Temperature Controlled System Market Research, 2032

The global temperature controlled system market size was valued at $1.8 billion in 2022, and is projected to reach $2.5 billion by 2032, growing at a CAGR of 3.9% from 2023 to 2032. A temperature-controlled system (TCS) is an integrated collection of technologies and equipment that monitor, manage, and maintain precise temperature conditions in a controlled environment. Temperature-sensitive processes, goods, or equipment are managed by these systems in a variety of sectors. The major purpose is to keep temperatures within set limits to optimize performance, prevent damage, and fulfil quality requirements. Temperature-controlled systems accomplish accurate temperature management by combining sensors, actuators, and control algorithms, resulting in a stable and regulated environment for a wide range of applications. Temperature controlled systems consist of several key components that work in harmony to achieve accurate temperature regulation. These components include sensors, actuators, controllers, and others.

Temperature-controlled systems improve operational efficiency by simplifying operations and decreasing wastage. In industries like logistics and transportation, where perishable items are transported over long distances, these systems play an important role in minimizing spoiling and keeping product freshness. This not only optimizes the supply chain but also lowers operating expenses connected with decaying or damaged items. The preservation of product integrity is one of the most important advantages of temperature-controlled systems. Precision temperature control ensures that items reach customers in ideal condition, whether it is maintaining the efficacy of medications or increasing the shelf life of perishable commodities. This, in turn, eliminates wastage and improves the supply chain's overall sustainability. Modern temperature-controlled systems include comprehensive tracking and monitoring capabilities, allowing for improved traceability across the supply chain. This not only helps organizations comply with legal standards, but it also allows them to identify and correct any deviations from ideal temperature conditions. In many businesses, the ability to show compliance and traceability is becoming a competitive advantage. Temperature-controlled systems enable firms to uncover inefficiencies and optimize operations by providing real-time information across the whole supply chain. This greater visibility allows for more proactive decision-making, which reduces the risk of disruptions and ensures a smoother operation.

Apart from the initial expenses, the operational expenses of temperature-controlled systems can be significant. Maintaining precise temperature settings necessitates constant energy input, which adds to costly utility expenses. The energy-intensive nature of these systems raises environmental issues while also increasing corporate operating costs. Finding solutions to improve energy efficiency and save operational expenses in temperature-controlled workplaces is an endless problem. Temperature-controlled systems require routine maintenance to guarantee proper functioning and accuracy. Inspecting and calibrating sensors, cleaning HVAC (heating, ventilation, and air conditioning) systems, and troubleshooting any failures are all part of the job. Maintenance jobs sometimes need specialized expertise and competent staff, raising total operational expenses. Furthermore, planned maintenance may cause downtime in industrial operations, reducing overall productivity and even triggering supply chain disruptions. The efficacy of temperature-controlled systems is constantly compromised by human error. Incorrect temperature settings, incorrect handling of sensitive equipment, and insufficient worker training can all contribute to deviations from ideal temperature conditions. For companies where temperature control is crucial, establishing comprehensive training programs and integrating automated measures to limit the impact of human mistake is a continuous problem.

The Internet of Things (IoT), artificial intelligence, and data analytics have facilitated the development of smart and connected temperature control systems. These systems use real-time data to improve temperature management, predictive maintenance, and overall operational efficiency. Smart sensors and tracking devices provide unique visibility and control over temperature activities, opening up opportunities for automation and remote management. As companies increasingly recognize the benefits of data-driven insights in optimizing their operations, this digital revolution is a major driver of future growth in the TCS sector. In the future, the expansion of temperature controlled system market is closely related to continued technology breakthroughs and its smooth integration into many sectors. TCS demand will be sustained due to the development of more accurate and adaptive temperature control systems, as well as the continuous expansion of the pharmaceutical, healthcare, and logistics industries. Furthermore, the confluence of TCS with other new technologies, like blockchain for supply chain transparency and 5G for improved connectivity, is set to further transform the world.

The key players profiled in this report include Carrier Global Corporation, Daikin Industries, Ltd., Johnson Controls, International plc, Siemens AG, Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Schneider Electric SE, Ingersoll Rand, and LG Electronics Inc. Partnerships, collaborations, and technological innovation are common strategies followed by major market players. For instance, on August 23, 2023, LG Electronics Singapore introduced the innovative Multi V I Variable Refrigerant Flow (VRF) technology. The LG Multi V I is a cutting-edge integrated system that blends innovation, sustainability, and unrivalled performance to meet the expanding market need for sophisticated heating, ventilation, and air conditioning (HVAC) systems.

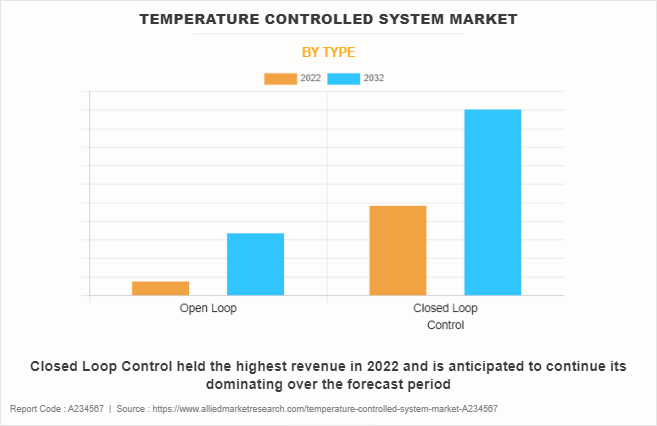

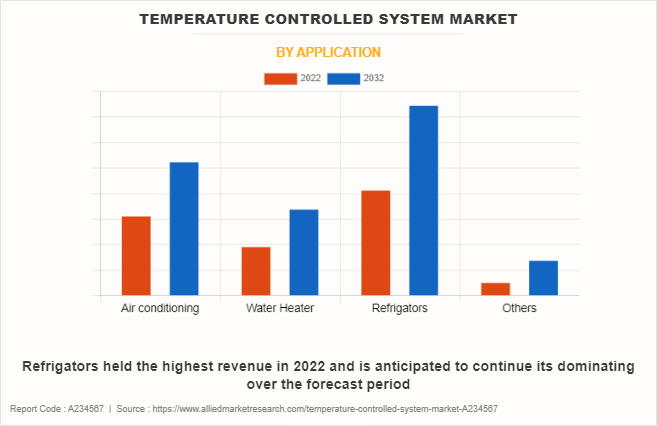

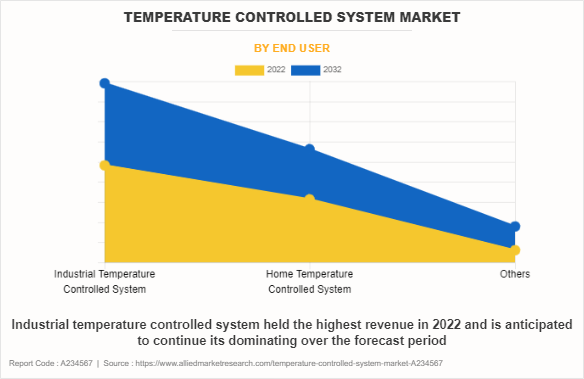

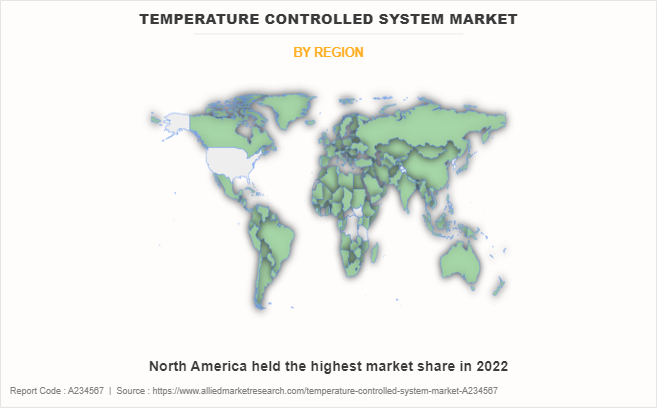

The temperature controlled system market report is segmented on the basis of type, application, end user and region. By type, the market is divided into open loop control and closed loop control. By application, the market is classified into air conditioning, water heater, refrigerators, and others. By end user, the market is classified into industrial temperature controlled system, home temperature controlled system, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The temperature controlled system market is segmented into Type, Application and End User.

By type, the closed loop control sub-segment dominated the global temperature controlled system market share in 2022. Sensor technology advancements are critical in accelerating the implementation of closed-loop control systems. High-precision sensors produce precise real-time data, allowing the controller to make immediate adjustments to maintain the appropriate temperature. The integration of smart sensors and IoT (Internet of Things) technology improves closed-loop system capabilities by allowing for remote monitoring and control. This connection not only enhances operating efficiency but also allows for predictive maintenance, which reduces downtime and increases overall system dependability. Another driving element is the incorporation of artificial intelligence (AI) and machine learning algorithms into closed-loop control systems. These innovative technologies allow the system to learn from past data, forecast temperature patterns, and optimize control parameters to increase efficiency. AI-powered closed-loop systems excel at adapting to changing surroundings and proactively addressing possible issues, lowering the risk of temperature excursions and product losses.

By application, the refrigerators sub-segment dominated the global temperature controlled system market revenue in 2022. The globalization of food supply chains has prompted stringent temperature control techniques to ensure the quality and safety of food items throughout transportation and storage. Refrigerators play an important function in keeping the cold chain intact from farm to fork. This tendency is especially obvious in the cold storage and logistics industries, where demand for temperature-controlled spaces has increased due to the requirement to avoid food spoiling and assure food safety across borders. Consumers are becoming more health concerned, resulting in an increase in demand for freezers that priorities food safety and preservation. Temperature-controlled compartments, humidity control features, and air filtration systems are becoming commonplace in contemporary refrigerators. These improvements not only increase the shelf life of perishable foods, but they also help to preserve the nutritional content of stored food, which is consistent with the growing emphasis on health & wellbeing.

By type, the industrial temperature-controlled system sub-segment dominated the global temperature-controlled system market share in 2022. Temperature regulation is frequently used in industrial operations. Maintaining appropriate temperatures promotes effective and streamlined operations from chemical processes to material handling. This optimization leads to higher productivity, shorter production cycles, and, eventually, more profitability. Temperature-controlled systems' precise control reduces the likelihood of faulty or poor items, lowering total waste. This is especially important in sectors that deal with delicate chemicals or sophisticated production processes, because even little temperature variations can result in substantial wastage. Extending the shelf life of items is a major challenge in businesses such as food and medicines. Temperature-controlled systems prevent spoiling and deterioration, ensuring that items are as fresh and effective as possible when they reach customers. This not only improves customer happiness but also decreases the financial costs associated with expired goods.

By region, North America dominated the global temperature controlled system market in 2022. North America's temperature-controlled system is versatile enough to serve a wide range of industries. From medicines and biotechnology to the food & beverage industry, transporters deliver commodities that are important to society's well-being. This variety of uses demonstrates the versatility and significance of temperature-controlled transportation by encouraging several aspects of the economy . The temperature-controlled system in North America supports global connection by allowing items to be transported seamlessly across borders. Transporters who travel on foreign routes play an important role in ensuring that items meet the criteria of other countries and follow international legislation. This worldwide connectedness facilitates trade and the exchange of products on a global scale.

Impact of COVID-19 on the Global Temperature Controlled System Industry

- The increase in demand for pharmaceutical cold storage was one of the direct impacts of COVID-19 on the temperature-controlled systems industry. Due to the critical requirement for vaccine distribution and storage, pharmaceutical firms and logistics providers were confronted with the strong issue of assuring the safe transportation and storage of vaccines at ultra-low temperatures.

- This unexpected surge in demand put a strain on the industry's cold chain infrastructure, leading it to invest in expanding and improving storage facilities. The rush to deliver COVID-19 vaccines also highlighted the necessity of real-time monitoring and tracking inside temperature-controlled systems, driving businesses to implement new technology to safeguard the cold chain's integrity.

- The pandemic highlighted the importance of flexibility and agility in temperature-controlled systems. As the demand for some items, such as vaccinations, increased significantly, the industry needed to adapt swiftly. This emphasized the need of modular and scalable temperature-controlled systems that could be quickly modified to meet changing needs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the temperature controlled system market forecast period from 2022 to 2032 to identify the prevailing temperature controlled system market trends.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the temperature controlled system market analysis segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global temperature controlled system market overview, key players, market segments, application areas, and market growth strategies.

Temperature Controlled System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.5 billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | LG Electronics Inc., Mitsubishi Electric Corporation, Schneider Electric SE, Carrier Global Corporation, Emerson Electric Co., Siemens AG, Ingersoll Rand, Daikin Industries, Ltd., Johnson Controls International PLC, Delta Controls Inc., Honeywell International Inc. |

The temperature-controlled system market size is expected to grow due to an increase in demand for integrity and quality of products globally. In addition, the market is driven by rising adoption in industries such as logistics and transportation.

Healthcare, pharmaceuticals, vaccine storage and distribution, biological sample preservation, and other applications involve the use of temperature-controlled systems.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global temperature-controlled system market from 2022 to 2032 to determine the prevailing opportunities.

The major growth strategies adopted by the temperature controlled system market players are partnerships, collaborations, and technological innovation .

Asia-Pacific will provide more business opportunities for the global temperature controlled system market in the future.

The closed loop control sub-segment of the type segment acquired the maximum share of the global temperature controlled system market in 2022.

Carrier Global Corporation, Daikin Industries, Ltd., Johnson Controls, International plc, Siemens AG, Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Schneider Electric SE, Ingersoll Rand, and LG Electronics Inc, are the major players in the temperature controlled system market.

Pharmaceutical and healthcare industry companies are the major customers in the global temperature controlled system market.

Increase in use of E-commerce and cold chain logistics, and rise in advancements in technology of temperature-controlled system to drive the growth of temperature-controlled system market.

Loading Table Of Content...

Loading Research Methodology...