Tethered Drone Market Overview, 2031

The global tethered drone market size was valued at $257.3 million in 2021, and is projected to reach $404.9 million by 2031, growing at a CAGR of 4.9% from 2022 to 2031.A drone that is physically tied to a ground station is an unmanned aircraft. An actual tethered drone system is made up of a base station/power station, a drone tether, and the drone itself, which is tethered to the power station. The tethered stations can be utilized to create direct communication links, increase total flight time, provide continuous power, and perform tasks associated to tethering. Direct link between ground station and drone allows it to have unlimited power supply and complex communication capabilities, allowing them to be used in applications such as surveillance, communication, live steaming, search and rescue among others.

Factors such as advancement in electrical and cable components enabling light weight cables supporting long operating distances through cables, possibilities of continuous operations through power supply, increased up link and downlink capabilities, versatility towards mode of operations and efforts taken by industry players to provide commercial off the shelf stations to cater wider audience is driving the market. Companies like Elistair is providing tethered stations that can be integrated with any drone, allowing drone to increase its operational time. Such innovations will support business opportunities on personal and recreational industry where longer operational hours are needed. The usage of drones for search and rescue operations is one of the major factors supporting business opportunities within the military segment. Development of vehicle mounted ground stations of tethered drones and capabilities to have live feed with almost zero lag on ground stations is allowing nations to enter long term business acquisition and maintenance contract of tethered drones.

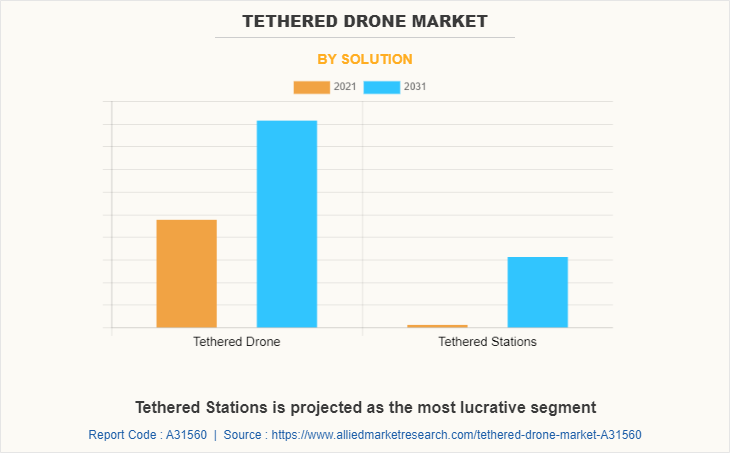

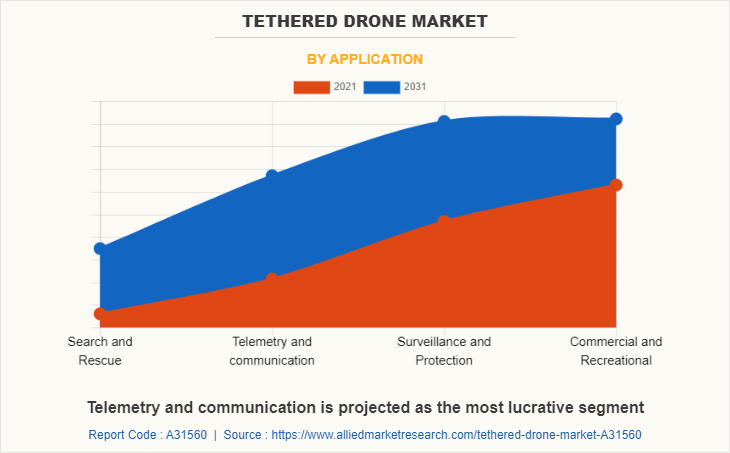

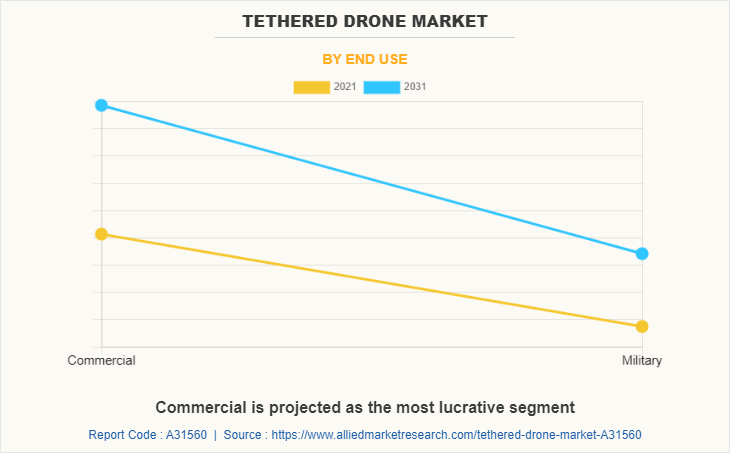

The tethered drone market is segmented into solution, application and end use, and region. By solution, the market is bifurcated into tethered drones and tethered stations. With respect to application, the market is divided into search and rescue, telemetry and communication, surveillance and protection, and commercial and recreational. The end use segment is divided by military and commercial. The region includes North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the Tethered Drone Market are Acecore Technologies, Comsovereign, Elistair INC, Flyfocus, Fotokite, Hoverfly Technologies, Novadem, Sky-Drones Technologies Ltd., Teledyne Flir LLC and Yuneec Holding Ltd.

Rapid adoption of tethered drone in commercial sector propelling market growth

The factors such as technological advancements in the industry and increased application areas such as precision agriculture, aerial imaging, cargo management, traffic monitoring, and others trigger the growth of tethered drone market. The strong growth of the agriculture industry owing to rising demand for food and vegetables across the globe fueled the need for technological equipment. Precision farming has a requirement for soil monitoring, disease monitoring, growth monitoring and pesticides spraying, which can be done through drone technology to increase production yield. For instance, in September 2022, Volarious introduced the V-Line Pro premium tethered kit at the Commercial UAV Expo in Las Vegas in order to further boost the M30’s use. V-Line Pro enables the M30 to fly forever while tethered. With a patented reel mechanism, users of the M30 will be able to climb at 5m/s without fear of severing the tether or suffering extreme stress. A lightweight aviation-grade cable allows users to soar up to 100 meters in the air.

Furthermore, the growing involvement of numerous technologies in smart farming is projected to propel the market growth during the forecast period. Technological advancements for the development of drone and government initiatives are expected to create lucrative opportunities for the market. For instance, in June 2022, Department of Agriculture and Farmers' Welfare of India has approved $828.6 million in funding for the Kerala agricultural university's research and demonstration of drone-based agricultural technologies including tethered drone. While $446.17 million has been set aside for drone research, the remaining $382.43 million has been set aside for large-scale demonstrations of various types of drones such as tethered drones, micro drones, and others which are used in fields. Thus, the rising adoption of tethered drone in commercial applications are anticipated to drive the market growth during the forecast period.

Rise in global defense expenditure

The global military expenditure has seen exponential growth in recent years. According to Stockholm International Peace Research Institute (SIPRI), the global military expenditure has reached $2113.31 billion in 2021 which is 0.7% more from 2020. The military expenditure accounted for 2.4% of global gross domestic product in 2020. Thus, increase in global military expenditure has augmented the adoption of modern defense systems, including tethered drones and other technologies.

For instance, in August 2022, KEF Robotics, a drone manufacturer based in Pittsburgh, received $1.5 million funding by the U.S. Army for R&D of tethered drones. Furthermore, advancements of weapons and attacking capabilities globally created the demand for modernization and installation of sophisticated defense infrastructure by governments to prevent threats and offensive attacks from foreign countries. Hence, increase in defense expenditure is expected to open new avenues for the growth of the tethered drone system market.

Rising competitiveness within aerial imagery

Increasing adoption of satellite imagery can limit the growth of the tethered drone market. Satellite imaging possesses an added advantage of government permissions, as most of the projects are government funded. Moreover, satellite imaging provides wider geographic reach, detailed information, and higher resolution images as compared to imaging done through drone. Satellite imaging is increasingly being used for green mapping, monitoring archaeological excavation sites, geospatial data collection and mapping, monitoring vegetation and land surfaces, and others. Continuous innovations in the field of satellite imaging and advanced commercial satellites are expected to lead to cost-effective satellite imaging solutions in the market. Worldview series, Landsat series, SPOT series, ALOS series, QuickBird, and IKONOS are some of the popular examples of commercial satellites providing satellite imaging. DigitalGlobe, Inc., Airbus, DS GmbH are some of the prominent companies in the market. Thus, satellite imaging can be a technologically restraining factor for the market. These restraining factors are expected to hamper the growth of the market severely during the forecast period.

Furthermore, the increasing adoption of airplanes by government organizations for enhance the homeland security are also restricted the growth of tethered drones during the forecast period. For instance, in July 2019, the Airports Authority of India (AAI) was adopted technology which is aided in more efficient surveillance of airplanes over Indian ocean. In addition, the state-run airport operator was partnered with Aireon LLC for implementing Space-Based Automatic Dependent Surveillance-Broadcast (ADS–B) data services, which provided real-time surveillance of airplanes over oceans falling in Indian airspace. Thus, such factors are anticipated to restrain the global tethered drone market during the forecast period.

Diversifying the connectivity of tethered drones

Market players have introduced drones that can be controlled through a smartphone application. For instance, in June 2022, DJI has expanded the availability of its mobile app dedicated to the Agras line of agricultural drones. The global smartphone market is growing at a rapid pace. Similarly, in September 2021, AT&T’s tethered drones, known as ‘Flying COWs’ offering internet connectivity in areas that have been hit by windstorms such as Louisiana. The tethered drones from AT&T are designed to stay up in the air indefinitely as they are supplied with power through the tether. The Flying Cows help restore phone and internet service in disaster-struck areas when the regular service has been interrupted. Thus, the growing connectivity options by tethered drones are expected to act as one of the opportunities for the growth of the tethered drone market.

Key Benefits For Stakeholders

- This study presents an analytical depiction of the global tethered drone market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall tethered drone market opportunity are determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global tethered drone market with a detailed impact analysis.

- The current tethered drone market are quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Tethered Drone Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 404.9 million |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 214 |

| By Solution |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | ACECORE TECHNOLOGIES, Hoverfly Technologies, ELISTAIR INC, Novadem, Fotokite, COMSOVEREIGN, YUNEEC HOLDING LTD., TELEDYNE FLIR LLC, SKY-DRONES TECHNOLOGIES LTD |

Analyst Review

This section provides the opinions of various top-level CXOs in the tethered drone market. Integration of new technologies and versatility offered by industry manufacturers will allow the market to generate new revenue streams from the commercial and military front. Industry players are offering multiple output from ground stations, allowing users to control from remote locations through hand held controllers or mobile phones and computers. Command execution and data transfer with zero lag is one of the major factors impacting business opportunities within the market. Rising demand of security and surveillance within commercial and military fronts to support business opportunities.

To fulfill the demand of customers, companies are engaging in research and development to enhance their product line and optimize performance of their drones. Industry players operation within the tethered drone market are quoting operational time of almost 24 hours through tethered power cable, offering round the clock uninterrupted solutions. Ultra-light weight tether cable, no-lag cable operations with automatic cable winding stations, and usage of multi-rotor drones to provide utmost stability during operations are some of the major trends practiced by the industry players. Long term government contracts, military agreements, customized offering for corporates clients, and participation in exhibitions and events to educate client base and provide demonstrations are among the primary business strategies practiced within the tethered drone market.

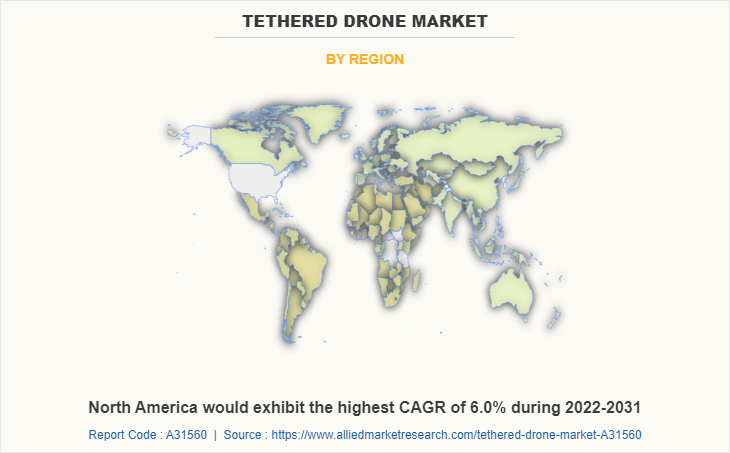

Among the analyzed regions, North America is the highest revenue contributor, followed by Europe, Asia-Pacific and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to grow at a suitable CAGR during the forecast period, due to the increased application of drones in different industries across the region.

The key players operating in the tethered drone market are Acecore Technologies, Comsovereign, Elistair INC, Flyfocus, Fotokite, Hoverfly Technologies, Novadem, Sky-Drones Technologies Ltd., Teledyne Flir LLC and Yuneec Holding Ltd.

the global tethered drone market was valued at $257.3 million in 2021, and is projected to reach $404.9 million by 2031, registering a CAGR of 4.9% from 2022 to 2031

North America is the largest regional market for tethered drone

Search And Rescue, Telemetry And Communication is the leading application of tethered drone market

Introduction of tethered station are the upcoming trends of tethered drone market in the world

Loading Table Of Content...