Suture Anchors Market Research, 2031

The global suture anchors market size was valued at $572.5 million in 2021, and is projected to reach $899.4 million by 2031, growing at a CAGR of 4.6% from 2022 to 2031.

Suture anchors are used to attach soft tissue to bone in a condition when insufficient soft tissue buildup on the bone makes it impossible to establish a direct soft tissue-to-soft tissue repair. In most areas of the body, tissue anchors enable reattachment of tissue to bone. Depending on the type of tissues present, these anchors are subject to various stresses through a variety of methods. There are several options for anchor selection, thus it is critical for the surgeon to comprehend the unique properties and biomechanics of each anchor as this can influence utilization.

Suture anchors can now be used in a wide range of musculoskeletal tissues, including the hip, elbow, hand, knee, foot, and ankle, thanks to innovations and sophisticated procedures. Furthermore, suture anchors consist of an anchor (which is put into the bone and can be made of metal or biodegradable substance) and an eyelet (a hole or a loop in the anchor through which the suture passes that help to link the anchor to the suture). Through the anchor's eyelet, the suture is attached to it. It could be an absorbable or non-absorbable material.

Historical Overview

The market was analyzed qualitatively and quantitatively from 2018-2020. The suture anchors market size grew at a CAGR of around 3-4% during 2018-2021. Most of the growth during this period was derived from the Asia-Pacific owing to the improving health awareness, rising disposable incomes, as well as well-established presence of domestic companies in the region.

Market Dynamics

Factors that drive the suture anchors market growth include increase in geriatric population, rise in sports-related injuries such as sprains, strains, tendinitis, contusions, surge in incidences of tendon & wrist injuries, and increase in interest in other workouts and physical activities among children & adults. For instance, according to a John Hopkins Medicine article, 30 million individuals participate in organized sports, resulting in more than 3.5 million sports injuries annually in the U.S. alone, with sprains and strains. Furthermore, increase in the number of product launches by different key players propels the market growth. For instance, in September 2020, Smith and Nephew, the global medical technology business, announced the launch of the HEALICOIL KNOTLESS Suture Anchor, expanding its revolutionary line of Advanced Healing Solutions for rotator cuff repair.

Furthermore, presence of a plethora of products in the pipeline and high market potential in untapped emerging economies are anticipated to serve as attractive suture anchors market opportunity during the forecast period. Moreover, expansion in medical tourism in developing economies, increase in consumer awareness for skin resurfacing, and aesthetic enhancement significantly propel the growth of the market. Moreover, increase in number of licensed medical centers fuels the growth of suture anchors market. In addition, accidents cause soft tissue injuries, particularly road accidents lead to increase in number of orthopedic surgeries, thus fueling the growth during suture anchors market forecast.

COVID-19 Impact Analysis-

The COVID-19 outbreak had a negative impact on the suture anchors industry as huge number of medical colleges and hospitals across the globe were reconstructed to increase hospital capacity for patients diagnosed with COVID-19. Discovery and development of suture anchors product slowed down during pandemic however did not stop. Surgeries of orthopedic patients were postponed, and home care setting was preferred. Non-essential surgical procedures took a potential backlog, owing to rapidly rising COVID-19 cases; only selective emergency surgeries were performed.

In addition, consumers focused only on highly essential products such as foods & beverages. However, with relaxation in lockdowns and decline in COVID-19 cases, companies have re-started their processes to meet the demand for products. Moreover, owing to the introduction of various COVID-19 vaccinations, people can now readily reach out to hospital and pharmacy due to which surge in the demand for suture anchors product for the treatment of injuries has increased. Thus, such development is anticipated to bring stabilization and drive the growth of the suture anchors industry during the forecast period.

Segmental Overview

The suture anchors market is segmented into product type, tying type, material, end user, and region. By product type, the market is categorized into absorbable and non-absorbable. On the basis of tying type, the market is segregated into knotless and knotted. On the basis of material, the market is divided into bio-composite suture anchor, peek suture anchor/ biostable, and others. By end user, the market is classified into hospitals & clinics and ambulatory surgery centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

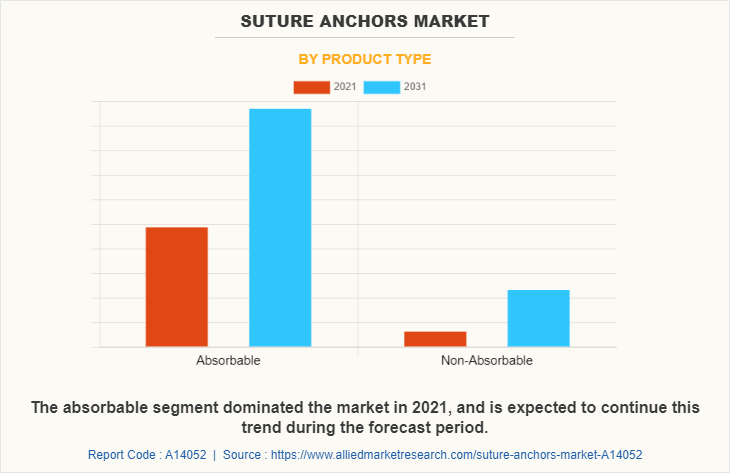

By Product Type: On the basis of product type, the market is segmented into absorbable and non-absorbable. The absorbable segment dominated the global market in 2021 and is expected to remain dominant throughout the forecast period, as absorbable sutures are widely used in multiple surgeries as they are biodegradable and do not require manual removal. Furthermore, absorbable sutures continue to be a reliable, consistent, and secure implant for attaching soft tissue to bone in and around the shoulder which further drive the segment growth.

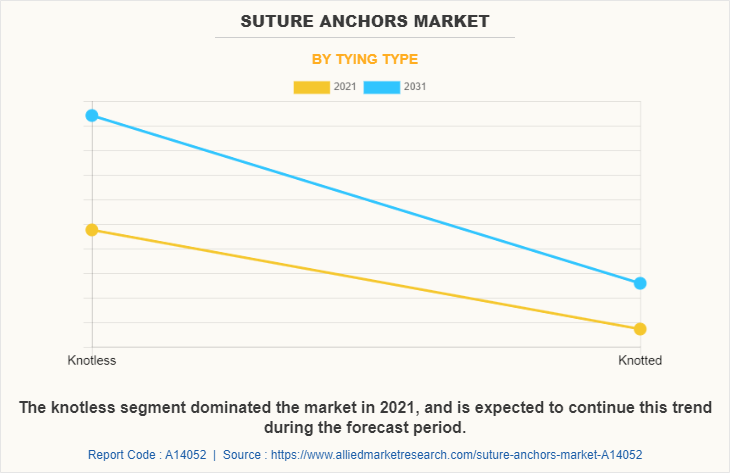

By Tying Type: Suture anchors market is segregated into knotless and knotted. The knotless segment dominated the global suture anchors market share in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to knotless suture anchors have contributed towards providing versatility and reducing time spent to perform the surgical procedures. Thus, this factor is anticipated to fuel the knotless segment growth. In addition, increase in rate of approval & commercialization of medical devices such as anchor sutures and improved supply chain activities are ехреÑtеd to Ñ€rореl the grоwth of the market.

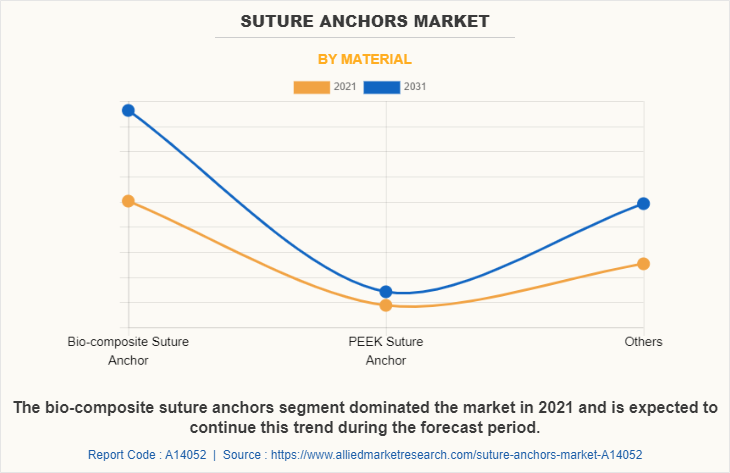

By Material: Suture anchors market is segregated into bio-composite suture anchor, peek suture anchor/ biostable and others. The bio-composite suture anchor segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to tricalcium phosphate (TCP) or hydroxyapatite, two reabsorbed materials, are the components of bio-composite suture anchors (HAP). These sutures lower the risk of articular injury, aid in boosting bone formation following reabsorption, and lessen the risks associated with implant removal. Thus, this factor is anticipated to fuel the bio-composite suture anchor segment growth.

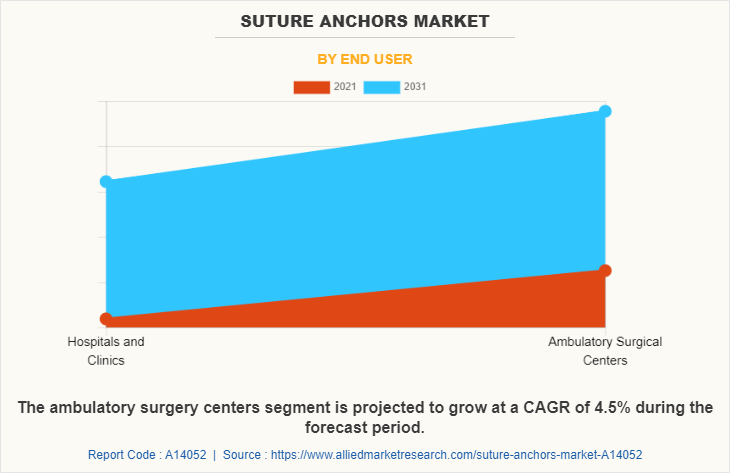

By End User: The market is classified into hospitals and clinics, and ambulatory surgery centers. The ambulatory surgery centers held the largest market share in 2021 and is expected to remain dominant throughout the forecast period, owing to well-equipped operation theaters, higher buying power, and rise in patient admission.

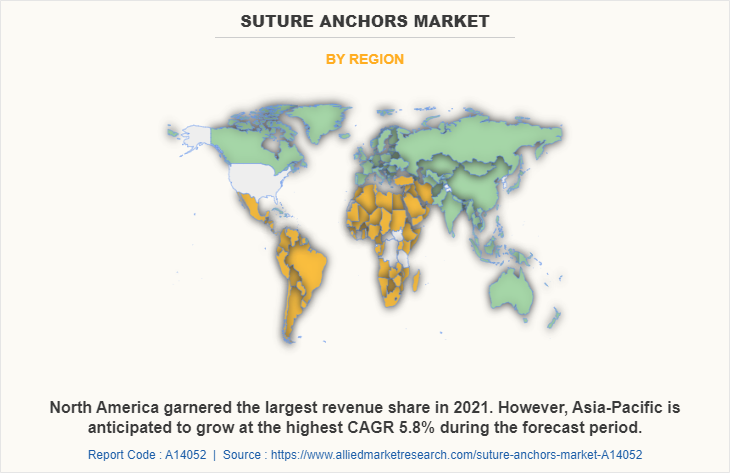

By Region: The suture anchors market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major suture anchors market share in 2021 and is expected to maintain its dominance during the forecast period. This is attributed to the rise in incidence of bone injuries, advent of new technologies, growing popularity of minimally invasive procedures, and increase in investment in orthopedic surgeries are ехреÑtеd to Ñ€rореl the grоwth оf thе mаrkеt. Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of suture anchors products are expected to drive the market growth.

Asia-Pacific is projected to register highest CAGR during the forecast period. The market growth in this region is attributable to presence of medical devices industry in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, increase in initiatives taken by government to develop advanced surgical centers in Asia-Pacific along with rise in R&D activities regarding development of new suture anchors products drive the growth of the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the laser aesthetics, such as Anika Therapeutics Inc, Arthrex, Inc. CONMED Corporation, Johnson and Johnson, Medtronic plc, Ossio Inc. Paragon 28, Inc, Smith & Nephew plc, Stryker Corporation and Zimmer Biomet Holdings, Inc. Major players have adopted product launch, product approval, and acquisition as key developmental strategies to improve the product portfolio of the suture anchors market.

Some examples of product launches in the market

In September 2020, Smith and Nephew, the global medical technology business, announced the launch of the HEALICOIL KNOTLESS Suture Anchor, expanding its revolutionary line of Advanced Healing Solutions for rotator cuff repair. This portfolio includes the innovative REGENETEN Bio inductive Implant and novel REGENESORB Material.

In May 2022, Paragon 28, Inc. announced an expansion of its soft-tissue portfolio with the launch of its Grappler Suture Anchor System. The Grappler Suture Anchor System provides surgeons an alternative fixation option designed to limit implant migration and loss of tension for intraoperative tissue reattachment and fixation in the foot and ankle.

In August 2022, OSSIO, Inc., a fast-growing orthopedic fixation technology company, announced the U.S. launch and first commercial use of OSSIOfiber Suture Anchors, expanding patient access to the company’s growing portfolio of bio-integrative implants for use in foot/ankle, shoulder, knee, hand/wrist, and elbow surgery.

Some examples of acquisition in the market

In December 2020, Zimmer Biomet has acquired A&E Medical and its complete portfolio of sternal closure devices – including sternal sutures, cable systems, and rigid fixation – along with a range of single-use complementary temporary pacing wire and surgical punch products. The deal is expected to have an immaterial impact to net earnings in 2020.

In June 2022, ConMed acquired the In2Bone who is a global developer, manufacturer, and distributor of orthopedic medical devices. This acquisition extends product portfolio, sales channel, and experienced leadership team of ConMed Corporation.

Some examples of product Approval in the market

In June 2022, Anika Therapeutics Inc. announced FDA approval of the X-Twist knotless fixation system for soft tissue repairs in the shoulder, foot and ankle and other extremities

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the suture anchors market analysis from 2021 to 2031 to identify the prevailing suture anchors market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the suture anchors market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global suture anchors market trends, key players, market segments, application areas, and market growth strategies.

Suture Anchors Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 899.4 million |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 368 |

| By Product Type |

|

| By Tying Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Paragon 28, Inc, Zimmer Biomet Holdings, Inc., Ossio Inc., Arthrex, Inc., Anika Therapeutics Inc., Stryker Corporation, Smith & Nephew plc, Johnson and Johnson, Medtronic plc, CONMED Corporation |

Analyst Review

This section provides opinions of top level CXOs in the suture anchors market. According to insights of CXOs, suture anchors have gained high traction in the market owing to increase in prevalence of bone injury, rise in R&D investments in drug discovery & development, and rise in awareness regarding physical exercise & sports-related disease.

Furthermore, key players in the market are focusing on adopting strategies to increase accessibility and utilization of suture anchors products in developing economies. Moreover, experts of key companies believe surge in geriatric population, increase in athletes, and sportspersons who are more prone to tendon injuries such as strains, sprains that increase the demand for suture anchors product. which further propel the market growth.

North America is expected to witness highest growth, in terms of revenue, owing to robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in geriatric population, unmet medical demands, and increase in public–private investments in the healthcare sector.

Absorbable segment is the most influencing segment as absorbable sutures are widely used in multiple surgeries as they are biodegradable and do not require manual removal

increase in use of suture anchors in reattaching bones to tissues in hands, elbows, knees, and ankles ,increasing geriatric population suffering from orthopedic illness, advancement in the technology , a boost in healthcare expenditure, and higher government support

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing to rise in well-established healthcare system, increase in number of geriatric patients and supportive reimbursement policies

Suture Anchors are useful fixation device for securing ligaments and tendons to bone

The forcast period for Suture anchors market is 2022 to 2031

The base year is 2021 in Suture anchors market

The market value of the Suture anchors market in 2031 is $899.4 million.

Top companies such as Smith & Nephew plc, Zimmer Biomet Holdings, Inc., CONMED Corporation, Johnson and Johnson and Medtronic plc held a high market position in 2021.

The total market value of Suture anchors market is $572.5 million in 2021.

Loading Table Of Content...