Tower Crane Rental Market Research: 2032

The Global Tower Crane Rental Market was valued at $3.8 billion in 2020, and is projected to reach $6 billion by 2032, growing at a CAGR of 4.2% from 2023 to 2032. Tower crane rental is the service to rent out construction equipment to end users for a certain period by signing contracts with terms and conditions about their usage. Construction equipment is majorly used at construction mining sites to facilitate heavy operations.

In developing countries in Asia, Africa, and Latin America, malls and office buildings are currently undergoing construction. For instance, Brazil experienced the construction of more than 13 shopping mall in 2021. These shopping centers are multistory and built on several acres of land, which increases the need for large construction tools.

Furthermore, the construction of brand-new, opulent office buildings in several nations and significant cities is a result of the rising industrialization of developing nations. For instance, in 2021, over 17 significant IT parks are currently being constructed in India's major cities of Mumbai, Delhi, Pune, Bangalore, and Hyderabad.

In addition, heavy construction equipment such as tower cranes tends to become damaged or undergo destruction regularly given the demanding tasks performed at construction sites. Heavy construction equipment, like any other vehicle, needs to be timely maintained by going through routine servicing and maintenance to keep it operating properly. In addition, there are labor costs and operational costs, which cover things such as the cost of hiring skilled, experienced drivers and fuel costs for running the equipment. However, equipment rental businesses employ and train their own staff of equipment operators. Furthermore, some businesses offer to pay the cost of the diesel, which is deducted from the customer's payment. These factors make it easy for customers to hire heavy and expensive equipment with well-trained operators only when needed. This helps to minimize the expense in the form of wages of operators as well as expenses incurred due to their maintenance. Hence such an advantage of construction rental equipment propels the tower crane rental market growth.

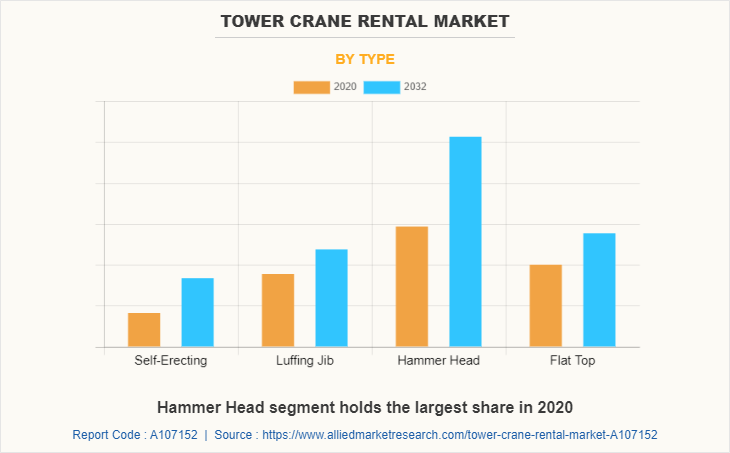

By Type:

By type, the market is classified into self-erecting, luffing jib, hammer top and flat top. The construction industry has been experiencing significant growth in various regions around the world. Rapid urbanization, infrastructure development, and economic growth have led to an increased demand for construction projects. Hammer head cranes, with their ability to handle large-scale construction tasks, have become essential equipment to meet the demands of these projects. Hammer head cranes segment is expected to generate the largest revenue during the forecast period.

These cranes are known for their impressive lifting capacities. They are designed to handle heavy loads, making them well-suited for large-scale construction projects such as high-rise buildings, infrastructure development, and industrial construction. As construction projects continue to increase in scale and complexity, the demand for cranes with high lifting capacities such as hammer head cranes is expected to rise. However, self erecting cranes segment is expected to grow with the highest CAGR. The development of advanced technology, such as remote control systems, load monitoring, and telematics, has improved the performance and capabilities of self-erecting cranes. These technological advancements make them more efficient, reliable, and user-friendly, further driving their demand in the construction industry.

Moreover, several housing developments are also being built throughout Africa. For instance, in February 2022, six new mega social housing projects are planned for South Africa in the coming few years. In addition, in 2021, Africa's largest 3D-printed affordable housing project started in Kenya. To operate, such infrastructure projects require heavy construction machinery. This equipment is rented and used at these sites, which drives the growth of the market and such developments are expected to offer lucrative tower crane rental market opportunity.

However, in developed countries in North America and Europe, there is a saturation of new construction activity due to the already constructed infrastructure, the recent industrial slump, and the high cost of development. As a result, substantial investments in brand-new building projects have declined, which is anticipated to eventually constrain the expansion of tower crane rental market size in developed countries.

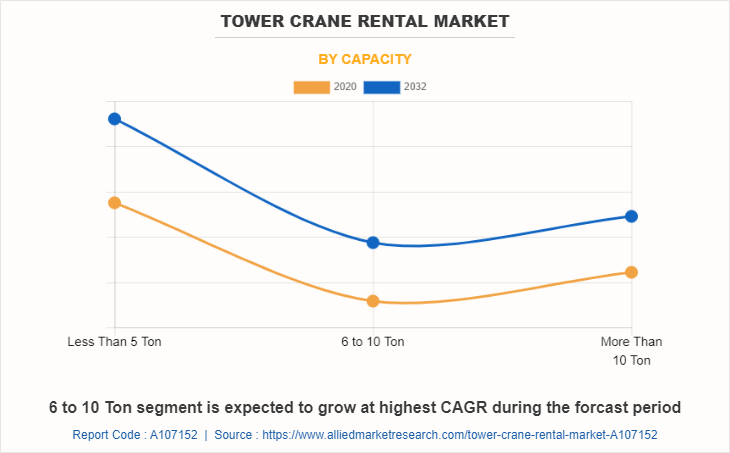

By Capacity:

The market is divided into less than 5 Ton, 6 to 10 Ton and more than 10 Ton. The less than 5 ton segment generated the highest revenue in 2020. In some regions, local regulations and safety requirements may restrict the use of larger and heavier cranes on certain construction sites. Low lifting capacity tower cranes offer a compliant solution that meets the safety regulations and requirements of these areas. As safety regulations become more stringent, the demand for low capacity cranes that meet the specified criteria increases.

However, the 6-10 ton segment is expected to exhibit the highest CAGR share in the market during the tower crane rental market forecast period. Medium lifting capacity tower cranes are designed to operate efficiently in confined spaces. They offer a balance between lifting capacity and a more compact size, making them suitable for construction sites with limited space or restricted access. These cranes can be maneuvered into tight spots and positioned closer to the construction area, maximizing their efficiency in smaller or urban projects.r

Moreover, at new construction sites, large cranes are inexpensive for rent instead of buying, simple to disassemble, and easy to move. In addition, rental firms can now easily follow the locations and operations of their equipment thanks to modern technology like IoT embedded in heavy construction equipment. IoT assists in addressing a lack of experienced labor, increasing task accuracy, guaranteeing on-time delivery within budget, and addressing equipment safety concerns. Thus, it is anticipated that throughout the projection period, the introduction of new internet-connected equipment will promote growth of tower crane rental industry.

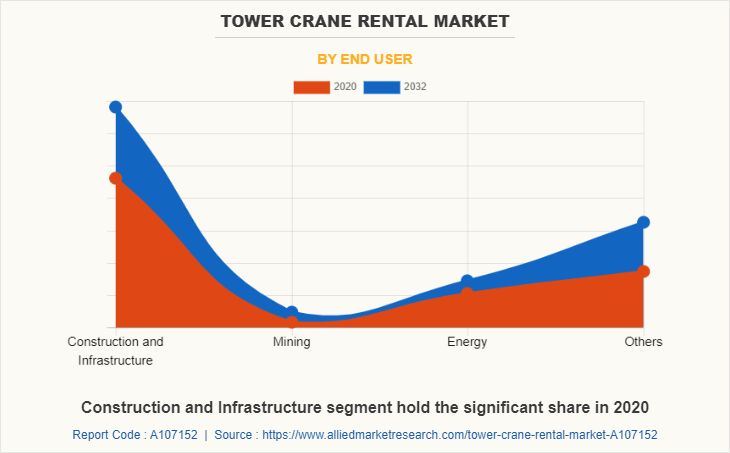

By End User:

The tower crane rental market is divided into construction & infrastructure, mining, energy, and others. Construction & infrastructure segment generated the highest revenue in 2020. Renting tower cranes shifts the responsibility of maintenance and repairs to the rental company. Rental companies typically provide well-maintained and regularly inspected cranes, ensuring reliable performance and reducing the risk of unexpected downtime. If any issues arise during the rental period, the rental company is responsible for resolving them promptly, minimizing disruptions to the construction schedule.

However, the mining segment is expected to exhibit the highest CAGR share in the tower crane rental market during the forecast period. Mining operations are subject to stringent safety regulations and standards. Rental companies ensure that their tower cranes comply with these safety requirements and possess the necessary certifications and inspections. By renting cranes, mining companies can rely on the rental company's expertise in safety compliance, ensuring that the equipment meets the required standards and contributes to a safe working environment.

Furthermore, several commodities, including food items, oil, and gas, saw a surge in price due to the Russia-Ukraine conflict. Due to supply chain interruptions, there are now more expensive shipping costs, fewer available containers, and less warehouse space. Since there have been delays in shipments and congestion, certain ports have been closed, and orders are being retracted, which influences industry and consumers globally. The decline in investor confidence has also increased stock market volatility. Economic instability has risen due to the strained commercial ties between Russia, Ukraine, and their different trading partners. Hence, all such factors have reduced export possibilities.

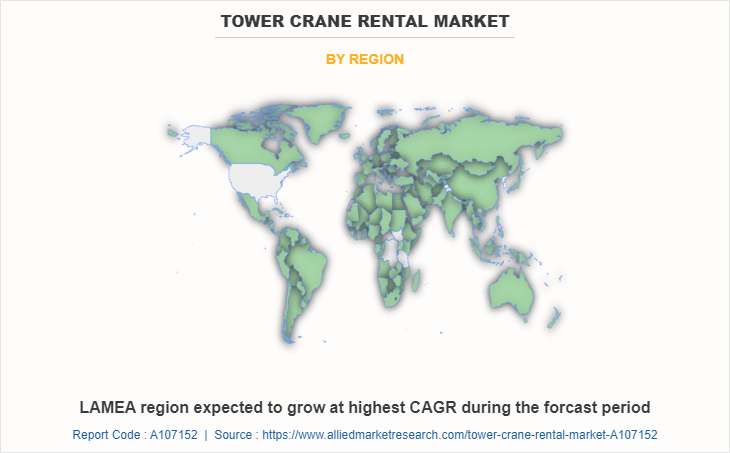

By Region:

The tower crane rental market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2020, Asia-Pacific held the highest revenue in tower crane rental market share. Major players strive to develop their presence in these markets to improve their customer base as well as serve the Asian industries, including construction, oil & gas, and mining. Furthermore, according to the report by the Overseas Development Institute (ODI) based in London, the Asian regional economy is projected to grow significantly until 2025.

This influences the overall growth of construction activities in this region. Thus, the improvement in overall construction activities in Asia-Pacific is likely to create opportunities for the growth of the tower crane rental market in this region. However, LAMEA is expected to exhibit the highest CAGR during the forecast period. emerging regions such as Africa are focused on establishing new mining activities along with infrastructural development. South Africa has the highest growth potential for the tower crane rental market, owing to various construction projects.

Segmental Overview

The tower cranes market is segmented into type, capacity, application, and region. By type, the market is classified into self-erecting, luffing jib, hammer top and flat top. By capacity, the market is divided into less than 5 Ton, 6 to 10 Ton and more than 10 Ton. By application, it is bifurcated into construction & infrastructure, mining, energy, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competition Analysis

The major players profiled in the tower crane rental market include Bigge Crane & Rigging Co., L.P. Crane, Action Construction Equipment, titan cranes & rigging, Falcon Tower Crane Service, Skycrane, leavitt cranes, All Tower Crane, WASEL GmbH, and Zoomlion ElectroMech India Pvt. Ltd.

Major companies in the market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the Tower crane rentals market.

Key Benefits For Stakeholders

- This report provides the tower crane rental market overview along with quantitative analysis of the market segments, current trends, estimations, and dynamics of the tower crane rental market analysis from 2020 to 2032 to identify the prevailing tower crane rental market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the tower crane rental market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global tower crane rental market trends, key players, market segments, application areas, and market growth strategies.

Tower Crane Rental Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2020 - 2032 |

| Report Pages | 188 |

| By Type |

|

| By Capacity |

|

| By End User |

|

| By Region |

|

| Key Market Players | WASEL Gmbh, Skycrane, Falcon Tower Crane Service, leavitt cranes, L.P. Crane, Zoomlion ElectroMech India Pvt. Ltd, Action Construction Equipment, All Tower Crane, titan cranes & rigging, Bigge Crane & Rigging Co. |

Analyst Review

The rise in construction & mining activities in developing countries propels the growth of the tower crane rental market. Moreover, decline in expenses such as maintenance cost of the equipment and high labor cost such as wages for skilled labors and operational costs at the time of actual working on the site have led end users to opt for rental equipment. Furthermore, the ownership of this heavy equipment can incur high initial investment, which is not affordable for all end users. In addition, it is inconvenient to hire a full-time skilled operator of this equipment as the wages might be higher.

However, the construction market has saturated in several developed nations and has affected the tower crane rental market. On the contrary, integration of IOT in the equipment prevents accidents in the workplace and aids in downtime reduction, thereby it is expected to boost the growth of the tower crane rental market during the forecast period.

Furthermore, rapid urbanization & industrialization of emerging countries and use of construction equipment are anticipated to provide lucrative opportunities for the growth of the tower crane rental market.

The global tower crane rental market was valued at $3,774.5 million in 2020, and is projected to reach $5,972.1 million by 2032, registering a CAGR of 4.2% from 2023 to 2032.

The forecast period considered for the global tower crane rental market is 2023 to 2032, wherein, 2020 is the base year, 2022 is the estimated year, and 2032 is the forecast year.

The latest version of global tower crane rental market report can be obtained on demand from the website.

The base year considered in the global tower crane rental market report is 2020.

The major players profiled in the tower crane rental market include Bigge Crane & Rigging Co., L.P. Crane, Action Construction Equipment, titan cranes & rigging, Falcon Tower Crane Service, Skycrane, leavitt cranes, All Tower Crane, WASEL GmbH, and Zoomlion ElectroMech India Pvt. Ltd.

he top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based type the hammer head segment was the largest revenue generator in 2020.

Loading Table Of Content...

Loading Research Methodology...