Underwriting Software Market Research, 2032

The global underwriting software market was valued at $5.7 billion in 2023, and is projected to reach $15.9 billion by 2032, growing at a CAGR of 12.5% from 2024 to 2032. With rise in demand for digital transformation and data-driven decision-making, the underwriting software market is expected to continue growing as businesses seek innovative solutions to optimize their underwriting processes.

Market Introduction and Definition

The underwriting software market refers to the sector in the financial industry that focuses on providing software solutions to streamline and automate the underwriting process. Underwriting software is designed to assess risks, evaluate data, and make informed decisions on whether to approve or deny insurance policies, loans, or other financial products. This market caters to insurance companies, financial institutions, and other organizations looking to enhance efficiency, accuracy, and speed in their underwriting operations.

Key Takeaways

The underwriting software market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected underwriting software market forecast period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major underwriting software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and underwriting software market outlook.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The financial industry's growing need for automation and digitization has led to the development of underwriting software. As businesses strive to enhance efficiency and accuracy in their underwriting processes, the adoption of underwriting software solutions is on the rise. These tools enable organizations to streamline data analysis, risk assessment, and decision-making, leading to faster and more informed underwriting decisions. Also, the growing complexity of risks and regulations in the financial sector is fueling the need for advanced underwriting software that can handle intricate data sets and compliance requirements. However, concerns around data security and privacy hamper the market. With the sensitive nature of the information involved in underwriting processes, organizations are cautious about the potential risks of data breaches and cyber threats. Ensuring robust security measures and compliance with data protection regulations is crucial for building trust among users and mitigating these concerns.

Furthermore, the underwriting software market presents significant opportunities for growth and innovation. The increasing focus on personalized customer experiences and data-driven decision-making is driving the development of advanced underwriting software solutions that can provide tailored insights and recommendations. Moreover, the integration of artificial intelligence and machine learning technologies in underwriting software is opening new possibilities for predictive analytics, risk modeling, and automation of underwriting tasks. By leveraging these opportunities, companies in the underwriting software market can differentiate themselves, drive operational efficiencies, and deliver enhanced value to their clients.

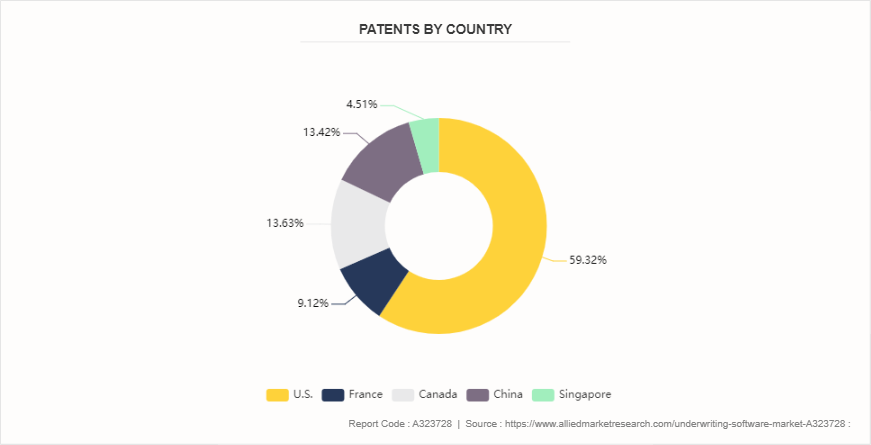

Patent Analysis

To improve decision-making processes, underwriting software is more focused on integrating cutting-edge technology such as machine learning and artificial intelligence. These technologies enable underwriting software to analyze vast amounts of data, identify patterns, and make predictive assessments with a high degree of accuracy. In addition, some underwriting software solutions offer real-time monitoring and dynamic risk assessment capabilities, allowing organizations to adapt quickly to changing market conditions and regulatory requirements. The integration of these cutting-edge technologies sets the underwriting software market apart by providing innovative solutions that drive efficiency, improve risk management, and deliver valuable insights to users. For instance, in Mary 2024, Applied Systems Europe® extended its partnership with Bravo Networks to support client money management for Applied Epic brokers. The partnership enabled the network and broker management system provider to complete architecture enhancements that deliver new reporting functions and compliance assurances, allowing Bravo Networks to support brokers with, their FCA compliance responsibilities, thereby enabling additional cost savings and scalability.

Market Segmentation

The underwriting software market is segmented into functionality, deployment mode, end user, and region. On the basis of deployment, the market is divided into on-premise and cloud. On the basis of functionality, the market is divided into automated underwriting systems (AUS), rating engines and decision support systems. On the basis of end user, the market is divided into insurance companies, insurance brokers and agencies, reinsurers and MGA (managing general agent). Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The U.S. underwriting software market is robust and dynamic, driven by the presence of a large and mature insurance industry that is increasingly embracing digital transformation. Insurers in the U.S. are investing in underwriting software solutions to improve operational efficiency, enhance risk assessment capabilities, and deliver personalized services to policyholders. The country's regulatory environment and focus on data security are also key factors shaping the underwriting software market, with a strong emphasis on compliance and data protection driving demand for secure and reliable software solutions. Further, the UK underwriting software market is characterized by a strong emphasis on regulatory compliance and risk management, with insurers investing in advanced software solutions to navigate the complexities of the insurance landscape. The UK's well-established insurance sector and focus on customer-centric services drive the adoption of underwriting software that can streamline processes, improve underwriting accuracy, and enhance customer experience.

In March 2023, Send Technology Solutions Ltd. (Send) and Sollers Consulting announced a new partnership to deliver Send’s underwriting platform to commercial and specialty insurers. Sollers supported the UK InsurTech in the successful implementation of Send Underwriting Workbench to a major international insurer in a matter of months. The two companies enhance their digital underwriting skills in response to growing demand from global insurers.

In March 2024, the leading global provider of AI-based SaaS solutions for financial services, and Sollers Consulting, an international operational advisory and software integrator for the financial sector, announced partnership delivering Earnix solutions to property & casualty (P&C) insurers in the UK, the U.S., France, Benelux, Nordics, and DACH regions. The partnership enables clients to harness advanced analytics, machine learning, and AI capabilities, empowering them to make data-driven decisions, improve pricing strategies, optimize product offerings, and manage risk more effectively.

In September 2021, Applied Systems Europe partnered with Willis Towers Watson to support real-time pricing. Willis Towers Watson’s Radar Live partner programme enables insurers and MGAs to develop their rates, underwriting rules and adjustments, and then deploy them directly to the market in real time. Also, Applied expanded their Rating Hub functionality to host and integrate with Radar Live, giving insurers enhanced access to data and analytics, and a choice of rating products to suit their business and pricing needs.

Industry Trends:

Insurers are leveraging AI and ML algorithms to enhance underwriting processes by analyzing vast amounts of data, identifying patterns, and predicting risks more accurately. By incorporating AI and ML capabilities into underwriting software, insurance companies can automate decision-making, improve risk assessment accuracy, and streamline operations. This trend reforms the underwriting landscape, enabling insurers to make data-driven decisions, enhance underwriting efficiency, and deliver more personalized and competitive insurance products and services to customers. For instance, in November 2022, Duck Creek Technologies announced integration of AI and ML capabilities into their underwriting software to enhance risk assessment and decision-making process.

Insurers are increasingly adopting advanced technologies to automate manual underwriting processes, improve operational efficiency, and enhance customer experience. By integrating automation tools and digital solutions into underwriting software, insurance companies can streamline workflows, reduce processing times, and minimize errors. This trend is driving a shift towards more agile and responsive underwriting practices, enabling insurers to adapt quickly to changing market conditions and customer needs. The focus on automation and digital transformation in underwriting software is revolutionizing the insurance industry, paving the way for more efficient, data-driven, and customer-centric underwriting processes. For instance, in 2023, Insurity unveiled a new underwriting software feature that automates policy checking and validation process, streamlining underwriting operations and enhancing efficiency.

Cloud computing's scalability, adaptability, and cost-effectiveness are being recognized by insurers as advantages for underwriting procedures. Insurance businesses are able to access real-time data, facilitate smooth team collaboration, and improve overall operational efficiency by utilizing cloud-based underwriting software. In addition, cloud-based solutions provide easier system integration, better security measures, and data backup capabilities. The insurance business is experiencing innovation due to the trend toward cloud-based underwriting software, which makes it possible for insurers to make better decisions, adjust to shifting market dynamics, and provide clients with more responsive and agile underwriting services. For instance, in 2022, Oneshield software launched a cloud-underwriting platform to provide insurers with scalable and flexible solutions for underwriting process.

Competitive Landscape

The major players operating in the underwriting software industry include Insurity LLC., Applied Systems, Inc, Ebix Inc, Guidewire Software, Duck Creek Technologies, Accenture, Sapiens International, FINEOS, Verisk Analytics, Inc, OneShield, and others.

Recent Key Strategies and Developments

In October 2023, Appian announced the availability of the Connected Underwriting Life Workbench to help insurers unify workflows and data in an automated, end-to-end process. The solution makes underwriters' lives easier by giving them a single interface to evaluate and classify risk, handle exceptions, and make case decisions. The new Connected Underwriting Life Work benchmark is a streamlined underwriting solution prebuilt on the Appian Platform.

In April 2023, Federato partnered with Google Cloud to integrate advanced AI capabilities into its RiskOps underwriting platform. It is hoped that this move will enable underwriters to make data-driven decisions and focus on opportunities where they are most price competitive by leveraging Federato’s signature RiskOps optimisation framework and embedding these innovations into the core platform for gradual adoption.

Key Sources Referred

Whattech

Aimultiple

Oneshield

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the underwriting software market analysis from 2024 to 2032 to identify the prevailing underwriting software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network and underwriting software market share.

- In-depth analysis of the underwriting software market segmentation assists to determine the prevailing underwriting software market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global underwriting software market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global underwriting software market trends, key players, market segments, application areas, and underwriting software market growth strategies.

Underwriting Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 15.9 Billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 215 |

| By Functionality |

|

| By Delpoyment Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ebix Inc, Accenture, Guidewire Software, OneShield, Applied Systems Inc., FINEOS, Duck Creek Technologies, Verisk Analytics, Inc., Insurity LLC., Sapiens International |

The underwriting software market was valued at $5,678.43 million in 2023 and is estimated to reach $18,247.90 million by 2032, exhibiting a CAGR of 12.5% from 2024 to 2032.

Growing focus on data analytics and artificial intelligence are the upcoming trends of Underwriting Software Market in the globe.

Integration of Internet of Things (IoT) devices and telematics data into underwriting software is the leading application of Underwriting Software Market.

North America is the largest regional market for Underwriting Software as of now 2023.

Insurity LLC., Applied Systems, Inc, Ebix Inc, Guidewire Software, Duck Creek Technologies, Accenture, Sapiens International, FINEOS, Verisk Analytics, Inc, OneShield are the top companies to hold the market share in Underwriting Software.

Loading Table Of Content...