T-Cell Therapy Market Research, 2032

The global t-cell therapy market size was valued at $2.8 billion in 2022 and is projected to reach $15.2 billion by 2032, growing at a CAGR of 18.3% from 2023 to 2032. T-cell therapy, also known as adoptive cell transfer therapy, is an innovative and personalized form of immunotherapy that aims to harness the power of a patient's own immune system to target and eliminate cancer cells or other diseases. It involves extracting T cells, a type of white blood cell, from a patient's body and modifying them in a laboratory to enhance their ability to recognize and attack specific cancer cells or disease targets. These modified T cells are then expanded in large quantities and reinfused back into the patient's body. By doing so, T-cell therapy helps to boost the immune response against the targeted disease, offering a potentially effective and precise treatment option.

Market dynamics

The rise in cancer prevalence, rise in geriatric population, and rise in the use of various cell therapy technologies to treat the symptoms of cancer are the main drivers propelling the growth of the T-cell therapy market size. Leukemia, myeloma, lymphoma, and cancer relapse are among the cancers that are becoming more common, which increases the demand for effective therapeutic treatments and propels the market's expansion. For instance, according to National Library of Medicine in China 2022, is estimated the approximately 88,249 new cases of leukemia (50,213 male cases and 38,036 female cases). In addition, increase in number of clinical trials and increase in public and private investments for the development of cell therapy technology in which T cells are collected from a patient are genetically modified ex vivo and re-injected into the patient drive the T-cell therapy market growth.

Moreover, the T-cell therapy market is characterized by continuous evolution and growth, primarily fueled by ongoing research and development efforts. The field of T-cell therapy is dynamic, with scientists and researchers exploring novel approaches, technologies, and therapeutic targets to enhance the effectiveness and broaden the applications of T-cell therapies.

In addition, the presence of multiple drugs in the clinical development phase is also driving the market growth. For instance, CB-010 and CB-011 of Caribou Biosciences, Inc are in clinical phase I trials. Similarly, DESCARTES-17 and DESCARTES-25 of Cartesian Therapeutics, Inc. are in preclinical and Phase I trials respectively. Thus, the focus of key players on developments is further anticipated to potentially drive the growth during T-cell therapy market forecast.

Furthermore, the growing demand for effective therapeutic solutions is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Moreover, an increase in promotional activities by manufacturers and growth in awareness for proper treatment medications for cancer among the general population are expected to fuel their adoption during the forecast period.

However, the market growth of T-cell therapy is hindered by several factors including the high cost associated with T-cell therapy. It poses a barrier to its widespread adoption and limiting patient access. Furthermore, stringent government regulations and lengthy approval processes create delays in introducing T-cell therapies to the market, affecting their availability. In addition, the guidelines that restrict the use of T-cell therapy as a later line of treatment after chemotherapy failure limit its potential impact and delay its application in earlier stages of disease. These factors collectively impede the market growth of T-cell therapy, necessitating efforts to address cost concerns, streamline regulatory processes, and explore its utilization in earlier treatment settings.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world including the T-cell therapy market. The T-cell therapy market is negatively impacted by the pandemic as most countries adopted lockdown. Some companies experienced delays in the manufacture and delivery of T-cell therapies due to supply chain disruptions.

Additionally, many clinical trials of T-cell therapies had been disrupted due to the COVID-19 pandemic, with some trials being delayed or suspended altogether. This has slowed down the development and approval of new T-cell therapies. For instance, according to a Cancer Research Institute and IQVIA survey published in Nature Reviews Drug Discovery, found that patient enrollment in oncology clinical trials during the early stages of the pandemic was significantly impacted in the U.S and Europe, where 60% and 86% of institutions respectively were enrolling new patients at a lower rate. The main obstacles to enrollment in trials were access, concerns over patients’ risk of contracting the virus. Thus, decline in people transit, closing of borders, and confinement of the population impacted the supply chains of these life-saving medical therapies and had a negative impact on the growth of T-cell therapy industry.

However, post pandemic it was observed that the prevailing cases of cancer have highlighted the need for innovation in the healthcare sector, and many companies are increasing their investments in research and development. Furthermore, the increasing approvals by regulatory agencies have further driven the opportunity for the key players. For instance, in November 2022, Caribou Biosciences, Inc., a leading clinical-stage CRISPR genome-editing biopharmaceutical company, received clearance for its Investigational New Drug (IND) application from the U.S. Food and Drug Administration (FDA) for CB-011, a genome-edited allogeneic anti-BCMA CAR-T cell therapy with immune cloaking. Thus, the increasing cases, growing demand for ideal therapeutics, and presence of multiple promising drugs in pipeline are expected to drive the market during the forecast years.

Segmental Overview

The global T-cell therapy market is segmented into therapy type, indication, end user and region. As per therapy type, the market is categorized into CAR T-cell Therapy and T Cell Receptor (TCR)-Based. The CAR T-cell Therapy segment is further categorized by product type into Axicabtagene Ciloleucel, Tisagenlecleucel, Bexucabtagene Autoleucel and Others (Ciltacabtagene autoleucel, Lisocabtagene Maraleucel, Idecabtagene Vicleucel). According to indication, the market is segregated into Lymphoma, Acute Lymphocytic Leukemia, and Others (Multiple Myeloma, Melanoma). According to end user, the market is segregated into Hospitals and Cancer Treatment Centers. Region wise, the market is analyzed across North America (the U.S., Canada), Europe (Germany, France, the UK, and rest of Europe), Asia-Pacific (Japan, China and rest of Asia-Pacific), and LAMEA (Latin America, Middle East & Africa).

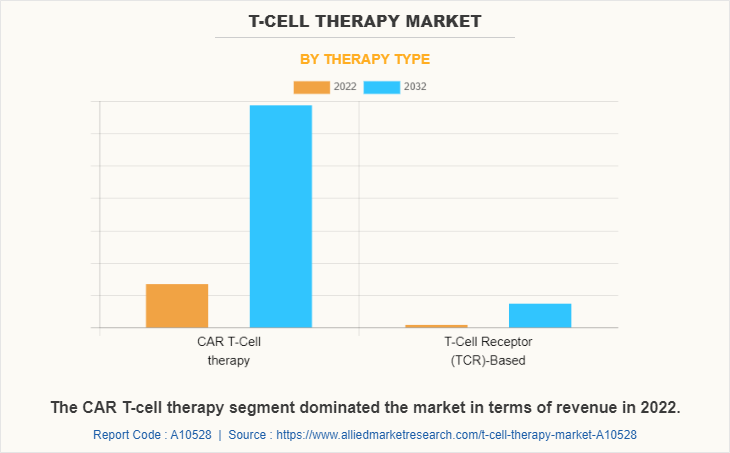

By Therapy Type:

The T-Cell therapy market is categorized into CAR T-cell Therapy, T Cell Receptor (TCR)-Based and Tumor Infiltrating Lymphocytes (TIL)-Based. The CAR T-Cell therapy segment occupied the highest share in 2022 and is expected to remain dominant during the forecast period owing to exponential growth in number of CAR T-cell therapy clinical trial and growth in commitment of major key players in gene therapy. However, the T-Cell Receptor (TCR)- based segment is projected to register the highest CAGR during the forecast period, owing to its positive results in treatment of solid malignancies. Furthermore, the growing focus of key players in expanding its application in treatment of different cancers such as melanoma is driving the growth of T-cell therapy industry.

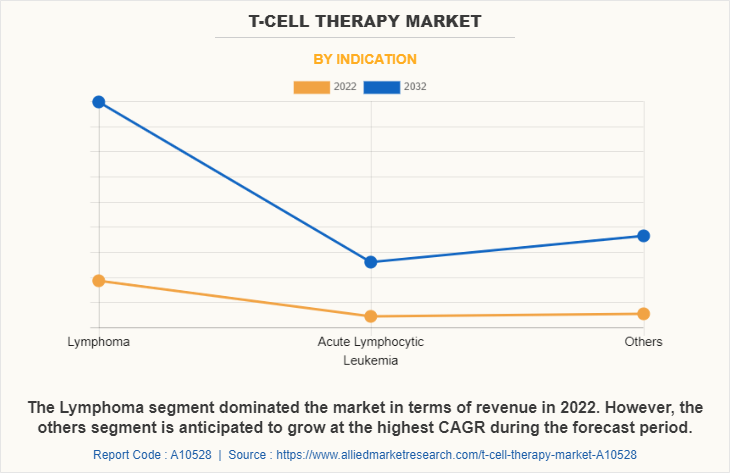

By Indication:

The T-Cell therapy market is categorized into Lymphoma, Acute Lymphocytic Leukemia, and others (Multiple Myeloma, Melanoma). The Lymphoma segment occupied highest T-cell therapy market share in 2022 and is expected to remain dominant during the forecast period, owing to significant success of T-cell therapy in the treatment of blood cancers such as lymphoma. Additionally, the prevailing cases and ongoing research and development in this area are expected to drive the growth. However, the others segment is projected to register the highest CAGR during the forecast period owing to growing interest in developing T-cell therapies for the treatment of such diseases, which are often more difficult to treat with traditional therapies. Additionally, recent advancements in T-cell therapy technology, such as TCR-based, have shown promising results in the treatment of Multiple Myeloma, Melanoma.

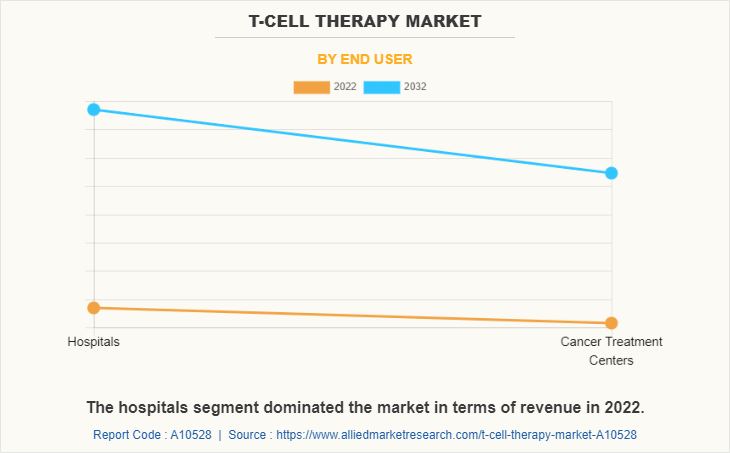

By End User:

The T-Cell therapy market is categorized into hospitals and cancer treatment centers. The hospital segment occupied highest share in 2022 and is expected to remain dominant during the forecast period, owing to presence of well-established infrastructure and advanced medical facilities necessary for conducting T-cell therapy. Additionally, presence of experts in hospitals for performing T- cell therapy are expected to drive the growth. However, the cancer treatment centers segment is projected to register the highest CAGR during the forecast period owing to availability of a wide range of choice of treatment and increase in number of cancer centers in some developing nations.

By Region:

The T-Cell therapy market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest T-cell therapy market share in terms of revenue in 2022. This growth is attributed to a rise in prevalence of cancer cases, growth in investment by private and public agencies and well-established research & commercialization base. In addition, the increase in the geriatric population in North America has led to a higher prevalence of cancer, leading to increased demand for ideal therapeutics. Moreover, the healthcare system has made significant investments in improving healthcare infrastructure and facilities, which has enabled better access to healthcare services and treatments for patients with cancer.

However, Asia-Pacific is expected to witness highest growth during the forecast period, owing to rise in incidence of relapse cancer, increase in healthcare expenditure, growth in awareness about the importance of early detection and treatment of cancer and rise in adoption of gene therapy arena are expected to boost the market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the T-cell therapy market, such as Novartis AG, Autolus Therapeutics, Caribou Biosciences, Inc, Gilead Sciences, Immunocore Ltd., Celyad Oncology, Cartesian Therapeutics, Inc., Johnson & Johnson, Bristol-Myers Squibb Company and Cellectis, Inc. Major players have adopted product approval, agreement, and collaboration as key developmental strategies to improve the product portfolio of the T-cell therapy market.

Recent Approvals in T-Cell therapy market

- In April 2023, Caribou Biosciences, Inc., a leading clinical-stage CRISPR genome-editing biopharmaceutical company, received Fast Track designation grant to CB-011, which is being developed for relapsed or refractory multiple myeloma (r/r MM) from the U.S. Food and Drug Administration (FDA).

- In April 2022, Autolus Therapeutics plc, a clinical-stage biopharmaceutical company, received the Regenerative Medicine Advanced Therapy (RMAT) designation to its lead gene therapy obecabatagene autoleucel (obe-cel) from U.S. Food and Drug Administration (FDA). It is a CD19-directed autologous chimeric antigen receptor (CAR) T therapy that is being investigated in the ongoing FELIX Phase 2 study of adult relapsed/refractory B-Acute Lymphocytic Leukemia.

- In February 2022, Johnson & Johnson, received the U.S. Food and Drug Administration (FDA) approval for CARVYKTI (ciltacabtagene autoleucel; cilta-cel) for the treatment of adults with relapsed or refractory multiple myeloma (RRMM) after four or more prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody.

- In March 2021, Bristol Myers Squibb, received the U.S. Food and Drug Administration (FDA) approval for Abecma (idecabtagene vicleucel; ide-cel) as the first B-cell maturation antigen (BCMA)-directed chimeric antigen receptor (CAR) T cell immunotherapy for the treatment of adult patients with relapsed or refractory multiple myeloma after four or more prior lines of therapy.

Recent Agreement in T-Cell therapy market

- In January 2021, Celyad Oncology, a clinical-stage biotechnology company focused on the discovery and development of chimeric antigen receptor T cell (CAR T) therapies for cancer, has entered into a committed equity purchase agreement for up to $40 million with Lincoln Park Capital Fund, LLC (“LPC”), a Chicago-based institutional investor.

Recent Collaboration in T-Cell therapy market

- In June 2022, Immunocore Ltd., a commercial-stage biotechnology company, entered into a clinical trial collaboration and supply agreement with Sanofi. In this collaboration Sanofi will evaluate its precisely PEGylated, engineered version of IL-2, SAR444245, in combination with KIMMTRAK.

- In February 2021, AbbVie and Caribou Biosciences, Inc., a leading clinical-stage CRISPR genome editing biotechnology company, entered into a collaboration and license agreement for the research and development of chimeric antigen receptor (CAR)-T cell therapeutics.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the t-cell therapy market analysis from 2022 to 2032 to identify the prevailing t-cell therapy market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the t-cell therapy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global t-cell therapy market trends, key players, market segments, application areas, and market growth strategies.

T-Cell therapy Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.2 billion |

| Growth Rate | CAGR of 18.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 274 |

| By Therapy Type |

|

| By Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | Autolus Therapeutics, Cartesian Therapeutics, Inc., Gilead Sciences, Inc., Bristol-Myers Squibb Company, Novartis AG, Caribou Biosciences, Inc, Celyad Oncology, Immunocore Ltd., Cellectis, Inc., Johnson & Johnson |

Analyst Review

The increase in demand for novel therapeutics and rise in investments globally is expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives and a rise in awareness about available medications has piqued the interest of several companies to develop novel therapeutics.

Rapidly expanding clinical trial activities, recent commercialization of T-cell therapy products, and increasing focus of key players in adopting strategies to increase accessibility and utilization of cell therapy products are expected to fuel the market growth during the forecast period. Further, geriatric people are at high risk of cancer due to weekend immunity. Thus, a rise in the number of geriatric population results in rise in demand for effective novel medications, thereby driving the growth of the market.

Furthermore, North America accounted for largest share in terms of revenue in 2022. This growth is attributed to a rise in prevalence of cancer cases and well-established research & commercialization base. However, Asia-Pacific is expected to witness highest growth during the forecast period, owing to rise in geriatric population, unmet medical demands, initiatives by government & non-governmental organizations (NGOs) to promote awareness regarding gene therapy, and increase in public–private investments in the healthcare sector.

T-cell therapy, also known as T-cell immunotherapy, is a type of cancer treatment that uses the body's own immune system to target and attack cancer cells. The therapy involves extracting T-cells (a type of white blood cell) from the patient's blood, genetically modifying them in a laboratory to target and destroy cancer cells by recognizing and binding to specific proteins on their surface.?

The major factor that fuels the growth of the T-Cell therapy market are Rise in prevalence of cancer , Increase in demand of ideal therapeutics for treatment andRise in awareness regarding T-cell therapy.

The CAR T-cell therapy segment is the most influencing segment in T-Cell therapy market owing to exponential growth in number of CAR T-cell therapy clinical trial and growth in commitment of major key players in gene therapy.

Top companies such as Autolus Therapeutics, Bristol-Myers Squibb Company, Caribou Biosciences, Inc and Celyad Oncology held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The market value of T-Cell therapy market in 2032 is $15,182.30 million

The base year is 2022 in T-Cell therapy market.

The total market value of T-Cell therapy market is $2,823.07 million in 2022.

The forecast period for T-Cell therapy market is 2022 to 2032

Loading Table Of Content...

Loading Research Methodology...