Underwater Drone Market Summary

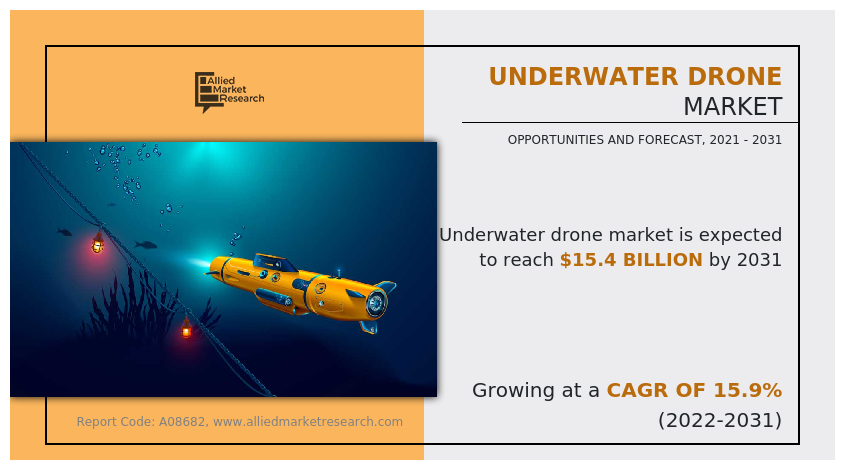

The global underwater drone market size was valued at $3.6 billion in 2021 and is projected to reach $15.4 billion by 2031, growing at a CAGR of 15.9% from 2022 to 2031.

Key Market Trends and Insights

Region wise, North America generated the highest revenue in 2021.

The global underwater drone market share was dominated by the defense and security segment in 2021 and is expected to maintain its dominance in the upcoming years

The Remotely Operated Vehicle (ROV) segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 3.6 Billion

- 2031 Projected Market Size: USD 15.4 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 15.9%

- North America: Generated the highest revenue in 2021

Market Dynamics

Underwater drones, also known as unmanned underwater vehicles (UUV) are the type of vehicles that are capable of functioning under the water (ocean and sea) without a human occupant. These vehicles are generally divided into two categories, remotely operated underwater vehicles (ROVs) that are controlled throughout their operations by a distant human operator, and autonomous underwater vehicles (AUVs) that are capable to function autonomously without any real-time human inputs. Technological advancements in unmanned underwater vehicles, for instance, high-resolution cameras, superior manipulator arms, and highly sensitive sonar have led to a reduction in the timelines required to inspect equipment and other submerged items, consequently opening an ocean of opportunities in the underwater drone market.

Factors such as a rise in deep-water offshore oil & gas exploration, increase in demand for underwater drones for defense and security applications, growth in demand for oceanographic research, and surge in government support to modernize military forces are anticipated to boost the growth of the global underwater drone market forecast timeframe. However, the communication problems associated with AUVs are expected to hinder the growth of the global underwater drone market during the forecast period.

Rise in deep-water offshore oil and gas exploration

In the recently released International Energy Outlook 2019 (IEO2019), the U.S. Energy Information Administration (EIA) predicted that global energy consumption shall grow by approximately 50% between 2018 and 2050. Currently, 80% of the energy demand is met by fossil fuels. There is an increase in the demand for energy across the world, and oil & gas (which form a major component of energy share) companies are improving the production, efficiency, and safety of their assets. Most of the world’s oil & gas reserves lie beneath the ocean. With the advancements in exploration, drilling, and production of oil & gas, now companies are able to drill thousands of feet deep, and more than a hundred miles offshore. Deep-water oil & gas production is shifting from the traditional floating type platforms to seafloor wellheads connected to seafloor pipes. Such systems depend on enhanced remote monitoring equipment and autonomous installations, which comprise unmanned underwater drones.

As operators continue to explore oil & gas reserves in deeper waters, the adoption of ROVs and AUVs is expected to take a leap over the years. Underwater drones increase operational safety, provide support in drilling and subsea construction, reduce the environmental impact of inspection operations, and decrease the deployment of personnel. Underwater drones provide an alternative to sending divers under the sea to perform routine inspection work. The inspection work carried out by drones is safe, and efficient, and reduces the environmental impact from frequent monitoring and inspection.

Rise in demand for underwater drones for defense and security applications

In recent years, military across the globe (for instance, the U.S. and UK) have begun using underwater drones for observation and inspection purposes. For instance, the U.S. Navy sees underwater drones as a key part of its defense strategy. According to a United States Department of Defense (DoD) report titled Autonomous Undersea Vehicle Requirement for 2025, submarine-based underwater drones will be used to increase the effective range of the submarine’s weaponry and sensors over the years. Unmanned Underwater Vehicles (UUVs) or drones allow the formation of an underwater surveillance, investigation, and intelligence network. These drones are immensely useful in carrying out dangerous missions such as countermeasures. The rise in the usage of underwater drones for military applications is anticipated to propel the global underwater drone market growth.

Communication problems associated with AUVs

One of the major challenges with the deployment of AUVs is communication and navigation. In the case of underwater communication, information is usually transmitted using radio waves (for instance submarine communications). Radio signals, for instance, those produced by GPS navigation systems, travel with the speed of light in air or vacuum. But, as the absorption of light in water is several times bigger than that in air, the radio signals can’t go reach greater depths underwater and therefore are not feasible for underwater communications.

To overcome these challenges with communications via radio waves, underwater drone navigation has to depend on different communication technologies, for instance, high-power inertial navigation sensors (INS) that are really expensive and cost thousands of dollars. Hence, the problems related with communication in deep water are estimated to hinder the growth of underwater drones during the forecast period.

Advancement of Underwater AI Systems for Autonomous Underwater Vehicles

The introduction of artificial intelligence in autonomous underwater vehicles will open up lucrative opportunities for manufacturers during the forecast period. Underwater artificial intelligence will allow unmanned devices to map the seafloor and perform underwater infrastructure repairs that would be dangerous for human technicians. The introduction of underwater artificial intelligence and 3D computer imaging in the field of underwater robotics will reduce the cost of offshore renewable energy generation. The Russian Navy has developed a nuclear-capable underwater drone, the Poseidon drone, and a special nuclear submarine Belgorod, as part of Project 09852. Poseidon is also known as an autonomous underwater drone and an autonomous nuclear torpedo. The Russian Navy plans to launch its UUV-powered nuclear submarine in 2020. Belgorod and Khabarovsk will equip each nuclear submarine with six Poseidon drones.

Segment Review

The underwater drone market size is segmented into type, propulsion system, application, product type, and region. The type of segment is further divided into remotely operated vehicle (ROV), autonomous underwater vehicles (AUV), and hybrid vehicles. By propulsion system, the underwater drone industry is segmented into electric system, mechanical system, and hybrid system. Depending on application, the market is segmented into defense & security, scientific research, commercial exploration, and others. In terms of product type, the market is segmented into micro, small and medium, light work-class, and heavy work-class. Region wise, the underwater drone market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

Micro type t is projected as most lucrative segment.

North America comprises U.S., Canada, and Mexico. North America is projected to witness an increase in demand for underwater drones driven largely by the increase in procurement of ROVs and AUVs for military modernization. For instance, in November 2022, the U.S. nuclear attack submarine fleet will be able to launch underwater drones to its submarine fleet with the capability to both launches and be recovered via torpedo tubes, allowing any submarine in the fleet to operate them on patrol. The drone, known as Razorback, will perform dangerous scouting work for crewed submarines. Furthermore, the rise in demand for underwater drones in the North American oil & gas industry for offshore drilling, inspection, and surveying the oil & gas reserves has increased the sales of underwater drones over the years.

By Application

Scientific research is projected as most lucrative segment.

In addition, manufacturers also developing underwater drones for several defense and military projects in the U.S. For instance, in September 2022, Northrop Grumman Systems Corporation is developing a new unmanned underwater vehicle (UUV) Manta Ray with the aim to operate long-range missions in ocean environments that support the Defense Advanced Research Projects Agency’s (DARPA’s) vision.

By Type

Hybrid vehicles is projected as most lucrative segment.

The growing product development, R&D, and innovation activities by the underwater drone manufacturing companies are anticipated to boost the growth of the underwater drone market in Canada over the forecast timeframe.

By Propulsion System

Mechanical system segment is projected as most lucrative segment.

Competitive Landscape

Competitive analysis and profiles of the major underwater drone market players include The Boeing Company, Lockheed Martin Corporation, Bluefin Robotics, Saab Seaeye Ltd, Teledyne Marine Group, Kongsberg Maritime, Oceaneering International, Inc., TechnipFMC plc, ECA Group, and Deep Ocean Engineering, Inc.

By Region

Asia-Pacific would exhibit the highest CAGR of 18.0% during the forecast period 2022-2031

The leading companies are adopting strategies such as agreements, expansion, partnerships, contracts and product launches to strengthen their market position. In August 2021, General Dynamics Mission Systems parent company of Bluefin Robotics Corporation opened a new UUV manufacturing and assembly facility at its Taunton manufacturing site.

In October 2021, ECA Group's A18D Autonomous Underwater Vehicle (AUV) was evaluated by the French Directorate General of Armaments, French Navy and Naval Hydrographic and Oceanographic Service as part of the Future Hydrographic and Oceanographic Capacity (CHOF) program. In October 2022, Kongsberg Maritime was awarded a contract of $9.8 million to deliver its underwater drones for three Polish Navy Kormoran II-class mine countermeasure vessels. Under the contract, Kongsberg will supply three HUGIN Autonomous Underwater Vehicle (AUV) systems and related HiPAP sub-surface positioning and communication systems. In March 2022, Kongsberg Maritime launched its new HUGIN Edge Autonomous Underwater Vehicle (AUV) with a forward-looking sonar design providing 3D sensing capabilities for improved trajectory planning and directional collision avoidance coupled to traditional forward scanning methodology. In August 2019, Deep Ocean Engineering, Inc. introduced a new light work-class ROV- PHANTOM. X8. Configured with six vectored horizontal and two vertical 2.2 kW Tecnadyne brushless thrusters, the PhantomR. X8 has complete control and authority in any given direction, even in the toughest currents.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the underwater drone market analysis from 2021 to 2031 to identify the prevailing underwater drone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the underwater drone market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the underwater drone industry players.

- The report includes the analysis of the regional as well as global underwater drone market trends, key players, market segments, application areas, and market growth strategies.

Underwater Drone Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 15.4 billion |

| Growth Rate | CAGR of 15.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 430 |

| By Application |

|

| By Type |

|

| By Propulsion System |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Deep Ocean Engineering, Inc., Bluefin Robotics Corporation, kongsberg maritime, TechnipFMC plc, ECA Group, Lockheed Martin Corporation, teledyne marine, The Boeing Company, Saab Seaeye Ltd, Oceaneering International, Inc. |

Analyst Review

The global underwater drone market is expected to witness significant growth due to the rise in demand for upgraded deep-water exploration and inspection equipment across different industry verticals. Underwater drones hold a promising potential in changing the traditional naval surveillance missions and to clear mines and map the ocean floor. Over the next decade, it is anticipated that the navies will extensively use the underwater drones to fetch sonar arrays and bring mines to the bottom of the ocean, launch torpedoes or itself become torpedoes to destroy opponent warships. Moreover, the rise in modernization of armies is expected to boost the growth of the market.

Underwater drones are being increasingly used in offshore oil & gas exploration activities across the world. Offshore oil & gas production accounts for a major share in the overall oil & gas production, and underwater drones with the capability of diving thousands of meters underwater, equipped with cameras, sensors, manipulator arms, and other payloads offer great benefits over traditionally deployed human divers and ships. Underwater drones encounter communication problems. The GPS signals that use radio waves are largely absorbed by the water; hence are not suitable for underwater communications. To overcome this problem, underwater drone navigation has to depend on expensive inertial navigation sensors (INS), which makes the operations of underwater drones costly. Such issues can be resolved with the development of technologies over the years.

The rise in demand for underwater drones for defense and security applications and the growing demand for oceanographic research are expected to drive the underwater drone market during the forecast period. Moreover, the advent of energy-efficient underwater drones and the rise in government support to modernize military forces are expected to offer lucrative opportunities for the market over the forecast timeframe. Besides this, the rising participation of start-ups (for instance Aquabotix, EyeROV, among others) to develop underwater drones across the globe is expected to boost the demand for the underwater drone market during the forecast timeframe.

The global underwater drone market size was valued at USD 3.6 billion in 2021, and is projected to reach USD 15.4 billion by 2031

The global underwater drone market is projected to grow at a compound annual growth rate of 15.9% from 2022-2031 to reach USD 15.4 billion by 2031

The Boeing Company, Lockheed Martin Corporation, Bluefin Robotics, Saab Seaeye Ltd, Teledyne Marine Group, Kongsberg Maritime, Oceaneering International, Inc., TechnipFMC plc, ECA Group, and Deep Ocean Engineering, Inc.

The largest regional market for Underwater Drone is North America.

An increase in defense expenses to strengthen the armed forces, a rise in offshore oil & gas exploration activities, and a surge in demand for oceanographic research to assess the oceans are anticipated to drive the growth of the global underwater drone market during the forecast period.

Loading Table Of Content...

Loading Research Methodology...