Thermal Interface Material Market Research, 2031

The global thermal interface material market size was valued at $4.7 billion in 2021, and is projected to reach $10.8 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Report Key Highlighters:

- The thermal interface material market forecast has been analyzed in both value and volume. The value of the market is analyzed in millions.

- Global thermal interface material market report is fragmented in nature with many players such as Laird Technologies Inc., DuPont, Honeywell International Inc. (Honeywell), Henkel Corporation, Zalman, 3M, Indium Corporation, Wakefield Thermal Solutions, Inc., Parker-Hannifin Corporation, and Momentive. Also tracked key strategies such as product launches and business expansion of various manufacturers of thermal interface material.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of thermal interface material to understand the market trends, growth factors, pricing, and key players competitive strategies.

Thermal interface materials are a group of thermal management products that are applied between two interface surfaces or components in order to improve the thermal coupling. Thermal greases (thermal compounds/thermal paste) are silicone or hydrocarbon containing thermal interface materials that are used to eliminate microscopic air pockets. Thermal tapes or thermal adhesive tapes are types of thermal interface materials with adhesive on one or both surfaces. In addition, use of pressure-sensitive adhesive on the thermal tape surface/surfaces eases the application.

Gap fillers are a type of thermal interface materials that are used to fill large gaps or voids present between heat generating and dissipating surfaces. Thermal interface phase change material tends to soften under melting temperature or upon reaching component operating temperature. Thus, with additional application of clamp pressure, these phase change materials conform precisely over mating surfaces and offer maximum heat dissipating characteristic.

Thermal interface phase change materials are used widely for high heat dissipation electronic applications across aerospace & military, consumer electronics, automotive, and industrial end-use industries. Phase change materials are used as an alternative over thermal greases. Traditionally, thermal greases are used as thermal interface material between power devices and their respective heat sinks.

However, high heat dispensable characteristics of thermal interface phase change material make it prominent TIM is the key market trend. Non-thixotropic characteristic of phase change material allows easy handling and application process during high volume electronic production drives the demand of the global thermal interface material market. Thermal interface phase change material is capable of completely filling the voids and eliminating air gaps. In addition, these thermal interface materials are proven to displace trapped air between electronic components that are dissipating power. Use of phase change materials for void filling improvises heat sink performance and enhances electronic component reliability.

These are the major growth factors. Moreover, phase change materials tend to melt after reaching elevated temperature and form minimum bond-line thickness (MBLT) between the voids or surfaces. This further ensures proper thermal management between two electronic surfaces. Formation of MBLT results in zero thermal contact resistance owing to minimal thermal resistance path. All these factors are extremely important and considerable factors for using thermal interface material in advanced electronic components. These factors are considered to drive the demand of the global thermal interface material market.

However, there are certain limitations associated with the use of thermal interface materials across pre-defined applications. For instance, thermal pads are used to fill the large voids between heat sink and its components. However, the production process of thermal pads intended to be used across miniature devices is restricted. In addition, high costs associated with use of thermal pad across most demanding applications hampers the market growth. On the other hand, thermal grease requires advanced production equipment in order to maintain coating thickness. High coating thickness of thermal grease will reduce thermal conductivity and thus hamper the heat dissipation. In addition, the thickness of thermal grease should not exceed 0.2 mm and thermal greases are not suitable to be used for large scale coating application.

Thus, key-players in the electronic industry tend to switch to alternative materials in such instances. Phase change materials are another popular thermal interface material used in the electronic and automotive industries. However, storage and transport of phase change thermal interface materials is a high-cost process. For instance, this thermal interface material tends to change its physical phase upon changing environmental conditions. Thus, it requires proper storage and ambient temperature in order to avoid the phase change. All these factors escalate the production cost; thus allowing consumers to choose alternatives over thermal interface materials, which hampers the market growth.

Conversely, proper thermal exchange between computer processor such as integrated heat spreader (IHS) and the fan-heatsink is crucial to run the computer components effectively. Thermal interface materials allow effective thermal transfer between integrated heat spreader (IHS) and the fan-heatsink in computer systems. In addition, use of processors in computers without any thermal compound or thermal interface material leads to damaged compressor. Computer system efficiency depends on the performance of heat sink.

Thermal interface materials such as thermal paste and greases are used to fill the microscopic void present between computer's CPU and heat sink. This in turn allows cooling capability of heat sink that further allows smooth CPU running is anticipated to offer new growth opportunities. In addition, thermal management plays a vital role in the telecommunication industry. The telecom industry uses different and advanced high-power electronic components. These electronic components require use of thermal interface materials for improved operation of the components and to extend the reliability of the telecom systems. In addition, several key-players in the thermal interface materials are launching innovative products that are intended to be used in the telecom industry.

For instance, Henkel launched one-part high thermal conductivity dispensable thermal interface gel that is sold under the trade name of BERGQUIST LIQUI FORM TLF 10000. The thermal interface gel is used to fill the voids present in the high-power telecommunication components. Technological development in the telecommunication industry has diversified the use of 5G telecom infrastructure equipment such as routers & servers and microchips such as ASICs and FPGAs. These advanced servers, routers, and microchips need proper thermal interface materials for heat dissipation. Growing demand for fast and swift data processing in the telecommunication sector demands for advanced thermal interface materials for thermal management. All these factors are driving the demand for thermal interface materials across telecom application thereby expected to offer lucrative growth opportunities during the forecast period.

Technological development in the telecommunication industry has diversified the use of 5G telecom infrastructure equipment such as routers & servers and microchips such as ASICs and FPGAs. These advanced servers, routers, and microchips need proper thermal interface materials for heat dissipation. Growing demand for fast and swift data processing in telecommunication sector demands for advanced thermal interface materials for thermal management. All these factors are driving the demand for thermal interface materials across telecom applications. Medical devices use different semiconductors that act as source of heat sinks. For instance, graphics processors, integrated circuits (ICs) for computing, power semiconductors, RF power devices, and others. These semiconductor heat sinks must operate efficiently in order to run medical devices such as surgical lamps, operating theater lighting fixtures, CT scanners, and surgical laser systems. Diverse portfolio of thermal interface materials is employed in a complex medical electronics system. In addition, thermal design factor plays an important role in medical imaging and surgical devices.

Growing demand for thermal interface materials in medical devices and electronics

Thus, thermal interface materials are embedded within the medical imaging devices, surgical devices, and other CT scanners for allowing proper heat dissipation in the heat sinks that are attached to these medical devices is the key market trend. Gap filling thermal interface materials are used to fill the large voids present on the surface of graphics processors, integrated circuits (ICs), and RF power devices. Technological development, population growth, and increasing consumer trend toward the use of advanced technologies for treatment has augmented the need for advanced medical devices and electronic equipment.

In order to comply with the ongoing technological trend, key-players in the medical electronics and devices are producing small yet powerful devices. However, these small devices need proper heat transfer and thermal management products. Key-players in the thermal interface materials are partnering with medical device manufacturers in order to offer the best suited thermal interface materials for electronic devices. For instance, Boyd, a leading player in thermal management products has been in the market for over 50 years and is continually working along with the medical devices manufacturers for supply of required thermal interface materials. All these factors have escalated the global demand of the thermal interface material market.

The thermal interface material market is segmented on the basis of type, application, and region. By type, the market is divided into greases & adhesives, tapes & films, gap filler metallic TIMs, phase change materials, and others. The applications covered in the report include computers, telecom, medical devices, industrial machinery, consumer durables, and automobile electronics. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Key players in thermal interface material industry include Laird Technologies Inc., DuPont, Honeywell International Inc. (Honeywell), Henkel Corporation, Zalman, 3M, Indium Corporation, Wakefield Thermal Solutions, Inc., Parker-Hannifin Corporation, and Momentive.

On the basis of type, the global market is divided into greases & adhesives, tapes & films, gap fillers metallic TIMs, phase change materials, and others. The greases & adhesives segment accounted for 31% thermal interface material market share in 2021 and is expected to maintain its dominance during the forecast period. Combination of conductive filler and silicone-free thermal greases are gaining importance across the electronic sector, as this type of thermal grease offers improved thermal management.

Thermal grease tends to spread out as a thin layer after application across flat surfaces. Formation of thin layers over two electronic flat surfaces ensure minimal thermal resistance between the applied surface that further offers proper thermal management. In addition, use of mounting hardware and spring forces during application of thermal greases increases thermal management characteristics of the grease. High volume electronic production requires the use of consistent grease application. Use of thermal grease for high volume production with template screening controls distribution of applied thermal grease. All these factors have escalated the demand for thermal grease across the electronic end-use industry.

Adhesives or thermal conductive adhesives are formulated to offer proper thermal management in heat-generating components. In addition, this thermal interface material serves as a bonding product between two electronic parts. Thermally conductive adhesives are mainly used for facilitating thermal management and removing the use of space-restrictive mechanical fasteners. Strong bond between heat sinks and electronic components is crucial, as it reduces the use of screws and clips. Thermally conductive adhesives are strong adhesion products used for effective thermal management and adhesion of electronic components is the key market trend.

Pad, liquid, and laminates are different thermal conductive adhesive forms available in the market. Adhesive thermal interface material is proven to offer reliable, long-lasting bonding capability, and effective heat dissipation in electronic devices, which drives the demand of the global market.

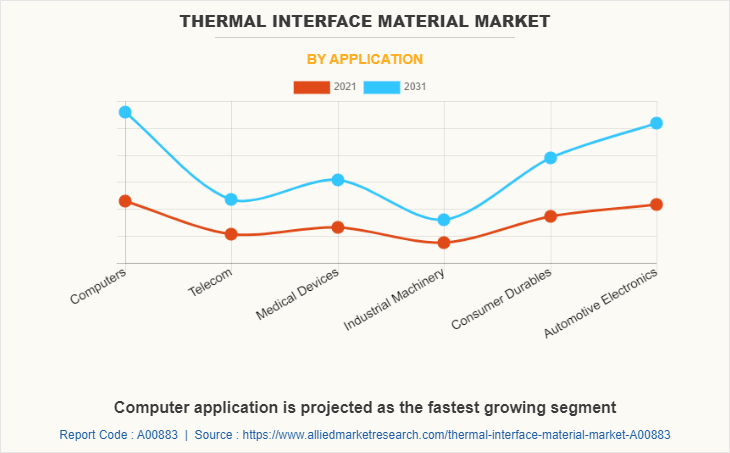

By application, it is divided into computers, telecom, medical devices, industrial machinery, consumer durables, and automotive electronics. Computer applications accounted for the largest revenue share in the thermal interface material market in 2021. Technological development has led to the development of high-power computers with minimalistic weight and design. However, constrained package area for computer components increases the risk of thermal management. Thus, in order to overcome this problem, advanced thermal interface materials are being used for packaging of processors.

Factors such as low thermal impedance, high thermal conductivity, improved conformability, and high adhesion strength make thermal grease a crucial thermal interface material in computers. All these factors are driving the demand for thermal interface materials in computer applications. Moreover, thermal grease and paste removes heat from computer semiconductor junction to ambient environment or heat sinks. Thus, the demand and use of thermal interface materials across advanced PCs for proper thermal management is anticipated to offer new growth opportunities.

Sometimes the operating temperature of the embedded PCs tends to be more than the expected operating temperature, which further leads to performance loss, components failure, and associated downtime cost. Thus, such PCs require use of advanced thermal management materials for ensuring proper working and high performance. All these factors are driving the demand of the global market.

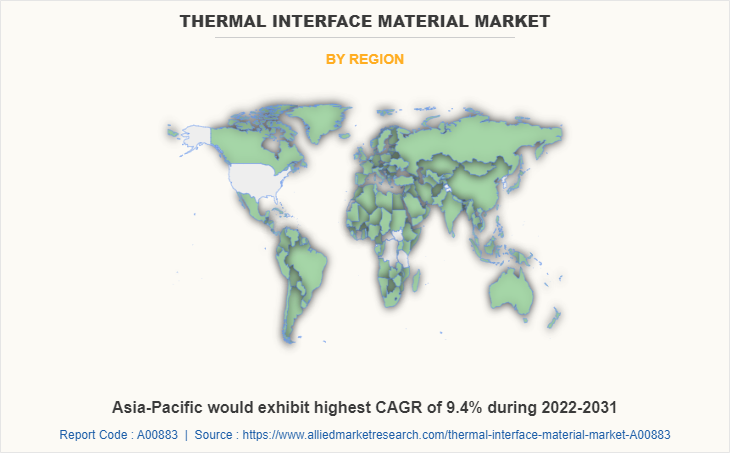

On the basis of region, Asia-Pacific accounted for 49% thermal interface material market share in 2021 and is expected to maintain its dominance during the forecast period. Consumer durable products such as electronic products use processors or batteries. These processors or batteries tend to generate heat and thermal management is important in these consumer electronic products.

Other consumer durable wearables also require thermal management for assuring reliable functioning of the products. Asia-Pacific region is a leading consumer and producer of consumer durable electronic goods, which has escalated the demand of thermal interface materials. Factors such as shifting consumer preferences and demographic factors have further escalated the demand for electronic products across Asia-Pacific.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the thermal interface material market analysis from 2021 to 2031 to identify the prevailing thermal interface material market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the thermal interface material market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global thermal interface material market trends, key players, market segments, application areas, and market growth strategies.

Thermal Interface Material Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 10.8 billion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 256 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Parker Hannifin Corporation, Laird Technologies Inc., Henkel Corporation, Indium Corporation, Momentive, Wakefield Thermal, Inc., DuPont, Zalman, 3M, Honeywell International Inc. |

| Other Key Market Players | Fujipoly, Bergquist Company, SIBELCO, Shin-Etsu, SEMIKRON, Linseis GmbH, DuPont, Dycotec Materials Ltd, KraFAB, Advanced Thermal Solutions, Inc. |

Analyst Review

The thermal interface material market is expected to exhibit high growth potential. Electronic device packaging is challenging owing to growing power level consumption in miniature electronic devices. Furthermore, in order to comply with technological advancement, electronic device manufacturers are inclined toward reducing device size. However, reducing the electronic device size further requires use of proper thermal interface material for allowing effective heat transfer. Thermal interface materials are proven to offer reliable heat transfer between electronic integrated circuits and heat spreaders.

Thermal interface materials are generally used between heat generating devices or components such as microprocessors, photonic ICs, and others. Removal or transfer of heat from miniature semiconductors used in electronic devices is utmost important for ensuring reliable operation of the device and improve longevity of the electronic components. Microscopic surface imprecision and non-planarity of integrated circuits or heat spreaders used in electronic devices hamper heat dissipation capacity. In addition, formation of proper thermal contact between surfaces is hampered owing to surface imprecision. All these factors will hamper thermal conductivity thereby demanding the use of thermal interface materials.

Thermal management is a sizeable factor considered during automotive electronics production. Some of the electronic components are located near the internal combustion engines. Thus, the heat generated by IC engine and ambient temperature tends to put forward heat dissipation problems on the electronic components. Thermal interface materials such as thermal pads and phase change materials are widely used in automotive electronics. Advanced automotive cars are equipped with technologically developed electronics such advanced driver assistance systems (ADAS) and other climate control electronics.

Modern cars, buses, and passenger vehicles include high functionality and development of hybrid cars have pushed the need for thermal management. Hybrid cars have electric batteries that are packed into the car. However, it further increases power density consumption. Power density consumption is directly related to generation of high heat. Thus, thermal interface materials are being used and implemented in automotive electronics and batteries for thermal management.

Growing demand for thermal interface materials for miniature device packaging and automotive regulations such as implementation of Euro 6 standard, has further augmented the demand for high power density automotive electronics and ECU. This technological advancement has created new challenges for thermal management. Generation of heat across these ECU and other electronic components coupled with presence of ambient temperature of the automotive engine components degrades system reliability and thus make the electronic component susceptible to thermal degradation. Several studies have been conducted and demonstrated that use of thermal interface materials in electronic components help to achieve high heat conduction under harsh environmental and working conditions are the upcoming trends of thermal interface material market in the world

Computer is the leading application of thermal interface material

Asia-Pacific is the largest regional market for thermal interface material

The global thermal interface material market was valued at $4.7 billion in 2021, and is projected to reach $10.8 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Parker Hannifin Corporation, DuPont, and Henkel Corporation are the top companies to hold the market share in thermal interface material

Loading Table Of Content...