Global Temporary Power Market Research, 2033

The global temporary power market size was valued at $6.4 billion in 2023, and is projected to reach $16.7 billion by 2033, growing at a CAGR of 10.2% from 2024 to 2033. Temporary power refers to electrical power that is provided on a temporary basis, often through portable generators, battery systems, or grid connections, to meet short-term energy needs. It is primarily used in situations where a permanent or fixed power source is unavailable, or there is an immediate requirement for extra capacity.

Introduction

Temporary power solutions are designed to be deployed quickly, are flexible, and is easily removed once the need has passed. These systems are commonly employed in various industries and applications where continuous or permanent power installations would be either unnecessary, cost-prohibitive, or impractical. Temporary power solutions are typically scalable, as they are adjusted based on the size of the demand, whether it’s for small-scale operations or large, high-demand sites. These systems vary in scale, from compact portable generators powering a few devices to large modular power plants supporting major industrial projects. Their adaptability, mobility, and rapid deployment capabilities make them essential across various sectors, particularly for unexpected situations or project-specific energy needs.

One of the most significant users of temporary power is the construction industry. During the construction of buildings, bridges, roads, and other infrastructures, electricity is needed for various purposes such as running machinery, lighting, and powering tools. However, permanent connections to the grid may not yet be available or feasible at the start of the project. Temporary power solutions such as diesel generators, battery-powered systems, or mobile substation units are frequently used to ensure continuous power throughout the construction phase. Temporary power is also widely used in the events and entertainment industry, where large-scale productions require immediate access to electricity. From concerts, festivals, and sporting events to film shoots and exhibitions, power needs can be substantial and specific. Temporary power solutions in this industry include large generators and battery banks that can supply the energy required for stages, sound and lighting equipment, video screens, and more.

Key Takeaways

- The temporary power market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global temporary power markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the temporary power market share.

- The key players in the temporary power market are Aggreko, Power Temp Systems Inc, Valid Manufacturing Ltd., ALLIED POWER AND CONTROL, APR Energy, United Site Services Inc., Sunbelt Rentals, Inc., Herc Rentals Inc., Trinity Power, and PowerPlus. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Increase in demand for fuel-efficient and environmentally friendly generators is expected to drive the growth of market. Modern generators are designed with advanced engines and systems that reduce fuel consumption, lowering operating costs and extending runtimes, making them ideal for continuous power needs during events such as natural disasters or construction. Energy storage advancements, especially lithium-ion batteries, enable efficient energy storage and use, reducing dependence on fossil fuels. Integrating renewable energy sources such as solar and wind with energy storage enhances sustainability, offering cleaner temporary power solutions. The Gujarat Renewable Energy Policy-2023 aims to generate 50% of power from renewables by 2030, attracting $60,024 million in investments and supporting eco-friendly energy solutions.

However, limited availability of resources is expected to restrain the growth of market in future. In many rural or off-grid areas, there is a shortage of skilled technicians and operators capable of setting up, maintaining, and troubleshooting temporary power systems. Asia-Pacific countries not have access to specialized resources or trained personnel who can handle the installation of large generators, solar units, or energy storage systems, which further exacerbates the logistical challenges. Without the necessary expertise, equipment is installed improperly, reducing efficiency or leading to operational issues, which delay power restoration and increase costs for businesses or communities relying on temporary power solutions. In addition, the supply chain for temporary power equipment is strained in remote regions, particularly in underdeveloped countries where access to advanced technologies and spare parts is limited. Temporary power systems, especially larger generators, often require specific components that are readily available locally.

Segments Overview

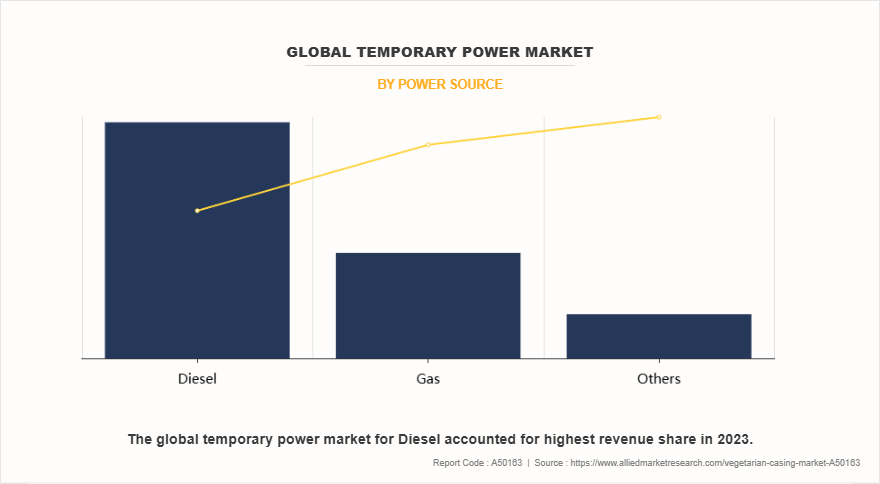

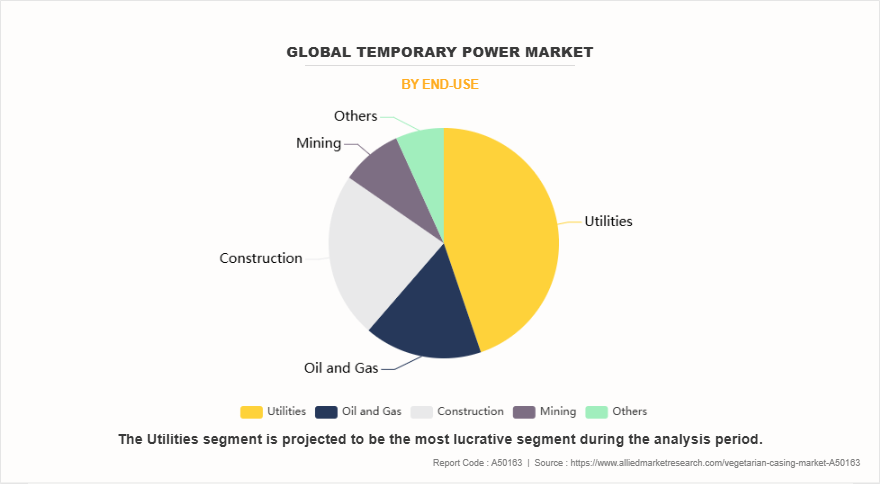

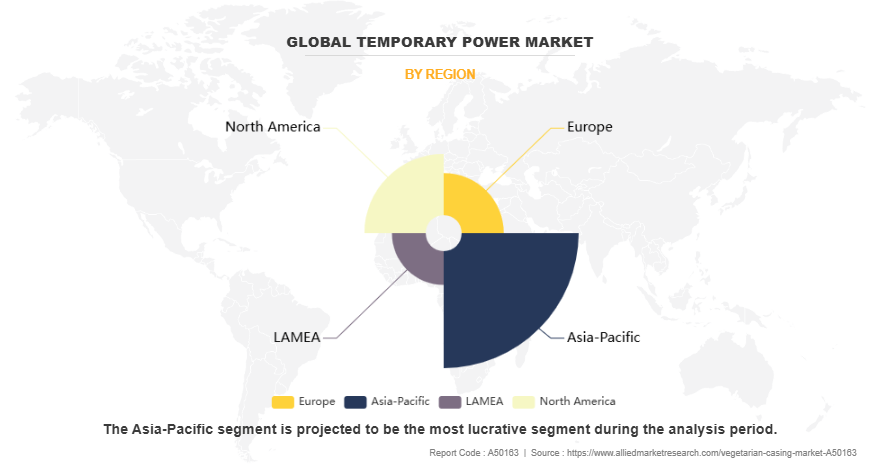

The temporary power market is segmented on the basis of power source, end use, and region. On the basis of power source, the market is categorized into diesel, gas, and others. On the basis of end use, the market is classified into utilities, oil & gas, construction, mining, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of power source, the diesel segment dominated the market in 2023, representing the CAGR of 10.0% during the forecast period. Diesel-powered temporary power solutions are widely utilized across various industries to provide reliable and efficient energy when permanent power sources are unavailable or insufficient. These solutions are commonly used in construction sites, outdoor events, disaster relief operations, remote industrial projects, and backup power for critical infrastructure. Diesel generators, which form the backbone of temporary power supply, offer high energy density, making them a preferred choice for situations requiring continuous and stable power output. Their portability and scalability allow businesses and emergency responders to deploy power solutions quickly and efficiently, ensuring minimal disruptions to operations.

On the basis of end-use, the utilities segment dominated the market in 2023, growing with the CAGR of 9.1%. Utilities often rely on temporary power solutions, such as diesel or gas generators, battery storage systems, and mobile substations, to maintain service reliability. In grid modernization projects, temporary power sources help minimize disruptions, allowing seamless transitions when upgrading substations, transmission lines, and distribution networks. In disaster recovery situations, such as storms or natural calamities, utilities deploy temporary power systems to restore electricity swiftly while permanent repairs are underway.

By region, Asia-Pacific dominated the temporary power market in 2023. Temporary power usage in Asia-Pacific countries is driven by rapid industrialization, urbanization, and infrastructure development. China, India, Japan, South Korea, and many southeast Asian countries rely on temporary power solutions for construction projects, emergency backup power, and large-scale events. With the expansion of smart cities and mega infrastructure projects, demand for diesel & gas generators, battery storage systems, and renewable-based temporary power solutions has surged. These power sources are essential for industries such as oil & gas, mining, manufacturing, and telecommunications.

Competitive Analysis

The major prominent players operating in the temporary power market include Aggreko, Power Temp Systems Inc, Valid Manufacturing Ltd., ALLIED POWER AND CONTROL, APR Energy, United Site Services Inc., Sunbelt Rentals, Inc., Herc Rentals Inc., Trinity Power, and PowerPlus. These players have adopted several strategies to make their market position strong.

- In December 2023, Aggreko acquired nine community solar projects in New York, totaling 59 MW. This acquisition aligns with the company's strategy to enhance its renewable energy portfolio and support energy transition initiatives

- In January 2025, Aggreko has continued to provide temporary power solutions for major events, including the 2022 COP26 Conference in Glasgow and the 2022 Commonwealth Games in Birmingham. These engagements underscore Aggreko's role in supporting large-scale events with reliable power services.

Temporary Power Industry News

- In September 2023, the Ministry of Power introduced a comprehensive framework to advance Energy Storage Systems (ESS). Key measures include financial incentives, regulatory reforms, and the promotion of indigenous manufacturing to support the integration of renewable energy sources and ensure grid stability

- The Uttar Pradesh government has committed to investing Rs 5,000 crore to strengthen the state's power infrastructure in November 2024. This investment focuses on building new substations, enhancing existing ones, and ensuring a robust transmission and distribution system to provide continuous power supply.

- In September 2023, India's Ministry of Power released a comprehensive framework to transform the country's energy storage landscape. The blueprint includes financial incentives, regulatory revisions, and the promotion of indigenous manufacturing to support the development of Energy Storage Systems (ESS). Key proposals involve Viability Gap Funding for Battery Energy Storage Systems and the integration of ESS into long-term resource planning.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global temporary power market analysis from 2023 to 2033 to identify the prevailing global temporary power market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the global temporary power market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global temporary power market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the temporary power market growth forecast.

- The report includes the analysis of the regional as well as global global temporary power market trends, key players, market segments, application areas, and market growth strategies.

Temporary Power Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 16.7 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 316 |

| By Power Source |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | United Site Services Inc, APR Energy PLC, Power Temp Systems Inc, Valid Manufacturing Ltd., PowerPlus, Trinity Power, Aggreko, Sunbelt Rentals, Inc., ALLIED POWER AND CONTROL, Herc Rentals Inc |

Analyst Review

According to the opinions of various CXOs of leading companies, industrial shutdowns and maintenance is expected to drive the growth of the temporary power market. Industrial shutdowns and maintenance periods are a crucial aspect of many industries, ranging from manufacturing plants to data centers, and during these times, temporary power solutions play a vital role in ensuring continued operations and minimizing losses. Scheduled maintenance is necessary to keep equipment running efficiently and to perform repairs or upgrades. However, these shutdowns can lead to significant disruptions if power is lost or if systems are unable to operate without a consistent power source. Temporary power solutions, such as backup generators, ensure that critical machinery and processes continue to run smoothly during maintenance activities, preventing unnecessary downtime and operational disruptions. In April 2024, to ensure adequate electricity supply during the summer months, the Ministry of Power revised the maintenance schedules of thermal power plants. Approximately 1.7 GW of thermal power plant maintenance was rescheduled from April to the monsoon season, with an additional 6 GW to 9 GW shifted to June. This strategic adjustment was intended to meet the anticipated increase in electricity demand due to higher temperatures.

However, environmental concerns is expected to restrain the growth of market. Environmental concerns surrounding traditional temporary power sources, particularly diesel generators, are a significant challenge for the temporary power market. Diesel generators, commonly used for backup power in emergencies or during scheduled maintenance, are known for their high emissions of harmful pollutants such as nitrogen oxides (NOx), carbon dioxide (CO2), and particulate matter. These emissions contribute to air pollution, climate change, and health problems, which has led to surge in scrutiny from both regulators and environmentally-conscious consumers. In regions where there is an increase in emphasis on sustainability and environmental responsibility, the reliance on diesel generators for temporary power can hinder market growth, as stricter environmental regulations are enforced to limit the use of fossil fuels.

The global temporary power market was valued at $6.4 billion in 2023, and is projected to reach $16.7 billion by 2033, growing at a CAGR of 10.2% from 2024 to 2033.

The key players operating in the temporary power market include Aggreko, Power Temp Systems Inc, Valid Manufacturing Ltd., ALLIED POWER AND CONTROL, APR Energy, United Site Services Inc., Sunbelt Rentals, Inc., Herc Rentals Inc., Trinity Power, and PowerPlus.

Asia-Pacific is the largest regional market for global temporary power.

Utilities is the leading end-use of global temporary power market.

Rise of hybrid power solutions are the upcoming trends of global temporary power market.

Loading Table Of Content...

Loading Research Methodology...