Underground Construction Equipment Market Research: 2031

The Global Underground Construction Equipment Market Size was valued at $19.4 billion in 2021, and is projected to reach $31.3 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031. Underground construction equipment are specially designed machinery used to perform or assist in construction operations below the earth's surface. Typically, these machines include tunneling equipment, piercing tools, vibratory plows, load and haul equipment, underground utility vehicles, dewatering systems and shortcrete solutions and others. These equipment are used for different functions such as tunneling, drilling, hauling, compacting, dewatering, and others. The global underground construction equipment market covers different industries such as construction & infrastructure, oil and gas and mining.

Market Dynamics

Although the construction sector is facing a slowdown, which is affecting new underground construction equipment sales, the underground construction equipment market is expected to recover during the forecast period. One of the reasons for the growth is anticipated to be the rise in focus on public-private partnerships (PPP). These partnerships are called joint ventures between government and private sector companies to build public infrastructure systems. In this type of partnership, a private company handles a project and lends technical & operational expertise to government projects.

The growth in public-private partnerships in different countries such as India, Africa, and China are expected to fuel the growth of the underground construction equipment end-user segment. Further, the rise in urbanization across the world has increased the demand to build infrastructure and transportation is expected to boost the underground construction equipment market growth. By 2040, the global population is estimated to grow by 2 billion with the urban population growing by over 40%.

However, factors such as strict government regulations and carbon emissions and high investment cost are anticipated to restrain the underground construction equipment market growth. Moreover, technological innovations are expected to provide lucrative opportunities for players that operate in the underground construction equipment market. For example, Caterpillar provides real-time feedback and onboard weighing systems in the vehicle, which help machinists trace key performance indicators such as day-to-day production capacity, tons/fuel charred, truckload counts, and tons/hours.

In addition, in 2020, 38-ton Sandvik launched an autonomous mining loader, known as Sandvik LH514. Moreover, in September 2022, the same company launched battery powered AutoMine® Concept Underground Drill. Autonomous vehicles are anticipated to allow the workers to manage the equipment rather than just functioning on the field. The penetration of automation technologies has made it possible to track equipment productivities from remote platforms such as mobile equipment type platforms and computer software. Automation technologies include inventory management solutions to conserve time and monetary expenses caused by mismanagement of equipment operations. The major manufacturers have already adopted these technologies to improve equipment performance, thereby creating opportunities for an upsurge in the underground construction equipment industry during the forecast period.

The demand for underground construction equipment decreased in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic has shut down the production of various products for the underground construction equipment end-user, owing to prolonged lockdowns in major global countries. This has hampered the growth of the underground construction equipment market significantly during the pandemic. The major demand for equipment and machinery was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, and China, which was severely affected by the spread of coronavirus, thereby halting demand for equipment and machinery. Equipment and machinery manufacturers must focus on protecting their workforce, operations, and supply chains to respond to immediate crises and find new ways of working after COVID-19 infection cases start to decrease.

Segmental Overview

The underground construction equipment market is segmented on the basis of type, solution, application, and region. By type, the market is categorized into tunneling equipment, piercing tools, vibratory plows, load and haul equipment, underground utility vehicles, dewatering system, shortcrete solutions. On the basis of solution, it is bifurcated into product and services. And on the basis of application, the market is categorized into oil & gas, railway and highway, municipal engineering, underground mining and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Solution Type:

The underground construction equipment market is divided into products and services. In 2021, the products segment dominated the underground construction equipment market, in terms of revenue, and the services segment is expected to maintain this trend during the forecast period. The products segment includes all the underground construction machinery offered by the manufacturers such as tunneling equipment, piercing tools, vibratory plows, load and haul equipment, underground utility vehicles, dewatering system, and similar others.

Companies such as Epiroc AB, Komatsu, and Caterpillar, provide a complete range of underground construction equipment; encompassing loaders, underground trucks, tunnel boring machine. Underground construction equipment manufacturers and distributors have started to generate a sizeable portion of revenue by providing services and replacement parts associated with underground construction equipment. The service segment covers maintenance, repair, replacement parts, support, and other services (inspection, design, and training).

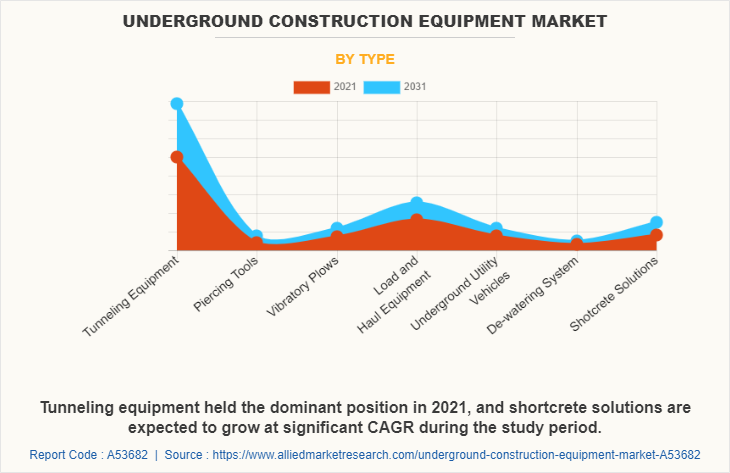

By Type:

The construction equipment market is categorized into tunneling equipment, piercing tools, vibratory plows, load and haul equipment, underground utility vehicles, dewatering system and shortcrete solutions. In 2021, the tunneling equipment segment accounted for the highest market share in the global underground construction equipment market share, and shortcrete solutions segment is anticipated to grow at a fastest CAGR during the forecast period. A tunnel boring machine is the modern type of machine used for boring the tunnel and it is also used for micro tunneling.

It is used for the excavation of non-circular tunnels, u-shaped tunnels, horseshoe tunnels, rectangular tunnels as well as square tunnels. It offers various advantages such as a high degree of precision and the entire operation has to be completed in less time. In addition, increasing applications in construction activities of roadway, railway, and mining are driving the demand for tunneling equipment. For instance, in May 2021, the Hudson tunnel Project is a part of the Gateway Program, developed to overhaul the aging New York City regional rail infrastructure. The Gateway program, which costs $1.8 billion to upgrade the existing North River Tunnel and $9.8 billion to build a new tunnel, increased in costs by 2.4% over the past year, due to delays, according to the Gateway non-profit.

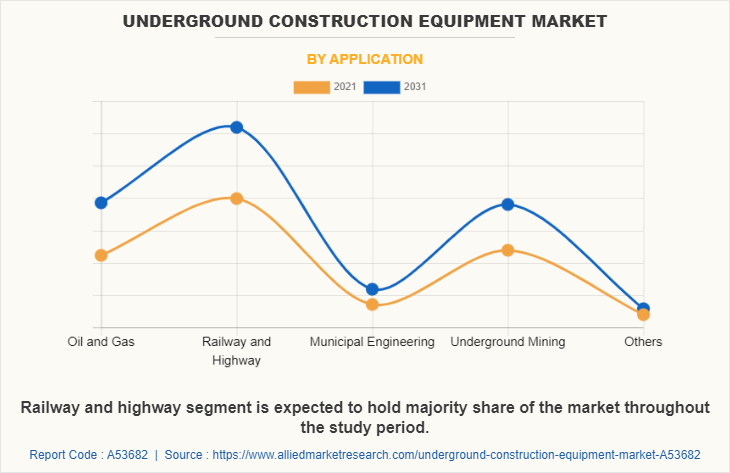

By Application:

The construction equipment market is divided into oil & gas, railway and highway, municipal engineering, underground mining, and others. In 2021, the railway and highway segment registered the highest market share in terms of revenue. The oil & gas segment is expected to grow at the highest CAGR during the forecast period. The demand for the oil and gas is expected to increase during the forecast period. For instance, according to a report published in 2020, by the Energy Information Administration (EIA), the demand for petroleum and liquid fuels is expected to rise by a total of 5.7 million barrels per day by 2025, with China and India accounting for about half of the growth.

Furthermore, according to the Invest India, total consumption of natural gas in India, in the financial year 2021-2022 was 63.9 billion cubic meters marking an increase of 5% over the previous financial year. Therefore, the increased spending on oil and gas exploration, and rising demand for oil and gas are expected to increase the demand for underground construction equipment used in the oil and gas industry. Moreover, in February 2023, the Tanzania government announced the construction of a crude oil pipeline for $3.5 billion is expected to complete by 2025. Such instances are anticipated to boost the growth of the market during the forecast period.

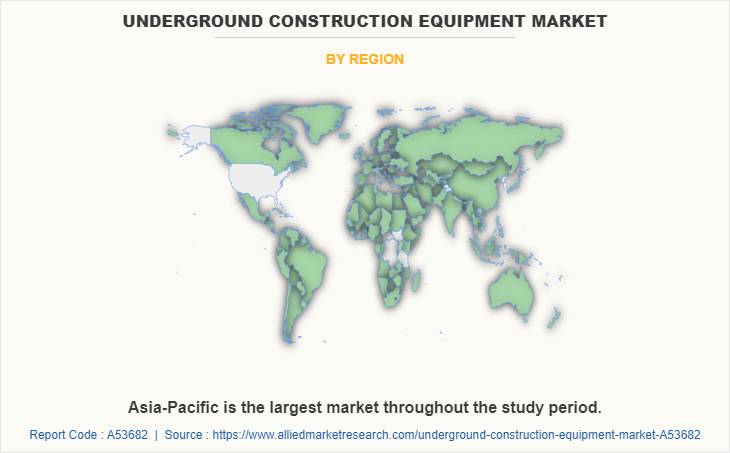

By Region:

The underground construction equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest underground construction equipment market share and is anticipated to secure the leading position during the forecast period, due to extensive demand in the construction & infrastructure segment. The major players are striving to develop manufacturing units in these markets to improve production quantities as well as serve the Asian industries including construction, oil & gas, mining, and others.

Furthermore, according to the report published by the Overseas Development Institute (ODI) based in London, the Asian regional economy grew by 6% in 2017 and is projected to grow significantly until 2025. This influences the overall growth of underground construction and manufacturing facilities in these regions. Thus, the improvement in overall production facilities is expected to create an underground construction equipment market opportunity in this region. Additionally, the major global players in the underground construction equipment market are strengthening their businesses and offerings in India, realizing the extensive growth opportunities for industrial growth in the country. Moreover, China is one of the major exporters of underground construction equipment globally.

China has motivated underground construction equipment manufacturers to establish their production units in the country. The low labor and material costs in China help manufacturers produce underground construction equipment at lower prices. The Chinese underground construction equipment market also includes many small manufacturers that serve the Asian demand for underground construction equipment. Furthermore, industries such as manufacturing, energy, mining, and agriculture are some of the major industries in China. Hence, the development of these industries creates opportunities for the growth of underground construction equipment in China.

Competition Analysis

Competitive analysis and profiles of the major players in the construction equipment end-user, such as Caterpillar Inc, China railway group limited, Epiroc AB, Global TBM Company, Herrenknecht ag, Kawasaki Heavy Industries, Ltd., Komatsu Ltd., Mitsubishi Corporation, Sandvik AB, and Sany Group Co Ltd are provided in this report. There are some important players in the market such as Sandvik AB, Komatsu, and Epriroc. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the underground construction equipment market.

Some examples of product launches in the market

In December 2022, Sandvik mining and rock solutions launched a highly automated, compact, twin boom drill for underground development and small scale tunneling. The new DD322i is a versatile drill that can be utilized in mining or tunneling, and it has a new carrier and design and can tram in small headings, tight corners, and intersections because of its compact size. Further, the lower costs of compact equipment boost their adoption in end-user industries.

Acquisitions in the market

In December 2022, Komatsu Ltd. acquired GHH Group GmbH, which is a leading manufacturer of underground mining, tunneling, and special civil engineering equipment and has its headquarter in Gelsenkirchen, Germany.

Key Benefits For Stakeholders

- This underground construction equipment market forecast report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the underground construction equipment market analysis from 2021 to 2031 to identify the prevailing underground construction equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the underground construction equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global underground construction equipment market trends, key players, market segments, application areas, and market growth strategies.

Underground Construction Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 31.3 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 278 |

| By Solution Type |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Global TBM Company, Sandvik AB, Epiroc AB, China Railway Group Limited, Sany Group Co., Ltd., Mitsubishi Corporation, Herrenknecht AG, Caterpillar Inc., Kawasaki Heavy Industries, Ltd., Komatsu Ltd. |

Analyst Review

The underground construction equipment market has witnessed significant growth in the past few years, owing to a surge in construction and infrastructure development activities. The rise in demand for compact underground construction equipment in countries such as the U.S., Canada, the UK, Germany, and China has fueled the growth of the underground construction equipment.

Furthermore, growth in infrastructure projects is positively influencing the market growth, especially in developing countries such as India, China, and Vietnam. Heavy construction equipment is extensively used in construction sites owing to their larger capacities. Apart from these positive factors, the market is negatively impacted by strict government regulations regarding carbon emissions released by construction equipment and high initial investments for the equipment. Moreover, integration of latest advanced technologies such as automation in the underground construction equipment are providing lucrative opportunities for the growth of the market.

Rise in number of infrastructure projects and advancements in technology are some of the upcoming trends of Underground Construction Equipment Market in the world.

Underground Construction Equipment are extensively used for a wide range of construction and mining activties.

Asia-Pacific is the largest regional market for Underground Construction Equipment.

$19,418.9 Million is the estimated industry size of Underground Construction Equipment.

Caterpillar Inc, China railway group limited, Epiroc AB, Global TBM Company, Herrenknecht ag, Kawasaki Heavy Industries, Ltd., Komatsu Ltd., Mitsubishi Corporation, Sandvik AB, and Sany Group Co Ltd are some of the top companies to hold the market share in Underground Construction Equipment?

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

$31,256.9 Million will be Underground Construction Equipment control market growth in 2031.

Latest version of global Underground Construction Equipment market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...