Threat Intelligence Market Overview

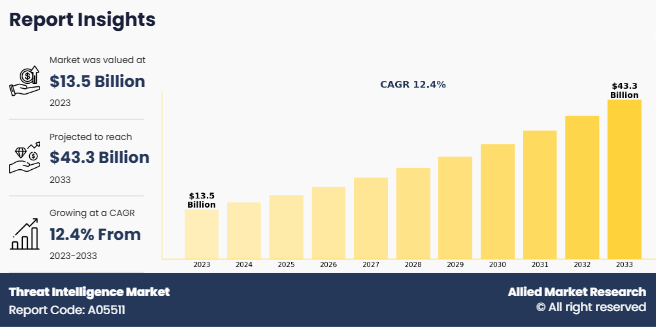

The global threat intelligence market size was valued at USD 13.5 billion in 2023, and is projected to reach USD 43.3 billion by 2033, growing at a CAGR of 12.4% from 2023 to 2033.

Growing emphasis on remote work environments across regions is one of the major driving factors for the threat intelligence services market. With a substantial portion of the global workforce operating in non-traditional office environments, organizations are faced with heightened cyber security intelligence in security intelligence market. The presence of remote employees that gain access to corporate networks and sensitive information from different locations and devices leads to vulnerabilities that malicious individuals exploit. Thus, there is a growing demand for real-time identification, monitoring, and response capabilities provided by threat intelligence solutions. These solutions in threat intelligence solutions market enable organizations to safeguard remote access points, detect and mitigate threats aimed at remote workers, and ensure secure connectivity, making them essential in the current landscape of remote work, fueling the growth of the global threat intelligence market.

Introduction

Threat intelligence refers to the process of collecting, analyzing, and disseminating information concerning current and emerging cybersecurity threats, vulnerabilities, and dangers. This data is acquired from various sources including open-source data, government agencies, cybersecurity firms, and internal security records. The primary objective of threat intelligence is to provide organizations with practical insights into potential threats and attacks, enabling them to proactively identify and mitigate cyber risks. It assists organizations in staying informed about the evolving threat landscape, understanding the tactics and techniques of threat actors, and making informed decisions to strengthen their cybersecurity defenses and protect critical assets and data. It plays a crucial role in enhancing an organization's ability to detect, respond to, and recover from cyber incidents

The threat intelligence market is expected to offer numerous opportunities for new players in the market. Rise in the adoption of cloud technology has led to increase in the demand for cloud-based threat intelligence solutions. These platforms enable organizations to monitor, analyze, and respond to threats in real-time, offering scalable and accessible security measures. This creates an opportunity to develop or enhance cloud-based threat intelligence platforms that integrate security alerts, threat analytics, and automated response mechanisms, ensuring robust protection against evolving cyber threats.

In addition, threat intelligence as a service (TIaaS) is emerging as a cost-effective solution for small and medium-sized enterprises (SMEs) that lack the resources to maintain extensive in-house security teams. The surge in the demand for managed threat intelligence services provides these organizations with access to actionable intelligence, expert analysis, and enhanced detection capabilities. This presents a significant opportunity to develop subscription-based threat intelligence services that offer affordable, scalable solutions tailored for SMEs, emphasizing ease of use and seamless integration. These factors are expected to offer remunerative opportunities for the market growth.

For instance, on October 30, 2024, Filigran partnered with Intrinsec to enhance cyber intelligence capabilities. This collaboration includes an enriched version of Intrinsec’s flagship product, CTI Feeds, which now delivers a more extensive stream of indicators of compromise (IoCs). The partnership aims to bolster companies' threat intelligence capabilities and support the growth of the Threat Intelligence market. Additionally, they plan to offer a managed service around OpenCTI, providing a custom Threat Intelligence Program based on a SaaS-enriched Threat Intelligence Platform (TIP) and dedicated support.

Furthermore, there is upsurge in use of cybersecurity threat intelligence platforms (TIPs) within modern security infrastructures, as they streamline the collection, normalization, and distribution of threat intelligence across different security systems. By integrating threat data from various sources, both open and commercial, TIPs offer actionable insights to reduce risks. This creates an opportunity for threat intelligence platform market to improve TIP solutions that focus on compatibility, real-time data sharing, and easy integration with other cybersecurity tools like SIEM and SOAR systems.

Furthermore, the Governments are increasingly emphasizing on safeguarding national security from cyber espionage, cyber warfare, and terrorism, which present substantial national and geopolitical risks. Cyber threat intelligence is vital in helping governments anticipate and defend against these threats. As a result, there is a rising demand for threat intelligence solutions tailored to the specific needs of national security agencies, law enforcement, and defense organizations, focusing on the unique and ever-evolving challenges security intelligence market. These factors are expected to provide lucrative threat intelligence market opportunities for growth.

For instance, on March 20, 2025, Cloudflare expanded its threat intelligence offering with the launch of the Cloudforce One threat events platform. This new platform provides real-time intelligence on cyberattacks occurring across the Internet, leveraging telemetry from Cloudflare’s extensive global network. Cloudforce One helps security teams by offering a single view of ongoing attacks, enabling faster issue detection and response. It also provides personalized information tailored to specific environments, industries, or regions, enhancing the overall effectiveness of threat management.

Segment Review

The global threat intelligence market is segmented into component, application, deployment mode, enterprise size, industry vertical, and region. By component, the market is segmented into solutions and services. On the basis application, it is segmented into security information and event management, government, risk and compliance, and business continuity planning and management. By deployment mode, the threat intelligence market is segmented into on-premise, and cloud. By enterprise size, the market segmented into large enterprises, and SMEs. On the basis of industrial vertical, the market is segmented into IT and Telecom, BFSI, healthcare and life science, retail and e-commerce, manufacturing, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and Latin America, and Middle East Africa.

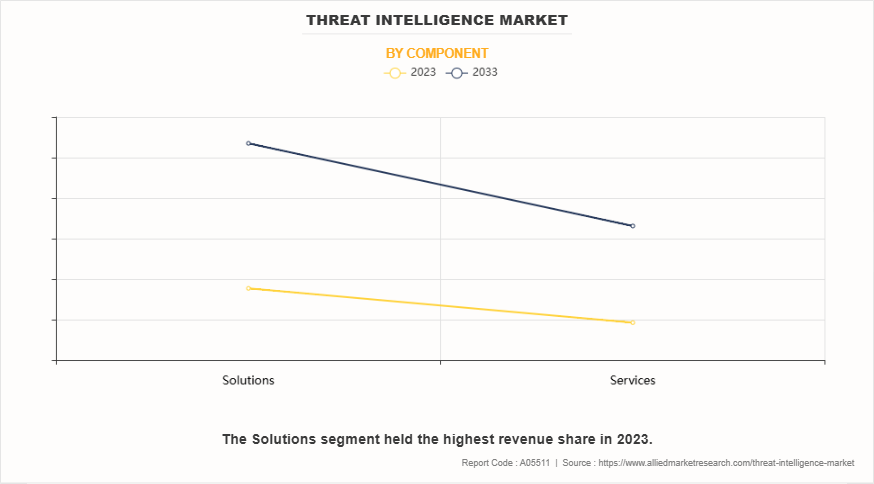

On the basis of component, the solutions segment acquired a major share in the threat intelligence market in 2023. This is attributed the growing demand for advanced security solutions to counter sophisticated cyber threats. Businesses increasingly rely on threat intelligence solutions for real-time data analysis, proactive threat detection, and effective incident response, which drives the segment growth. However, service segment is expected to register the highest CAGR during the threat intelligence market forecast period, owing to the rise in importance of protecting patient privacy and complying with regulatory standards such as HIPAA, the demand for threat intelligence solutions to monitor, detect, and respond to these threats is rapidly growing.

For instance, on August 21, 2024, Anomali has launched its AI-powered Security Operations Platform on Amazon Web Services (AWS) in Europe, specifically in Frankfurt, Germany. This strategic move allows organizations across Europe to access Anomali’s advanced, cloud-native big data solution locally. The platform leverages analytics, intelligence, automation, and AI to enhance visibility, threat detection, response, and cyber exposure management.

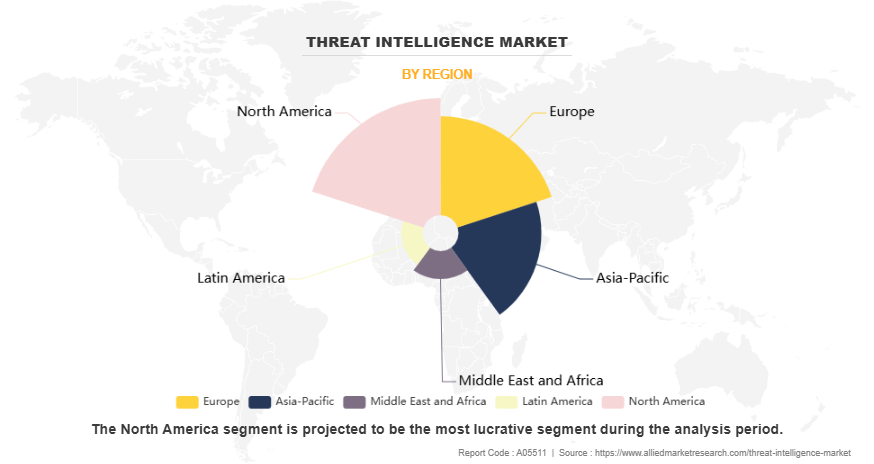

Region-wise, North America dominated the threat intelligence market share in 2023. This is attributed to the region's advanced technological infrastructure, high adoption of cybersecurity solutions, and the presence of leading market players. However, Middle East and Africa is expected to be the fastest-growing region during the forecast period. This is attributed to the rapid digital transformation, increasing internet penetration, and rising awareness of cyber security intelligence across the region in security intelligence market.

The report focuses on growth prospects, restraints, and analysis of the global threat intelligence market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global threat intelligence market.

Top Impacting Factors

Market Drivers

Rise in number of sophisticated cyberattacks

The threat intelligence market and threat intelligence services is experiencing substantial growth, primarily due to increase in the number of sophisticated cyberattacks. As cybercriminals enhance their ability to evade conventional security measures, organizations are increasingly relying on threat intelligence solutions to stay one step ahead. These solutions offer real-time insights into emerging threats and attack vectors, empowering organizations to proactively strengthen their defenses. Furthermore, the integration of artificial intelligence and machine learning within threat intelligence platforms facilitates the identification of intricate, previously unrecognized threats in threat intelligence platform market. Consequently, businesses are making investments in threat intelligence to mitigate risks, safeguard their sensitive data, and uphold customer trust.

For instance, in August 2024, Cyble partnered with Wipro Limited to strengthen enterprise cybersecurity risk management through AI-driven threat intelligence solutions. This partnership combines Cyble's patented AI systems and automation capabilities with Wipro's expertise in global security and compliance. Through the partnership, it offers security teams deeper insights, enabling more informed decision-making. By integrating Cyble’s AI and machine learning-driven platforms into Wipro’s cybersecurity frameworks, the partnership provides real-time threat intelligence, proactive attack surface management, and comprehensive risk assessments.

Moreover, rise in sophisticated cyberattacks is significantly driving the threat intelligence market demand. As cybercriminals develop more advanced tactics, organizations are adopting to threat intelligence solutions to proactively identify, analyze, and respond to emerging threats. These solutions help businesses enhance their security posture, minimize risks, and protect critical assets from evolving cyber threats in real-time. Therefore, rise in number of sophisticated cyberattacks is driving the threat intelligence market size.

Restraints

High cost associated with threat intelligence solutions

High cost associated with threat intelligence solutions presents a noteworthy hindrance in the threat intelligence market. Enterprises, especially small and medium-sized enterprises (SMEs), often face financial burdens when contemplating investment in such solutions. This heightened expense encompasses various factors, including charges for software licensing, hardware prerequisites, ongoing subscriptions for threat feeds, as well as the expenditure involved in recruiting or training competent professionals to effectively manage and utilize these solutions. Furthermore, there may be hidden costs linked to system integration and customization to cater to the distinct requirements of diverse organizations.

Furthermore, many organizations, particularly small and medium-sized enterprises (SMEs), face budget constraints that make it difficult to invest in advanced threat intelligence tools. These solutions often require significant financial resources for implementation, ongoing maintenance, and skilled personnel to manage them effectively. As a result, some businesses may opt for less comprehensive or manual security measures, limiting their ability to proactively detect and respond to cyber threats. This cost barrier slows the widespread adoption of threat intelligence solutions across industries. Therefore, high cost associated with threat intelligence solutions is hampering the threat intelligence market growth.

Opportunities

Favorable government initiatives and investments to strengthen security infrastructure

Favorable government initiatives have played a crucial role in strengthening the security infrastructure and driving the growth of the global threat intelligence market. Governments around the world have acknowledged the increasing cybersecurity threats posed by malicious actors, including state-sponsored hackers and cybercriminal organizations. As a result, they have launched various programs and policies aimed at improving national and critical infrastructure security. These initiatives often involve significant investments in threat intelligence solutions, promoting collaboration between the public and private sectors, and the development of cybersecurity regulations and standards.

Government initiatives have played a significant role in driving the threat intelligence market demand for threat intelligence solutions, as they actively promote the adoption of proactive cybersecurity strategies by organizations. An illustrative example of this is the establishment of cyber threat information sharing platforms by numerous governments, which enable organizations to exchange real-time threat data and gain valuable threat intelligence market insights. Furthermore, threat intelligence market growth has been further stimulated by the provision of incentives such as tax breaks or grants for businesses that invest in cybersecurity measures.

In addition, the enforcement of regulatory frameworks, such as the General Data Protection Regulation (GDPR) in the European Union, has compelled organizations to prioritize data security, resulting in an increased emphasis on the adoption of threat intelligence solutions to ensure compliance. Furthermore, the execution of governmental initiatives has led to the establishment of a robust network of cybersecurity startups and trailblazers, thus benefiting the international market for intelligence regarding potential dangers.

These emerging enterprises frequently obtain assistance from the government through research grants and partnerships, thus facilitating innovation and the advancement of cutting-edge technologies for the identification and analysis of threats. To summarize, constructive governmental initiatives have not only bolstered the security infrastructure, but have also made a noteworthy contribution to the expansion of the global threat intelligence market for intelligence on potential threats by heightening awareness, fostering collaboration, and promoting investments in cybersecurity solutions

Key Threat Intelligence Companies

The following are the leading companies in the threat intelligence market. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the threat intelligence industry.

Cisco Systems Inc.

McAfee

LLC

Broadcom

Juniper Networks, Inc.

CrowdStrike, Inc.

Palo Alto Networks, Inc.

IBM Corporation

Anomali, Inc.

Check Point Software Technologies Ltd.

Microsoft Corporation.

What are the Latest Developments in the Threat Intelligence Industry?

In October 2023, CrowdStrike, Inc. partnered with Box to enhance cloud security and protect enterprise data against cyber threats. This collaboration integrates Box's secure content management and collaboration capabilities with CrowdStrike's AI-powered Falcon platform, delivering advanced real-time access control and threat prevention. The partnership aims to safeguard cloud-stored content and help organizations prevent data breaches across diverse industries.

In August 2023, CrowdStrike, Inc. launched its Counter Adversary Operations initiative, combining the power of CrowdStrike Falcon Intelligence, Falcon OverWatch managed threat hunting teams, and trillions of real-time telemetry events from the AI-driven Falcon platform. This comprehensive approach aims to detect, disrupt, and neutralize advanced threats while increasing the operational costs for cyber adversaries.

In September 2023, Cisco Systems Inc. acquired Splunk and enhanced its threat intelligence solutions to help move organizations from threat detection and response to threat prediction and prevention.

In April 2023, Cisco Systems Inc. upgraded its threat intelligence solutions with Cisco's new XDR solution and the release of advanced features for Duo MFA to help organizations better protect the integrity of their entire IT ecosystem.

Current Market Trends

The threat intelligence market is expected to witness several noteworthy trends in the market. One of the significant trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML) with threat intelligence by automating and analyzing vast amounts of data and identifying new patterns of cyber threats. This enables quicker detection of malicious activities and reduces response times. Businesses and startups that harness AI and ML to enhance predictive threat intelligence, threat detection, and decision-making processes will lead the way in this rapidly evolving field. In addition, there is a growing trend toward the adoption of threat sharing platforms enabling organizations to collaborate and share threat intelligence, leading to stronger defenses and quicker identification of emerging threats. Industries such as banking financial services and insurance(BFSI), healthcare, and government are increasingly adopting these shared intelligence models. This has led to the development of platforms that facilitate real-time intelligence sharing between organizations, thereby boosting collaborative defense efforts.

For instance, on March 20, 2025, Anomali partnered with Consortium to enhance cybersecurity automation and risk reduction. This collaboration aims to provide organizations with advanced threat intelligence capabilities, enabling them to predict, detect, and respond to cyber threats more effectively. By combining expertise and technology, the partnership focuses on improving the speed and accuracy of threat detection, mitigating risks, and streamlining security operations for businesses and government agencies alike.

Another notable trend is the increase in use of connected devices (IoT) which has led to the surge in potential entry points for cyberattacks, making critical infrastructure such as energy, utilities, and transportation systems more vulnerable to cyber threats. This creates a high demand for threat intelligence services specifically tailored to IoT and critical infrastructure. Companies that develop specialized intelligence solutions to monitor and protect these environments will gain a significant market advantage. In addition, there is shift in preferences towards the integration of threat intelligence into broader security frameworks, such as incident response, vulnerability management, and endpoint protection, providing organizations to act quickly and proactively against threats.

Furthermore, there in a growing trend in the adoption of dark web intelligence essential for identifying hidden threats, as the dark web is a hub for illegal activities such as the sale of stolen data, hacking services, and malicious software. Monitoring these activities is increasingly important for threat intelligence operations. Companies that specialize in dark web intelligence, focusing on monitoring and reporting illicit activities, data breaches, and emerging threats from this concealed part of the internet, will play a vital role in threat prevention. Moreover, the development of advanced data analytics and visualization simplifies complex threat intelligence data, making it easier for security teams to interpret and respond to threats. Developing tools that enhance data visualization and decision-making can significantly improve the accessibility and effectiveness of threat intelligence.

For instance, on July 9, 2024 , ThreatConnect has acquired Polarity to enhance its ability to deliver intelligence at the point of decision for security teams. This acquisition aims to streamline security analysts' workflows by integrating contextual data from over 200 sources, including security alerts, logs, and threat intelligence indicators. The combined capabilities of ThreatConnect and Polarity will improve threat detection and response efficiency, enabling security teams to make faster, more informed decisions.

Report Coverage & Deliverables

The threat intelligence market report covers an in-depth analysis, encompassing global and regional threat intelligence market size estimations, growth forecasts, and key industry trends. It explores the primary drivers, challenges, and opportunities influencing the threat intelligence sector, along with detailed insights into evolving cybersecurity threats, attack vectors, and emerging technologies. The report also highlights the significant landscape of threat intelligence, highlighting the growing need for proactive cybersecurity strategies in response to increasingly sophisticated cyberattacks and data breaches.

Key deliverables include in-depth threat intelligence market forecasts, along with a thorough examination of competitive strategies employed by major market players. In addition, the report provides remarkable insights into the strategic partnerships, mergers, and acquisitions shaping the market landscape. Key highlights notable trends in the adoption of threat intelligence platforms, such as artificial intelligence (AI) and machine learning (ML), and their role in enhancing predictive capabilities and automating threat detection.

What are the Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the threat intelligence market analysis from 2023 to 2033 to identify the prevailing threat intelligence market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces threat intelligence marketanalysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the threat intelligence market segmentation assists to determine the prevailing threat intelligence market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global threat intelligence market trends, key players, market segments, application areas, and market growth strategies.

Threat Intelligence Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 43.3 billion |

| Growth Rate | CAGR of 12.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 412 |

| By Organization Size |

|

| By Component |

|

| By Applications |

|

| By Deployment Mode |

|

| By Vertical |

|

| By Region |

|

| Key Market Players | IBM Corporation, Microsoft Corporation, Juniper Networks, Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., Anomali, Inc., Broadcom, Inc., CrowdStrike, Inc., McAfee, LLC, Palo Alto Networks, Inc. |

Analyst Review

The threat intelligence enhances the customer experience by providing security services within the context of the user's daily activities. The threat intelligence market is characterized by intense competition, which can be attributed to the strong presence of established vendors. It is expected that threat intelligence solution and service providers, that possess extensive technical and financial resources, will have a competitive advantage over their competitors due to their ability to meet the global market needs.

Furthermore, the competitive landscape within the market is anticipated to become even more intense as a consequence of technological advancements, product expansions, and various strategies employed by key vendors. Factors such as presence of prominent technology companies and industry consortiums focusing on cybersecurity infrastructure have contributed to the demand for advanced threat intelligence solutions and services. Asia-Pacific is the fastest-growing region in the market, which is mainly attributed to the growing focus of the market players to address the demands for advanced security frameworks with cost-effectiveness.

Major companies operating in the threat intelligence market are focusing on strategic partnerships to develop advanced threat intelligence solutions. For instance, in March 2023, Anomali Inc., a security solution providers partnered with Canon IT Solutions Inc., and offered Threat Intelligence Platform services for enterprise customers. Utilizing Anomali’s ThreatStream, the service offers actionable intelligence to small and mediumsized enterprises regarding cyber attackers, emerging tactics, and information-centric security measures. This allows customers of Canon IT Solutions to determine their susceptibility to attacks and acquire effective measures to protect against the latest cyber threats in a convenient and efficient manner. The similar strategies by the market players operating at a global and regional level will help the market to grow significantly during the threat intelligence market forecast period.

Moreover, governments and industries are enforcing stricter data protection regulations, such as GDPR, CCPA, and HIPAA, prompting organizations to adopt advanced threat intelligence platforms to ensure compliance. Furthermore, rise in dependence on cloud computing has created new challenges, as cloud environments require robust cybersecurity strategies. As a result, cloud-based threat intelligence solutions are gaining traction for their scalability and ability to provide real-time insights. For instance, in December 2024, Amazon Web Services (AWS) expanded its multi-layered threat intelligence capabilities to protect customers from rise in number of cyberattacks. In December 2023, the cloud computing leader increased transparency around its security operations, highlighting the critical role its cloud infrastructure plays in defending against evolving threats. This approach underscores the importance of robust security measures within cloud computing environments, ensuring that organizations leveraging AWS can mitigate risks and safeguard their data and applications.

Threat intelligence collects, analyzes, and utilizes information about potential or existing cyber threats to help organizations protect their data, networks, and systems. It involves identifying malicious activities, understanding attack tactics, and responding proactively to prevent damage.

The global threat intelligence market size was valued at USD 13.5 billion in 2023, and is projected to reach USD 43.3 billion by 2033

The global threat intelligence market is projected to grow at a compound annual growth rate of 12.4% from 2023-2033 to reach USD 43.3 billion by 2033

Key players in the threat intelligence are Cisco Systems Inc., McAfee, LLC, Broadcom, Juniper Networks, Inc., CrowdStrike, Inc., Palo Alto Networks, Inc., IBM Corporation, Anomali, Inc., Check Point Software Technologies Ltd., and Microsoft Corporation.

Loading Table Of Content...

Loading Research Methodology...