Sweetener Market Summary

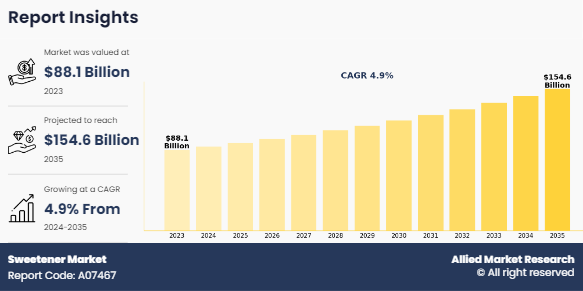

The global sweetener market size was valued at $88.1 billion in 2023, and is projected to reach $154.6 billion by 2035, growing at a CAGR of 4.9% from 2024 to 2035.

Key Market Trends and Insights

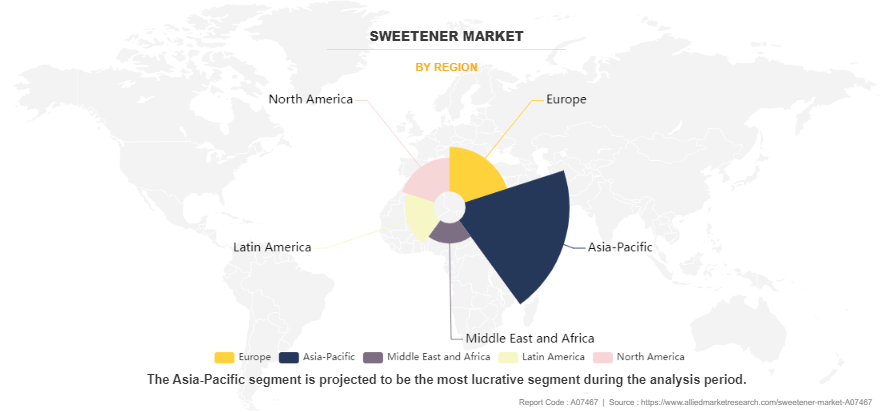

Region wise, Asia-Pacific generated the highest revenue in 2022.

The global sweetener market share was dominated by the beverages segment in 2022 and is expected to maintain its dominance in the upcoming years

The supermarket and hypermarkets segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2023 Market Size: USD 88.1 Billion

- 2035 Projected Market Size: USD 154.6 Billion

- Compound Annual Growth Rate (CAGR) (2024-2035): 4.9%

- Asia-Pacific: Generated the highest revenue in 2022

Market Dynamics

Sweeteners are food additives used to increase the experience of sweetness during consumption. Sweeteners are numerous natural sweeteners and artificial sweeteners compounds that add sweetness to meals and beverages. Sweeteners are employed in a variety of activities, including food preservation, fermentation (in brewing and winemaking), baking (to provide texture, tenderization, and leavening), and food browning and caramelization. Low-calorie sweeteners are commonly used in meals and beverages to minimize dental caries and decrease the number of calories as they prevent the rise of blood sugar levels.

Emerging markets like Asia-Pacific, Latin America, and Africa are witnessing a rise in population, economic growth, urbanization, and increase in knowledge of the benefits of low-calorie and healthy sweeteners. More than 75% of the world's population is projected to reside in Asia and Africa. The majority of the countries in these two regions are emerging nations and are experiencing strong economic growth. The rise in penetration of quick-service restaurants and fast-food chains, beverage processing companies, and food processing companies is boosting the demand for low-calorie sweeteners.

Moreover, a significant rise in the consumption of soft drinks and fruit juice concentrates fuels the sweetener market growth of developing regions. The presence of a large population and their consumption behavior boost the demand for confectioneries, soft drinks, and processed food across the developing regions. This is expected to foster the demand for sweeteners among the food & beverage manufacturers in the developing regions.

In the current scenario, the vaccination drive, and the fall of COVID-19 cases around the globe have helped to normalize the situation. Governments have lifted the lockdown which has eased the difficulties in the supply chain. The sweetener market is witnessing new heights of growth and is expected to recover its losses in the next 1-2 years. The change in consumer consumption patterns has increased the popularity of low-calorie products in the market. Consumers are eager to try new sweetener products and maintain a healthy lifestyle to cope with the post-effect of the COVID-19 pandemic.

The majority of sugar alcohols are manufactured industrially by catalytic hydrogenation of sugars at high pressure and temperature. However, conventional chemical procedures demand severe temperatures and expensive chromatographic purification stages, resulting in a poor end-product yield. With these limitations, several research projects are underway to develop cost-effective procedures for the manufacturing of such high-value-added products, intending to help both customers and the industry. One such step forward produced by current research is the biotechnological manufacture of sugar alcohols.

Microbial fermentation-based biotechnological manufacturing provides safer and more environmentally friendly procedures. However, due to a variety of difficulties, including increased manufacturing and purification costs and low efficiency, not all fermentative techniques are suitable for industrial-scale manufacture. Therefore, sugar alcohol biotechnological processes are competitive and cost-effective. It is essential to diversify value-added chemical compounds derived from sugar alcohols, improve the applicability of low-cost substrates such as cellulosic hydrolysates, and develop effective bioconversion procedures to produce higher-value derivatives of sugar alcohols. As a result, the high manufacturing costs of sugar alcohols relative to sugar are projected to limit the sweetener market expansion.

Manufacturers in the sweetener market are continuously investing in R&D to expand their product portfolios and market presence. The need for cost-effective procedures for manufacturing sweeteners will aid in minimizing the ultimate cost of the product and fuel the sweetener industry expansion.

For instance, in April 2020, ERYSTA, the first polyol sweetener produced by Ingredion EMEA, enables producers to decrease or replace sugar to fulfill nutrition-related claims including no added sugar or calorie-reduced in a variety of applications.

Furthermore, Cargill, Incorporated, debuted their newest label-friendly sweetener TruSweet 01795 in 2020, which allows for a 30% sugar and calorie reduction in drinks and other food applications through reduced consumption levels. The entire sweetener industry is expected to grow at an increasing pace in the upcoming years owing to the expansion of the range of sugar and sweetener producers.

According to the European Starch Industry Association, Europe is one of the leading manufacturers of sweeteners using starch. The demand for sweeteners made from starch is on a significant increase in Europe. The starch sweetener manufacturers are investing in business expansion and are positioning their businesses for long-term growth.

For instance, Cargill made an investment of around $48 million in February 2022 to open its corn mill in Fort Dodge, Iowa, which will help expand value-added corn production for the company’s food ingredient market. Similarly, the major global sweetener manufacturers are adopting business expansion as a key strategy for the long-term growth of the sweetener market.

Key players like Archer Daniels Midland Company and Tate & Lyle Plc are investing in the establishment of new manufacturing facilities and emphasizing R&D activities to promote innovation. In October 2021, Tate & Lyle PLC opened a new state-of-the-art food and beverage Technical Application Centre in Dubai to promote R&D activities in the region and to help improve the quality of its products.

In May 2022, Archer Daniels Midland Company announced plans to expand the production of starch in its Marshall, Minnesota, facility, to keep up with the increase in demand for food and beverage additives and sweeteners. Therefore, the rising investments in business expansion by the leading sweetener market players are expected to offer lucrative growth opportunities to the market players in the foreseeable future.

On the other hand, product awareness of high-intensity and low-calorie sweeteners is poor in rural regions, which acts as a barrier to the expansion of the sweeteners market in the rural areas of emerging nations. Access to supermarkets, hypermarkets, and department shops is confined to metropolitan regions and certain rural areas, which is the primary source of the market's lack of understanding of sugar alternatives. The development of urbanization in rural regions is predicted to flourish the market for sweeteners in the upcoming years, and the availability of alternative sweeteners at affordable prices will help increase sales.

Segments Overview

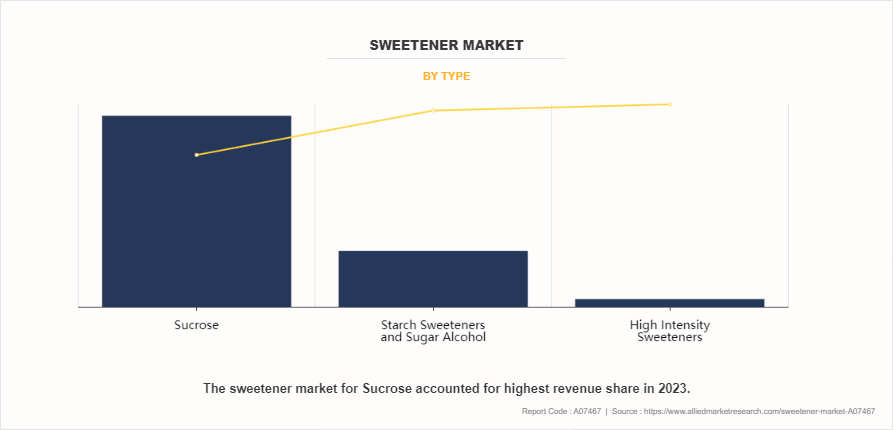

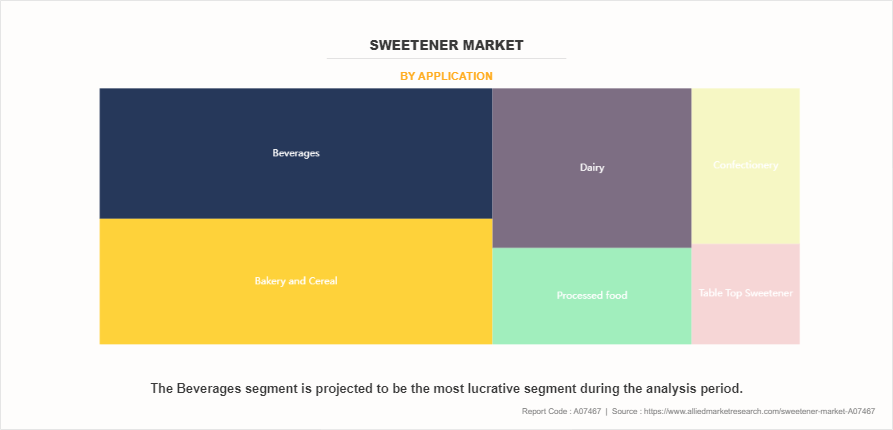

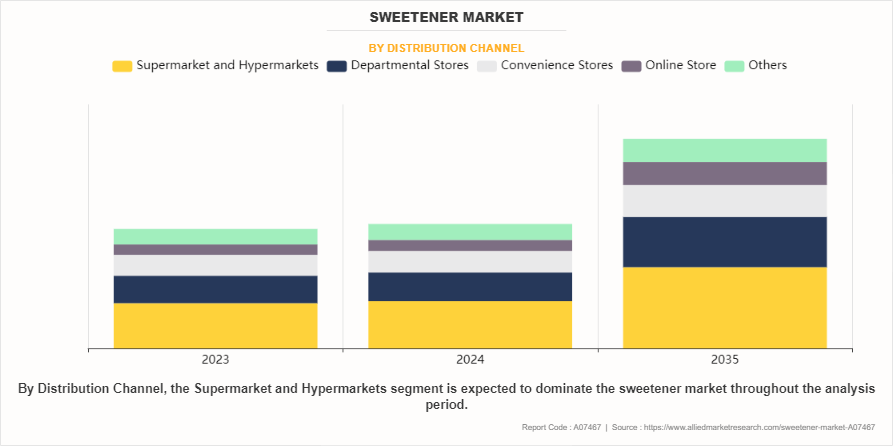

The sweetener market is segmented into type, application, distribution channel, and region. Based on type, the market is segmented into sucrose, starch sweeteners & sugar alcohol, and high-intensity sweeteners. Based on application, it is segmented into bakery & cereal, beverages, dairy, processed food confectionery, and tabletop sweeteners. By distribution channel, it is segmented into supermarkets & hypermarkets, departmental stores, convenience stores, online stores, and others. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, Malaysia, Thailand, Indonesia, and rest of Asia-Pacific), and LA (Brazil, Argentina, rest of LA), MEA (UAE, South Africa, and rest of MEA).

By Type

Based on type, the sucrose segment gained a major share in the global market in 2023 and is expected to sustain its market share during the forecast period as sucrose is the most common form of a sweetener that is used by the global population for consumption and is easily available in the market. There is an increase in the demand for processed food owing to the rise in the global population, which, in turn, increases the usage of sugar to ensure the production process is running smoothly.

By Application

According to sweetener market trends, based on application, the processed food segment gained a major share in the global market in 2023 and is expected to sustain its market share during the forecast period. Changing lifestyles and increasing urbanization have led to a rise in convenience food consumption, where sweeteners are often used as ingredients. Additionally, with the growing health consciousness among consumers, there is a shift towards low-calorie and sugar-free options in processed foods. Moreover, advancements in food technology have enabled the development of innovative products with enhanced taste profiles, further driving the demand for sweeteners in the processed food industry.

By Distribution Channel

According to the sweetener market analysis, based on distribution channels, the supermarkets & hypermarkets segment accounted for the major market market share size in 2023 and is expected to sustain its sweetener market share during the forecast period. Supermarkets & hypermarkets offer a convenient experience of diverse shopping under a single roof to the consumers. Supermarkets & hypermarkets provide consumers with a premium advantage, i.e., higher availability of sweetener products at discounts, the assistance of sales representatives, and easy checkouts. These advantages are expected to drive the growth of supermarkets & hypermarkets during the forecast period.

By Region

Based on region, Asia-Pacific dominated the market in 2023 and is expected to remain dominant during the sweetener market forecast period. The dominance of the market is largely due to the deep product knowledge among the consumers and the increase in the consumption of sugar by the local population. The industry is witnessing an increase in the demand for healthy sweeteners as customers turn toward healthier food options. In this region, sedentary lifestyles and lifestyle changes have increased the adoption of alternative sweeteners. The region has the maximum presence of manufacturers and suppliers. In addition, an increase in purchasing power, high growth rate, and development in new food habits, including the consumption of low calories sodas and diet drink supplements increase the sweetener market demand.

Competitive Analysis

Major players such as Ajinomoto Co, Inc., Archer Daniels Midland Company, Associated British Foods Plc, and Cargill Incorporated have adopted product approval, partnership, agreement, and acquisition as key developmental strategies to improve the product portfolio of the sweetener market.

Recent Developments in the Sweetener Industry

In March 2023, Tate & Lyle (UK) forged a partnership with IMCD (Belgium) in Brazil, enhancing its distribution network for sweeteners, fibers, starches, and stabilizing solutions. This collaboration bolstered Tate & Lyle's (UK) presence in the market, facilitating growth and expanding its market reach.

In August 2022, Flavors & Inc. (US) inaugurated its new Nourish Innovation Lab in New Jersey, US, dedicated to research and development in the food and beverage sector. This initiative aimed to facilitate the introduction of innovative products across various categories.

In March 2021, Cargill (US) and DSM (Netherlands) established a joint venture named Avansya, focusing on the commercial-scale production of EverSweet stevia sugar. This strategic alliance was aimed at meeting the increasing demand for stevia-based sweeteners in the food and beverage industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the sweetener market size, segments, current trends, estimations, and dynamics of the sweetener market analysis from 2023 to 2035 to identify the prevailing sweetener market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sweetener market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sweetener market trends, key players, market segments, application areas, and market growth strategies.

Sweetener Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 445 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Kerry Group, Roquette Freres, DuPont de Nemours, Inc., Ingredion Incorporated, Archer Daniels Midland Company, Associated British Foods Plc, Südzucker Group, Cargill, Incorporated, Tate and Lyle Plc, Ajinomoto Co, Inc., Celanese Corporation |

Analyst Review

According to CXOs, there is a saying that goes "One sweetener's loss is another sweetener's gain." The number of people who are obese or concerned about their weight is increasing rapidly, causing a shift towards healthier eating options. Obesity can lead to diabetes, hypertension, and cardiovascular issues. Consuming sugary products on a long-term basis is not ideal, which is why the popularity of plant-based and artificially synthesized sweeteners is expected to grow in the coming years. Due to busy lifestyles and an increase in the working population, people have less time to prepare cooked meals. As a result, they are turning to processed foods to satisfy their hunger and meet their daily calorie requirements, often containing high amounts of sugar.

Although sugar is harmful to the body, its consumption is increasing due to its low production cost compared to other alternative sweeteners. This results in a lower final product price, which attracts middle-class populations. As a result, sugar consumption in urban areas is decreasing, while it is increasing in rural areas. However, this is mainly due to poor product awareness of high-intensity and low-calorie sweeteners in rural regions, which acts as a barrier to the expansion of the sweeteners market in emerging nations' rural areas. Limited access to supermarkets, hypermarkets, and department shops in rural areas also contributes to this lack of understanding of sugar alternatives. The anticipated development of rural areas and urbanization is expected to boost the sweeteners market in the upcoming years. Furthermore, the availability of alternative sweeteners at an affordable price will help increase sales.

The global sweetener market size was valued at $88.1 billion in 2023, and is projected to reach $154.6 billion by 2035

The global Sweetener market is projected to grow at a compound annual growth rate of 4.9% from 2024 to 2035 $154.6 billion by 2035

Major players such as Ajinomoto Co, Inc., Archer Daniels Midland Company, Associated British Foods Plc, and Cargill Incorporated have adopted product approval, partnership, agreement, and acquisition as key developmental strategies to improve the product portfolio of the sweetener market.

Based on region, Asia-Pacific dominated the sweetener market in 2023 and is expected to remain dominant during the sweetener market forecast period.

Increasing Health Consciousness and Demand for Low-Calorie Alternatives, Rising Prevalence of Lifestyle Diseases Like Obesity and Diabetes., Growing Adoption of Natural Sweeteners.

Loading Table Of Content...

Loading Research Methodology...