Underground Mining Vehicle Market Research, 2032

The Global Underground Mining Vehicle Market size was valued at $33 billion in 2022, and is projected to reach $53.7 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032. Underground mining vehicles can be defined as specialized equipment capable of performing activities such as tunneling, drilling, compacting, dewatering, and material handling below the surface of the earth. These vehicles are used for underground mining operations for the transportation of materials, excavations, drilling, and extraction of minerals. It has various applications such as coal mining, metal mining, mineral mining, and others.

Market Dynamics

The growing population, rising urbanization, and industrialization are boosting the underground mining vehicle industry is expected to continue to grow as the demand for various metals and minerals increases. By 2040, the global population is estimated to grow by 2 billion with the urban population growing by over 40%. A sufficient supply of minerals and raw materials is essential to the sustainability and growth of the global economy. Almost every industry depends on underground mining products, such as coal, among others. Underground mining vehicles are used to excavate precious metals, which are found in hard rock deposits, for example, ore containing gold, silver, iron, copper, zinc, nickel, tin, and lead. It is also used to excavate ores of precious gems such as diamonds or rubies. Softer minerals such as salt, and coal, among others, are also mined by using underground mining vehicles. However, factors such as strict government regulations carbon emissions and high investment cost are anticipated to restrain the underground mining vehicle market growth.

Moreover, technological innovations are expected to provide lucrative opportunities for players that operate in the underground mining vehicle market. For example, Caterpillar provides real-time feedback and onboard weighing systems in the vehicle, which help machinists trace key performance indicators such as day-to-day production capacity, tons/fuel charred, truckload counts, and tons/hours. In addition, in 2020, 38-ton Sandvik launched an autonomous mining loader, known as Sandvik LH514. Moreover, in September 2022, the same company launched battery powered AutoMine Concept Underground Drill. Autonomous vehicles are anticipated to allow the workers to manage the equipment rather than just functioning on the field. The penetration of automation technologies has made it possible to track equipment productivity from remote platforms such as mobile equipment type platforms and computer software. Automation technologies include inventory management solutions to conserve time and monetary expenses caused by mismanagement of equipment operations. The major manufacturers have already adopted these technologies to improve equipment performance, thereby creating opportunities for an upsurge in the underground mining vehicle market during the forecast period.

Segmental Overview

The underground mining vehicle market is segmented into Type, Application, Propulsion Type, and region. By type, the market is categorized into hydraulic excavators, mining dozers, underground haulers, and others. On the basis of application, it is segmented into metal mining, mineral mining, and coal mining. On the basis of propulsion type, the market is categorized into ICE and electric. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

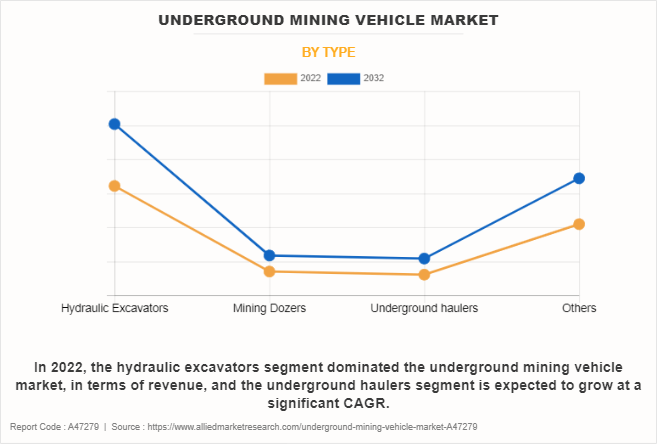

By Type:

The underground mining vehicle market is divided into hydraulic excavators, mining dozers, underground haulers, and others. In 2022, the hydraulic segment dominated the underground mining vehicle market, in terms of revenue, and the underground haulers segment is expected to grow at a significant CAGR. An excavator is a type of underground mining vehicle used for digging the ground and handling materials such as soil, sand, aggregate, and other similar materials. An excavator comprises of boom, dipper, bucket, and cab on a rotating platform. Excavator is mainly used in mines, forestry, construction, demolition, and material handling. They are popularly known as diggers, or mechanic shovels. Moreover, key players are focusing on developmental strategies such as product launches to boost their product offerings. These products are made to sustain severe conditions and with advanced features. For instance, in May 2023, Komatsu Ltd. developed a new concept medium-sized hydraulic excavator that combines a hydrogen fuel cell for the application of various industry verticals such as mining, construction, material handling, and others. All such factors are anticipated to boost the growth of the market.

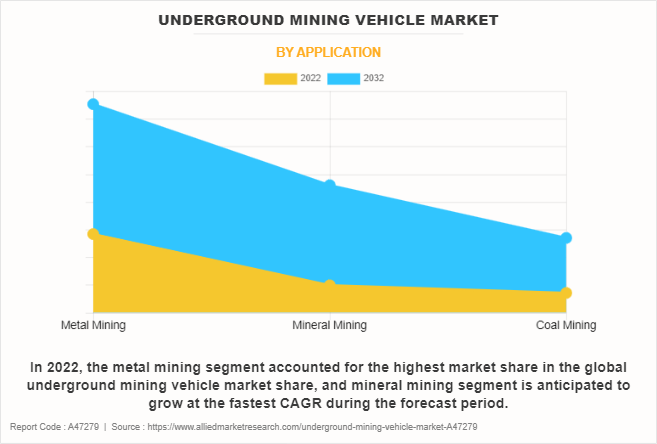

By Application:

The underground mining vehicle market is categorized into metal mining, mineral mining, and coal mining. In 2022, the metal mining segment accounted for the highest market share in the global underground mining vehicle market, and mineral mining segment is anticipated to grow at the fastest CAGR during the forecast period. The major drivers for the underground mining vehicle are growth in mining activity, increasing demand for metal and mineral commodities and rapid urbanization is expected to boost the growth of the market. Mining is one of the most important sectors in the world. Globally, the demand for metal has increased; thus, mining of metal ores has also increased. For instance, iron ore exports of India reached $2.23 in billion financial year 2021, registering an increase of 21.8% YoY.

Moreover, the transition from traditional fossil-based fuels to lower carbon alternative has increased the mining for different types of minerals such as lithium, cobalt, and alternative battery materials. Hence, the expected growth in the mining sector will increase the demand for equipment used in mining. In underground mining, operating systems have changed as equipment has evolved. A mine transportation system indispensable for underground mining. Robust manufacturing and high striking force of underground mining equipment make them efficient underground mining equipment, increasing the demand for underground mining vehicles during the forecast period.

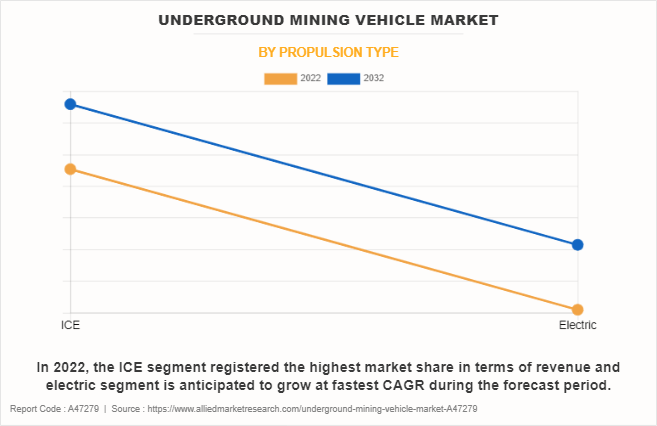

By Propulsion Type:

The market is divided into ICE and electric. In 2022, the ICE segment registered the highest underground mining vehicle market share in terms of revenue and electric segment is anticipated to grow at fastest CAGR during the forecast period. Internal combustion engine (ICE) underground mining vehicles continue to be driven by several key factors. One significant factor is the established infrastructure and familiarity with traditional engine technologies. Many mining operations already have the necessary infrastructure in place for fueling, maintaining, and servicing ICE vehicles.

The existing support systems, including fueling stations and maintenance facilities, contribute to the continued use of ICE vehicles in underground mining. In addition, the availability of a well-established supply chain for traditional fuels such as diesel ensures a reliable and consistent source of energy for these vehicles, which is crucial for continuous mining operations. Underground mining combustion engine (ICE) plays a vital role in the mining industry, and it offers various advantages such as reliability, efficiency, durability, ease of maintenance, and necessary mobility for mining operations. All such factors are anticipated to boost the market growth.

By Region:

The Underground Mining Vehicle Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific had the highest share in market and is anticipated to secure the leading position during the forecast period. The major share of the underground mining vehicle market in Asia-Pacific is held by China, in terms of utilization and manufacturing. However, developing countries such as India, Vietnam, Indonesia, and others have been recognized as important markets, owing to rapid infrastructural growth. Some of the key players operating in the Asian market include Komatsu (Japan), and Jinan Fucheng Hydraulic Equipment Co., Ltd.

Moreover, major players are adopting various strategies such as acquisitions, product launches, and collaboration to sustain the intense competition. For instance, in October 2021, Komatsu announced a collaboration with Proterra to electrify the underground mining machines using Proterra’s battery technology. Proterra supplies H series battery system technology to Komatsu for the development of battery electric LHDs, drills, and bolsters for underground hard rock mining. Furthermore, growth in the construction of tunnels, subways, and other sectors is expected to create opportunities for the growth of the underground mining vehicle market in this region.

Competition Analysis

Competitive analysis and profiles of the major players such as Caterpillar Inc, China Railway Group Limited, Epiroc AB, Global TBM Company, Herrenknecht ag, Kawasaki Heavy Industries, Ltd., Komatsu Ltd., Mitsubishi Corporation, Sandvik AB, and Sany Group Co Ltd are provided in this report. There are some important players in the market such as Sandvik AB, Komatsu, and Epriroc. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the underground mining vehicle market.

Some examples of product launches in the market

In September 2023, MacLean launched its latest battery electric mining vehicle “ML5 BEV Multi-Lift” at the Asia-Pacific International Mining Exhibition (AIMEX) in Sydney, Australia.

In October 2023, MacLean launched its new battery electric-powered scissor truck “EV SeriesTM SL3 Scissor Lift” at the XXXV International Mining Convention in Queretaro, Mexico.

In October 2023, Normet launched Normet Xrock, a line of hydraulic breakers, pedestal breaker booms, and boom automation systems. This newly launched equipment can be used for different construction, tunneling, and infrastructure works.

In June 2023, Normet launched the Spraymec MF 050 VC SD for cleaner, safer, and more productive concrete spraying for underground mining applications.

Collaboration in the market

In October 2023, Caterpillar and Freeport-McMoRan announced a collaboration to convert the mining company’s fleet of 33 Cat® 793 haul trucks at its Bagdad mine in Arizona to an autonomous haulage system (AHS) using Cat MineStar™ Command for hauling.

Acquisitions in the market

In December 2022, Komatsu Ltd. acquired GHH Group GmbH, which is a leading manufacturer of underground mining, tunneling, and special civil engineering equipment.

In May 2022, Normet acquired Aliva Equipment assets to strengthen its sprayed concrete offering. Normet adopted this growth strategy to strengthen its offering in sprayed concrete processes.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging underground mining vehicle market trends and dynamics.

- In-depth underground mining vehicle market analysis is conducted by constructing market estimations for the key market segments between 2022 and 2032.

- Extensive analysis of the underground mining vehicle market opportunity is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The underground mining vehicle market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the underground mining vehicle market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the underground mining vehicle industry.

Underground Mining Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 53.7 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Application |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | Johnson Industries, Fucheng Underground Mining Equipment Manufacturer, MacLean Engineering & Marketing Co., Komatsu, AB Volvo, Normet, Epiroc AB, SANY Group, Caterpillar, Hermann Paus Maschinenfabrik GmbH |

Analyst Review

The underground mining vehicle market has witnessed significant growth in the past few years, owing to a surge in construction and infrastructure development activities. The rise in demand for compact underground mining vehicles in countries such as the U.S., Canada, the UK, Germany, and China has fueled the growth of the underground mining vehicles market.

Furthermore, growth in infrastructure projects is positively influencing the market growth, especially in developing countries such as India, China, and Vietnam. Heavy construction equipment is extensively used in construction sites and mining sectors owing to their larger capacities. Apart from these positive factors, the market is negatively impacted by strict government regulations regarding carbon emissions released by equipment and high initial investments in the equipment. Moreover, the integration of latest advanced technologies such as automation in the underground mining vehicle are providing lucrative opportunities for the growth of the market.

The global underground mining vehicle market was valued at $32,974.5 million in 2022, and is projected to reach $53,649.4 million by 2032, registering a CAGR of 4.9% from 2023 to 2032.

The base year is considered in the global Underground mining vehicle market. report is 2022.

Rise in the number of infrastructure projects and advancements in technology are some of the upcoming trends of the Underground Mining Vehicle Market in the world.

Metal Mining is the leading application of the Underground Mining Vehicle Market.

Asia-Pacific is the largest regional market for Underground Mining Vehicle.

AB Volvo, Caterpillar, Epiroc AB, Fucheng Underground Mining Equipment Manufacturer, Hermann Paus Maschinenfabrik GmbH, Johnson Industries, Komatsu Ltd., MacLean Engineering & Marketing Co., Normet, and Sany Group Co Ltd. are the top companies to hold the market share in Underground Mining Vehicle.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Latest version of the global Underground Mining Vehicle market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...