Trade Credit Insurance Market Overview

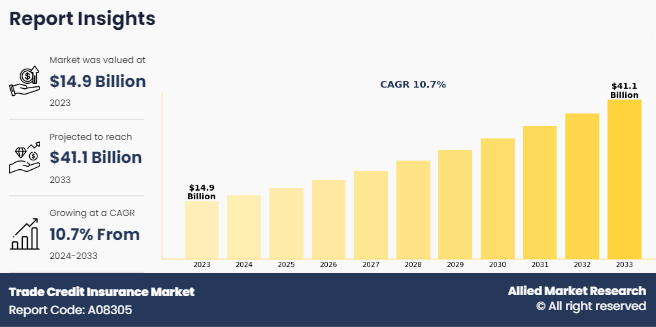

The global trade credit insurance market size was valued at USD 14.9 billion in 2023, and is projected to reach USD 41.1 billion by 2033, growing at a CAGR of 10.7% from 2024 to 2033. Growing globalization and cross-border trade activities, driven by the demand for trade credit insurance, as businesses seek risk management solutions to protect against payment defaults amid rising economic uncertainty, contribute to the growth of the market.

Market Dynamics & Insights

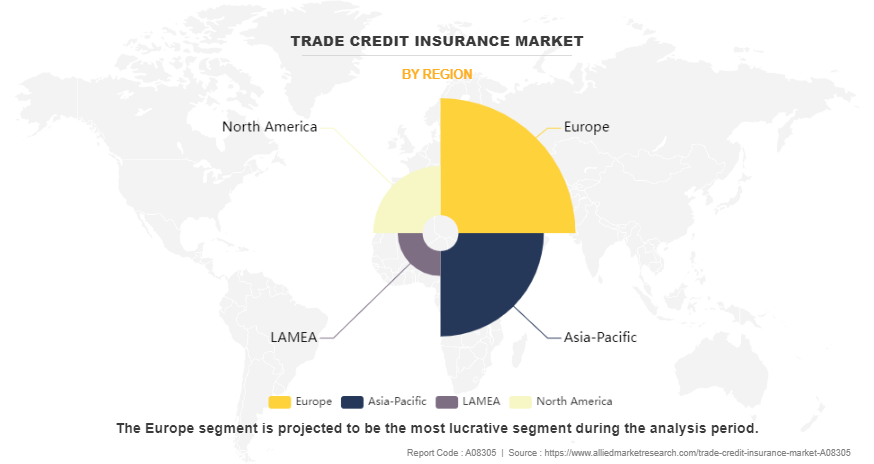

- The trade credit insurance industry in Europe held the largest share of 42% in 2023.

- By component, the product segment held the largest trade credit insurance market share in 2023, accounting for the revenue share of 70%.

- By enterprise size, the large enterprise segment held the largest share in the trade credit insurance market for 2023, accounting for the revenue share of 62%.

- By coverages, the whole turnover coverage segment held the largest share in the market for 2023, accounting for the revenue share of 83%.

- By industry vertical, the others segment held the largest share in the trade credit insurance market for 2023, accounting for the revenue share of 29%.

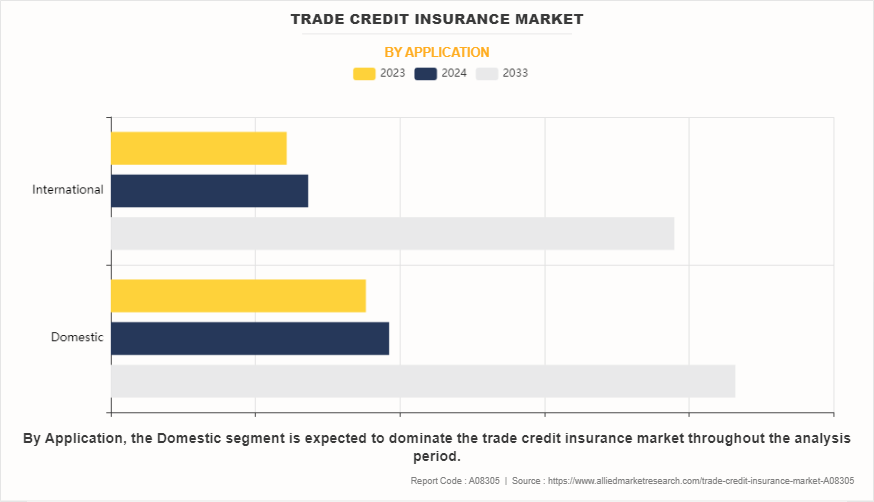

- By application, the domestic segment held the largest share in the trade credit insurance market for 2023, accounting for the revenue share of 59%.

Market Size & Future Outlook

- 2023 Market Size: USD 14.9 Billion

- 2033 Projected Market Size: USD 41.1 Billion

- CAGR (2024-2033): 10.7%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

What is Meant by Trade Credit Insurance

Trade credit insurance is a type of insurance designed to protect businesses from political & commercial risks that may influence the finances of the business. It is a type of property & casualty insurance, generally offered by private insurance companies and governmental export credit agencies to business entities or individuals. Moreover, trade credit insurance is largely used to protect accounts receivable from loss due to credit risks such as protracted default, insolvency, or bankruptcy.

Key Takeaways

- By component, the product segment held the largest share in the trade credit insurance market for 2023.

- By enterprise size, the large enterprise segment held the largest share in the trade credit insurance market for 2023.

- By coverages, the whole turnover coverage segment held the largest share in the trade credit insurance market for 2023.

- By industry vertical, the others segment held the largest share in the trade credit insurance market for 2023.

- By application, the domestic segment held the largest share in the trade credit insurance market for 2023.

- Region-wise, Europe held the largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the trade credit insurance market forecast period.

The trade credit insurance market outlook is driven by increasing globalization and cross-border trade, which raises the demand for risk management solutions. Economic uncertainty and the need to protect against payment defaults thereby drives the market growth. However, high premiums and limited trade credit insurance awareness among small and medium-sized enterprises (SMEs) hamper market growth. Furthermore, the growing adoption of digital platforms and advancements in data analytics present opportunities for more efficient underwriting and risk assessment, which further drive market expansion by attracting new clients and improving service offerings.

Trade Credit Insurance Market Segment Review

The trade credit insurance market share is segmented into component, enterprise size, coverage, industry vertical, application and region. Based on component, the market is bifurcated into products and services. On the basis of enterprise size, it is segmented into large enterprises. and small & medium enterprises. By coverage, the market is bifurcated into whole turnover coverage and single buyer coverage. Based on industry vertical, it is segmented into food & beverages, IT & telecom, metals & mining, healthcare, energy & utilities, automative & others. By application, it is categorized into domestic and international. Region-wise, the trade credit insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of application, the global trade credit insurance market was dominated by the domestic segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to rise in the number of wholesalers and retailers involved in buying goods from manufacturers or dealers., which drives the segment growth. However, international segment is expected to grow at the highest rate during the forecast period, owing to increasing globalization, expanding cross-border trade, and rising demand for protection against non-payment risks in foreign transactions, which drives the segment growth in the market.

Region wise, the trade credit insurance market was dominated by North America in 2023 and is expected to retain its position during the forecast period, owing to strong economic activity, high export volumes, and a growing need for trade credit insurance to mitigate payment risks in an increasingly uncertain trade environment drives the region growth in the market. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to expanding regional economies, increased international trade, a growing number of SMEs, and rising demand for financial risk mitigation solutions. Thereby drives the region growth in the market.

Competition Analysis

The report analyzes the profiles of key players operating in the trade credit insurance market such as American International Group Inc., QBE Insurance (Australia) Ltd., Atradius N.V., Aon Plc, Coface, Marsh LLC., Chubb Group Holdings Inc., Zurich Insurance Company Ltd, Authorized Policy Insurance Brokers Ltd., Credit Oman., Howden Group Holdings Ltd., Credendo, Allianz Saudi Fransi, Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), HDFC ERGO General Insurance Company Limited and SINOSUR. These players have adopted various strategies to increase their market penetration and strengthen their position in the trade credit insurance industry.

Which Products have Been Launched in the Trade Credit Insurance Industry

- In April 2024, Allianz Group announced the completion of the disposal of its 51% stake in Allianz Saudi Fransi to Abu Dhabi National Insurance Company (ADNIC), a multiline regional insurance provider based in the United Arab Emirates and listed on the Abu Dhabi Stock Exchange. The signing of a binding agreement was initially reported on September 28, 2023.

- In May 2022, Coface and Al Rajhi Takaful announced the strategic partnership in Credit Insurance. This partnership recognized Coface's global expertise as a credit insurer as well as its 75 years of experience and its extensive network in 100 countries. It allows Al Rajhi Takaful to strengthen its position in the Saudi market by further enriching its suite of insurance solutions.

- In August 2022, Aon Inc. launched an innovative trade credit insurance solution. This new offering is uniquely designed for the B2B e-commerce sector, utilizing a single-invoice-based approach that ensures coverage is tailored to individual invoices.

- In June 2021, Credit Oman and the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) signed the Reinsurance Agreement. The agreement entails a joint cooperation in the field of reinsurance to cover credit insurance risks and to enhance the services and offerings provided by ICIEC in this field.

What are the Top Impacting Factors in Trade Credit Insurance Market

Drivers

Numerous Benefits Provided by Trade Credit Insurance Solutions

Trade credit insurance provides customers favorable credit terms, offers protection against customer default or insolvency & export risks, reduces concentration risks, facilitates bank financing, and others. Moreover, trade credit insurance options helps to transfer risk from businesses seeking to protect their accounts receivable against nonpayment. Furthermore, trade credit insurance is beneficial for large, small, and medium enterprises trading globally across several sectors. These major benefits provided by adoption & implementation of trade credit insurance propel the market growth.

Rapid Expansion of New Geographic Markets

The expansion of trade in new regions has gained momentum in the market due to increase in export & import of goods & services worldwide. In addition, the trade credit insurance requirements increased and is expected to maintain its dominance during the forecast period due to this increased trade, which includes issuing letters of credit (LCs), receivables & invoice finance, and others. Moreover, trade credit is used by manufacturers, importers, exporters, buyers, and sellers to ease financing activities during trade. Therefore, surge in requirement of goods & services from one country to another and expansion of trade in different regions have increased, thereby boosting the demand for trade credit insurance in the market.

Increase in Commercial Threat to the Trade

Commercial threats such as political instability, contract cancellations, import restrictions, and trade war majorly drive the market growth. Moreover, traders generally use trade credit insurance in the market to mitigate such threats & risk while trading globally, as it protects sellers from non-payment and enables them to expand the business without fear of loss. Furthermore, increase in globalization, rise in terrorism, currency demonetization, exchange rates fluctuations, bankruptcy cover, and others boost the demand for trade credit insurance, making it a significant product for traders, which is therefore propelling the trade credit insurance market.

Restraints

Varied and Conflicting Trade Regulations Across Different Jurisdictions

Various laws have set different standards & regulations across different jurisdictions with an increased unified approach taken by financial centers toward trade regulation. This becomes a crucial factor for credit insurance companies to elaborate solutions, which brings an inter-regulation conflict and hinders the growth of the trade credit insurance market. For instance, in the U.S., Export Credit Insurance (ECI) protects an exporter of products & services against the risk of non-payment by a foreign buyer. Therefore, meeting regulatory norms of respective countries before providing trade credit insurance is a major factor that hampers the trade credit insurance market growth.

Lack of Awareness Towards Trade Credit Insurance Across the Globe

Lower standardization in terms of premium of trade credit insurance, lack of awareness toward distribution of trade credit insurance in comparison to other lines of insurance, and lesser investment among brokers in distributing this line of business are the major factors limiting the market growth. Moreover, industry standards are not fully established, and various laws set different standards & conditions for traders, which are expected to hamper the market growth.

Opportunities

Surge in Small and Medium Enterprises Globally

Trade credit insurance helps small businesses & medium enterprises or suppliers of goods & services against the risk of non-payment by its customers. In addition, these enterprises are looking for new approaches of trading to increase their market share & to grow their business globally. Moreover, trade credit insurance is emerging as a route for these enterprises to expand sustainably and has driven small business owners to pursue financing through trade credit insurance as a secured means for trading. Furthermore, the trade credit insurance more affordable and accessible to small and medium enterprises, enabling them to manage credit risks more effectively and secure their cash flow, which is expected to drive the market growth. Therefore, rise in the number of small & medium enterprises looking for expansion into global trade and several benefits provided by trade credit insurance are the factors that boost the market growth.

Untapped Potential of Emerging Economies

Developing economies offer significant opportunities for trade credit insurance solution providers to expand their offerings, as several businesses are dealing in credit trades and are expected to create potential for the trade credit insurance market in the coming years. High investments toward expansion into global trades and rapid growth of domestic enterprises especially among countries such as Australia, China, India, Singapore, and South Korea are anticipated to adopt trade credit insurance while trading across global markets. Moreover, Asia-Pacific consists of many trade credit insurance in developing countries witnessing high growth in their manufacturing sector. The region has become a global manufacturing hub with the presence of diverse manufacturing industries. Therefore, the increased role for export credit insurance & the liberalized export credit market in aggregation with an increase in small & medium enterprise is expected to experience growth in this region.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the trade credit insurance market analysis from 2023 to 2033 to identify the prevailing trade credit insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the trade credit insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global trade credit insurance market trends, key players, market segments, application areas, and market growth strategies.

Trade Credit Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 41.1 billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 375 |

| By Industry Vertical |

|

| By Application |

|

| By Component |

|

| By Enterprise Size |

|

| By Coverage |

|

| By Region |

|

| Key Market Players | Howden Insurance Brokers LLC, COFACE, QBE Insurance (Australia) Ltd., Authorized Policy Insurance Brokers Ltd. (APPLUS), American International Group Inc., Allianz Saudi Fransi, Aon plc., Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), Chubb, Credendo, HDFC ERGO General Insurance Company Limited, SINOSURE, Marsh LLC., Credit Oman, Zurich Insurance Company Ltd., Atradius N.V |

Trade credit insurance protects businesses against the risk of non-payment by their buyers. It provides coverage for accounts receivable, ensuring companies receive payment for goods or services rendered even if a buyer defaults.

The forecast period for the trade credit insurance market is 2024 to 2033.

The base year is 2023 in the trade credit insurance market.

The total market value of the trade credit insurance market was $14.9 billion in 2023.

The market value of the trade credit insurance market is projected to reach $41.1 billion by 2033.

Loading Table Of Content...

Loading Research Methodology...