borrowing. Therefore, this is the major growth factor for the growth of the sustainable finance market in Europe.

For instance, On October 1, 2024, the World Bank Group and partners launched the “Sustainable Finance Knowledge Center for Francophone Africa.” This virtual platform, available in English and French, aims to equip companies and financial institutions in Francophone Africa with the knowledge and skills needed for sustainable finance and business models. The Center's curricula, primarily delivered in French, address the need for upskilling among French-speaking business leaders, helping them manage sustainability risks and opportunities. This initiative is crucial for the region, which faces significant climate change challenges impacting economic growth and human capital development.

The report focuses on growth prospects, restraints, and trends of the sustainable finance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the sustainable finance market.

Competitive Analysis

The report analyzes the profiles of key players operating in the sustainable finance market, such as Acuity Knowledge Partners, Aspiration Partners, Inc., BNP Paribas, Deutsche Bank AG, Goldman Sachs, HSBC Group, KPMG International, NOMURA HOLDINGS, INC., PwC, Refinitiv, South Pole, Starling Bank, Stripe, Inc., Tred Earth Limited, Triodos Bank UK Ltd., Arabesque Partners, and Clarity AI. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the sustainable finance market.

COVID-19 Impact Analysis

The COVID-19 pandemic had a moderate impact on the sustainable finance market size. The investors were facing huge losses during the pandemic as the market was highly volatile during the period. Moreover, investors were looking for investment opportunities, which gave high returns and projected less risk. Therefore, sustainable financing became a great option for investment as it gave better returns as compared to traditional investments. Moreover, the awareness about ESG sustainability among consumers and investors significantly impacted the sustainable finance market.

Key Industry Developments

- February 2025, DBS has been named the World's Best Bank for Sustainable Finance by Global Finance. This recognition highlights DBS's leadership in sustainable finance, including innovative solutions that support Asia's transition to a more sustainable future and empower small and medium-sized enterprises (SMEs) in their sustainability journeys12. This accolade underscores the bank's commitment to integrating environmental and social considerations into its business practices

- July 2024, Deutsche Bank launched BASF’s first sustainability-linked payables finance program in Asia, focusing on its operations in China. This program converted BASF’s existing payables finance to sustainability-linked financing, incentivizing suppliers to adopt sustainable practices. Supplier performance was measured by EcoVadis, with rated suppliers qualifying for preferential interest rates. The program aimed to enhance BASF’s supply chain sustainability and was recognized by The Asset’s Triple A Treasurise Awards for ‘Best ESG Solution in China’.

- September 2024, The Strategic Banking Corporation of Ireland (SBCI) and Business Venture Partners (BVP) have launched a €50 million Green Transition Finance product to support Irish businesses in achieving sustainability goals. This initiative provides flexible lending solutions tailored to the needs of SMEs and small mid-caps investing in sustainable and green projects.

- November 26, 2024, APIX collaborated with Hitachi to bring innovative green financing solutions to market at scale. Hitachi sought innovators from various fields to join an Innovation Challenge, leveraging datasets from the Hitachi Green Finance Dataset Library to develop sustainability solutions for the real estate sector. They identified four critical areas needing solutions: limited innovative green finance products, lack of verifiable data and trust, difficulty accessing sustainable investment opportunities, and low incentives for sustainability upgrades.

What are the Top Impacting Factors in Sustainable Finance Market

Rise in Investment in Businesses with Sustainable Practices

Investing in businesses and projects with sustainable ESG practices is on the rise, as the demand for finance professionals with expertise in this niche yet rapidly growing field is rapidly increasing. Furthermore, a report from February 2021, by the United Nations’ Intergovernmental Panel on Climate Change makes the urgent case for integrating ESG, among other factors, into investment decisions for fast, actionable impact on the environment. Moreover, market leaders in the space are demonstrating that thinking differently about environmental and social performance can drive change that delivers more business value while harnessing the power of enterprise to deliver better outcomes for people and the planet. Therefore, this is one of the major driving factors of the sustainable finance market.

Diversification Issues of Sustainable Finance

Green banks restrict their business transactions to those business entities who qualify screening process done by green banks. With the limited number of customers, they will have a smaller base to support them. Moreover, if banks are involved in projects that are damaging the environment, they are prone to loss of their reputations. In addition, credit risks arise due to lending to those customers whose businesses are affected by the cost of pollution, changes in environmental regulations, and new requirements on emissions levels. It is higher due to the probability of customer default as a result of uncalculated expenses for capital investment in production facilities, loss of market share and third-party claims. Therefore, this is a major limiting factor for the growth of the sustainable finance market.

Growing Awareness of Sustainability Among Various Sectors

Sustainability is an increasingly important issue for many people, especially in the business world. For business owners, leaders, and administrators, sustainable business practices are becoming imperatives. According to NASA, it is more than 95% likely that human activity is causing the planet to get warmer. Human industry is a big part of climate change because of its reliance on land, resources, fossil fuels, and non-stop production and consumption. Therefore, growing awareness about sustainability among various sectors is expected to propel investors to make investment in businesses which are more sustainable and consider the ESG reliance. Therefore, this factor is anticipated to provide immense lucrative opportunities for the sustainable finance market growth of the market in upcoming years.

Financial Inclusion and Access to Credit

Financial inclusion is a essential element of sustainable finance, ensuring that all individuals, regardless of their financial background, have access to essential financial services. Short-term cash advances, high-interest personal loans, and emergency payday lending are often used by individuals who lack access to traditional credit options. These financial products provide quick access to funds, offering immediate relief for urgent needs such as medical bills or car repairs.

However, while these products offer much-needed liquidity, they come with significant challenges. Short-term cash advances and payday loans often involve high interest rates and fees, which can lead to a cycle of debt for borrowers who struggle to repay on time. High-Interest Personal Loans also carry greater financial burdens compared to more traditional, lower-interest borrowing options.

To truly promote financial inclusion, there is a growing need for alternative solutions that provide accessible credit without exploiting vulnerable individuals. Sustainable finance solutions can drive the development of low-cost, transparent lending options designed for those with limited access to traditional banking systems. Ensuring that these products are fair, ethical, and transparent is crucial to improving financial well-being and helping underserved communities achieve long-term economic stability without falling into debt traps.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the sustainable finance market segments, estimations, and dynamics of the sustainable finance market share from 2021 to 2031 to identify the prevailing sustainable finance market opportunities.

- In-depth analysis of the sustainable finance industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global sustainable finance market forecast.

- The report includes the analysis of the regional as well as global sustainable finance market trends, key players, market segments, application areas, and sustainable finance market growth strategies.

Sustainable Finance Market Report Highlights

| Aspects | Details |

| By Investment Type |

|

| By Transaction Type |

|

| By Industry Verticals |

|

| By Region |

|

| Key Market Players | KPMG International, South Pole, Starling Bank, Refinitiv, Deutsche Bank AG, Pwc, NOMURA HOLDINGS, INC., Treecard, Stripe, BNP Paribas, Clarity AI, Triodos Bank, Aspiration Partners, Inc., Arabesque, HSBC Group, Acuity Knowledge Partners, Goldman Sachs |

Analyst Review

Sustainable finance refers to the ways of providing funds to different projects that aim toward bringing improvement in the quality of natural resources, atmosphere, and the health of living beings by overcoming negative environmental impacts of human activities. In addition, aside from improving the environmental quality and encouraging social activities, sustainable financing also provides a healthy workforce to the economy, ensures the availability of good quality natural resources, and stimulates economic activities. Thus, the act of banks or other financial institutions to grant green finance to social or commercial sectors can accelerate and sustain the high economic growth rate. Moreover, sustainable financing includes several financial factors, such as green bonds, green loans, green securities, and green investments that can improve the environmental quality and enhance the economic development of the affiliated countries.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in September, 2021, HSBC Bank Canada announced the launch of five new sustainable finance tools for commercial and global banking clients. These financial tools are available to the Canadian businesses of all sizes. These sustainable financial tools include green deposits, green trade finance, green revolving credit facilities, sustainability-linked loans, and green equipment financing, which were added to the HSBC’s successful green loans launched in 2019. With the new suite of sustainable finance offerings, HSBC has become the first bank in Canada to apply sustainable finance market principles to both, trade and deposit products. Therefore, such developments in the field of sustainable finance are driving the market growth. Some of the key players profiled in the report include, Acuity Knowledge Partners, Aspiration Partners, Inc., BNP Paribas, Deutsche Bank AG, Goldman Sachs, HSBC Group, KPMG International, NOMURA HOLDINGS, INC., PwC, Refinitiv, South Pole, Starling Bank, Stripe, Inc., Tred Earth Limited, Triodos Bank UK Ltd., Arabesque Partners, and Clarity AI. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Investments in businesses with sustainable practices is rapidly growing as demand for finance professionals with expertise in the sustainable finance is a rapidly growing field. In addition, sustainable finance offers cost cutting and risk mitigation along with better returns.

By transaction type, the green bond segment attained the highest growth in the sustainable finance industry. This is attributed to the fact that green bonds can deliver several benefits for both issuers and investors, an enlargement of the investor base and reputational benefits. There is also increasing evidence of pricing benefits for some issuers, driven by strong investor demand and limited supply. Furthermore the growth of the green bond market has attracted a diversified and more mainstream investor base.

Region-wise, Europe attained the highest growth in 2021. This is attributed to the fact that sustainable Fintech incorporates ESG principles into business decisions and investment strategies, covering issues from climate change to labor practices. It has become more mainstream in emerging markets in part because of pandemic-related financing needs, such as healthcare, as well as Europe’s surge in climate-related borrowing. Therefore, this is the major growth factor for the growth of the sustainable finance market in Europe.

The global sustainable finance market size was valued at $3,650.00 billion in 2021, and is projected to reach $22,485.56 billion by 2031, growing at a CAGR of 20.1% from 2022 to 2031.

Acuity Knowledge Partners, BNP Paribas, Deutsche Bank AG, Goldman Sachs, HSBC Group, KPMG International, PwC, and Refinitiv are the top companies to hold the market share in sustainable finance market.

Loading Table Of Content...