Underground Electric Construction Equipment Market Research, 2032

The global underground electric construction equipment market size was valued at $4.5 billion in 2023, and is projected to reach $16.3 billion by 2032, growing at a CAGR of 15.3% from 2024 to 2032.

The Underground Electric Construction Equipment Industry contains a wide variety of electric-powered systems used for underground construction and maintenance work. Electrically powered underground construction equipment is becoming increasingly famous due to its environmental friendliness, decreased noise level, and lower working costs. Moreover, the construction sector is a significant emitter of greenhouse gases, accounting for approximately 20% of total emissions, with diesel-powered machinery being a primary contributor. Electric construction equipment offers a solution by producing zero emissions during operation, thus playing a crucial role in mitigating climate change and enhancing air quality. With zero emissions and quieter operation, electric powered equipment minimizes air pollutants and disruptions to surrounding regions, making it perfect for constrained and tight underground spaces. In addition, electric equipment requires less maintenance and offers more reliability, contributing to accelerated task completion. Its versatility and adaptability similarly enhance its suitability for the demanding situations of underground construction, allowing for specific maneuverability in tight spaces.

Key Benefits For Stakeholders

- The underground electric construction equipment market studies more than 23 countries. The analysis includes a country-by-country breakdown analysis in terms of value.

- The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3, 700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The Underground electric construction equipment market share is marginally fragmented, with players such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, JCB (J.C. Bamford Excavators Ltd) , Sany Group, Doosan Infracore, XCMG Group, and Terex Corporation. Major strategies such as product Launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Key Market Dynamics

The construction industry stands at a pivotal juncture, facing the constraints to reduce its environmental footprint while meeting the demands of rapid urbanization and infrastructure development. Amid various methods and ways, electrification of critical equipment such as diggers, drills, jumbos, and others is playing a crucial role in driving down the carbon footprint.

As cities expand and populations surge, the demand for underground utilities from electrical cables to water pipelines becomes evident. Underground electric construction equipment is a necessity for such construction as it is an environment-friendly solution since it does not release any fumes. However, a major restraint to the Underground Electric Construction Equipment Market Growth is the high upfront cost of the electric construction equipment.

However, a significant restraint for the widespread adoption of electric construction equipment lies in its upfront costs, which often surpass those of conventional diesel-powered counterparts. This financial barrier can deter companies from making the switch, despite the long-term environmental benefits.

Advancements in battery technology and the accelerating shift towards renewable energy sources present a compelling opportunity for the underground electric construction equipment market. As battery costs continue to plummet and renewable energy infrastructure expands, the economic viability of electric equipment becomes increasingly evident. With each technological leap, the gap between electric and diesel-powered machinery narrows, making the former a more attractive investment for construction companies seeking to future-proof their operations

In conclusion, the ascent of electric construction equipment underground symbolizes a transformative shift towards sustainability in the construction industry. While challenges persist, the promise of cleaner, greener operations and a brighter, more sustainable future beckons. As companies embrace this paradigm shift, they not only pave the way for cleaner construction practices but also lay the groundwork for a more sustainable world for generations to come.

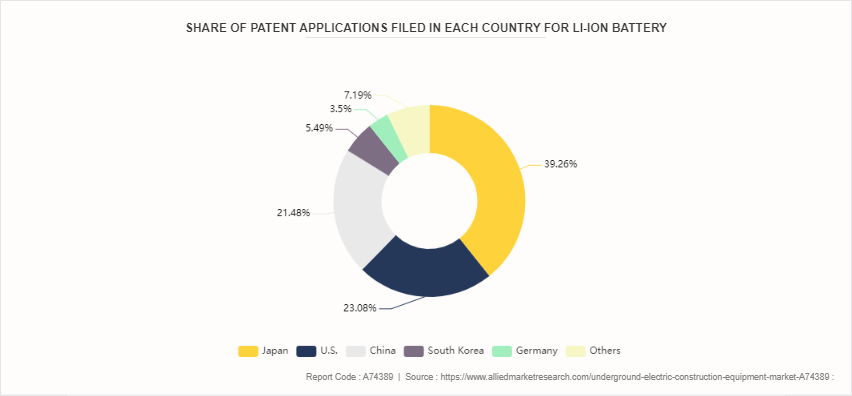

Patent Analysis of Global Underground electric construction equipment Market

Although the growth of the underground electric construction equipment market has been more rapid in recent years, the industry can draw on the earlier U.S. and international experience; code, standard, regulatory, and research bodies. In recent years many new patents have been filed by various entities across the world. The chart below depicts the share of patents filed in different regions across the world.

Market Segmentation

The underground electric construction equipment market is segmented into offering type, equipment type, application, and region. On the basis of offering type, the market is divided into products and services. As per equipment type, the market is segregated into boomers, loaders, trucks, drill rigs, excavators, trenchers, and others. On the basis of application, the market is bifurcated into oil and gas, railway and highway, municipal engineering, underground mining, others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The Asia-Pacific region stands as a vibrant hub of infrastructure construction activity, fueled by rapid urbanization, population growth, and economic development. With its diverse mix of emerging and established economies, the region offers a dynamic landscape for infrastructure investment and development. China, as the largest economy in the region, holds a significant share of infrastructure construction activity. The country's ambitious Belt and Road Initiative (BRI) and urbanization projects continue to drive substantial investments in transportation, energy, and real estate infrastructure. China alone accounts for approximately 45% of the infrastructure construction market in the Asia-Pacific region.

India, with its burgeoning population and robust economic growth, also plays a pivotal role in shaping the infrastructure landscape. The government's focus on initiatives such as "Make in India" and "Smart Cities Mission" has spurred investments in transportation, renewable energy, and urban infrastructure projects. India accounts for around 20% of the infrastructure construction market share in the region. Southeast Asian countries like Indonesia, Vietnam, and the Philippines are witnessing a surge in infrastructure development, driven by infrastructure gaps, urbanization, and the need for connectivity. These countries collectively contribute approximately 15% to the infrastructure construction market in Asia-Pacific.

Government Policies favoring the market:

- Under section 80IA, the Indian government provides tax benefits to the businesses involved in infrastructure development, which is also a driver of the market.

- In China, Local governments issued 3.41 trillion yuan approximately ($471.262 billion) in new special bonds, supporting over 23, 800 projects. In addition, investment in rural infrastructure and new areas like cloud computing and 5G base stations have witnessed a surge.

Competitive Landscape

The major players operating in the underground electric construction equipment market include Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, JCB (J.C. Bamford Excavators Ltd) , Sany Group, Doosan Infracore, XCMG Group, and Terex Corporation.

Other players in underground electric construction equipment market include Atlas Copco, Sandvik Group, Wacker Neuson SE, Kobelco Construction Machinery Co., Ltd., and Hyundai Construction Equipment Co., Ltd.

Recent Key Strategies and Developments

- In March 2021, Epiroc launched its latest boomer drill. Epiroc's latest innovation, the Boomer M20, features protected hydraulics, sensors, and cables, meticulously designed to reduce unexpected downtime and optimize performance in challenging underground mining environments. Representing the next evolution in underground mining technology, this cutting-edge equipment sets a new standard for uptime and operational efficiency.

- In May 2024, Komatsu unveiled the second generation of its Z2 product line, comprising small-class development drill and bolting equipment. This latest iteration introduces notable enhancements and additions, including Komatsu's inaugural battery-electric offerings within its underground hard rock portfolio.

Key Sources Referred

1. Associated General Contractors of America (AGC)

2. National Association of Home Builders (NAHB)

3. Construction Industry Institute (CII)

4. Associated Builders and Contractors (ABC)

5. National Center for Construction Education and Research (NCCER)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the Underground electric construction equipment Market segments, current trends, estimations, and dynamics of the underground electric construction equipment market analysis from 2023 to 2032 to identify the prevailing Underground Electric Construction Equipment Market Opportunity.

- The Underground Electric Construction Equipment Market Forecast is analysed between 2024 and 2033.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Underground electric construction equipment Market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Underground electric construction equipment Market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global underground electric construction equipment market trends, key players, market segments, application areas, and market growth strategies.

Underground Electric Construction Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.3 Billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2024 - 2032 |

| Report Pages | 199 |

| By Offering Type |

|

| By Equipment Type |

|

| By Application |

|

| By Region |

|

Analyst Review

The construction industry is at a pivotal juncture, balancing the need to reduce its environmental footprint with the demands of rapid urbanization and infrastructure development. Among various methods, the electrification of critical equipment such as diggers, drills, and jumbos is crucial for lowering the carbon footprint. As cities expand and populations grow, the demand for underground utilities like electrical cables and water pipelines becomes evident. Underground electric construction equipment is essential for such construction, providing an eco-friendly solution that emits no fumes. However, a significant restraint on market growth is the high upfront cost of electric construction equipment compared to conventional diesel-powered counterparts. This financial barrier can deter companies from making the switch, despite the long-term environmental benefits.

Advancements in battery technology and the accelerating shift towards renewable energy sources present a compelling opportunity for the underground electric construction equipment market. As battery costs continue to decrease and renewable energy infrastructure expands, the economic viability of electric equipment becomes increasingly apparent. Each technological leap narrows the gap between electric and diesel-powered machinery, making electric equipment a more attractive investment for construction companies looking to future-proof their operations.

A major upcoming trends of Underground Electric Construction Equipment Market in the globe is increasing demand for sustainability.

Based on application, the underground mining segment held the highest market share in 2023.

Asia-Pacific is the largest regional market for Underground Electric Construction Equipment.

According to the report, the underground electric construction equipment market was valued at $4.5 billion in 2023, and is estimated to reach $16.3 billion by 2032, growing at a CAGR of 15.3% from 2024 to 2032.

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, JCB (J.C. Bamford Excavators Ltd), Sany Group, Doosan Infracore, XCMG Group, and Terex Corporation.

Loading Table Of Content...