Threat Intelligence In BFSI Market Research, 2031

The global threat intelligence in BFSI market size was valued at $4.3 billion in 2021, and is projected to reach $29.8 billion by 2031, growing at a CAGR of 21.5% from 2022 to 2031.

Threat intelligence is data on a current or potential attack that poses a threat to a particular company or organization that has been analyzed, refined, and organized. Organizations can assess the seriousness of potential threats such as sophisticated persistent exploits or zero-day attacks with the help of threat intelligence. Furthermore, with the widespread adoption of cloud platforms, IoT, and other networking technologies, enterprises are becoming increasingly vulnerable to major cybersecurity breaches. In addition, businesses in the BFSI industry should be encouraged to employ threat intelligence systems to enhance their capabilities, owing to fast evolving cybercrime scenario.

Rise in incidences of security breaches and cybercrimes and increase in demand for professional and managed services across BFSI led to the increase in the use of threat intelligence in BFSI sector. Moreover, the productivity of businesses is being hampered by cyber threats, causing damage to sensitive data which results in organization’s investment in threat intelligence to protect their digital assets from cyber threats. Therefore, rise in incidences of cybercrimes across BFSI drive the growth of the market. In addition, rise in the evolution of next-generation security solutions propels growth. However, a low data security budget & high installation cost of the solution is expected to hamper the market expansion. On the contrary, the rise in focus of organizations in the BFSI sector to include threat intelligence across the developed economies is expected to provide lucrative opportunities to the market in the upcoming years.

The threat intelligence in bfsi market is segmented on the basis of component, deployment mode, enterprise size, application, end user, and region. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. By application, the market is divided into anti-money laundering and fraud management, risk and compliance management, identity management, and others. By end user, it is divided into banks, insurance companies, and others. By region, it is analyzed across North-America, Europe, Asia-Pacific, and LAMEA.

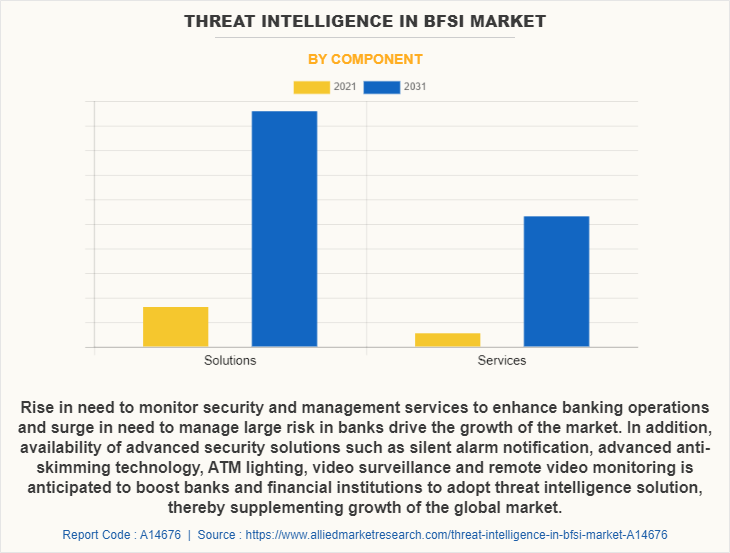

Based on component, the solution segment attained the highest growth in 2021. This is attributed to the rise in need to monitor security and management services to enhance banking operations and surge in need to manage large risk in banks drive growth of the market. In addition, availability of advanced security solutions such as silent alarm notification, advanced anti-skimming technology, ATM lighting, video surveillance and remote video monitoring is anticipated to boost banks and financial institutions to adopt threat intelligence solution, thereby supplementing growth of the global market.

Based on region, North America attained the highest growth in 2021. This is attributed to the fact that increase in awareness of threat intelligence solutions among banks & financial institutions and surge in partnership of companies providing technologies with major banks & financial institutions in this region notably contribute toward the market growth. Furthermore, surge in demand for threat intelligence solutions to handle business contingencies and emergencies such as cyber-attacks & data thefts among companies operating in the BFSI sector act as the key driving forces of the North America threat intelligence in BFSI industry.

The report focuses on growth prospects, restraints, and trends of the threat intelligence in BFSI market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the threat intelligence in BFSI market.

The report profiles of key players operating in the threat intelligence in BFSI market analysis such as Check Point Software Technologies Ltd., Cisco Systems, Inc., DXC Technology Company, Fortinet, Inc., IBM Corporation, Juniper Networks, Inc., McAfee, LLC, Trend Micro Incorporated, VMware, Inc. and Webroot Inc. These players have adopted various strategies to increase their market penet/ration and strengthen their position in the threat intelligence in BFSI market.

COVID-19 impact analysis

Since, due to the tremendous increase in adoption of digital banking during pandemic, which involve managing customer data, BFSI security providers offered AI cyber security platforms such as cyber threat intelligence solutions, ideally suited for the digital banking industry to stay protected from the threat or cybercrimes. This, as a result has become one of the major growth factors for the growth of the threat intelligence in BFSI market during the pandemic situation. Furthermore, the COVID-19 pandemic outbreak has created disruption in many industries, including the threat intelligence in BFSI market. Many private, as well as government organizations, had allowed their employees to work from home amid the lockdowns, which has created need for monitoring the network security proactively, as people were remotely connected consuming enterprise resources and sharing documents using collaboration tools. As a result, businesses were increasingly adopting security solutions to manage such security risks in the new home-working environment. Thus, the COVID-19 had a positive impact on the threat intelligence in BFSI market.

Top impacting factors

Surge in incidences of security breach & cybercrimes

Banks, financial institutions, and insurance sectors are in a constant threat such as data thefts, cyber-attacks, and others. To safeguard the digital assets from online attacks, organizations are spending money on cybersecurity. Threat monitoring and cyber protection are essential in evolving threat environment. The cybercrimes & data breaches cause serious financial losses for people, companies, and governments. Furthermore, cyberattacks, which are harming sensitive data and essential IT infrastructure, are also hindering firms' productivity. In addition, there is a rise in the frequency of cybercrimes due to rapid expansion of the threat intelligence in BFSI industry into digital transactions in various nations. This, as a result, increases the number of security breaches and cybercrimes. Therefore, demand & adoption of security products & services continues to rise in the market, owing to rise in numerous threats & attacks across the BFSI sector. Therefore, these factors as a result have become major reasons for the growth of the threat intelligence in BFSI market opportunity.

Increased demand for professional & managed services across BFSI

The cybercriminals and hackers are taking advantage of employees' due to the lack of awareness on security policies among employees. Furthermore, it is a huge task to enable employees to share the same thought process regarding cybersecurity policies, though there are numerous setups in place, including a workforce to operate the security operations centres (SOCs) for businesses. In addition, demand for security of data due to cybercrimes & threats continues to rise in the BFSI sector, with the increase in digitalization. Moreover, banks, financial institutions, and other financing firms are rapidly switching toward digitalized business operations, thus, adoption & implementation of security solutions & services has increased tremendously. Therefore, the threat intelligence in BFSI market provides cyber-security services to protect the BFSI sector from such threat issues. This is one of the major factors that propels the threat intelligence in BFSI market growth.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the threat intelligence in BFSI market share from 2021 to 2031 to identify the prevailing threat intelligence in BFSI market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities in threat intelligence in BFSI market forecast.

- In-depth analysis of the threat intelligence in BFSI market trends assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global threat intelligence in BFSI market outlook.

The report includes the analysis of the regional as well as global threat intelligence in BFSI market trends, key players, market segments, application areas, and market growth strategies.

Threat Intelligence in BFSI Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprises Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | VMware, Inc., IBM, Trend Micro Inc, McAfee, ThreatConnect, Inc., Cisco Systems Inc., Fortinet Inc., Broadcom Inc., AT&T Inc., DXC Technology |

Analyst Review

Increase in risks in the BFSI industry cybercriminals are constantly attacking the financial sector—one of the most important industry sectors. Financial institutions that collect and handle consumer data, especially those that provide financial services to retail and commercial customers, are a clear target. According to VMware’s Modern Bank Heists research, there was a huge increase in cyberattacks on financial sector organizations since the COVID-19 pandemic. Among others, many DDoS attacks were among these attacks, which are typically accompanied by ransomware demands and extortion. As a result, 39% of financial industry executives consider the overall network security threat to BFSI sector organizations. The rush to adopt new technologies has resulted in various security risks while the global financial services sector is well-versed in identifying methods to increase efficiency and meet user demand.

Microsoft, a company that develops and licenses consumer and enterprise software known for its windows operating systems and office productivity suite has launched two new security products that include Microsoft defender threat intelligence and Microsoft defender external attack surface management, to provide organizations with a deeper context into threat actor activity and help to lock down their infrastructure and reduce the overall attack surface. The Microsoft defender threat intelligence maps the internet every day, providing security teams with the necessary information to understand adversaries and attack techniques. Furthermore, the customers can access a library of raw threat intelligence detailing adversaries by name, correlating the tools, tactics, and procedures (TTPs), and can see active updates within the portal as new information is distilled from Microsoft’s security signals and experts. Moreover, this threat data reveals the techniques used by attackers and threat groups and helps security teams in finding, removing, and blocking hidden adversary tools within the organization. Some of the key players profiled in the report include Check Point Software Technologies Ltd., Cisco Systems, Inc., DXC Technology Company, Fortinet, Inc., IBM Corporation, Juniper Networks, Inc., McAfee, LLC, Trend Micro Incorporated, VMware, Inc., and Webroot Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The global threat intelligence in BFSI market size was valued at $4,300.45 million in 2021, and is projected to reach $29, 759.42 million by 2031, growing at a CAGR of 21.5% from 2022 to 2031.

Cisco Systems, Inc., DXC Technology Company, Fortinet, Inc., IBM Corporation, and Juniper Networks, Inc. are the leading players in threat intelligence in BFSI market.

The threat intelligence in BFSI market is segmented on the basis of component, deployment mode, enterprise size, application, end user, and region. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises. By application, the market is divided into anti-money laundering and fraud management, risk and compliance management, identity management, and others. By end user, it is divided into banks, insurance companies, and others. By region, it is analyzed across North-America, Europe, Asia-Pacific, and LAMEA.

By application, the market is divided into anti-money laundering and fraud management, risk and compliance management, identity management, and others.

Loading Table Of Content...