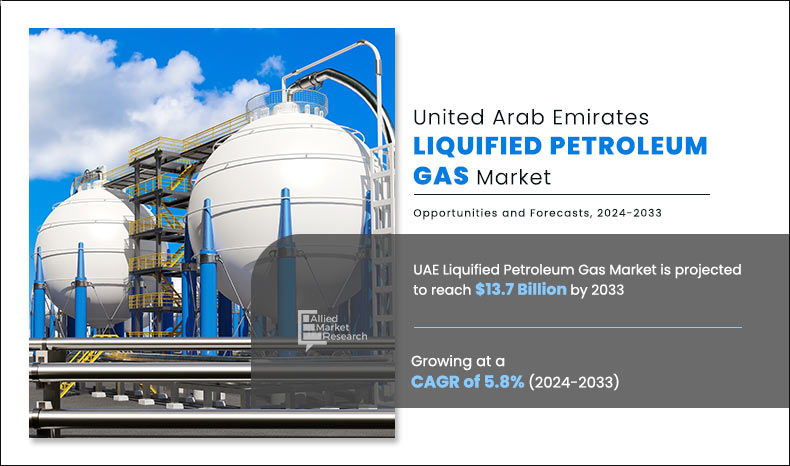

The UAE liquified petroleum gas market size was valued at $6.6 billion in 2023 and is projected to reach $13.7 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033. The rise in investment in oil and gas exploration and production activities in the UAE presents significant opportunities for the liquified petroleum gas market within the country. UAE has consistently invested in expanding its oil and gas reserves through exploration and production initiatives.

The UAE liquified petroleum gas market is experiencing moderate growth due to impact from oversupply of LPG in the global market. The overall production of LPG was more than the global demand for LPG for 2023. However, strong demands from countries like China, India, Indonesia, and Thailand are projected to drive the market growth for the UAE liquified petroleum gas market.

Report Hey Highlighters

- The report outlines the current UAE liquified petroleum gas market trends and future scenario of the market from 2022 to 2032 to understand the prevailing opportunities and potential investment pockets.

- The UAE liquified petroleum gas market has been analyzed in terms of value ($ Billion) and volume (tons). The analysis in the report is provided on the basis of product type and end-use industry across the country.

- The UAE liquified petroleum gas market share is fragmented in nature with many players such as Abu Dhabi National Oil Company (ADNOC), Dubai Fuel Supply LLC., Emarat, Sharjah National Oil Corporation (SNOC), Shield Gas Systems which hold significant share of the market.

- The report provides strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the UAE liquified petroleum gas market growth.

Introduction

Liquified Petroleum Gas (LPG) is a versatile hydrocarbon fuel commonly used for heating, cooking, and as a fuel for vehicles. It is a mixture of propane and butane, which are gases at room temperature and atmospheric pressure but liquified under moderate pressure. LPG is derived from natural gas processing and petroleum refining. It is produced during the refining of crude oil and the processing of natural gas. After extraction, LPG undergoes a purification process to remove impurities and separate it into its constituent gases, propane, and butane. It is then compressed and stored in liquid form under pressure for transportation and storage.

The UAE's industrial sector encompasses a diverse range of industries that rely heavily on energy sources such as LPG for various applications. LPG is commonly used in manufacturing processes, such as metal fabrication, plastic production, and chemical processing, where it serves as a clean-burning fuel for heating, melting, and drying operations. In addition, LPG is utilized in the construction sector for tasks such as welding and cutting metals, as well as in commercial establishments for heating, cooking, and powering appliances. The versatility of LPG makes it a preferred choice for industries seeking efficient energy solutions to support their growth and expansion initiatives. All these factors are expected to drive the demand for UAE liquified petroleum gas market during the forecast period.

However, the high installation costs associated with establishing LPG refineries pose a significant barrier to the growth of LPG in the UAE. The capital-intensive nature of building and operating LPG refineries, coupled with stringent safety and environmental regulations, contributes to high upfront investment costs that deter potential investors and stakeholders from entering the market. This cost burden hampers the expansion of LPG infrastructure and limits the competitiveness of LPG as an energy source compared to renewable alternatives that require lower upfront investment. The increased investment in LPG sector contributes to the country's energy security and generates ancillary benefits for the LPG sector. All these factors are anticipated to offer new growth opportunities for UAE liquified petroleum gas market during the forecast period.

Market Dynamics

Economic growth and industrial expansion are key drivers of the increasing demand for LPG in the UAE. As the UAE continues to experience rapid economic development and diversification, fueled by initiatives such as Vision 2021 and Vision 2030, the demand for energy sources such as LPG has surged to support the expanding industrial sector. For instance, the Abu Dhabi Economic Vision 2030 reaffirms economic diversification as a “key pillar” and aims to grow the non-oil sector by more than 7.5% annually to help the UAE achieve a neutral non-oil trade balance. In addition, the UAE's strategic location as a global trade hub, combined with its robust infrastructure and business-friendly environment, has attracted significant investments across various industries, driving up the need for reliable and cost-effective energy solutions.

The industrial sector in the UAE encompasses a wide range of industries such as manufacturing, petrochemicals, construction, and hospitality, all of which rely heavily on energy sources such as LPG to power their operations. With industrial activities expanding rapidly to meet the growing domestic and international demand, there is a corresponding increase in the demand for LPG as a fuel for various industrial processes, such as heating, drying, and powering machinery. This surge in industrial activity, coupled with the government's emphasis on economic diversification and industrialization, has fueled the demand for LPG as a primary energy source in the UAE.

UAE continues to diversify its energy mix and prioritize sustainable development. The renewable energy sector has experienced remarkable growth, particularly in solar and wind power generation. This expansion of renewable energy sources poses a competitive challenge to traditional fossil fuels such as LPG, as it offers cleaner and more environmentally friendly alternatives for meeting energy needs. The increasing deployment of renewable energy technologies, coupled with declining costs of solar panels and wind turbines, has led to greater affordability and accessibility of clean energy solutions in the UAE. As a result, there is a growing preference for renewable energy options over fossil fuels such as LPG, particularly in residential and commercial applications where sustainability considerations play a significant role.

Additionally, the high installation costs associated with establishing LPG refineries pose a significant barrier to the growth of LPG in the UAE. Unlike natural gas, which is transported via pipelines from gas fields to distribution points, LPG requires specialized refineries for processing and purification before it is distributed for use. The capital-intensive nature of building and operating LPG refineries, coupled with stringent safety and environmental regulations, contributes to high upfront investment costs that deter potential investors and stakeholders from entering the market. All these factors are expected to hamper the growth of the UAE liquified petroleum gas market during the forecast period.

The rise in investment in oil and gas exploration and production activities in the UAE presents significant opportunities for LPG within the country's energy landscape. As a major player in the global oil and gas industry, the UAE has consistently invested in expanding its oil and gas reserves through exploration and production initiatives. For instance, ADNOC plans to construct a new liquified natural gas plant in Fujairah that is more than double its export capacity, with production of as much as 9.6 million tons a year. This increased investment contributes to the country's energy security and generates ancillary benefits for the LPG sector.

Furthermore, the expansion of oil and gas exploration and production activities lead to the development of integrated energy infrastructure such as processing facilities and transportation networks, which is leveraged to support the production, storage, and distribution of LPG. By utilizing existing oil and gas infrastructure, the UAE enhances the efficiency and cost-effectiveness of LPG operations, facilitating greater market penetration and accessibility for consumers across residential, commercial, and industrial sectors. All these factors are anticipated to offer new growth opportunities for the UAE liquified petroleum gas market during the forecast period.

Segment Overview

On the basis of source, the market is classified into refinery, associated gas, and non-associated gas. The non-associated gas segment accounted for 52.4% of UAE liquified petroleum gas market share in 2022 and is expected to maintain its dominance during the forecast period. The growing domestic demand for natural gas as a cleaner alternative to traditional fossil fuels drives the exploration and production of non-associated gas in the UAE. Non-associated gas, with its lower carbon emissions and environmental benefits, represents a valuable resource for meeting growing energy demand while reducing environmental impact and mitigating air pollution in the UAE.

By Source

Associated gas is projected as the most lucrative segment.

On the basis of application, the UAE liquified petroleum gas market analysis is done across residential, commercial, agricultural, industrial, transportation, and others. The residential segment accounted for 38% of the market share in 2022 and is expected to maintain its dominance during the UAE liquified petroleum gas market forecast period. UAE's rapid urbanization and population growth have led to a surge in residential construction and development, driving the demand for reliable and cost-effective energy sources for heating, cooking, and powering household appliances. LPG, with its clean-burning properties and versatility, emerges as a preferred energy choice for residential use, particularly in areas where natural gas infrastructure is limited or unavailable.

By Application

Agriculture is projected as the most lucrative segment.

Competitive Analysis

Major players operating in the UAE liquified petroleum gas industry includes Abu Dhabi National Oil Company (ADNOC), Al Fanar Gas, Brothers Gas, Dubai Fuel Supply LLC., Emarat, Emirates Gas LLC, Plumblend, Sharjah National Oil Corporation (SNOC), Shield Gas Systems, and TotalEnergies.

Abu Dhabi National Oil Company (ADNOC) is the leading marketer, supplier, and distributor of bulk refined petroleum products, such as gasoil, gasoline, LPG, finished lubricants, and specialized products, to commercial, residential, industrial, and government customers in the UAE, in a highly competitive market space. In addition, the company’s proprietary Abu Dhabi National Oil Company voyager lubricants are exported to distributors in 25 countries, across the GCC, Africa, Europe, and Asia with more countries in the pipeline.

Sharjah National Oil Corporation (SNOC) is Sharjah’s most reliable energy provider and one of the leading natural gas, condensate and LPG producers in the United Arab Emirates. They have three gas condensate fields, a large gas processing plant at Sajaa that connects and delivers gas to the Northern Emirates for the past 35 years, and two export terminals at Hamriyah.

UAE Liquified Petroleum Gas Market Report Highlights

| Aspects | Details |

| By Source |

|

| By Application |

|

| Key Market Players | Emirates Gas LLC, Dubai Fuel Supply LLC., Sharjah National Oil Corporation, Plumblend, Al Fanar Gas, Abu Dhabi National Oil Company, Shield Gas Systems, Total Energies, Emarat, Brothers Gas |

Analyst Review

According to the opinions of various CXOs of leading companies, the UAE liquified petroleum gas market is expected to witness an increase in demand during the forecast period. Economic growth & industrial expansion, and energy diversification & security are expected to increase the demand for UAE liquified petroleum gas market during the forecast period.

LPG finds extensive use as a fuel for transportation, particularly in areas where infrastructure for natural gas vehicles (NGVs) is limited. LPG-powered vehicles, commonly referred to as Autogas vehicles, offer similar performance to gasoline or diesel vehicles while emitting fewer pollutants and greenhouse gases. This makes LPG an attractive alternative fuel for fleets, taxis, buses, and private vehicles, contributing to reduced air pollution and improved air quality in urban areas.

The market growth is primarily driven by UAE's robust economic development and diversification that play a pivotal role in driving the demand for LPG. As the UAE continues to invest in various industries such as manufacturing, construction, hospitality, and transportation, there is a corresponding increase in the demand for energy sources such as LPG to power these sectors. The versatility of LPG makes it a preferred choice for a wide range of applications such as heating, cooking, and as a fuel for vehicles, thereby driving its consumption across multiple industries.

The estimated market size for UAE liquified petroleum gas market was $13.7 billion by 2033.

The emerging players in the UAE liquified petroleum gas industry is Abu Dhabi National Oil Company (ADNOC), Al Fanar Gas, Brothers Gas, Dubai Fuel Supply LLC., Emarat, Emirates Gas LLC, Plumblend, Sharjah National Oil Corporation (SNOC), Shield Gas Systems, and TotalEnergies.

The major areas for development for UAE liquified petroleum gas market is residential and refinery.

Agriculture & transportation is projected to increase the demand for UAE liquified petroleum gas Market.

The most influencing segment of the market is associated gas

Loading Table Of Content...