Tequila Market Research, 2031

The global tequila market size was valued at $12.89 billion in 2021, and is projected to reach $24.19 billion by 2031, growing at a CAGR of 6.6% from 2022 to 2031.

Tequila is a distilled liquor and is made from blue agave plants that only grows in specific regions of Mexico, such as Jalisco and Tamaulipas. Tequila is made by distilling the fermented juices of the Weber blue agave plant. Tequila is discovered by a lesser-known civilization from the South American continent. It has a unique earthy flavor with an alcoholic kick. Dependent on where the agave was grown and the style, tequila is a common liquor in Mexico as it originated in Mexico. Four types of tequilas are available in the market, which include blanco, reposado, anejo, and joven.

Market Dynamics

Surge in demand for cocktails is the major driver of the tequila market. Owing to changing lifestyles and increasing disposable income, premium and handcrafted variants are gaining more traction around the globe. Tequila is gaining more popularity across the world as the number of hotels, bars, and restaurants is increasing significantly. Tequila is used in a variety of drinks such as the popular drink margarita. In addition, key players in the market are introducing new flavors to attract more consumers and expand their portfolios. The increasing popularity of spirits among youngsters is further acting as a key driver of the market. The involvement of social media in everyone’s life is increasing significantly as the number of consumers has increased on social media platforms. The inclination of youngsters toward alcohol is rising, due to the increasing number of parties and availability of alcoholic beverages in bars and restaurants. In addition, increase in penetration of e-commerce sales is expected to offer remunerative opportunity for the expansion of the market. Furthermore, the outbreak of the COVID-19 pandemic escalated the sales of tequila through e-commerce platforms, which notably contributed toward the tequila market growth.

According to WHO, worldwide 3 million deaths every year result from the harmful use of alcohol. This represents 5.3% of all deaths. WHO further stated that alcohol consumption causes death and disability relatively early in life. In people aged 20–39 years, approximately 13.5% of total deaths are attributable to alcohol. In the developing countries, such as India, consumption of alcohol is prohibited in the states of Bihar, Gujarat, Nagaland, Mizoram, as well as the union territory of Lakshadweep. There is a partial ban on alcohol in some districts of Manipur. These kinds of government policies negatively affect the sale of alcoholic beverages worldwide, thus hampering the growth of the market.

Segment Overview

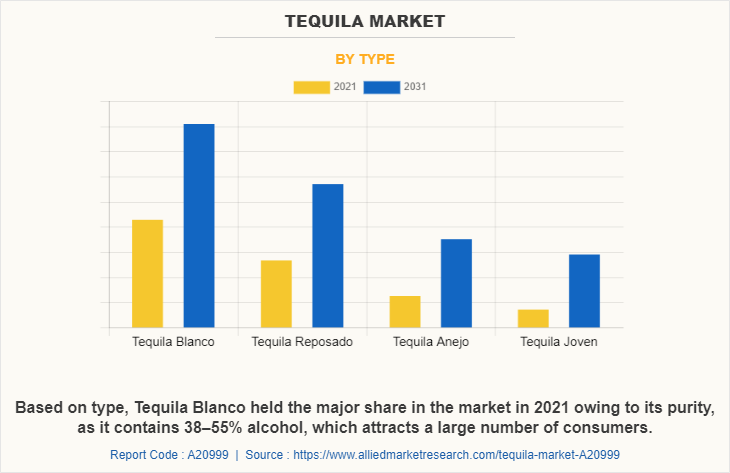

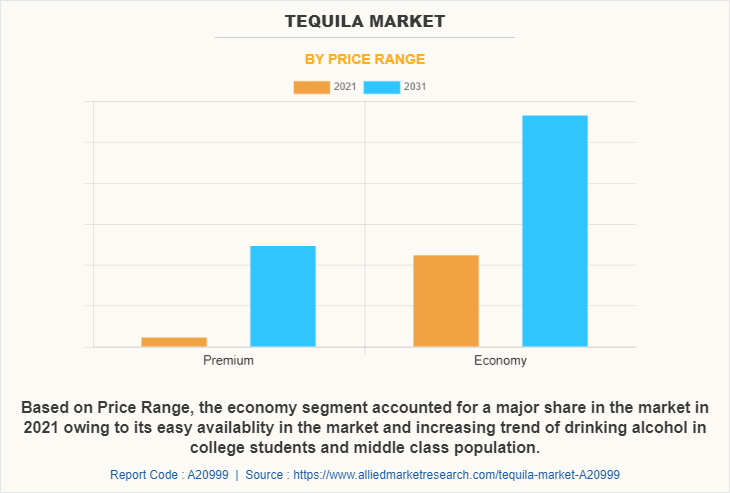

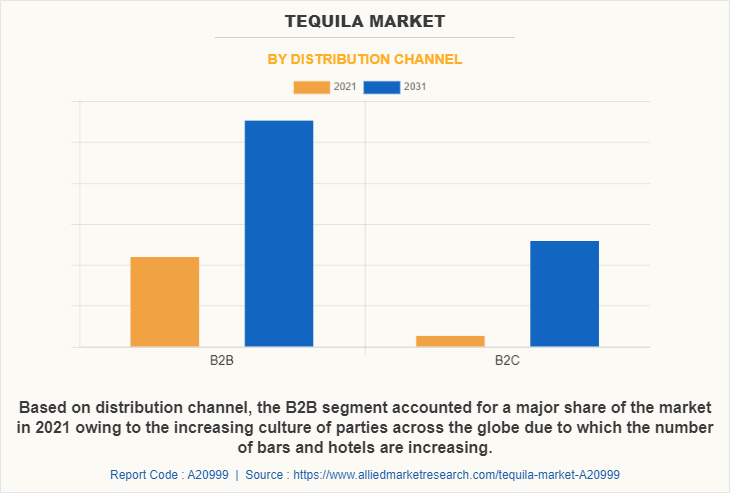

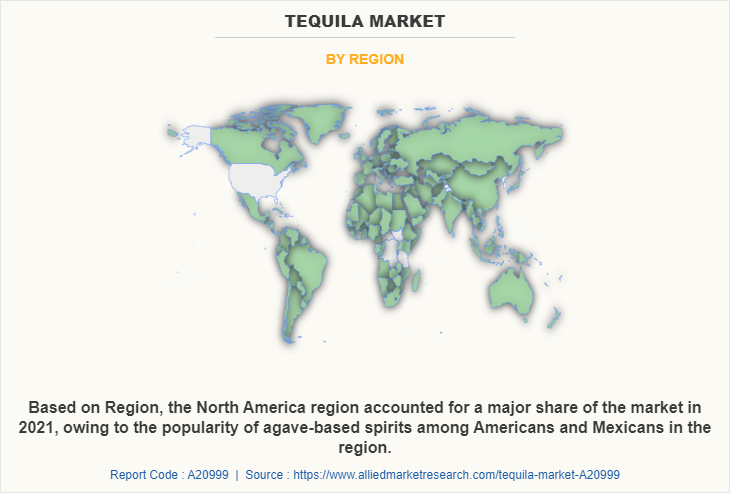

The global tequila market is segmented into product type, price range, distribution channel, and region. On the basis of product type, the market is segregated into tequila blanco, tequila reposado, tequila anejo and tequila joven. By price range, it is classified into premium and economy. Depending on distribution channel, it is categorized into B2B and B2C. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product type, the tequila blanco segment accounted for a major tequila market share in 2021, and is expected to grow at a significant CAGR during the forecast period. Blanco tequilas is used for mixing into cocktails due to its crisp, bright, and unadorned expression of agave. Consumers prefer blanco tequila due to its purity, as it contains 38–55% alcohol, which attracts a large number of consumers. Moreover, cocktail culture is spreading all over the world, due to which consumer demand for tequila in cocktails increased attributable to the availability of vivid flavors and its premium quality.

By price range, the economy segment accounted for a major share in the market in 2021, and is expected to grow at a significant CAGR during the tequila market forecast period. Economic priced tequila may not have pure 100% blue agave but it is still in demand due to factors such as it is not costly and it is easily available. College students and the middle-class population prefer economic priced tequila as they are not able to afford premium tequilas.

By distribution channel, the B2B segment accounted for a major share of the tequila market in 2021, and is expected to grow at a significant CAGR during the forecast period. The B2B segment is getting popularity due to the increasing culture of parties all over the world and the demand for alcohol. Consumers are adopting the western lifestyle due to increase in disposable income and rise in the working population of males and females. Thus, consumers prefer quick serving, entertainment, and ambiance, which drive the growth of the B2B segment.

By region, North America region accounted for a major share of the market in 2021, and is expected to grow at a significant CAGR during the forecast period. The rising demand for tequila in the different business sectors such as restaurants, bars, and pubs is driving the market growth in North America. The consumption of tequila among the North American population is significantly increasing, because agave-based spirits are becoming more and more popular among Americans and Mexicans. In 2019, over 52% of US citizens, according to the International Wine and Spirits Research (IWSR) study report, drank alcohol. Along with this, the key players in the market such as Parton and Jose Cuervo are expanding their exports globally and also introducing new flavors in the market such as butterscotch and vanilla, which are anticipated to open new avenues for the market growth.

Competition Analysis

The major players operating in the market focus on key market strategies such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the tequila industry include Diageo Plc, Eastside Distilling, Bacardi Limited, Brown-Forman Corporation, Constellation Brands Inc., Becle, S.A.B DE C.V., Pernod Ricard, Proximo Spirits, Ambhar Global Spirits LLC, and California Tequila Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the tequila market analysis from 2021 to 2031 to identify the prevailing tequila market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the tequila market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tequila market trends, key players, market segments, application areas, and market growth strategies.

Tequila Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Price Range |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | BECEL, S.A.B. DE C.V., Ambhar Global Spirits, LLC, EASTSIDE DISTILLING, BROWN-FORMAN CORPORATION, CONSTELLATION BRANDS INC., PERNOD RICARD, CALIFORNIA TEQUILA INC, Proximo, DIAGEO PLC, BACARDI LIMITED |

Analyst Review

According to the insights of the CXOs, the global tequila market is expected to witness robust growth during the forecast period. This is attributed to increase in disposable income in developing countries and changes in the lifestyle of consumers. Moreover, rise in demand for cocktail culture has fueled the growth of the global tequila market. Consumers are more attracted to handcrafted tequila such as Casa Ginger Mint Paloma, and Oaxacan Old Fashioned. Furthermore, key players of the market are investing in R&D activities and are making continuous efforts to launch new and exciting flavors to get traction around the globe.

CXOs furthermore added a rise in the trend of e-commerce sales as consumers are getting inclined toward online buying of alcoholic beverages. The availability of alcohol products through e-commerce sites is expected to fuel the growth of the tequila market. However, the availability of non-alcoholic beverages and government organizations encouraging consumers not to consume much alcohol are expected to hamper the growth of the tequila market in the future.

Increase in focus of manufacturers to launch new flavors of tequila and surge in demand for these flavors by consumers are the major factors that significantly drive the market growth.

North America held the major share in the Tequila market in 2021.

Expected to reach $24,189.5 million by 2031, registering a CAGR of 6.6% from 2022 to 2031.

key players in the tequila industry include Diageo Plc, Eastside Distilling, Bacardi Limited, Brown-Forman Corporation, Constellation Brands Inc., Becle, S.A.B DE C.V., Pernod Ricard, Proximo Spirits, Ambhar Global Spirits LLC, and California Tequila Inc.

Tequila Blanco held the major share in the tequila market in 2021.

Loading Table Of Content...