Switching Mode Power Supply Market Research, 2032

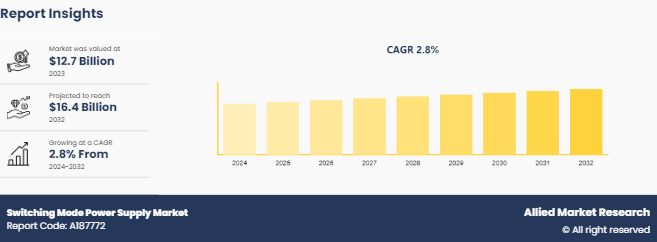

The Global Switching Mode Power Supply Market was valued at $12.7 billion in 2024, and is projected to reach $16.4 billion by 2032, growing at a CAGR of 2.8% from 2024 to 2032.

Market Introduction and Definition

Switched mode power supply (SMPS) is an extremely energy-efficient and compact alternative for powering a wide variety of off-line end products. These devices operate in the universal AC input voltage range of 90 Vac to 264 Vac and produce a variety of nominal DC output voltages to suit a wide range of applications. Renowned providers provide these dependable and adaptable power supplies, which ensure maximum performance and efficiency. Further, the surge in advancements in technology has led to the development of more efficient, compact, and reliable SMPS units, fueling market expansion.

In addition, stringent regulatory standards for energy efficiency and the growing emphasis on reducing carbon footprints propel the demand for SMPS. The market has witnessed significant growth in the Asia-Pacific region, where rapid industrialization and urbanization, coupled with a strong electronics manufacturing base, contribute to the rising demand for switched-mode power supplies.

Key Takeaways

Based on type, the AC-DC converter segment dominated the switching mode power supply market size in terms of revenue in 2023 and is anticipated to grow at a high CAGR during the forecast period.

By technology, the switching mode power supply market forecast is led by the above current mode PWM segment and is expected to grow at a high CAGR during the forecast period.

Based on the application, the consumer electronics segment dominated the switching mode power supply market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

On February 13, 2024: The U.S. Department of Energy (DOE) announced a $50 million investment in research and development of next-generation power electronics, including SMPS technologies. The initiative aims to improve energy efficiency and reduce greenhouse gas emissions in various sectors, including data centers, industrial equipment, and consumer electronics.

On March 20, 2024: The European Commission adopted new eco-design regulations for external power supplies, setting stricter energy efficiency standards for SMPS used in a wide range of electronic devices. The regulations aim to reduce energy consumption and electronic waste, driving manufacturers to develop more efficient and sustainable SMPS solutions.

On May 15, 2024: The Chinese government launched a new program to promote the development and adoption of high-efficiency SMPS for industrial applications. The program includes subsidies for switching mode power supply manufacturers and incentives for businesses to adopt energy-saving power supplies, aiming to reduce energy consumption and carbon emissions in the industrial sector.

On June 25, 2024: The Indian government announced a new initiative to boost domestic manufacturing of electronic components, including SMPS. The initiative aims to reduce the country's dependence on imported power supplies and create new jobs in the electronics manufacturing sector. The government is providing financial incentives and creating a favorable regulatory environment to attract investments in switch mode power supply circuit manufacturing.

Key market dynamics

The rising incidence of chronic diseases and regular sodium level monitoring in patients are driving up demand for sodium ion selective electrodes in healthcare and clinical diagnostics. These instruments are critical for accurate blood analysis, which enables optimal patient care and management. Furthermore, rigorous environmental rules are driving market expansion as governments and regulatory agencies around the world implement strict policies to combat water pollution. As a result of regulatory requirements, sodium ion selective electrodes are increasingly being used for environmental monitoring and water quality analysis.

Technological breakthroughs and product innovations have fueled this expansion even further. For example, constant developments in electrode technology have resulted in more durable, accurate, and user-friendly electrodes that are more accessible and easier for consumers. Furthermore, advancements such as portable and combination electrodes have resulted in their applicability across various fields.

However, a major market restraint is the high initial cost and maintenance of high-quality sodium ion selective electrodes. The substantial investment required may deter some potential users, and the need for skilled personnel for maintenance and calibration adds to the overall cost and complexity, limiting market penetration, especially in cost-sensitive regions and smaller enterprises.

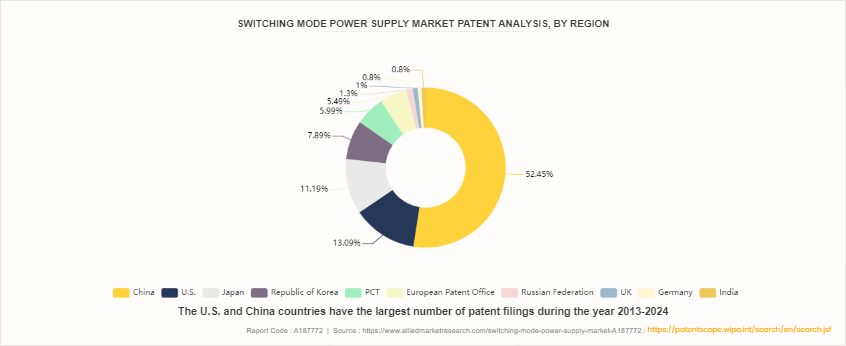

Patent Analysis of Global Switching Mode Power Supply Market

The global switching mode power supply industry is segmented according to the patents filed in China, the U.S., Japan, the Republic of Korea, the European Patent Office, PCT, the European Patent Office, Russian Federation, UK, Germany, and India. The switching mode power supply for U.S market acquired the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these the U.S. regions have a maximum number of patent filings.

Market Segmentation

The switching mode power supply industry report is segmented into type, technology, end user, and region. By type, the switching mode power supply market data is divided into DC to DC converters, AC to DC converters, forward converters, flyback converters, self-oscillating flyback converters, and others. By technology, the switching mode power supply market is segregated into current mode PWM, voltage mode PWM, and others. By end user, the market is classified into consumer electronics, industrial, communication, and others. Region-wise, the switching mode power supply sector analysis includes North America, Europe, Asia-Pacific, and LAMEA.

Market Segment Outlook

By type, the AC-DC converter segment leads the switching mode power supply market insights in 2023. Its wide application in consumer electronics, industrial machines, and communication appliances accounts for that. They are indispensable in powering countless electronic gadgets and systems since they can easily convert power from AC to DC with high flexibility and efficiency. The increased need for efficient power supply options in these fields emphasizes the importance of this sub-division.

Based on technology, the market for SMPS is led by the current mode PWM segment in the year 2023. It is preferred over other technologies due to its improved load management, transient responsiveness, and stability qualities. It is utilized not just in consumer electronics, but also in devices with great precision and reliability, such as industrial equipment. The rising use of efficient power stable systems, which these applications require, is driving the dominance of current mode PWM.

The consumer electronics segment is the largest end-user in the switching mode power supply industry in 2023. The rapid proliferation of electronic devices such as smartphones, laptops, tablets, and home appliances drive significant demand for SMPS units. The continuous innovation and development in consumer electronics, coupled with the need for compact, efficient, and reliable power supplies, underscore the importance of this segment. The ongoing trend of miniaturization and the integration of advanced features in consumer devices further boost the demand for SMPS in this end-user category.

Regional/Country Market Outlook

In terms of region, Asia-Pacific is the largest region in the SMPS market, accounting for the highest revenue share during the year 2023. The region's dominance is attributed to its strong electronics manufacturing base, particularly in countries like China, Japan, South Korea, and Taiwan. These countries host major electronics and switching mode power supply manufacturer, driving substantial demand for SMPS units. The Asia-Pacific segment witnessed a significant surge in investment in electronics and semiconductor markets due to rapid industrialization that occurred in the region. Therefore, the region experienced a positive trend in almost all other economic indices relating to these markets. Moreover, the surge in lucrative infrastructure investments and favorable government initiatives across top developing countries are facilitating the tech-oriented investments made in the Asia-Pacific region. By country, Asia-Pacific switching mode power supply market size by country is doiminted by China and is expected to follow the same trend during the forecast period.

Competitive Landscape

The switching mode power supply market share by companies is analyzed across are Delta Electronics, Lite-On Technology, Chicony Power, Mean Well Enterprises Co., Ltd., TDK Corporation, XP Power, Flextronics International Ltd, Artesyn Embedded Technologies, CUI Inc., and AcBel Polytech Inc. Further, the other players in switching mode power supply company list includes FSP Group., and Salcomp Plc.

Recent Key Strategies and Developments

On January 28, 2024: Delta Electronics launched a new series of high-efficiency, modular SMPS designed for data center applications. The new products boast up to 96% efficiency and a compact design, meeting the growing demand for power density and energy savings in data centers.

On February 22, 2024: TDK Corporation announced a strategic partnership with Qualcomm Technologies to develop next-generation power management solutions for mobile devices. The collaboration aims to leverage TDK's expertise in passive components and Qualcomm's advanced mobile platforms to create highly efficient and compact SMPS solutions for smartphones and other portable devices.

On April 15, 2024: Mean Well Enterprises unveiled a new line of high-voltage SMPS designed for medical and industrial applications. The new products offer enhanced safety features and comply with stringent regulatory standards for use in critical environments like hospitals and factories.

On May 10, 2024: XP Power introduced a new series of ultra-compact, high-density SMPS for industrial automation and robotics applications. The new products are designed to withstand harsh operating conditions and provide reliable power delivery in demanding environments.

On June 5, 2024: Flextronics: Flextronics announced a collaboration with a leading semiconductor company to develop and manufacture custom SMPS solutions for various industries, including automotive, consumer electronics, and industrial automation. The partnership aims to leverage Flextronics' manufacturing expertise and the switching mode power supply company listed technology leadership to provide innovative and cost-effective power solutions.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the switching mode power supply market analysis from 2025 to 2032 to identify the prevailing switching mode power supply market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the switching mode power supply market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global switching mode power supply market trends, key players, market segments, application areas, and market growth strategies.

Switching Mode Power Supply Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.4 Billion |

| Growth Rate | CAGR of 2.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | TDK Corporation, XP Power Limited, LITE-ON Technology Corporation, CUI Inc., Flextronics International Ltd, Artesyn Embedded Technologies, AcBel Polytech Inc., Chicony Power, Delta Electronics, Mean Well Enterprises Co |

Top companies in the SMPS market include Texas Instruments, Infineon Technologies, and Analog Devices, which are renowned for their advanced power management solutions and broad product portfolios. Mean Well Enterprises and ON Semiconductor also hold significant market share with their diverse SMPS offerings.

The switching mode power supply market was valued at $12.7 billion in 2023.

The leading application of the Switching Mode Power Supply (SMPS) market is in consumer electronics, where it powers devices such as smartphones, laptops, and televisions due to its efficiency, compact size, and ability to handle varying power demand

Asia-Pacific is the largest region in Switching Mode Power Supply Market in 2023

The global SMPS market is driven by advancements in efficiency and miniaturization, with a growing focus on integrating renewable energy sources and supporting electric vehicles. Innovations in semiconductor technology and increasing demand from IoT and data centers further propel market growth.

Loading Table Of Content...