Test Lanes Market Research, 2032

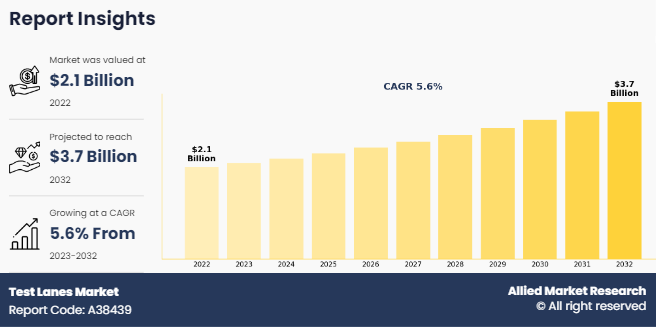

The global test lanes market size was valued at $2.1 billion in 2022, and is projected to reach $3.7 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. A test lane, also known as a testing lane or inspection lane, refers to a particular location within a facility where automobiles go through numerous examinations and tests to ensure compliance with protection, emissions, and roadworthiness requirements. These assessments typically include inspections of important components along with brakes, lighting, tires, and emissions levels. Test lanes are typically used in automotive service facilities, government inspection facilities, and other institutions chargeable for comparing the condition and compliance of vehicles.

Report Key Highlighters

The test lane market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

The test lane market share is marginally fragmented, with players such as Boston Garage Equipment Ltd., Crypton Technology Ltd., Cormach Test Lane Systems, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Hofmann Megaplan, VTEQ, Capelec, Snap On Vehicle Service Group Italy S.r.l., Butler Vehicle Service Group Italy S.r.l., and ATS ELGI. Major strategies such as product launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Dynamics

The regulatory landscape governing car protection, emissions, and roadworthiness plays a pivotal role in increasing demand for check lanes. Governments globally enact and put in force guidelines mandating periodic car inspections to ensure compliance with regulatory norms, which ensure safety and environmental protection. For example, emissions aim to shrink air pollutants via tracking automobile exhaust emissions, whilst protection inspections recognition on assessing crucial components such as brakes, lighting, and tires to make certain roadworthiness. These policies create a constant demand for test lane services as car proprietors need to adhere to mandated checking out intervals. In addition, evolving regulations, including stricter emission standards or superior protection necessities, can also necessitate extra frequent or complete test, which in turn is expected to drive the demand for test lanes. As governments prioritize road safety and environmental protection, the regulatory guidelines are stringent, which are expected to increase the demand for test lane equipment, and drive the growth of test lanes market.

In addition, continuous advancements in automobile technology drives the need for test lane offerings. Modern cars are equipped with more and more complicated components and systems, consisting of advanced driver assistance systems (ADAS), electronic control units (ECUs), and onboard diagnostics (OBD). As advancement in vehicles become more sophisticated, the need for specialized testing device and information grows. Test lane operators play a crucial function in making sure the right functioning and calibration of those advanced systems through comprehensive testing and diagnostics. As automotive technology keeps conforming, test lane operators should stay abreast of the modern trends and invest into training and system improvements to satisfy the evolving desires of vehicle proprietors and manufacturers. Such factors are expected to diver the test lanes market growth.

One of the restraints in the test lanes market is the huge upfront investment required to establish and maintain test lane centers. Setting up test lane service center involves sizeable expenses, including land acquisition, production, equipment purchase, and workers training. The complexity of current test lanes, which regularly advance superior test system and technologies, similarly amplifies the initial funding requirement. Such factors are expected to restrain the test lane industry growth.

Test lane operators have the possibility to expand their service offerings other than conventional testing and inspection services. By diversifying their services of automotive vehicles diagnostics, renovation, and repair offerings, operators can cater to the wider automotive vehicles aftermarket and increase revenue generation sources. For instance, imparting diagnostic services the use of advanced scanning gear and software program allows operators to discover and cope with vehicle troubles proactively, enhancing consumer experience. Moreover, offering maintenance and repair services alongside testing facilities creates convenience for vehicle owners, consolidating their automobile provider wishes under one roof. In addition, diversifying into ancillary offerings which includes components, tire replacement, and fluid replenishment in addition complements revenue ability and strengthens client relationships. By evolving into complete-automobile service centers, test lane operators can capitalize on cross-selling and upselling possibilities, using enterprise growth and profitability in an competitive market landscape. Such factors are expected to offer lucrative opportunities during the forecast period for the growth of test lanes market.

Segmental Overview

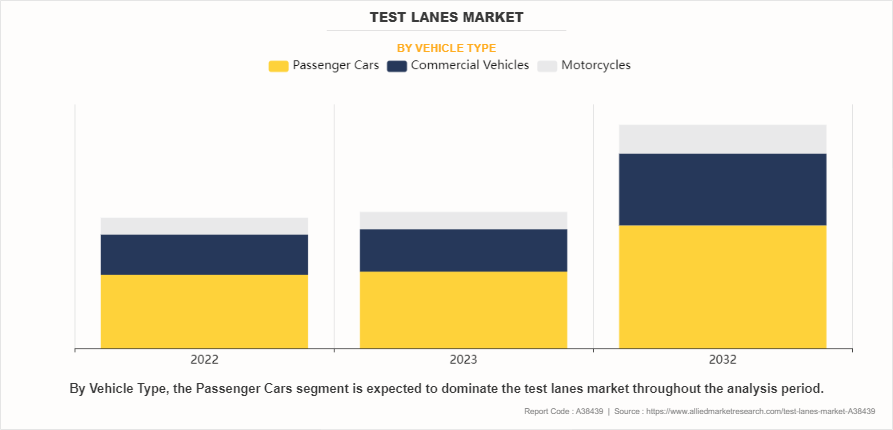

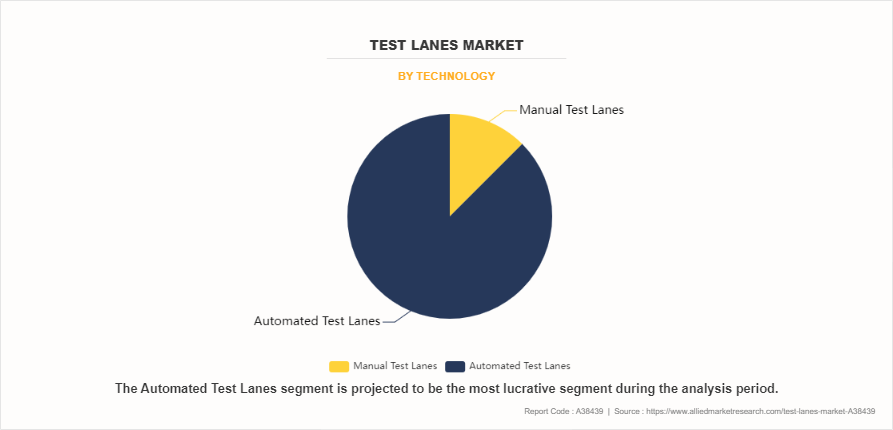

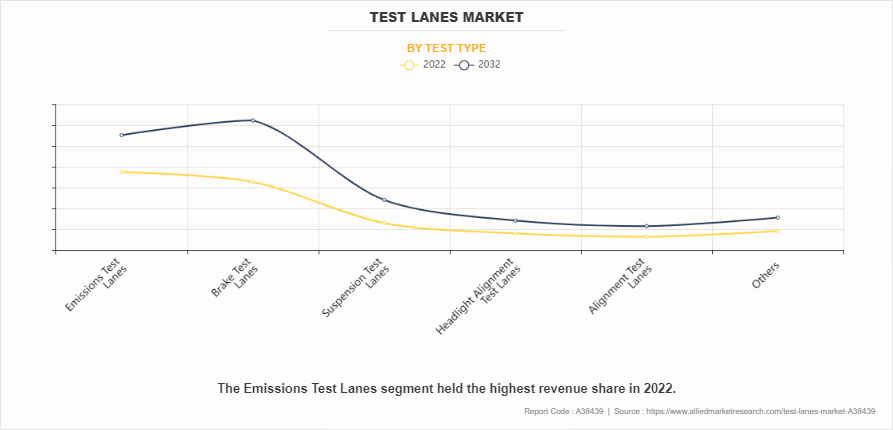

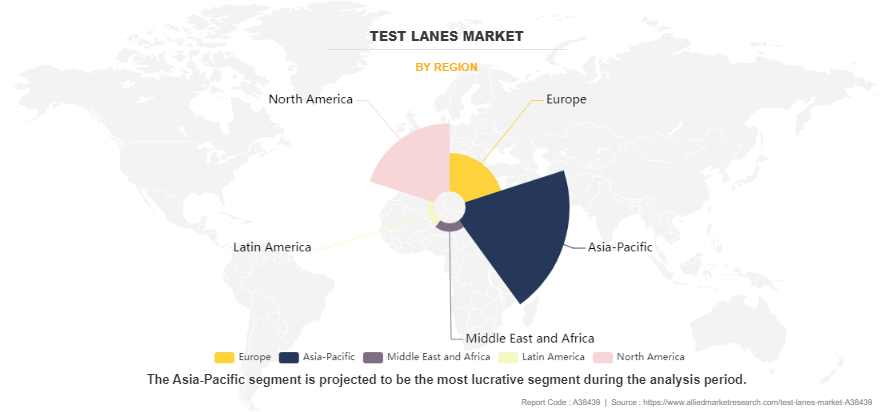

The test lanes market is segmented on the basis of vehicle type, technology, test type and region. By vehicle type, the market is divided into passenger cars, commercial vehicles, and motorcycles. By technology, the market is divided into manual test lanes and automated test lanes. By test type, the market is divided into emissions test lanes, brake test lanes, suspension test lanes, headlight alignment test lanes, alignment test lanes and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By vehicle type, the test lanes market is divided into passenger cars, commercial vehicles, and motorcycles. In 2022, the passenger cars segment dominated the test lanes market share, in terms of revenue, and the commercial vehicles segment is expected to grow with a higher CAGR during the forecast period.

By technology, the test lane market is divided into manual test lanes and automated test lanes. In 2022, the automated test lanes segment dominated the test lane market, in terms of revenue, and is expected to witness growth at a higher CAGR during the forecast period.

By test type, the test lanes market overview is divided into emissions test lanes, brake test lanes, suspension test lanes, headlight alignment test lanes, alignment test lanes and others. In 2022, the emissions test lanes segment dominated the test lanes industry, in terms of revenue, and the brake test lanes segment is expected to witness growth at a higher CAGR during the forecast period.

Region-wise, the test lanes market forecast is studied across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and Latin America, and Middle East & Africa. Asia-Pacific accounted for the highest market share in 2022 and is expected to grow with a highest CAGR during the forecast period.

Competition Analysis

Key companies profiled in the test lanes market report include Boston Garage Equipment Ltd., Crypton Technology Ltd., Cormach Test Lane Systems, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Hofmann Megaplan, VTEQ, Capelec, Snap On Vehicle Service Group Italy S.r.l., Butler Vehicle Service Group Italy S.r.l., and ATS ELGI.

The major players that operate in the global market have adopted key strategies such as acquisition, business expansion, product launch, and other strategies to strengthen their market outreach and sustain the stiff competition in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the test lanes market analysis from 2023 to 2032 to identify the prevailing test lanes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the test lanes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global test lanes market trends, key players, market segments, application areas, and market growth strategies.

Test Lanes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.7 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Test Type |

|

| By Technology |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Boston Garage Equipment Ltd., Hofmann Megaplan GmbH, VTEQ, Josam, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Capelec, Crypton Technology Ltd., Butler Vehicle Service Group Italy S.r.l., ATS ELGI., Cormach Test Lane Systems |

Analyst Review

The test lane market is poised for growth due to evolving regulations, including strict emission and safety standards. Ensuring safety and reliability is paramount for vehicle owners, regulators, and manufacturers, necessitating regular testing to identify potential hazards and ensure optimal performance. However, significant upfront investments, including land acquisition, construction, and equipment procurement, pose a primary restraint on market expansion. Despite this challenge, the integration of digital technologies such as automation and AI offers promising opportunities to enhance efficiency and accuracy in test lane operations.

As vehicle technology advances, test lane operators must adapt by investing in specialized equipment and training to meet the evolving requirements of testing. Furthermore, the growing emphasis on environmental sustainability and the transition to greener transportation options contribute to rise in demand for emissions testing and validation services. Test lane operators can leverage this trend by offering comprehensive emissions testing solutions, tailored for both traditional and alternative fuel vehicles.

The global test lanes market was valued at $2,141.5 million in 2022, and is projected to reach $3,664.4 million by 2032, registering a CAGR of 5.6% from 2023 to 2032.

The forecast period considered for the global test lane market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global test lane market report can be obtained on demand from the website.

The base year considered in the global test lane market report is 2022.

The major players profiled in the test lane market include Boston Garage Equipment Ltd., Crypton Technology Ltd., Cormach Test Lane Systems, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Hofmann Megaplan, VTEQ, Capelec, Snap On Vehicle Service Group Italy S.r.l., Butler Vehicle Service Group Italy S.r.l., and ATS ELGI.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on test type, the emissions test lanes segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...