Thermal Paper Market Research, 2031

The global thermal paper market size was valued at $3.4 billion in 2021 and is projected to reach $5.7 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031.

Thermal paper is a special paper type that has an invisible chemical coating on its surface. The heat from the print head activates the chemical coating on the paper as it passes through a thermal printer, creating a high-definition image. This procedure, in contrast to ordinary paper, employs heat to initiate a chemical reaction within the paper itself. As a result, it is easier to use than other solutions because it does not require a ribbon or toner. The thermal paper's coating, which turns black when heated, allows thermal energy to be transferred directly to the paper to create the image. Information can be recorded on thermal paper without the use of an ink ribbon, toner, or ink cartridge. Small, portable thermal printers that do not require a lot of maintenance are used for thermal printing.

The primary feature of thermal paper is thermal printing. This is why it is crucial to consider the thermal printing quality and image stability in addition to standard paper characteristics like thickness, grammage, and strength. In addition, the thermal paper must be pre-printable using traditional printing techniques like offset or flexography.

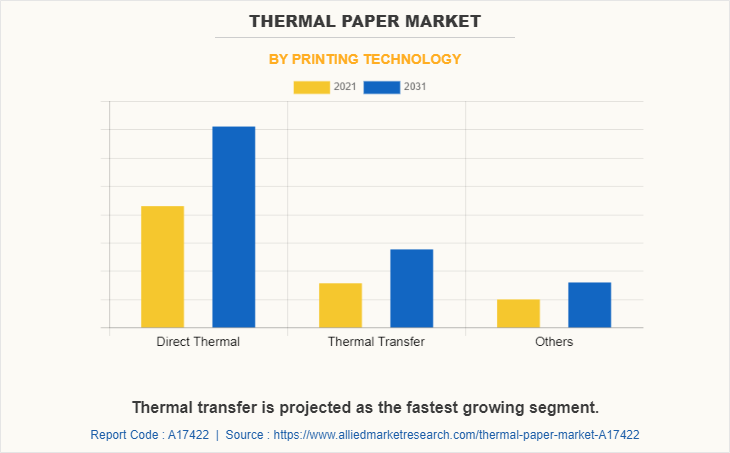

Direct thermal printing and thermal transfer are the two types of thermal printing. Each technique makes use of a thermal print head that warms the surface being marked. Thermal transfer printing employs a heated ribbon to create durable, long-lasting images on a range of materials, as opposed to direct thermal printing, which uses chemically prepared, heat-sensitive media that darkens when it passes under the thermal print head.

Overall, thermal label printers are the best choice for printing barcode labels since they deliver precise, high-quality pictures with sharp edges. The precise bar widths needed for successful barcode printing and scanning are produced by thermal transfer printers, which are engineered to print with close tolerances. At the same print rates and resolutions, each technology is capable of creating one- and two-dimensional barcode symbologies, images, and text.

The increased use of POS terminals in warehouses and retail enterprises is anticipated to fuel the need for thermal paper. Improved government policies and increased domestic consumption of pharmaceutical, food, and beverage products in the South Asian region are predicted to create a favorable business environment for thermal paper market expansion. The existence of paper manufacturers in countries like China is expected to positively impact the thermal paper industry growth. However, the increasing digitalization of the transaction process is hindering the demand for thermal paper for printing at POS terminals. However, rising e-commerce usage is expected to boost the demand for thermal paper in the form of labels and tags.

Expanding retail chains and outlets in emerging markets like China and India is anticipated to have a positive effect on POS terminal usage and will accelerate thermal paper market growth. The usage of thermal paper for packaging and labeling purposes is also anticipated to grow as a result of government measures to support the food and pharmaceutical industries in emerging economies. In addition, the presence of a large number of raw material suppliers in offering base paper to thermal paper manufacturers is expected to have a positive impact on the thermal paper market. Responsible sourcing and proactive supply chain adjustments are two ways that industry participants are constantly working to enhance their procurement processes. When the sourcing requirements are defined, the contract is drafted, and during the tendering process, procurement initiatives are reviewed and resolved by a dedicated team. In addition, for the pre-qualification procedure, industry players have begun obtaining information from different suppliers, such as financial soundness and carbon emissions.

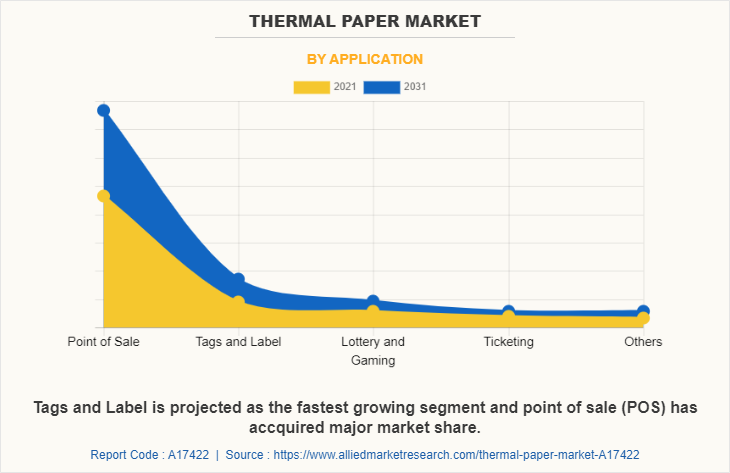

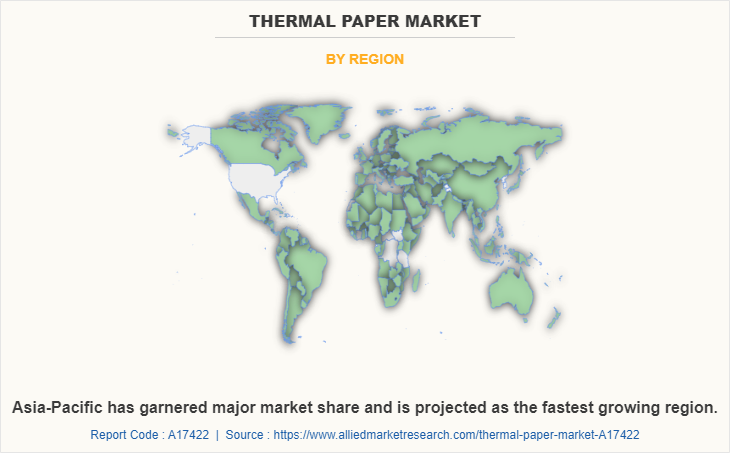

The thermal papers market is segmented into printing technology, application, and region. Depending on printing technology, the market is segmented into direct transfer and thermal transfer. On the basis of application, it is categorized into point of sale (POS), tags & labels, lottery & gaming, ticketing, and others. Region-wise, the thermal paper market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The direct thermal segment accounted for the largest share i.e., 62.68% due to increasing demand from food and beverages industry. The thermal Transfer segment is the fastest growing segment, growing at around 59.% CAGR over the forecasted period, this is because it produces crisp, high-definition text, graphics, and barcodes for optimal readability and scanning.

The point-of-sale segment accounted for the largest share i.e., 67.99% because of increased contactless payment signs on ATMs and credit cards. The tags and Label segment is the fastest growing segment, growing around 6.7% CAGR over the forecasted period. This is due to increased demand for detailed labeling in the pharmaceutical industry.

Asia-Pacific contributed 49.8% market share in 2021 and is projected to grow at a CAGR of 5.9% during the forecast period. Owing to the increased demand from the pharmaceutical and food and beverages industries.

The major players operating in the global thermal papers market are Appvion, Domtar Corporation, Hansol Paper Co. Ltd., Henan Province JiangHe Paper Co. Ltd., Jujo Thermal Ltd, Kanzaki Specialty Papers Inc, Koehler Paper, Lecta, Mitsubishi Paper Mills Limited, Nakagawa Manufacturing (USA), Inc, Oji Holdings Corporation, Panda Paper Roll, Rotolificio Bergamasco Srl, Thermal Solutions International Inc., and Twin Rivers Paper Company. Other players operating in the thermal papers market are Avery Dennison, Ricoh Company, Ltd., and Siam Paper.

IMPACT OF COVID-19 ON THE GLOBAL THERMAL PAPER MARKET

Malls, shopping centers, and other businesses have to shut down as a result of partial or whole lockdowns imposed by governments globally as a result of the rapid spread of COVID-19, among various nations. The market for thermal paper has expanded as a result of the expanding instant billing trend in malls and shopping centers. Prior to the COVID-19 pandemic, this market had been on the decline. Nonetheless, demand in the pharmaceutical industries, healthcare sectors, and packaging sectors grew fast during the pandemic, resulting in an increase in the thermal paper market price.

Due to the expansion of the retail sector in developing nations like China and India, the POS category has the biggest market share. In addition, the rising number of supermarkets in advanced economies is anticipated to accelerate the development of POS terminal applications. Many nations are still in lockdown as a result of COVID-19, and businesses are coming up with new strategies to accommodate the rising demand for e-commerce. The pandemic has benefited the e-commerce sector since it has necessitated the implementation of preventative measures like social segregation. The market expansion for thermal paper is hampered by these digital transactions.

With its great durability, thermal paper is being used more frequently to print transaction receipts, which is driving the market. The hospital billing application makes extensive use of these receipts. Nevertheless, online transactions are preferable to prevent the virus from spreading.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2021 to 2031 to identify the prevailing thermal paper market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the thermal paper market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global thermal paper market report.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global thermal paper market trends, key players, market segments, application areas, and market growth strategies.

Thermal Paper Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 5.7 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 285 |

| By Application |

|

| By Printing Technology |

|

| By Region |

|

| Key Market Players | Appvion, Domtar Corporation, Oji Holdings Corporation, Kanzaki Specialty Papers Inc, Panda Paper Roll, Koehler Paper, Twin Rivers Paper Company, Rotolificio Bergamasco Srl, Mitsubishi Paper Mills Limited, Henan Province JiangHe Paper Co. Ltd., Lecta, Hansol Paper Co. Ltd., Nakagawa Manufacturing, Jujo Thermal Ltd, Thermal Solutions International Inc. |

Analyst Review

According to the perspective of the CXOs of leading companies, the emergence of digitization in growing regions, such as India has increased the demand for point-of-sale (POS) systems and, consequently, the market demand for thermal paper. In addition, the increasing significance of product labeling against counterfeiting has had a favorable effect on the thermal paper market. Furthermore, thermal paper offers outstanding coloring capabilities at fast rates and a highly durable surface that is resistant to fading. This capability enables the use of printed bar codes in point-of-sale food labeling and other applications throughout their manufacturing and transportation, which has increased the global need for thermal paper.

The increased use of POS terminals in warehouses and retail enterprises is the major factor driving the demand for the thermal paper market.

Asia-Pacific is the largest regional market for thermal paper.

The global thermal paper market size was valued at $3.4 billion in 2021 and is projected to reach $5.7 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031.

Point of sale is the leading application of the thermal paper market.

Hansol Paper Co. Ltd., Koehler Paper, and Kanzaki Specialty Papers Inc are some of the top companies to hold the market share in thermal paper.

Increasing use of thermal paper in point of sale and ticketing are the upcoming trends in the thermal paper market in the world.

COVID-19 had a negative impact on the thermal paper market owing to the lockdown imposed by various governments as many of the malls, shopping centers were closed.

Loading Table Of Content...