Track Digital Axle Counter Market Research: 2032

The Global Track Digital Axle Counter Market size was valued at $345.2 million in 2022, and is projected to reach $903.5 million by 2032, growing at a CAGR of 10.1% from 2023 to 2032. A track digital axle counter is a type of axle counter system used in railway signaling to detect and count the number of axles of passing trains. The track digital axle counter system is designed to provide accurate and reliable information about the occupancy of a specific section of railway track. Primarily there are two types of track digital axle counters, which includes single-section digital axle counter (SSDAC), and multi-section digital axle counter (MSDAC).

Market Dynamics

The global population has grown at a substantial rate and has played a crucial role in the growth of industrialization and urbanization across the globe. This is a primary factor that drives the growth of rain infrastructure in any region. The presence of a well-developed rail network is a catalyst for economic development. It facilitates the smooth movement of goods, connecting industries, businesses, and markets. Railways contribute to the growth of regional and national economies. Furthermore, railways contribute to reducing congestion, lowering fuel consumption, and minimizing the environmental impact of road traffic by offering an alternative mode for both freight and passenger transport. In addition, urban transit systems, that is commuter trains, metro systems, and urban rail networks provide efficient and sustainable alternatives for daily commuting, reducing reliance on private vehicles. Owing to such benefits of railways, countries across the globe such as India, China, the U.S., the UAE, France, and others have invested heavily in their railway infrastructure expansion.

For instance, India has developed its dedicated freight corridor by investing billions of dollars for the transportation of goods throughout the country. Similarly, in February 2023, Etihad Railways, a $200 billion project was completed. Such railway projects include advanced signaling systems including digital axle counters. For example, in September 2019, Hitachi successfully deployed the 'Dedicated Freight Corridor' (DFC) featuring Automatic Block Signaling and the European Train Control System (ETCS) along the route from Rewari to Vadodara to Jawaharlal Nehru Port Trust (JNPT). Electronic Interlocking that is serially interfaced with a Multi-Section Digital Axle Counter (MSDAC) has updated signaling systems technologies. Such factors have driven the demand for Multi-Section Digital Axle Counter (MSDAC) and have a positive impact on the track digital axle counter market.

Digital axle counters play a crucial role in ensuring precise train detection, significantly reducing the expectancy of signalling errors and enhancing overall railway safety. This is a major factor driving the track digital axle counter market growth. Furthermore. a key advantage is their effectiveness in minimizing Signal Passing at Danger (SPAD) incidents, where a train proceeds past a stop signal, presenting a substantial safety risk. Digital Axle Counters contribute to SPAD prevention by providing accurate information about train locations on the track.

For instance, the incorporation of track circuiting, block-proving axle counters, data loggers, and related systems can help railway operators, such as Indian Railways, eliminate or drastically reduce the occurrence of train collisions and related fatalities. The implementation of block proving by axle counters becomes instrumental in averting collisions in block sections, especially in cases where a separated load is left behind. Axle counters contribute to making train transportation inherently safer by diminishing the need for extensive human intervention in railway signalling. Consequently, the growth in emphasis on safety within railway operations is a driving factor behind the increase in demand for digital axle counters.

However, the upfront cost of digital axle counters is relatively more than track circuits owing to the inclusion of the latest digital technology. This high cost can play a significant role in discouraging a railway company from adopting this technology. In addition, digital axle counters are dependent on a stable power supply. Power disruptions or failures impact their functionality, potentially leading to operational challenges. Moreover, harsh environmental conditions, such as extreme temperatures or exposure to moisture, could affect the performance of digital axle counters. Such factors are expected to restrain the track digital axle counter market growth in the coming years.

Moreover, technological development in the track digital axle counters is a major track digital axle counter market opportunity for the key market players. The implementation of industry 4.0 technologies which includes IoT, AI, ML, and others have played an important role in making rail transport safer. In addition, iniTECH Industrial, a solution provider associated with GE Vernova and specializing in train system integration, has devised a communication solution. This solution facilitates the integration of axle counters, including those from Frauscher, into central monitoring and diagnostic systems based on CIMPLICITY. This integration can help in improving the abilities of railway authorities to proactively detect any problems, and resolve them before they happen, from their central control room. It is expected to help in increasing safety, delivering more reliable on-time service, and achieve greater operations efficiency.

The track digital axle counter market witnesses various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to slow-paced growth of railway infrastructure. This led to reduced demand for track digital axle counters. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing track digital axle counters. In addition, the cost of oil & gas has also increased substantially, and many countries; especially, the countries in Europe, Latin America, North America, and Sub-Saharan Africa experience severe negative impacts in industrial production, including the production of track digital axle counter. However, India and China have performed relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less.

Segmental Overview

The track digital axle counter market is segmented on the basis of component, application, and region. On the basis of component, the market is bifurcated into wayside axle counter, and on-rail axle counter. On the basis of application, it is bifurcated into railway, and urban rail transit. On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, the UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

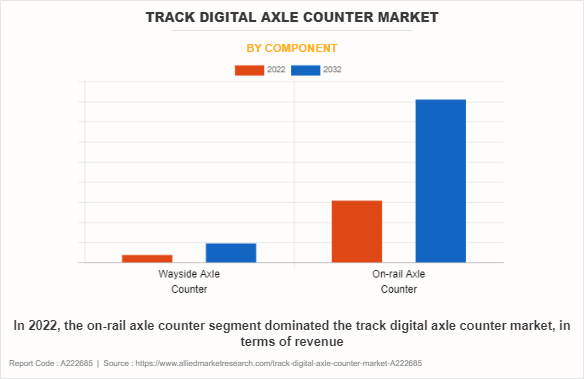

By Component:

The market is bifurcated into wayside axle counter, and on-rail axle counter. In 2022, the on-rail axle counter segment dominated the track digital axle counter market, in terms of revenue, and the same segment is expected to grow with a higher CAGR during the forecast period. The on-rail segment is further classified into; t multi-section digital axle counter (MSDAC) and single-section digital axle counter (SSDAC) MSDAC is an innovative system that enables the simultaneous detection of track vacancies across various sections and point zone areas. It is especially useful in situations where there is a convergence or divergence of multiple tracks, as seen in stations or yards featuring intricate layouts. Modernization of railway networks is a key growth factor for this on-rail axle counter segment.

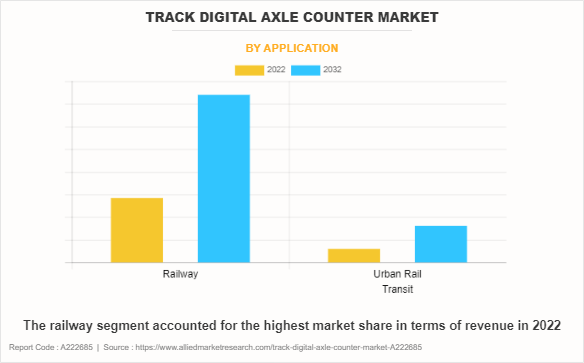

By Application:

The market is divided into railway and urban rail transit. The railway segment accounted for the highest track digital axle counter market share in 2022, owing to the rapid growth of railway infrastructure in various countries. However, the urban rail transit segment is anticipated to dominate the track digital axle counter market forecast by growing with a higher CAGR, owing to a rise in urbanization, especially in developing nations such as India and China.

By Region:

Europe accounted for the highest market share in 2022 and the Asia-Pacific region is expected to grow with the highest CAGR during the forecast period. Asia-Pacific is a highly developing region with the fastest-growing population and industrialization. Thus, owing to high population growth and urbanization in the region, the industrial, construction, and agriculture sector witness a rapid rise, thereby, there is a rise in demand for an efficient railway infrastructure, which eventually drive growth of the track digital axle counter market.

Competition Analysis

Competitive analysis and profiles of the major players in the track digital axle counter market are provided in the report. Major companies in the report include ALTPRO, CLEARSY, Eldyne Electro Systems Pvt. Ltd., Frauscher Sensor Technology Group, Schaltbau Holding AG, Voestalpine AG, Siemens AG, Thales Group, Applied Electro Magnetics, G.G.Tronics India Pvt. Ltd., Kernex Microsystems (India) Ltd., HBL Power Systems Ltd, Central Electronics Ltd., Scheidt and Bachmann GmbH, Alstom SA (Alstom Transport India Limited), Medha Servo Drives Private Limited, Lab to Market Innovations Private Limited, Ircon International Limited, Argenia Railway Technologies, and Nippon Signal Co., Ltd. (Nippon Signal India Private Limited). Major players to remain competitive offer a wide range of innovative track digital axle counters. Moreover, in December 2021, ProRail, the entity responsible for managing rail infrastructure in the Netherlands, granted Thales an eight-year contract to supply the generic axle counter system for railway lines equipped with ERTMS (European Rail Traffic Management System). The European Rail Traffic Management System is the system of standards for the management and interoperation of signaling for railways by the European Union.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging track digital axle counter market trends.

- In-depth track digital axle counter market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the track digital axle counter market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The track digital axle counter market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the track digital axle counter market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the track digital axle counter industry.

Track Digital Axle Counter Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 903.5 million |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Frauscher Sensor Technology Group, Nippon Signal Co., Ltd. (Nippon Signal India Private Limited), Central Electronics Ltd., Eldyne Electro Systems Pvt. Ltd., Medha Servo Drives Private Limited, Scheidt and Bachmann GmbH, Voestalpine AG, Ircon International Limited, Kernex Microsystems (India) Ltd., Thales Group, HBL Power Systems Ltd, Siemens AG, CLEARSY, Argenia Railway Technologies, Alstom SA (Alstom Transport India Limited), Schaltbau Holding AG, Lab to Market Innovations Private Limited, Applied Electro Magnetics, G.G.Tronics India Pvt. Ltd., ALTPRO |

Analyst Review

The track digital axle counter market has witnessed significant growth in the past few years, owing to growth in railway infrastructure especially in middle income countries and rise in concerns regarding safety and punctuality of trains.

Track digital axle counter counters easily detect trains moving with high speeds making them a primary choice for high-speed rail networks in countries such as China, Japan, France, and others. In addition, Indian railways has gradually strived to increase the speed of its railways which is also expected to drive growth of the market. Moreover, train travel is 34% more energy efficient than flying and 46% more efficient than driving, according to Department of Energy estimates in the U.S. Owing to such reasons, the railway segment contributed to a larger revenue share in 2022.

The global track digital axle counter market is a consolidated market where few manufacturing firms hold a larger market share. This is primarily due to the safety critical nature of this equipment, which requires them to pass various tests before they are certified safe to be used. In India, The Research Designs & Standards Organization (RDSO) establishes the standards that track digital axle counters have to follow.

Key factors driving the growth of the track digital axle counter market include growth in railway infrastructure, rise in safety concerns, and superiority of digital axle counters.

The latest version of the global track digital axle counter market report can be obtained on demand from the website.

The global track digital axle counter market size was valued at $345.2 million in 2022.

The global track digital axle counter market size is estimated to reach $903.5 million by 2032, exhibiting a CAGR of 10.1% from 2023 to 2032.

The forecast period considered for the global track digital axle counter market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

Europe is the largest regional market for track digital axle counter market.

Key companies profiled in the track digital axle counter market report include ALTPRO, CLEARSY, Eldyne Electro Systems Pvt. Ltd., Frauscher Sensor Technology Group, Schaltbau Holding AG, Voestalpine AG, Siemens AG, Thales Group, Applied Electro Magnetics, G.G.Tronics India Pvt. Ltd., HBL Power Systems Ltd, Kernex Microsystems (India) Ltd., Central Electronics Ltd., Scheidt and Bachmann GmbH, Alstom SA (Alstom Transport India Limited), Medha Servo Drives Private Limited, Lab to Market Innovations Private Limited, Ircon International Limited, Argenia Railway Technologies, and Nippon Signal Co., Ltd. (Nippon Signal India Private Limited).

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...