Takaful Insurance Market Research, 2032

The global takaful insurance market was valued at $31.7 billion in 2022, and is projected to reach $126.8 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

Takaful is a type of Islamic insurance wherein members contribute money into a pool system to guarantee each other against loss or damage. Takaful insurance is based on sharia or Islamic religious law, which explains responsibilities of individuals to cooperate and protect one another. Generally, takaful policies cover health, life, and general insurance needs. While having risk-sharing model concept, takaful insurance remains largely confined to the Muslim countries. In addition, takaful insurance is considered as the main form of insurance in Muslim majority countries. Hence it is considered as an important factor boosting the takaful insurance industry.

Moreover, in takaful insurance, the investment profits are distributed among the participants and premium amount collected from the members is returned back, in case there are no claims. Thus, these are some of the major factors that propel the takaful insurance market growth. Furthermore, takaful adheres to Shariah rules, which restrict certain financial practices like interest (riba) and uncertainty (gharar), by operating on the tenets of reciprocal assistance, shared accountability, and ethical investment. With the intention of providing insurance while upholding Islamic ethical and financial standards, policyholders partake in the gains and losses of the Takaful fund.

Growth in demand for takaful insurance across Muslim-majority has significant driver for the expansion of the takaful insurance. A growing middle class and strong economic growth have been seen in several nations with a majority of Muslims. As people's financial circumstances improve, they are more interested in using insurance to protect their possessions and well-being, and Takaful offers a Sharia-compliant choice. Furthermore, distribution of investment profit among both participants are driving the takaful insurance market.

However, lack of standardization in takaful insurance due to regional difference are hampering the takaful insurance market. Takaful operations and products may differ from one country or region to the other due to differences in regulatory structures, Shariah boards, and practices. This lack of uniformity makes it difficult for takaful operators to operate internationally and hinders the growth of a united global Takaful market.

Moreover, lower consumer awareness are major factors that hampers the growth of takaful insurance market. On the contrary, the untapped market potential for takaful insurance presents a significant opportunity for the takaful insurance market. While Takaful has seen significant growth in nations with a predominance of Muslims, there are still sizable populations worldwide, including Muslims residing in non-Muslim countries, who are either underfunded or not covered by Takaful products. This unexplored market encompasses areas with substantial Muslim populations, including Southeast Asia, Africa, and portions of Europe and North America, where awareness of and demand for Sharia-compliant financial products is growing. Thus, it is expected to provide major lucrative opportunities for the growth of takaful insurance market forecast.

The report analyses the profiles of key players operating in the takaful insurance market such as Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, and Zurich Malaysia. These players have adopted various strategies to increase their market penetration and strengthen their position in the takaful insurance market outlook.

Segment Review

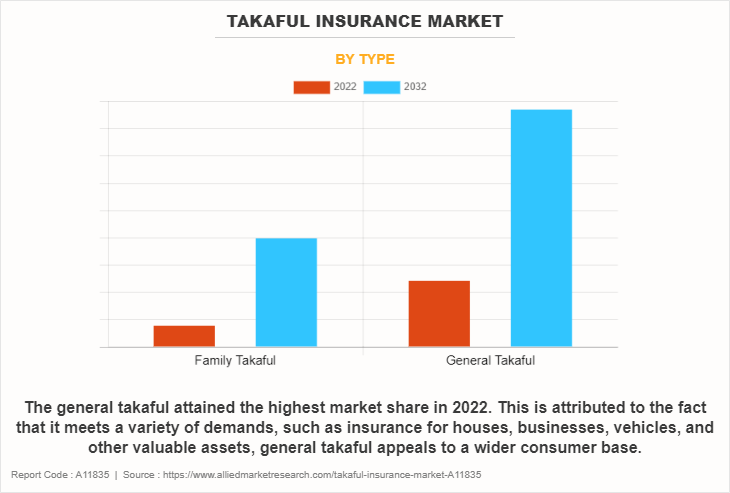

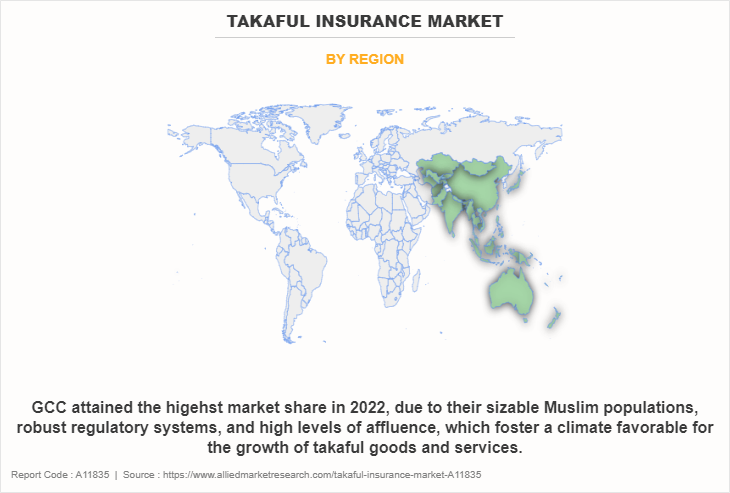

The takaful insurance market is segmented on the basis of type, distribution, application and region. Based on type it is segmented into family takaful, and genral takaful. By distribution, the market is segmented into agents and brokers, banks, direct response, and others. On the basis of application it is segmented into personal, and commercial. By region, it is analysed across GCC, MEA, Asia, and Rest of World.

On the basis of type, the general takaful segment attained the highest market share in 2022 in the takaful insurance. This can be attributed to fact that general takaful offers extensive non-life insurance coverage, including liability, property, auto, and travel insurance. These are crucial insurance categories that are frequently required in many nations, assuring a steady and significant demand for general Takaful products. Meanwhile, the family takaful segment is projected to be the fastest-growing segment during the forecast period. This is due to the family takaful products, which aim to give consumers financial security and chances for savings, strongly align with the beliefs and priorities of people and households in Muslim-majority and other markets. These products encourage long-term saving and wealth growth while providing families with financial security in the event of unanticipated events like illness, incapacity, or death. As a result, these products provide peace of mind.

On the basis of region, Gulf Corporation Council attained the highest market share in 2022 and emerged as the leading region in the takaful insurance market. This is attributed to the fact that The GCC region is a hub for Islamic finance, with a strong emphasis on Sharia-compliant financial products and services. Takaful insurance adheres to Islamic principles, making it a natural fit for this market. On the other hand, the Asia region is projected to be the fastest-growing region for the takaful insurance market during the forecast period. This growth is attributed to the fact that Asia region is home to a substantial Muslim population, including countries like Indonesia, Malaysia, Bangladesh, Pakistan, and several others. This large Muslim demographic creates significant demand for Sharia-compliant financial products, including Takaful insurance.

The report analyses the profiles of key players operating in the takaful insurance market such as Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, and Zurich Malaysia. These players have adopted various strategies to increase their market penetration and strengthen their position in the takaful insurance market share.

Market Landscape and Trends

The Takaful market has experienced substantial growth, with increasing demand from Muslim-majority countries as well as non-Muslim-majority regions. This expansion is driven by the ethical and Shariah-compliant nature of Takaful insurance, which resonates with a diverse range of consumers. Furthermore providers of takaful have expanded their product lines to appeal to a wider market. This covers, among others, investment-linked Takaful, general Takaful, family Takaful, and health Takaful. A wider client base has been drawn in thanks to this diversification. Moreover, operators of takaful are reaching out to markets outside of their home countries. They are reaching out to the Muslim community around the world as well as non-Muslims who are looking for inclusive and moral insurance choices. Collaborations and mergers with foreign insurance companies are also on the rise. In addition, the landscape of Takaful is changing because of digital technology. Accessibility and customer interaction are increasing because of online distribution channels, smartphone apps, and digital underwriting procedures. Takaful providers are able to streamline operations and improve customer experiences because of insures advances.

Top Impacting Factors

Growth in Demand of Takaful Insurance Across Muslim Majority Countries

Due to factors such as uncertainty of business losses, medical conditions, hospitalization and others, usury, and gambling, are often included into the practices of conventional insurance and are usually considered to be unethical by the Islamic law. Hence, conventional insurance is sometimes rejected by the Islamic Sharia law, since these practices are against the teachings of Islam. Moreover, in order to benefit from insurance and stay away from such practices, takaful insurance has been recommended by experts in Islamic finance. Furthermore, a growing middle class and strong economic growth have been seen in several nations with a majority of Muslims. As people's financial circumstances improve, they are more interested in using insurance to protect their possessions and well-being, and Takaful offers a Shariah-compliant choice. In addition, governments in nations with a majority of Muslims have recognized the value of the takaful market and set up legislative structures to support its expansion. The integrity of Takaful activities is protected by these laws, which also increase consumer confidence. Therefore, regulatory support, and economic growth are growing the demand of takaful insurance across Muslim majority countries.

Distribution of Investment Profits Among both Participants

In takaful insurance, usually there is a surplus amount left after all the claims are resolved and those amounts are shared among the participants. Since the premium is considered as a donation by the participants, a small portion of surplus amount is given to the organizer of the takaful for managing the process of insurance. While the rest of the amount is distributed equally among the participants. Furthermore, takaful insurance that distinguishes it from conventional insurance is the distribution of investment profits among both participants (policyholders) and the Takaful operator (insurance company). Moreover, the Takaful operator serves as the fund manager in this arrangement, with participants (policyholders) serving as investors. According to a pre-determined profit-sharing ratio, the operator and participants split any gains made by investing in the participants' contributions. Typically, a portion of the investment gains go to the participants, while the remaining half is used to pay the operator a management fee. In addition, participants designate the Takaful operator as their agent to handle the insurance transactions and manage their funds. Any profits made from the investments are distributed to the participants after the operator has deducted its fee (the Wakala fee) from the investment. There is no profit-sharing agreement with the operator under the Wakala model, in contrast to the Mudarabah concept. Therefore, distribution of investment profit among both participants are driving the growth of takaful insurance.

Lack of Standardization in Takaful Insurance due to Regional Difference

There is a significant regional difference in consumer’s attitudes and tolerance toward takaful insurance, which makes it difficult to standardize the process of takaful. For example, Malaysia is perceived to be more liberal and willing to adopt modern conventional concepts within the takaful framework. In contrast, the approach in the Middle East countries is more conservative, with less willingness to embrace modern conventions.

Furthermore, customers and potential participants may be confused by regional variations in Takaful practices and frameworks. Due to their difficulty in comprehending the differences in products and operations, this complexity may discourage people and companies from implementing Takaful insurance. In addition, lack of uniformity may prevent Takaful operators from extending their businesses internationally. It can be resource-intensive to adjust to various operational and legal frameworks in each location, which may deter market participants from pursuing global expansion prospects.

Furthermore, Standardization frequently enables economies of scale, which may result in cost savings. Takaful operators may not be able to achieve these economies due to inconsistent practices, which could lead to greater operating costs that are then passed on to policyholders in the form of increased premiums. Therefore, the lack of standardization in Takaful insurance practices, often attributed to regional differences and varying interpretations of Islamic principles, can indeed hamper the growth of the Takaful insurance .

Lack of Consumer Awareness

There is a significant regional difference in consumer’s attitudes and tolerance toward takaful insurance, which makes it difficult to standardize the process of takaful. For example, Malaysia is perceived to be more liberal and willing to adopt modern conventional concepts within the takaful framework. In contrast, the approach in the Middle East countries is more conservative, with less willingness to embrace modern conventions.

Furthermore, customers and potential participants may be confused by regional variations in Takaful practices and frameworks. Due to their difficulty in comprehending the differences in products and operations, this complexity may discourage people and companies from implementing Takaful insurance. In addition, lack of uniformity may prevent Takaful operators from extending their businesses internationally. It can be resource-intensive to adjust to various operational and legal frameworks in each location, which may deter market participants from pursuing global expansion prospects. Furthermore, Standardization frequently enables economies of scale, which may result in cost savings. Takaful operators may not be able to achieve these economies due to inconsistent practices, which could lead to greater operating costs that are then passed on to policyholders in the form of increased premiums. Therefore, the lack of standardization in Takaful insurance practices, often attributed to regional differences and varying interpretations of Islamic principles, can indeed hamper the growth of the Takaful insurance market size.

Untapped Market Potential for Takaful Insurnace

The takaful market is currently concentrated in Malaysia & the Middle East and has been experiencing significant growth rate in the upcoming years. There are currently more than 130 takaful companies in operation worldwide, of which nearly 50% of penetration are found in the GCC countries of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. There is an increased adoption & penetration of takaful insurance in these countries in comparison to conventional insurance market in the region. Furthermore, the world’s 1.5 billion Muslims represent a potential customer base for the takaful insurance. In fact, according to Standard & Poor’s, Islamic finance outlook, 60% of the global Muslim population is under 25 years of age. This youthful population are therefore becoming huge target segment, since it has the potential to be a customer base to be retained for 40 years or more. Thus, these factors offer lucurative opportunity for takaful insurance in the upcoming years.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the takaful insurance market analysis from 2022 to 2032 to identify the prevailing takaful insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the takaful insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global takaful insurance market trends, key players, market segments, application areas, and market growth strategies.

Takaful Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 126.8 billion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 364 |

| By Application |

|

| By Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | ISLAMIC INSURANCE, Syarikat Takaful Brunei Darussalam, Zurich Malaysia, Abu Dhabi National Takaful Co., AMAN INSURANCE, SALAMA Islamic Arab Insurance Company, Qatar Islamic Insurance, Allianz, Takaful International, Prudential BSN Takaful Berhad |

Analyst Review

Analyst Review: Global Takaful Insurance Market

The Takaful operators are increasingly offering customizable policies that allow policyholders to tailor coverage to their specific needs and preferences. This trend caters to a diverse range of customers. Moreover, takaful insurance provides educators with a wealth of data on student behavior and performance, which can be used to inform decision-making at the individual and institutional levels. Increase in availability of advanced technologies, such as sensors, machine learning algorithms, and artificial intelligence, has made it easier and more cost-effective to implement takaful insurance in the education sector. Furthermore, growing consumer awareness of the benefits of takaful insurance and availability of smart devices led to increase in adoption of takaful insurance solutions. In addition, deployment of high-speed, low-latency connectivity technologies such as 5G and Wi-Fi 6 enables seamless communication between devices and enhances the capabilities of takaful insurance systems. Therefore, these factors are expected to provide lucrative opportunities for the takaful insurance market growth.

Furthermore, market players have adopted strategies such as collaboration for enhancing their services in the market and improving customer satisfaction. For instance, in October 2022, Bahrain Development Bank (BDB) has signed an agreement to provide health and life insurance services to its employees in partnership with Medgulf Takaful and Protection Insurance Services. This partnership comes in line with BDB’s mission in ensuring to provide a healthy environment and the best insurance benefits to its employees. Such strategies are anticipated to boost the growth of the takaful insurance market.

Some of the key players profiled in the report include Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, and Zurich Malaysia. These players have adopted various strategies to increase their market penetration and strengthen their position in the takaful Insurance market.

The Takaful market has experienced substantial growth, with increasing demand from Muslim-majority countries as well as non-Muslim-majority regions. This expansion is driven by the ethical and Shariah-compliant nature of Takaful insurance, which resonates with a diverse range of consumers.

Generally, takaful policies cover health, life, and general insurance needs. While having risk-sharing model concept, takaful insurance remains largely confined to the Muslim countries.

GCC is the largest regional market for Takaful Insurance

The global takaful insurance market was valued at $31,649.72 million in 2022, and is projected to reach $126797.17 million by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, and Zurich Malaysia.

Loading Table Of Content...

Loading Research Methodology...