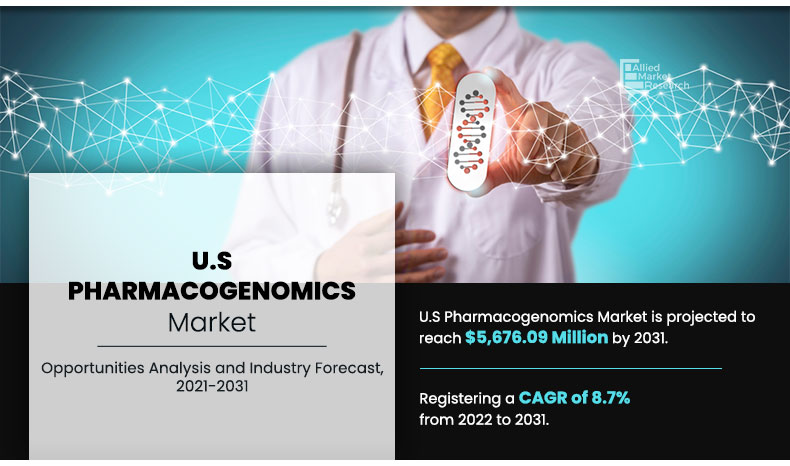

The U.S. Pharmacogenomics market size was valued at $2,463.9 Million in 2021, and is projected to reach $5,676.1 Million by 2031, registering a CAGR of 8.7% from 2021 to 2031.

Pharmacogenomics is the study of how genes affect a person's response to drugs. This area integrates the study of genes and their roles with the science of pharmaceuticals to create effective, secure medications that may be provided depending on a person's genetic profile. Pharmacogenomics is also a crucial element of precision medicine, which aims to individually or collectively modify medical therapy for each patient. Pharmacogenomics studies the relationship between DNA and how the body responds to drugs. Pharmacogenomics can help patients live healthier lives by helping them to know beforehand if a medication is likely to be helpful for them.

Pharmacogenomics is used to develop tailored drugs to treat a wide range of health problems, including cardiovascular disease, Alzheimer’s disease, cancer, and asthma.

There are 6 types of pharmacogenomics technologies, which include next-generation sequencing, polymerase chain reaction, gel electrophoresis, mass spectrometry, microarray, and others. Pharmacogenomics is used in cardiovascular diseases, infectious diseases, oncology, neurological diseases, and psychiatry. End users of pharmacogenomics technology include hospitals & clinics, research institutions, and academic institutes.

Historical overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The U.S. pharmacogenomics market grew at a CAGR of around 8.7% during 2021-2031. Most of the growth during this period was driven by a rise in the number of key players who manufacture pharmacogenomics drugs and an increase in the number of product launches and product approval for pharmacogenomic drugs.

Market Dynamics

Growth of the U.S. pharmacogenomics market is majorly driven by an increase in the prevalence of chronic diseases, such as cancer, diabetes, cardiovascular diseases, and infectious diseases; rise in the number of product launches of pharmacogenomics drugs; and advancements in technologies of the healthcare sector.

Rise in application of pharmacogenomics in cancer disease is anticipated to drive the growth of the U.S. pharmacogenomics market. Pharmacogenetics aims to identify individuals predisposed to a high risk of toxicity from conventional doses of cancer chemotherapeutic agents. Pharmacogenetic determinants may also influence treatment outcomes and clinical significance of polymorphisms in TS, MTHFR, and FCGR3A, as well as polymorphic DNA repair genes XPD and XRCC1, in influencing response to chemotherapy and survival outcomes.

Thus, the increase in the prevalence of cancer causes a rise in the application of pharmacogenomics for treatment, which increases market growth. For instance, according to the American Cancer Society, in 2021, an estimated 1.9 million new cancer cases were diagnosed, with 608,570 cancer deaths in the U.S. Moreover, according to the Centers for Disease Control and Prevention, in 2019, 1,752,735 new cancer cases were reported and 599,589 people died of cancer in the U.S. As per the same source, in 2019, for every 100,000 people, 439 new cancer cases were reported and 146 people died of cancer in the U.S.

Pharmacogenomics is also applied in the treatment of cardiac diseases, neurological disorders, infectious diseases, and others. Thus, the rise in the prevalence of chronic diseases such as cardiac diseases, neurological disorders, and infectious diseases are anticipated to boost the growth of the pharmacogenomics market. For instance, according to the Pan American Health Organization (PAHO), in 2019, neurological conditions account for 47.39% of deaths per 100,000 population.

In managing HIV/AIDS, with highly active antiretroviral agents, historical therapeutics maintain plasma concentrations at a level above the half-maximal inhibitory concentration (IC50) required for 50% inhibition in viral replication. Pharmacogenetic variations in drug-metabolizing enzymes contribute to this phenomenon. Over the last decade, knowledge about the role of pharmacogenetics in the treatment and prediction of ARV plasma levels has increased significantly. Thus, the rise in the prevalence of HIV is anticipated to drive the pharmacogenomics market. There is a rise in the application of pharmacogenomics in AIDS (Acquired Immune Deficiency Syndrome), which is anticipated to drive the growth of the U.S pharmacogenomics market. For instance, according to the HIV Gov., approximately 1.2 million people in the U.S. have HIV. As per the same source, in 2019, an estimated 34,800 new HIV infections occurred in the U.S.

The rise in presence of key players in the U.S. that manufacture pharmacogenomics drugs are anticipated to drive the growth of the U.S. pharmacogenomics market. For instance, Abbott Laboratories, Admera Health, Dynamic DNA Laboratories, Empire Genomics, LLC, F. Hoffmann-La Roche Ltd., Illumina, Inc., OneOme, LLC., Myriad Genetics Inc., OPKO Health, Inc., and Thermo Fisher Scientific, Inc. are some key players in the U.S. Hence, such factors propel the market growth.

Moreover, a rise in the adoption of key strategies such as acquisition, partnership, agreement, and business expansion by market players who manufacture pharmacogenomics is anticipated to fuel market growth. For instance, in May 2020, Admera Health, a biotechnology research company announced a partnership with Hygea Precision Medicine (Hygea), a company focused on developing a precision medicine software system for healthcare providers and patients to effectively manage genomic testing This important and strategic partnership allows Hygea to offer its customers high-quality tests from Admera Health, such as PGxOne™ Plus for pharmacogenomics.

In January 2021, Sema4 an AI-driven genomic and clinical data intelligence platform company, and OPKO Health, Inc. (“OPKO”), a multinational biopharmaceutical and diagnostics company announced they have signed a definitive agreement for Sema4 to acquire OPKO’s wholly owned subsidiary, GeneDx, Inc. (“GeneDx”), a leader in genomic testing and analysis, from OPKO. The acquisition strengthens Sema4’s leadership, growth, and scale for its market-leading health intelligence and genomic screening offerings. Hence, such factors propel the market growth.

The geriatric population is more susceptible to cardiac diseases, neurological disorders, infectious diseases, and cancer. Cancer can develop at any age. But as a person gets older, most types of cancer become more common.

This is attributed to the fact that cells can get damaged over time. This damage can then build up as a person gets older, and can sometimes lead to cancer. Thus, the rise in the number of geriatric populations in the U.S. is anticipated to fuel the application of pharmacogenomics for the treatment of cancer in the geriatric population. Thus, this factor is anticipated to drive the growth of the U.S. pharmacogenomics market.

For instance, according to the U.S. Administration for Community Living (ACL 2020) report, in 2019, the population aged 65+ was 54.1 million in which 30 million were women and 24.1 million were men. Thus, the increase in the geriatric population fuels demands for pharmacogenomics, which drives the growth of the pharmacogenomics market.

On the other hand, major factors that are expected to hinder the growth of the U.S. pharmacogenomics market include factors such as a shortage of skilled and highly trained healthcare professionals in performing pharmacogenomics diagnostics tests and a lack of pharmacogenomics information in electronic systems used by healthcare professionals.

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the U.S. pharmacogenomics market. Most of the chemotherapy and targeted therapy treatment schedules are postponed or rescheduled due conversion of cancer centers into COVID hospitals. Moreover, COVID-19 treatment has increased the use of personal protective equipment kits (PPE kits). Thus, it causes a scarcity of PPE kits for other surgical and medical process, which hinder market growth. Moreover, a decrease in the number of diagnostic and investigation tests for cancer, cardiovascular diseases, and neurological and psychiatric diseases are anticipated to have a negative impact on the U.S. pharmacogenomics market.

According to the JCO Global Oncology, an American Society of Clinical Oncology Journal, it was reported that delays and disruptions most investigated included a reduction in the routine activity of cancer services and a number of cancer surgeries. There was delay, rescheduling, or cancellation of outpatient visits. Interruptions and disruptions largely affected facilities and the supply chain.

On the other hand, the post-pandemic impact of COVID-19 on the U.S. pharmacogenomics market is expected to be positive, owing to a rise in the number of chemotherapy and targeted therapy treatments, which got canceled or rescheduled during the pandemic. In addition, the regularization of the supply chain of pharmacogenomics drugs in the U.S. by key players and the rise in the number of patient visits for investigation and treatment is anticipated to fuel the growth of the market after the COVID-19 pandemic.

U.S. PHARMACOGENOMICS MARKET SEGMENTATION

The U.S. Pharmacogenomics market is segmented on the basis of technology, application, and end user. By technology, the market is divided into next-generation sequencing, polymerase chain reaction, gel electrophoresis, mass spectrometry, microarray, and others. By application, it is divided into cardiovascular diseases, infectious diseases, oncology, neurological diseases, psychiatry, and others. By end user, it is segmented into hospitals & clinics, research institutions, and academic institutes.

By Technology

Polymerase Chain Reaction segment held a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Segment Review

By Technology

On the basis of technology, the market is divided into next generation sequencing, polymerase chain reaction, gel electrophoresis, mass spectrometry, microarray, and others. The polymerase chain reaction segment dominated the market, owing to an increase in the number of research activities.

By Application

Oncology segment held a dominant position in 2021 and would continue to maintain the lead over the forecast period.

By Application

On the basis of application, the market is classified into cardiovascular diseases, infectious diseases, oncology, neurological diseases, psychiatry, and others. The oncology segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to oncology.

By End User

Hospitals And Clinics was holding a dominant position in 2021 and would continue to maintain the lead over the analysis period.

By End User

On the basis of end user, the market is classified into hospitals & clinics, research institutions, and academic institutes. The hospitals & clinics segment dominated the market in 2021, and is expected to continue this trend during the forecast period, owing to an increase in the number of hospitals and a rise in the expenditure by the government to develop healthcare infrastructure.

Competition Analysis

Competitive analysis and profiles of the major players in the U.S. pharmacogenomics market include Abbott Laboratories, Admera Health, Dynamic DNA Laboratories, Empire Genomics, LLC, F. Hoffmann-La Roche Ltd., Illumina, Inc., OneOme, LLC., Myriad Genetics Inc., OPKO Health, Inc., and Thermo Fisher Scientific, Inc. There are some important players in the market such as Abbott Laboratories, Hoffmann-La Roche Ltd. and others. Major players have adopted product launch, product expansion and acquisition as key developmental strategies to improve the product portfolio of the U.S. pharmacogenomics market.

Agreement in market

in January 2021, Sema4, an AI-driven genomic and clinical data intelligence platform company, and OPKO Health, Inc. (“OPKO”), a multinational biopharmaceutical and diagnostics company, announced they have signed a definitive agreement for Sema4 to acquire OPKO’s wholly owned subsidiary, GeneDx, Inc. (“GeneDx”), a leader in genomic testing and analysis, from OPKO. The acquisition strengthens Sema4’s leadership, growth, and scale for its market-leading health intelligence and genomic screening offerings.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the U.S. pharmacogenomics market and the current trends & future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the market from 2022 to 2031 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the U.S. Pharmacogenomics market.

U.S. Pharmacogenomics Market Report Highlights

| Aspects | Details |

| By Technology |

|

| Key Market Players | Illumina, Inc., OneOme, LLC, F. Hoffmann-La Roche Ltd., Empire Genomics, LLC, Myriad Genetics Inc., Dynamic DNA Laboratories, Thermo Fisher Scientific, Inc, OPKO Health, Inc. (GeneDx.), Abbott Laboratories, Admera Health |

Analyst Review

This section provides perspective of CXOs of leading companies in the U.S. pharmacogenomics market. Pharmacogenomics (sometimes called pharmacogenetics) is a field of research that studies how a person’s genes affect how they respond to medications. Its long-term goal is to help doctors select the drugs and doses best suited for each person.

As per insights of CXOs, the Pharmacogenomics market in the U.S. has gained prominence in 2021, and is expected to witness a significant growth in the near future. This is attributed to the fact that utilization of pharmacogenomics has increased significantly, owing to rise in prevalence of chronic diseases and surge in adoption of key strategies such as acquisition, partnership, agreement, business expansion and others by market players.

For instance, in January 2021, Sema4, an AI-driven genomic and clinical data intelligence platform company and OPKO Health, Inc. (“OPKO”), a multinational biopharmaceutical and diagnostics company, announced they have signed a definitive agreement for Sema4 to acquire OPKO’s wholly owned subsidiary, GeneDx, Inc. (“GeneDx”), a leader in genomic testing and analysis, from OPKO. The acquisition strengthens Sema4’s leadership, growth, and scale for its market-leading health intelligence and genomic screening offerings.

The total market value of U.S pharmacogenomic market is $2,463.85 million in 2021.

The forecast period in the report is from 2022 to 2031

The market value of U.S pharmacogenomic market in 2022 was $2673.28 million

The base year for the report is 2021.

Yes, U.S pharmacogenomic companies are profiled in the report

The top companies that hold the market share in U.S pharmacogenomic market are Abbott Laboratories, Admera Health, Dynamic DNA Laboratories, Empire Genomics, LLC, F. Hoffmann-La Roche Ltd., Illumina, Inc., OneOme, LLC., Myriad Genetics Inc., OPKO Health, Inc., and Thermo Fisher Scientific, Inc.

The key trends in the U.S pharmacogenomic market are an increase in the prevalence of chronic diseases, such as cancer, diabetes, cardiovascular diseases, and infectious diseases; rise in the number of product launches of pharmacogenomics drugs; and advancements in technologies of the healthcare sector.

Loading Table Of Content...