Trauma Implants Market Research, 2031

The global trauma implants market size was valued at $8.4 billion in 2021, and is projected to reach $15.2 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031. Implants are medical devices used to replace a biological structure, enhance an existing biological structure, or support a damaged biological structure. Trauma implants are the types of medical implants used to repair fractures and other traumatic injuries of bone, such as those of shoulders, legs, arms, or skull.

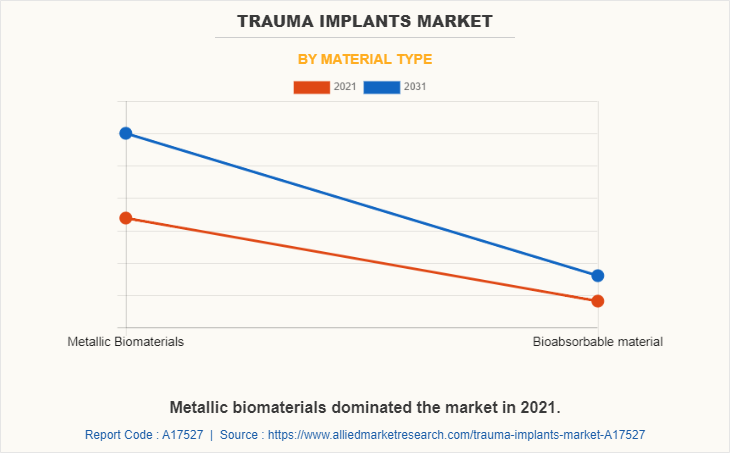

Trauma implants are manufactured by using metallic materials such as titanium, cobalt alloy, stainless steel, and gold. Some trauma implants are manufactured by using bioabsorbable materials. This bioabsorbable materials composed of polymers namely polyglycolic acid (PGA) and polylactic acid (PLA). Trauma implants help to decrease the pain of joints. Furthermore, there are different types of trauma implants, which include metallic screws, bioabsorbable fixators, interlocking nails, and K-wires.

The growth of global trauma implants market size is majorly driven by increase in road traffic accident. The road traffic accidents have documented as one of the modes of bone fractures, thus increase in number of road traffic accidents are likely to foster the demand for trauma implants during the forecast period. For instance, according to National Crime Records Bureau (NCRB), total 4,37,396 road accident cases were reported in 2019. Furthermore, as per the National Highway Traffic Safety Administration (NHTSA), in 2021 about 10.5% road accident cases increased from 2020. In addition, increase in research and development activities by key players such as J&J and Stryker Corporations propels the growth of the market.

Increase in old age population whci are more prone to bone fractures is the key factor that creates trauma implants market opportunity for the growth of the market. For instance, according to World Health Organization (WHO), in 2019, the number of people aged 60 years and older was 1 billion and this number is anticipated to increase to 1.4 billion by 2030.

In addition, rise in research and development activities for developing innovative trauma implants by key players such as J&J and Stryker Corporation will provide opportunities for the market growth during the forecast period.

Furthermore, increase in awareness about minimally invasive trauma implant surgeries propels the demand for trauma implants.

However, side effects of trauma implants such as chances of infection and pain negatively impact the growth of the market. In addition, expensive surgeries for trauma implants hamper trauma implants market growth. Furthermore, stringent government rules for product approval hinders the growth of the market.

Moreover, the global market expansion is being fueled by factors, such as rise in demand for screw implants and interlocking nail implants, increase in incidences of extremity fractures, and rise in healthcare expenditure in developing countries such as India and China. Moreover, increase in adoption of different strategies such as product launch, collaboration, and partnership among the key players in the field of trauma implants propels the growth of the global trauma implants market. For instance, in June 2021, Johnson & Johnson, announced the product launch of 2.7 mm Variable Angle Locking Compression Plate (VALCP) for the treatment of medical fractures.

Impact of COVID-19 on Market

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. Nearly all industries have been impacted by COVID-19. Coronavirus crises led to strictly follow the social distancing rules, and visit hospitals only for emergency need have resulted in a significant decline in demand for the trauma implants. For instance, according to the Commonwealth Fund, it was estimated that there was nearly 60% initial decrease in overall outpatient visits by May 2020 due to COVID-19. This was expected to negatively affect the demand for trauma implants for surgeries. The outbreak of COVID-19 impacted the market, as hospital and healthcare services were significantly reduced due to social distancing measures taken by governments to stop COVID-19 spread.

The overall impact of COVID-19 pandemic remained negative for key players in the trauma implants industry industry. For instance, 12-month revenue from Zimmer Biomet declined by 12% to around $7 billion in 2020, while orthopedics’ revenue from Johnson & Johnson decreased by 12.2%. However, the market is anticipated to witness recovery in 2021 and beyond, and show stable growth for trauma implants in the coming future.

TRAUMA IMPLANTS MARKET SEGMENTATION

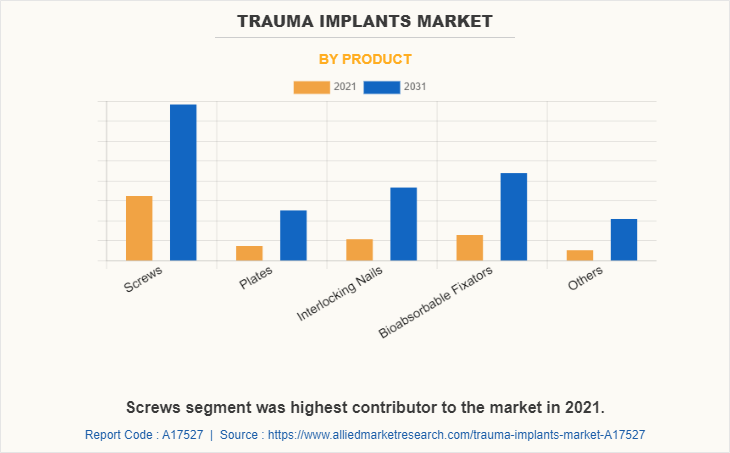

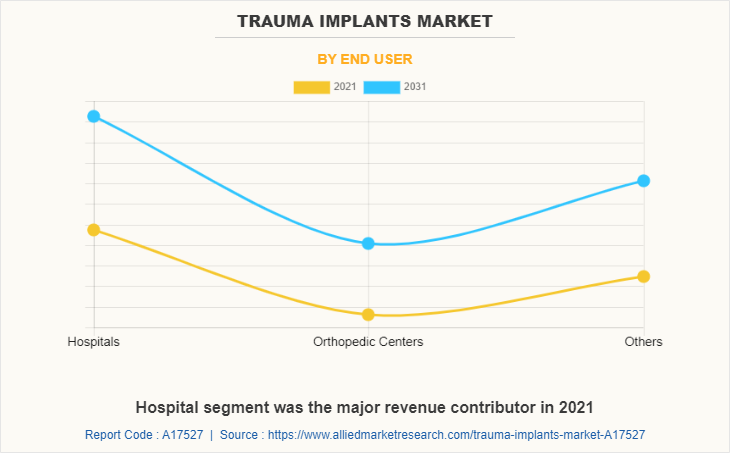

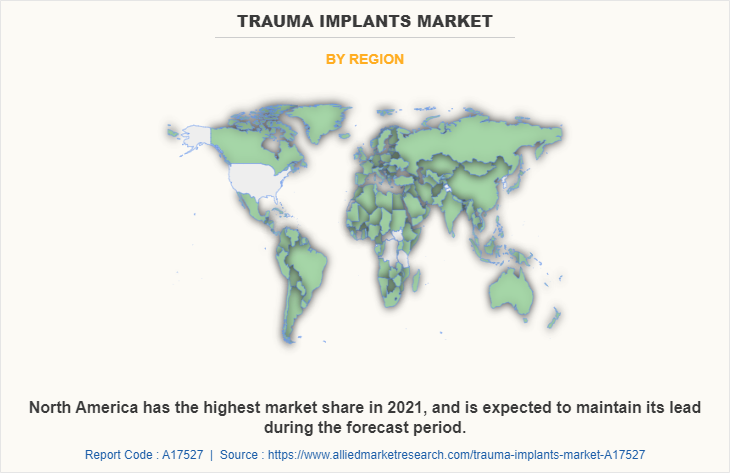

The trauma implants market is segmented on basis of product, material type, end user, and region. By product, it is segmented into screws, plates, interlocking nails, bioabsorbable fixators, and others. By material type, it is divided into metallic biomaterials (Stainless steel, titanium, and others) and bioabsorbable biomaterials. By end user, it is segmented into hospitals, orthopedic centers, and others. Region-wise, the market is studies across North America, Europe, Asia-Pacific, and LAMEA.

By product, the screws segment dominated the market in terms of revenue in 2021, due to increase in traumatic injuries and increase in demand for screws in treatment of tibial fractures. On the other hand, the bioabsorbable fixators segment is expected to witness a considerable market growth from 2022 to 2031. This is attributed to various advantages offered by bioabsorbable fixators such as it kept fractured bones stabilized and in alignment.

By material type, the metallic biomaterials segment dominated the market in terms of revenue in 2021 and is expected to continue this trend during the forecast period, due to increase in demand for metallic screws and metallic interlocking nails for the treatment of traumatic bone fractures. On the other hand, bioabsorbable materials segment is expected to witness a considerable market grown from 2022 to 2031. This is attributed to innovative biologically inert bioabsorbable material manufacturing.

The hospitals segment dominated the market in terms of revenue in 2021, due to hospitals provides quality of treatments for trauma implant surgeries. On the other hand, orthopedic centers segment expected to witness a considerable growth during trauma implants market forecast, due to increase in number of trauma implants surgeries performed in orthopedic centers.

The North America market was dominated trauma implants market share in 2021, owing to well established healthcare infrastructure and strong presence of key players in this region. On the other hand, Asia-Pacific expected to witness a considerable growth from 2022 to 2031, due to increase in awareness about innovative trauma implant surgeries and rise in research and development activities in pharmaceutical sector.

Some of the major companies that operate in the global trauma implants market include, B. Braun Melsungen Ag, Bioreted Ltd, Colsin Medical Llc (Acumed), Conformis Inc., Globus Medical Inc., Johnson and Johnson (Depuy Synthes), Medtronic Plc, Orthofix Medical, Inc., Siora Surgicals Pvt.Ltd, Smith and Nephew Plc, Stryker Corporation, and Zimmer Biomet Holdings, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the trauma implants market analysis from 2021 to 2031 to identify the prevailing trauma implants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the trauma implants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global trauma implants market trends, key players, market segments, application areas, and market growth strategies.

Trauma Implants Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 15.2 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 293 |

| By Product |

|

| By Material Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Zimmer Biomet Holdings, Globus Medical Inc., Siora Surgicals Pvt. Ltd., B. Braun Melsungen Ag, Conformis, Smith & Nephew plc, Stryker Corporations, Colson Medical Llc (Acumed), Johnson & Johnson (Depuy Synthes), Bioretec Ltd,, Medtronic Plc,, Orthofix Medical, Inc |

Analyst Review

The global trauma implants market is expected to exhibit high growth potential attributable to factors such as increase in prevalence of road accidents, bone fractures incidences, rise in geriatric population, surge in R&D activities, and increase in awareness about trauma implant surgeries. Furthermore, trauma implants market has gained interest of pharmaceutical manufacturing companies, owing to surge in demand for innovative trauma implant techniques.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in geriatric population, increasing investment from government & other organizations for enhancing healthcare, and strong presence of key players. However, Asia-Pacific is anticipated to witness notable growth owing to rise in R&D activities for trauma implants and unmet medical demands during the forecast period.

Trauma implants are the devices that are used to repair fractured bone.

Screws segment is the most influencing segment in trauma implants market which is attributed to rise in demand for metallic screws and increase in surgeries performed for traumatic injuries.

Top companies such as, Johnson & Johnson, Smith & Nephew, Stryker Corporation and Medtronic Plc. held a high market position in 2021. These key players held a high market postion owing to the strong geographical foothold in different regions.

The major factor that fuels the growth of the trauma implants market are increase in awareness about advanced trauma implants among the healthcare professionals, surge in in product approval & product innovation strategies by the key market players, and rise in geriatric population.

The total market value of trauma implants market is $8,418.39million in 2021.

The market value of trauma implants market in 2031 is $15,227.33 million.

The forecast period for trauma implants market is 2022 to 2031.

The base year is 2021 in trauma implants market.

Loading Table Of Content...