UK IVF Services Market Overview:

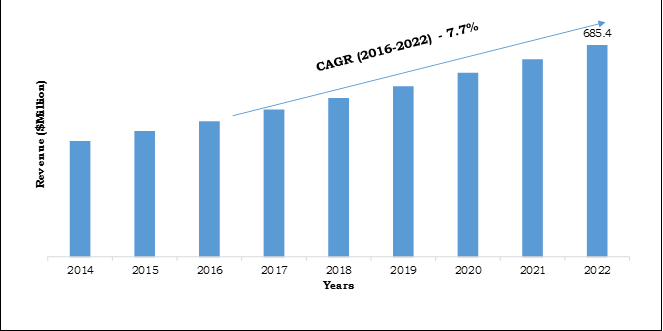

The UK IVF Services Market is projected to reach $685.4 million by 2022, registering a CAGR of 7.7% from 2016 to 2022. The emerging trend of delayed pregnancies and increasing average age of parenthood over the last decade drive the growth of the market. Moreover, rise in trend in same sex couples seeking parenthood through IVF treatment propels the growth of the market. Favorable government policies such as after Human Fertilization and Embryology Act in 2008 has favored single mothers and lesbian couples to opt for IVF treatment. In addition, there is growth in polygamy and polyandry, though, to a smaller level, which increases the need for alternative reproductive treatments. The UK has recently accepted the three parent IVF methods, commonly banned in other parts of the world. This method is anticipated to boost the growth of UK IVF services market owing to its inherent benefits of avoiding genes linked mitochondrial DNA diseases in babies.

However, ethical and religious issues related to surrogacy majorly restricts the market growth. For instance, Catholic Herald raised questions over the growth in number of perishing embryos and has demanded revaluation of the IVF legislation in the UK. The total number of IVF embryos allowed to perish has increased-from 6 in 1990 to 169,644 by 2013. This has largely limited the adoption of IVF technologies among infertile couples.

Key players profiled in the UK IVF services market report include Lister Fertility Clinic, The Bridge Center, and Chelsea and Westminster Hospital (Assisted Conception Unit).

UK IVF Services Market, ($Million), 2014-2022

The UK IVF services market is segmented based on end user and cycle type. Based on end user, the market is classified into fertility clinics, hospitals, surgical centers, and clinical research institutes. Based on cycle type the market is segmented as, fresh cycle (non-donor), thawed IVF cycle (non-donor), and donor egg IVF cycle.

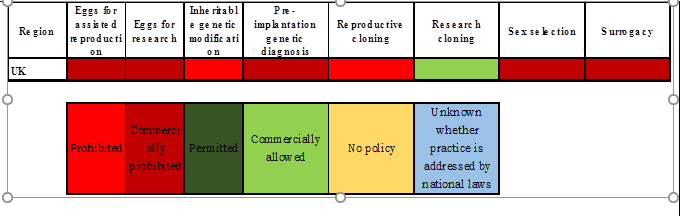

Uk Regulatory Scenario

Currently, the legislation that governs IVF and the related issues in UK is Human Fertilization and Embryology Act 2008 (HFE Act 2008), which is an amendment to Human Fertilization and Embryology Act 1990. Pursuant to HFE Act, HFEA was constituted for monitoring, licensing, and providing advice and information on human assisted reproduction (ART) and embryo research.

Key Benefits

- This report provides an extensive analysis of the current and emerging market trends and dynamics in the UK IVF services market

- In-depth analysis by quantitative analysis of the current market trends and estimations for 2014-2022 is provided in the report

- The IVF services market is analyzed based on cycle type and end users

- Extensive analysis of the market is conducted in terms of revenue and volume

UK IVF Services Market Key Segments:

End Users

- Fertility Clinics

- Hospitals

- Surgical Centers

- Clinical Research Institutes

Cycle Type

- Fresh IVF Cycles (Non-Donor)

- Thawed IVF Cycles (Non-Donor)

- Donor Egg IVF Cycles

UK IVF Services Market Report Highlights

| Aspects | Details |

| By END USERS |

|

| By CYCLE TYPE |

|

| By Region |

|

Analyst Review

The market for IVF services in the UK is growing, due to delayed pregnancy, increase in number of infertility cases, and delayed marriages. In addition, the commercialization of three parent IVF procedure in the UK in March 2012 has helped in the prevention of genetic diseases. This has provided further growth opportunities for the UK IVF services market. Furthermore, supportive regulation in the UK has supplemented the market growth. For instance, Human Fertilization and Embryo Authority (HFEA) adopted the double witness system to minimize the chances of embryo mix up in the UK clinics. They have made it necessary to appoint two specialists on the treatment site to minimize the risks associated with IVF treatments.

Loading Table Of Content...