Term Life Insurance Market Research, 2032

The global term life insurance market was valued at $1.1 trillion in 2023, and is projected to reach $2.4 trillion by 2032, growing at a CAGR of 8.7% from 2024 to 2032. Factors such as age, health status, and coverage amount influence the cost of premiums in this market. With rise in awareness about the importance of financial security, the term life insurance market continues to grow, offering individuals a cost-effective way to safeguard one's future.

Market Introduction and Definition

The term life insurance market refers to the sector in the insurance industry that specifically deals with providing coverage for a specified period, typically ranging from 5 to 30 years, in exchange for regular premium payments. This type of insurance offers financial protection to the policyholder's beneficiaries in the event of the insured individual's death during the term of the policy. The market is characterized by a wide range of policy options, including level term, decreasing term, and renewable term policies, each tailored to meet the diverse needs of consumers.

Key Takeaways

The market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Trillion) for the projected period 2023-2032 and term life insurance market forecast period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major term life insurance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and term life insurance market share.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global term life Insurance market growth and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The term life insurance market is driven by several key factors that contribute to its growth and sustainability. One of the primary drivers is rise in awareness among individuals about the importance of financial security and the need to protect their relatives in the event of unforeseen circumstances. As people become more conscious of the risks associated with life's uncertainties, the demand for term life insurance policies rises. In addition, advancements in technology and data analytics have enabled insurance companies to better assess risk profiles and offer more personalized and competitive premium rates to customers. This made term life insurance more accessible and affordable to a wider range of consumers, further fueling the market growth. However, the perception among some consumers that term life insurance is a complex and confusing product, leads to a lack of understanding and reluctance to purchase policies, which hinders the market growth. In addition, economic downturns and fluctuations in interest rates can impact the profitability of insurance companies, affecting their ability to offer competitive pricing and innovative products in the market.

Furthermore, the market presents several opportunities for growth and development. Rise in adoption of digital channels for insurance sales and customer service created opportunities for reaching and engaging with customers. Insurtech companies are leveraging technology to streamline processes, enhance customer experience, and offer innovative policy options, attracting a younger demographic of tech-savvy consumers. Moreover, the aging population and changing family structures present opportunities for insurers to develop tailored products that cater to the evolving needs of customers. By addressing these opportunities and overcoming the restraints, the market is expected to continue to thrive and meet the growing demand for financial protection among individuals and families.

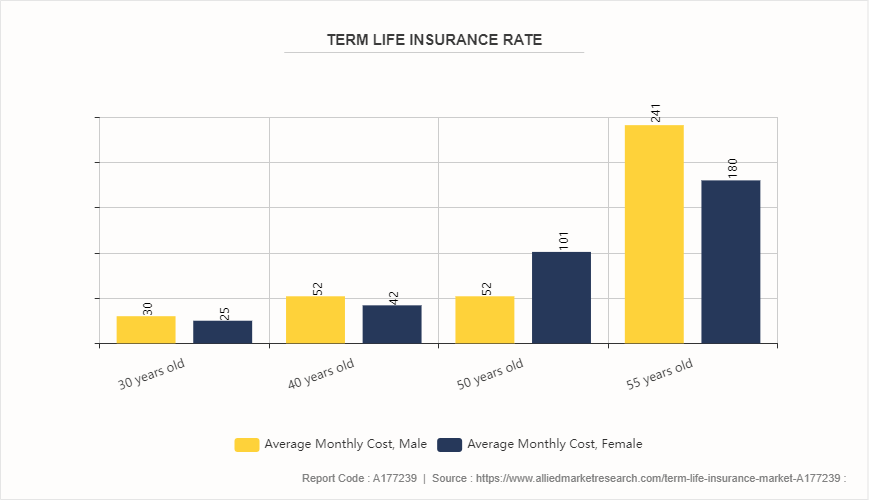

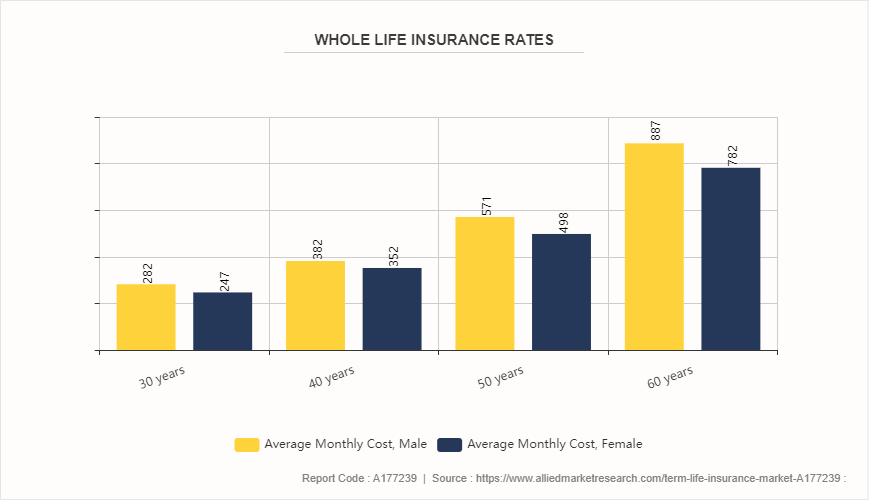

Cost of Term Life Insurance

Since term life insurance only provides a death benefit for a predetermined period and lacks the cash value component of permanent insurance, it is typically the least expensive type of life insurance. For instance, according to Insureon data, as of February 2023, healthy, nonsmoking guys in their 30s could get a 30-year term life insurance policy with a $500, 000 death benefit for an average of $30 per month. The monthly premium is anticipated to increase to $138 at the age of 50. In contrast, it is a type of permanent insurance with cash value that lasts the entirety of the policyholder's life, which represents the cost of a whole life insurance policy of nearly $500, 000. Moreover, the 30-year-old, healthy male would pay, on average, $282 per month.

Most term life insurance policies do not pay out a death benefit after they expire. As a result, the insurer bears less overall risk than with a permanent life policy. Premiums may also be impacted by interest rates, the insurance company's financial health, and state laws. Companies typically provide better rates at the $100,000; $250,000; $500,000; and $1,000,000; which are known as "breakpoint" coverage levels.

Market Segmentation

The market is segmented into insurance type, distribution channel, and region. On the basis of type, the market is divided into individual level term life insurance, group level term life insurance, and decreasing term life insurance. On the basis of distribution channel, the market is divided into tied agents and branches, brokers, bancassurance, and direct & other channels. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The term life insurance market in the U.S., the UK, and India exhibits unique characteristics and trends reflective of each country's economic landscape and consumer behavior. In the U.S., the market is well-established and highly competitive, with a wide range of insurance providers offering diverse policy options to cater to the varying needs of consumers. The market is driven by factors such as rise in awareness about financial security, favorable regulatory environment, and advancements in technology that have streamlined the insurance buying process. In the UK, the life insurance market is characterized by a high level of consumer awareness and preference for protection-based insurance products. The market is driven by factors such as changing demographics, increase in disposable income, and a growing emphasis on financial literacy. Further in India, the term life insurance market is experiencing rapid growth driven by factors such as increase in disposable income, rise in awareness about financial planning, and favorable regulatory reforms.

In February 2024, French reinsurer SCOR partnered with AIMCOR Group to help in a new era of efficiency and accessibility in the term life insurance. The new product, AIMCOR QuickLife, is powered by Techficient’s Dynamic Platform, and is underwritten by Ameritas and reinsured by SCOR. By harnessing predictive data modeling and cutting-edge technology, QuickLife looks to redefine the traditional barriers associated with obtaining term life insurance coverage in France.

In December 2021, State-owned Life Insurance Corporation of India (LIC) introduced a non-linked, non-participating, individual savings life insurance plan. The insurer added that there are special premium rates for female lives and the plan is allowed to the third gender.

In January 2021, SCOR collaborated with Life Science company Bayer and One Drop, a leader in digital solutions for people living with diabetes and other chronic conditions, to bring One Drop’s AI-powered digital health platform to life insurance carriers and policyholders across the U.S. This joint effort between SCOR, Bayer and One Drop aims to empower people to proactively manage their health through innovative products and to reduce the risk of life-threatening complications from medical conditions. It brings together SCOR’s in-depth knowledge of the insurance sector and its predictive risk assessment underwriting engine, VELOGICA®, One Drop’s fully personalized support experience and predictive capabilities, and Bayer’s expertise in the worldwide development and commercialization of health solutions.

Industry Trends:

The trend towards digitalization in the life insurance industry accelerated with more consumers opting to purchase term life insurance policies online. With the rise of digital technologies and changing consumer preferences, insurance companies are leveraging digital platforms to reach a wider audience, streamline the purchasing process, and offer more personalized and tailored insurance products. For instance, in August 2021, Prudential Financial launched its fully digital term life insurance product called PruFast Track, allowing customers to apply for coverage entirely online without the need for medical exam.

Insurers are leveraging data analytics and AI to offer personalized underwriting for term life insurance policies. For instance, in January 2020, Haven Life introduced a new underwriting algorithm that uses advance analytics to access applicants risk profile more accurately, resulting in faster approval time and tailored coverage options. The aim was to provide Haven Term applicants with instant coverage whenever possible. However, there are cases where AI-powered underwriting algorithms need more data, like a medical exam, to make a decision.

Competitive Landscape

The major players operating in the term life insurance industry include MetLife, Aegon Life Insurance Company, AIG, ManuLife, AIA, Allianz, Bajaj Allianz Life Insurance, HDFC Standard Life Insurance, Northwestern Mutual, SCOR. and others.

Recent Key Strategies and Developments

In August 2023, Northwestern Mutual, Marquette University, and the University of Wisconsin-Milwaukee strengthened their commitment to the Northwestern Mutual Data Science Institute (NMDSI) , extending their partnership for the groundbreaking organization through 2028. The three institutions contributed a total of $35 million to NMDSI over the next five years, building on the nearly $40 million invested to date to advance the Institute's mission of establishing Wisconsin as a recognized national hub for technology.

In April 2021, Northwestern Mutual, a leading financial services company, expanded its multi-year partnership with the Milwaukee Brewers, becoming the team's official financial planning and first-ever jersey patch partner. This strategic investment further helped to increase awareness of their comprehensive approach to financial planning helping people build financial security, while also highlighting their national philanthropy.

In September 2023, AU Small Finance Bank (AU SFB) , a small finance bank, and Bajaj Allianz Life Insurance, a private life insurer, entered into a strategic partnership. This collaboration is expected to empower AU SFB’s customers to gain access to Bajaj Allianz Life’s comprehensive suite of life insurance products, thereby addressing their imperative need for financial security. Uttam Tibrewal, Executive Director of AU Small Finance Bank and Tarun Chugh, MD and CEO, Bajaj Allianz Life Insurance signed the agreement and announced their strategic partnership.

Key Sources Referred

Insurance News

Forbes

Cafemutual

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the term life insurance market analysis from 2024 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions, strengthen their supplier-buyer network and term life insurance market outlook.

- In-depth analysis of the market segmentation assists to determine the prevailing term life insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global term life insurance market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global term life insurance market trends, key players, market segments, application areas, and market growth strategies.

Term Life Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.4 Trillion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2032 |

| Report Pages | 245 |

| By Insurance Type |

|

| By Distribution Channel |

|

| By Region |

|

The global term life insurance market was valued at $1.1 trillion in 2023, is projected to reach $2.4 trillion by 2032, growing at a CAGR of 8.7% from 2024 to 2032.

Increase in awareness about the importance of financial security and protection and advancements in technology and data analytics the upcoming trends of Term Life Insurance Market in the globe.

Adoption of digital channels for insurance sales and customer service is the leading application of Term Life Insurance Market.

North America is the largest regional market for Term Life Insurance.

MetLife, Aegon Life Insurance Company, AIG, ManuLife, AIA, Allianz, Bajaj Allianz Life Insurance, HDFC Standard Life Insurance, Northwestern Mutual, SCOR are the top companies to hold the market share in Term Life Insurance.

Loading Table Of Content...