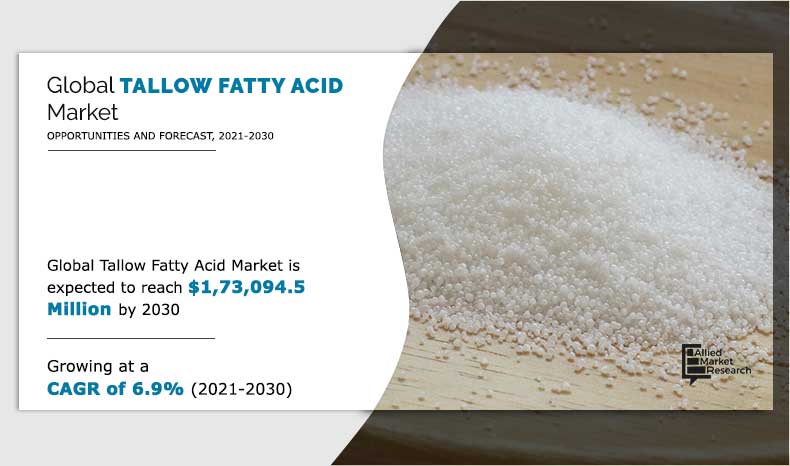

The global tallow fatty acid market was valued at $79,828 million in 2020, and is estimated to reach $173,094.5 million by 2030, registering a CAGR of 6.9% from 2021 to 2030.

Tallow fatty acid is used in oil field consumption, resins, industrial cleaners, personal care, and rubber & textile industries. Furthermore, it is usually an animal derivative rendered form of beef or mutton fat, and is primarily made up of triglycerides. Furthermore, it is used mainly in producing soap and animal feed. In addition, it can be used for the production of bio-diesel in much the same way as oils from plants are currently used.

Raw material used in the production for tallow fatty acid is tallow. Moreover, manufacturers have recognized the significance of this raw material and are attempting to implement a variety of strategies for increased production and cultivation to make their business profitable. Thus, rapid expansion of raw material cultivation and production represents a profitable tallow fatty acid market opportunity. In addition, developing fatty acid applications as trans-fat substitutes is also creating various opportunities for manufacturers.

Increasing use of fatty acids in the pharmaceutical industry is expected to provide lucrative market opportunities in the near future. Magnesium and calcium stearates are commonly used as lubricants in the formulation of tablets and dietary supplements in the pharmaceutical industry. The growing geriatric population is increasing the demand for healthcare services, such as drugs and medicines, which is driving the pharmaceutical industry growth and boosting the tallow fatty acid market growth. Increased lubricant production combined with rapid growth in various manufacturing industries is expected to create enormous market growth opportunities. Furthermore, rising demand for lubricants in the automotive industry for effective and smooth component procedure is expected to drive the growth. Moreover, rising investment in the chemical industry by key manufacturers is expected to drive the growth.

By Type

Saturated Fatty Acid segment is expected to grow at highest CAGR of 7.9% during the forecast period

Tallow fatty acids provide calories and fats while also assisting in the absorption of fat-soluble vitamins such as A, D, E, and K. In terms of health, the type of fatty acid consumed is just as important as the total amount of nutrients consumed. That is why it is critical to select unsaturated fatty acids with lower cholesterol levels. Saturated and trans-fats, for example, may raise unhealthy low-density lipoprotein cholesterol while decreasing healthy high-density lipoprotein cholesterol. This imbalance raises the risk of hypertension, atherosclerosis, heart attack, and stroke. All of these factors contribute to health problems caused by excessive fatty acid consumption.

Tallow is used in the production of fatty acids as a raw material. A sufficient amount of food is needed for tallow. Tallow necessitates some caution. Manufacturers have recognized the significance of this raw material and are attempting to implement a variety of strategies for increased production and cultivation. As the tallow fatty acids industry is very profitable, raw material formulation has increased.

By Form

Liquid segment is expected to grow at highest CAGR of 7.0% during the forecast period.

COVID-19 impact on tallow fatty acid

The overall impact of COVID-19 was negative on the tallow fatty acid market due to lockdown rules & regulations imposed globally. Apart from a few fast-moving consumer good (FMCG) products, such as soaps, personal care products, and detergent industries, the tallow fatty acid market demand declined in all other industries, such as oil field consumption, textile, and rubber, as manufacturing facilities were completely or partially shut down across the globe. Moreover, the outbreak of COVID-19 pandemic led to partial or complete shutdown of production facilities, which do not come under essential goods, owing to prolonged lockdown in major countries such as the U.S., China, Japan, India, and Germany. It led to either closure or suspension of their production activities in most of the industrial units across the world.

The tallow fatty acid market is segmented on the basis of type, form, end user, and region. Based on type, the tallow fatty acid market is divided into monounsaturated fatty acid, polyunsaturated fatty acid, and saturated fatty acid. As per form, it is bifurcated into liquid and solid.

By End User

Animal Feed segment is expected to grow at highest CAGR of 9.0% during the forecast period.

According to end user, the tallow fatty acid market is fragmented into animal feed, cosmetics and personal care industry, food & beverages industry, biodiesel, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, Belgium, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, New Zealand, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and the rest of LAMEA). In this way tallow fatty acid market analysis is and tallow fatty acid market forecast is done.

The major players operating in the global tallow fatty acid market are Ajinomoto Co., Inc., Australian Tallow Producers, Baker Commodities Inc., Cargill, Darling industries, Darling Ingredients, Inc., Jacob Stern & Sons Tallow, SARIA SE & Co. KG, Parchem, Cailà & Parés, and Vantage Specialty Chemicals Inc.

By Regions

Asia-Pacific dominates the market and is expected to grow at highest CAGR of 8.7% during the forecast period.

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current market, estimations, trends, and dynamics of the global tallow fatty acid market size from 2020 to 2030 to identify the prevailing market opportunities.

- The key countries in all the major regions are mapped based on the tallow fatty acid market share and tallow fatty acid market trends.

- Porter’s five forces analysis highlights the potency of the buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis of the market segment and size assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global tallow fatty acid industry.

- Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of market players.

Key Market Segments

By Type

- Monounsaturated Fatty Acid

- Polyunsaturated Fatty Acid

- Saturated Fatty Acid

By Form

- Liquid

- Solid

By End User

- Animal Feed

- Cosmetics and Personal Care Industry

- Food & Beverages Industry

- Biodiesel

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- Belgium

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- New Zealand

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

Tallow Fatty Acid Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Form |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ajinomoto Co. Inc, Cailà & Parés, .Darling Ingredients, Inc, Vantage Specialty Chemicals Inc, Jacob Stern & Sons Inc, Saria SE & Co. KG, Australian Tallow Producers, Parchem, Baker Commodities Inc., CARGILL, INCORPORATED |

Analyst Review

According to the insights of CXOs of leading companies, the tallow fatty acid market has witnessed consistent growth as well as innovations in the past few years. Various health benefits as well as demand from the soap & detergent market and food industries supplement the growth of the market. Currently, Europe has is the largest market and huge demand for tallow fatty acid has been witnessed.

The tallow fatty acids industry is very profitable, so raw material formulation has increased. As a result, rapid expansion of raw material cultivation and production represents a profitable opportunity for the tallow fatty acid market.

The demand from countries, particularly India, China, Malaysia, and Indonesia, drives the market. The demand for tallow fatty acid is being driven by respective food sectors of these countries, which are being supported by rising living standards and population growth. The growing emphasis on biofuels, such as biodiesel made from fatty acid, is driving the demand for tallow fatty acid.

Some health concerns are limiting the growth of the tallow fatty acid market. Consuming too much of these fatty acids creates hypertensions, atherosclerosis, heart attack, and stroke.

The key players in the tallow fatty acid market have been expanding into new markets through acquisitions, new product development, agreements, and certifications. New requirements to label trans-fatty acid levels in foods are putting pressure on manufacturers to use alternative methods for producing hydrogenated oils, thereby increasing the demand for oils with high trans-fat levels.

The global tallow fatty acid market was valued at $79,828 million in 2020, and is estimated to reach $173,094.5 million by 2030

The global Tallow Fatty Acid market is projected to grow at a compound annual growth rate of 6.9% from 2021 to 2030 $173,094.5 million by 2030

The major players operating in the global tallow fatty acid market are Ajinomoto Co., Inc., Australian Tallow Producers, Baker Commodities Inc., Cargill, Darling industries, Darling Ingredients, Inc., Jacob Stern & Sons Tallow, SARIA SE & Co. KG, Parchem, Cailà & Parés, and Vantage Specialty Chemicals Inc.

Asia-Pacific dominates the market

Increase in demand from downstream industries including personal care and detergent industries and rise in demand for tallow fatty acids in the food and beverage industry boost the growth of the global tallow fatty market

Loading Table Of Content...