Umbrella Insurance Market Research, 2031

The global umbrella insurance market was valued at $72.5 billion in 2021, and is projected to reach $170.7 billion by 2031, growing at a CAGR of 9.2% from 2022 to 2031.

Umbrella insurance is extra insurance that provides protection beyond existing limits and coverages of other policies. It offers an extra measure of protection to those who run the possibility of being held liable for injuries sustained by third parties or property damage caused by them in an accident. Invasion of privacy, vandalism, slander, and libel are also protected. Moreover, umbrella insurance provides coverage for claims that may be excluded by other liability policies including claims like false arrest, libel, slander, and liability coverage on rental units’ policy holder owns.

There is an increase in the demand for umbrella insurance as it minimizes business risk. Umbrella insurance provides different advantages for businesses, which help to stay protected from various types of risks. In addition, the ease of settling claims and rise in consumer awareness among the people are driving the growth of the umbrella insurance market. However, surge in fraudulent activities and lack of knowledge about umbrella insurance policies have emerged as key industry problems. On the contrary, technological advancement in the field of insurance is projected to be opportunistic for the umbrella insurance market growth.

The report focuses on growth prospects, restraints, and trends of the umbrella insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the umbrella insurance market size.

Segment Review

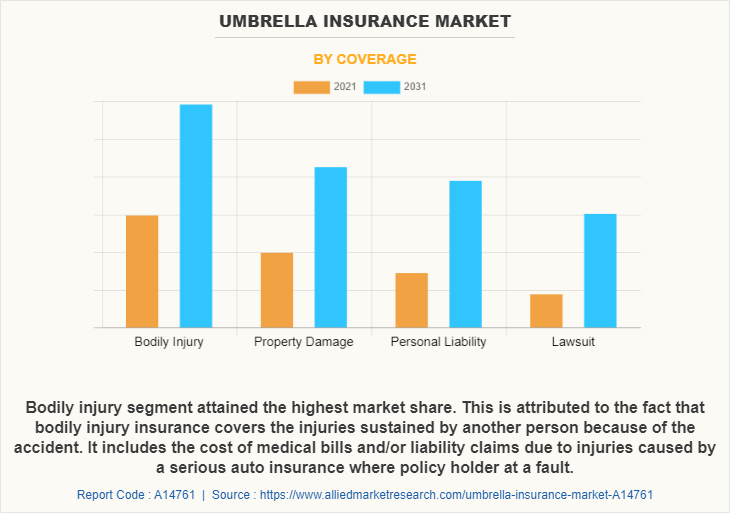

The umbrella insurance market is segmented on the basis of coverage, distribution channel, and end user. By coverage, it is segmented into bodily injury, property damage, personal liability and lawsuit. By distribution channel, it is bifurcated into insurance agents, direct response, banks and others. By end user, it is segmented into personal and business. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on coverage, the bodily injury segment attained the highest growth in 2021. This is attributed to the fact that bodily injury insurance covers the injuries sustained by another person because of the accident. It includes the cost of medical bills and/or liability claims due to injuries caused by a serious auto insurance where policy holder at a fault. Such factors drives the growth of the umbrella insurance market.

Based on region, North America attained the highest growth in 2021. The driving factor behind the growth of the market in North America region is the increased frequency and increased cost of each natural disaster which results in insurance carriers paying out more money in claims. Furthermore, various small business owners have gained awareness of this insurance policy, with rise in security concerns. Also, the umbrella insurance market is experiencing growth in North America, due to massive increase in natural hazards and loss by theft in developing countries.

The report analyzes the profiles of key players operating in the Umbrella insurance market such as CAN, GEICO, Insureon, NerdWallet, Nationwide, Progressive Casualty Insurance Company, Tata AIG General Insurance Company Limited, The Hartford and Travelers. These players have adopted various strategies to increase their market penetration and strengthen their position in the umbrella insurance market share.

Market Landscape and Trends

The exploration of technologies and search for differentiation in the insurance industry is driving an increased focus by insurance carriers on providing superior service to agency partners and customers. Moreover, insurance companies are responding to where customers choose to conduct business, whether it’s through a digital channel, over the phone, or a little of both. In addition, forward-thinking carriers in the umbrella insurance space are identifying unique ways to optimize their core systems to achieve faster solutions, simplify technology operations and adapt quickly to change. Furthermore, many companies are focused on opportunities to leverage software across multiple areas for enhanced solutions. For instance, utilizing the same vendor for processing claims and underwriting. This synergy improves the user experience as well as enhances efficiencies for employees and customers.

Top impacting factors

Umbrella Insurance Minimizes Business Risk

Umbrella insurance provides ample number of advantages for businesses, which help to stay protected from various types of risks. It protects the insured's business if injuries are caused to the other person due to their business operation. In addition, it safeguards the insured for an offense like wrongful entry, false arrest, and slander. Furthermore, it covers their legal liability for various offenses, which may arise if the insured company's marketing division violates someone's copyright rules. Moreover, if damages are filed against the insured, or if they are sued by any third party, the umbrella insurance policy covers the investigation and attorney expenses, medical expenses in case of injury. Furthermore, an umbrella insurance policy ensures that the insured ca n m b ove forward without incurring unnecessary monetary losses. The policy not only protects them against unexpected losses but also ensures a safe future for their business. Therefore, these are the major factors that propel the umbrella insurance market growth.

Ease in Settling Claims

The customer submits a claim to the insurance company, including all pertinent details. The process then determines the merit of the claim and the amount the company will pay during the claim settlement. Furthermore, insurance companies cannot afford to lose customer satisfaction as it is a key competitive advantage in the market, and so, they will try to assist their customers as quickly as possible by going through the claims they have submitted, thereby helping the customers to settle their claims in an easy and swift way. Therefore, the ease of settling claims is driving the growth of the insurance market during the forecast period.

Lack of Knowledge about Umbrella Insurance Policies

Umbrella insurance is a policy, which is not common among consumers as they are aware about life insurance policies and general insurance policies. Most of the consumers are not aware if umbrella insurance exists and if they know, they are not aware of the coverage under the policy. Therefore, lack of understanding and awareness regarding umbrella liability insurance coverage is a major factor that restrains the growth of the umbrella insurance market. Consumer experiences with respect to frequent road accidents and low adoption of motor vehicle liability insurance act as the primary concerns, which need to be addressed by eliminating knowledge gaps for motor vehicle liability insurance in the market. Therefore, this is a major factor that hampers the growth of the umbrella insurance industry.

Surge in Fraudulent Activities

Padding, inflating claims, staging accidents, misrepresenting facts on an umbrella policy application, submitting claims for injuries or damage that never occurred are some of the major frauds occur in the insurance sector. In addition, frauds such as internal fraud, rate evasion, underwriting fraud, claims fraud, and cybersecurity fraud are committed at different points in transaction by applicants, policyholders, third-party claimants, and professionals providing services to claimants. Therefore, this is one of the major factors that hampers the growth of umbrella insurance market.

Technological Advancements in the Field of Insurance

The growing number of small firms and technology improvements in the insurance industry are likely to propel the umbrella insurance market to new heights. In addition, predictive analytics is used by several umbrella insurers to collect a variety of data in order to fully understand and estimate corporate risks and losses. By delivering advanced services, such as quick and convenient insurance policies with reduced premium rates, the use of technology is aimed to promote client loyalty and expand the company's market position. Moreover, the umbrella insurance sector is predicted to develop as a result of government regulation necessitating umbrella insurance. Furthermore, the use of artificial intelligence (AI) has rapidly expanded, with AI-enabled devices becoming commonplace in homes around the world. With the help of AI, insurers can improve claims turnaround cycles and fundamentally change the underwriting process. Therefore, these factors will give opportunities for the growth of umbrella insurance market.

Report Coverage & Deliverables

Coverage Insights

Umbrella insurance policies provide extended liability coverage beyond standard insurance, offering protection against significant claims and lawsuits. Coverage typically includes personal liability, property damage, and legal fees, filling gaps left by primary policies.

Distribution Channel Insights

The market is distributed through various channels, including direct-to-consumer platforms, insurance agents, and brokers. Online distribution has been growing significantly due to the increasing preference for digital solutions.

End User Insights

Umbrella insurance caters to individuals, families, and businesses, with high-net-worth individuals being key users due to their need for higher liability protection.

Region Insights

North America dominates the umbrella insurance market, primarily due to higher consumer awareness and a well-established insurance sector. The U.S., in particular, has a large base of high-net-worth individuals who seek added liability protection, driving demand for umbrella policies. Europe follows closely, with a mature insurance industry and increasing uptake among individuals and businesses. In contrast, the Asia-Pacific region is experiencing rapid growth in the umbrella insurance market. Rising economic prosperity, increasing disposable income, and greater insurance penetration are contributing to the growing demand in countries like China, Japan, and India. Additionally, improving financial literacy and awareness of personal liability risks are expected to further boost adoption in the region. Latin America and the Middle East & Africa are also witnessing gradual market expansion, driven by increasing urbanization and economic development, though they still represent a smaller share of the global market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the umbrella insurance market forecast from 2021 to 2031 to identify the prevailing umbrella insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the umbrella insurance market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global umbrella insurance market trends, key players, market segments, application areas, and market growth strategies.

Umbrella Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 170.7 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 255 |

| By Coverage |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | The Hartford, NerdWallet, Tata AIG General Insurance Company Limited, Nationwide, GEICO, Progressive Casualty Insurance Company, CNA, Travelers, Insureon, Farmers |

Analyst Review

An umbrella insurance policy is a type of personal liability coverage that goes above and beyond the amount that regular home or vehicle insurance offers. Candidates for umbrella insurance include people who possess considerable assets or potentially hazardous things, or who engage in activities that could increase their risk of being sued.

Furthermore, market players are adopting product launch strategies for enhancing their services in the market and improving customer satisfaction. For instance, on February 2022, Distinguished Programs, a national insurance program manager, officially announces the relaunch of its Express Umbrella program which includes the Express Real Estate Umbrella and Express Community Associations Umbrella products. The program offers limits up to $5M and caters to community associations, homeowner associations, condominium associations and small commercial buildings.

Some of the key players profiled in the report include CAN, GEICO, Insureon, NerdWallet, Nationwide, Progressive Casualty Insurance Company, Tata AIG General Insurance Company Limited, The Hartford and Travelers. These players have adopted various strategies to increase their market penetration and strengthen their position in the umbrella insurance market.

The demand for umbrella insurance service is on an increase due to rise in consumer awareness amongst the people. There is a rise in the demand for umbrella insurance due to massive increase in natural hazards and loss by theft in developing countries.

Based on region, North America attained the highest growth in 2021. The driving factor behind this growth of the market in North America region is the increased frequency and increased cost of each natural disaster which results in insurance carriers paying out more money in claims. Furthermore, with rise in security concerns, various small business owners have gained awareness of this insurance policy. Also, due to massive increase in natural hazards and loss by theft in developing countries, the demand for umbrella insurance market has grown faster in North America.

The estimated industry size of umbrella insurance market is projected to reach $1,70,687.36 million by 2031, growing at a CAGR of 9.2% from 2022 to 2031.

CNA, GEICO, Insureon, NerdWallet, Nationwide, Progressive Casualty Insurance Company, Tata AIG General Insurance Company Limited, The Hartford and Travelers.

The umbrella insurance market is segmented on the basis of coverage, distribution channel, and end user. By coverage, it is segmented into bodily injury, property damage, personal liability and lawsuit. By distribution channel, it is bifurcated into insurance agents, direct response, banks and others. By end user, it is segmented into personal and business. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...