U.S. Children Entertainment Centers Market Statistics, 2033

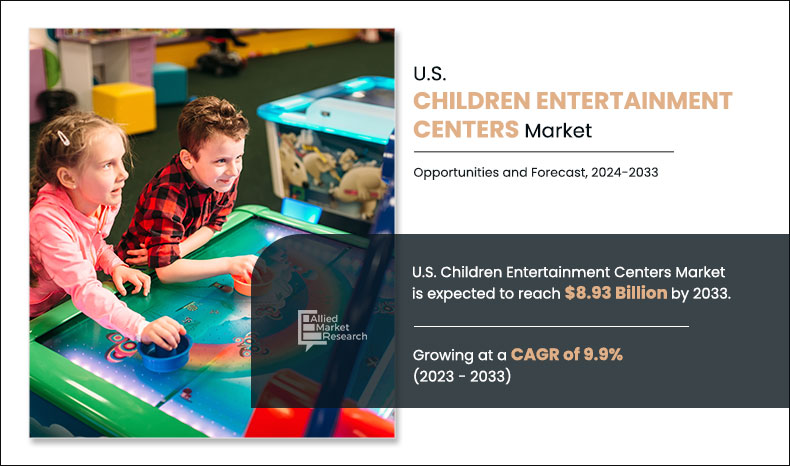

According to the report, the U.S. children entertainment centers market generated $4,880.53 million in 2023, and is projected to reach $10,672.61 million by 2033, registering a CAGR of 8.0% from 2024 to 2033. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscapes, and competitive scenarios.

U.S. children entertainment centers are dedicated recreational spaces designed to provide a wide array of amusement, play, and learning opportunities for kids. These centers typically offer a diverse range of activities and attractions specifically tailored to engage and entertain children of various age groups. They often feature playgrounds, themed play zones, interactive games, rides, and activities that promote physical activity, creativity, and cognitive development.

Many amusement parks include educational centers in their programs to make learning fun through engaging displays or instructive games. Safety is a primary concern, and these facilities usually implement stringent safety measures to provide a secure environment for children. Apart from recreational zones, these facilities may accommodate birthday celebrations, gatherings, or educational seminars, providing a well-rounded entertainment experience for families. To ensure a good overall experience, the U.S. centers frequently place a high priority on maintaining a tidy, friendly, and well-maintained atmosphere for both parents and children. Furthermore, kid-friendly entertainment venues frequently incorporate interactive digital activities or technology-driven games in response to industry trends. Families looking for a combination of enjoyment, education, and social interaction frequently visit these institutions.

U.S. children entertainment areas are preferable to host private celebrations such as corporate events, birthday parties, and even personal accomplishment celebrations. Growth in per capita disposable income, availability of diversified gaming and entertainment options, rise in preference for indoor entertainment, and favorable youth demographics majorly supplement the growth of the market. However, home gaming and mobile devices, high initial cost, and increase in ticket prices are expected to hamper the market growth.

Segment Overview

The U.S. children entertainment centers market is segmented on the basis of revenue source, activity area, and visitor demographic. By revenue source, the market is classified into entry fees & ticket sales, food & beverages, and merchandising. In terms of activity area, the market is categorized into arcade games, soft play centers, trampoline parks, virtual reality (VR) and augmented reality (AR) zones, bowling alleys, go-kart, mini golf, edutainment centers, and others. By visitor demographic, the market is segregated into families with 0-5 years, 6-12 years, and 13-18 years.

By Revenue Source

Entry Fees & Ticket Sales segment is projected as one of the most lucrative segments.

The report focuses on growth prospects, restraints, and analysis of the global children entertainment centers market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global children entertainment centers market analysis.

By Activity Area

Soft Play Centers segment is projected as one of the most lucrative segments.

On the basis of visitor demographic, families with children (6-12) segment dominated the children entertainment centers market size in 2023, owing to fun learning and recreational activities such as sports and arts that add value to personality as well as sharpen children’s skills. Thus the families with children between the ages of 6 and 12 years are more focused on shaping their children’s future through these numerous activities. However, the the 0-5 Years segment is expected to witness the fastest growth, owing to high inclination of teenagers toward video games and numerous new indoor and various categories provided by several children’s entertainment centers.

By Visitor Demographics

6–12 years segment is projected as one of the most lucrative segments.

Competition Analysis

Competitive analysis and profiles of the major players in the children entertainment centers industry include KidZania Operations S.A.R.L., Scene75 Entertainment Centers, CEC Entertainment Concepts, LP., Dave and Buster’s, Inc., LEGOLAND Discovery Center, Opry Glowgolf, LLC., Go Kart World, Sky Zone LLC, Urban Air, and ROUND1 Bowling & Amusement. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the children entertainment centers industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the demand side platform system market analysis from 2023 to 2033 to identify the prevailing demand side platform system market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the demand side platform system market growth to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global demand side platform system market trends, key players, market segments, application areas, and market growth strategies.

Analyst Review

According to the CXOs of leading market players, the popularity of children’s entertainment centers in the U.S. is expected to witness growth due to the increase mall developments across various cities. Thus, malls that integrate majority of the U.S. entertainment centers fulfill the need required by consumers to spend quality time with their family & friends while playing games and other indoor sports.

This is a major factor to make entertainment centers a favorite hangout place for families due to availability of combinational centers such as food court, shopping, and play area. Hence, the U.S. children entertainment centers are attracting a lot of families, which is expected to increase the growth of the U.S. children entertainment centers market during the forecast period.

These centers are evaluated based on their ability to provide a safe, engaging, and diversified experience for children and families. The range of activities and services offered assesses the diversity and suitability of different age groups. They emphasize the importance of a secure and well-maintained environment, often spotlighting safety protocols and measures.

A crucial component is the entertainment and educational value offered, with an emphasis on activities that promote creativity, exercise, and cognitive growth. Furthermore, it is common to emphasize the incorporation of technology and innovation into activities, whether via educational resources or interactive games. In addition, reviews usually rate the youcenter's overall ambience, meal quality, and available alternatives. Furthermore, in October 2023, VICI Properties Inc. has acquired Bowlero, a family entertainment experiential real estate company, which meets its investment criteria of lower-than-average cyclicality, low secular threat, proven durability, and favorable supply/demand dynamics.

The acquisition expands VICI's portfolio with 38 bowling entertainment centers across 17 states, representing 11 new states for the company. Bowlero is VICI's 12th tenant and will represent 1% of VICI's rent roll. The transaction is expected to provide immediate accretion to AFFO per share

Loading Table Of Content...