Unit Heater Market Research, 2032

The Global Unit Heater Market was valued at $4 billion in 2022 and is projected to reach $6.7 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

The global unit heater market is anticipated to experience significant growth in the forecast period, driven by factors such as the increase in demand for efficient heating solutions in residential, commercial, and industrial sectors, coupled with advancements in technology. The market size is predicted to expand further due to a rise in awareness regarding energy-efficient heating systems and the growing focus on sustainable heating solutions. Additionally, factors such as stringent regulations promoting energy conservation and the need for cost-effective heating options are expected to propel unit heater growth projections.

A unit heater is a heating appliance commonly used to warm up small to medium-sized spaces, such as garages, workshops, or warehouses. Characterized by its compact and self-contained design, a unit heater typically integrates all necessary components within a single housing, including the heating element, a fan or blower, and controls. These heaters can operate on various energy sources, such as electricity, natural gas, propane, or fuel oil. They are often mounted on walls or ceilings to save floor space and distribute heat more evenly. The directness of the heat output, combined with the ability to target specific areas, makes unit heaters a practical and versatile solution for spot heating in diverse settings.

Key Takeaways of the Unit Heater Market Report

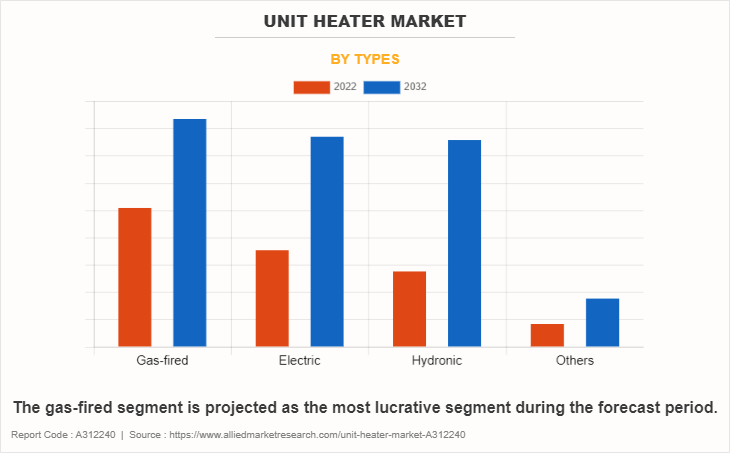

Based on type, the gas-fired segment held the largest unit heater market share in 2022. However, the hydronic segment is anticipated to grow at the fastest CAGR during the forecast period.

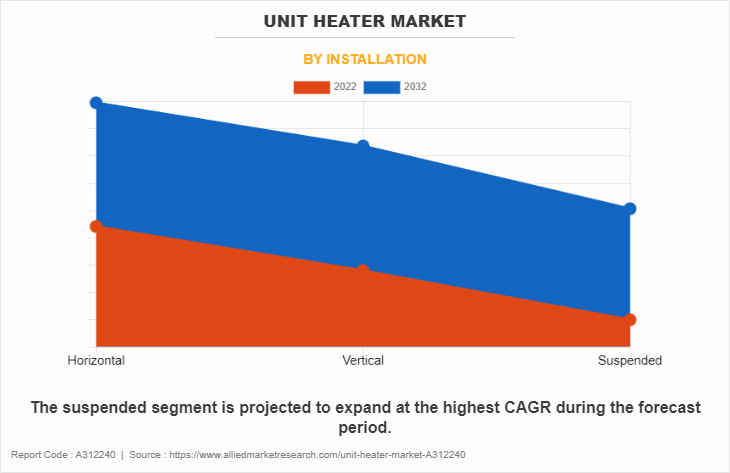

Based on installation, the horizontal segment dominated the unit heater market in terms of revenue in 2022. However, the suspended segment is anticipated to grow at the fastest CAGR during the forecast period.

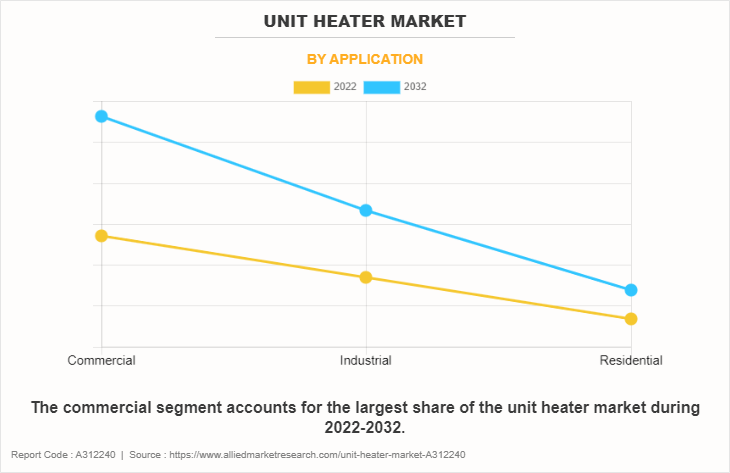

Based on Application, the commercial segment held the largest share in the unit heater industry in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

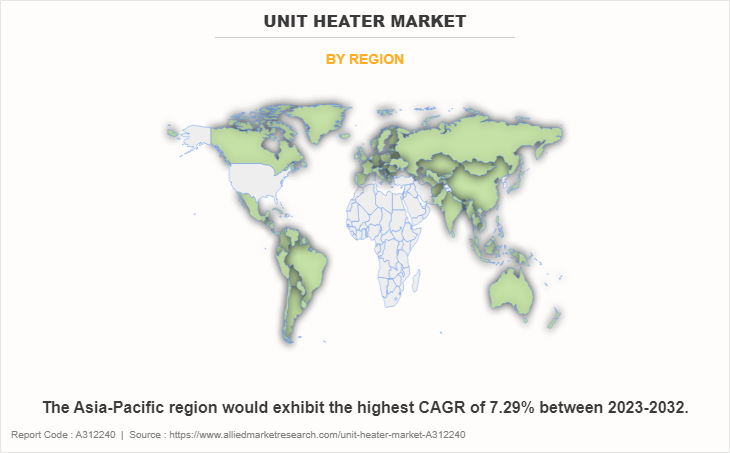

Region-wise, North America held the largest market share in 2022. The US dominates the unit heater market size by country in the North America region. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Market Dynamics

The surge in e-commerce drives unit heater demand in warehousing facilities

The expansion of e-commerce and warehousing facilities has emerged as a significant driver in the unit heater market. This rising demand for unit heaters can be attributed to the ever-expanding e-commerce landscape, where the efficient operation of distribution centers and storage facilities has become vital for seamless online shopping experiences and timely deliveries. As businesses strive to optimize their logistics and meet consumer demands efficiently, the importance of maintaining ideal warehouse conditions, including temperature control, has become increasingly evident.

For instance, on April 14, 2023, the shift to a regional fulfillment model by Amazon highlighted the need for efficient heating systems like unit heaters in warehousing facilities. With warehouses now closer to end customers, maintaining optimal working conditions is crucial for employee comfort and productivity. Unit heaters are essential for regulating temperatures, particularly in colder months or regions with harsh weather, aligning with Amazon's objective of enhancing delivery speeds and customer satisfaction amid the surge in e-commerce.

Environmental concerns impacting the unit heater market

Environmental concerns pose a significant restraint in the unit heater market. While unit heaters are effective heating solutions, some of them rely on fossil fuels as their heat source. This reliance on non-renewable energy sources raises concerns over emissions of greenhouse gases and air pollutants, contributing to environmental degradation and climate change. In an era of heightened environmental awareness and regulations aimed at reducing carbon footprints, the use of fossil fuels in unit heaters can hinder market growth. Consumers and businesses increasingly seek greener and more sustainable heating alternatives, which has led to a shift toward energy-efficient and eco-friendly heating technologies, posing a challenge for unit heaters that are not aligned with these environmental priorities.

For instance, in 2022, California enacted stringent regulations targeting emissions from heating appliances, including unit heaters, to combat air pollution and mitigate climate change impacts. The regulations, part of the state's broader environmental initiatives, mandate a phase-out of certain types of unit heaters reliant on fossil fuels. This move reflects a growing trend toward prioritizing eco-friendly heating alternatives and underscores the challenges faced by traditional unit heaters in meeting evolving environmental standards.

Product innovation creates opportunity in the unit heater market

Product innovation presents a promising opportunity in the unit heater market. The introduction of innovative unit heater designs, such as hybrid systems that combine multiple heating technologies or units with enhanced energy storage capabilities, can capture the attention of environmentally conscious customers. These innovations cater to the growing demand for energy-efficient and eco-friendly heating solutions and offer the potential for reduced operating costs and environmental impact. By staying at the forefront of technological advancements and addressing sustainability concerns, manufacturers can position themselves favorably in the market, attracting a discerning customer base seeking cutting-edge, efficient, and environmentally friendly unit heaters. This avenue of product innovation holds the potential to drive unit heater market growth and competitiveness.

For instance, LG Electronics introduced the world's first solar-powered air conditioner on February 18, 2022, targeting greener cooling solutions. This breakthrough innovation integrates traditional AC technology with solar energy generation, lessening reliance on the grid and minimizing environmental impact. The development highlights the potential for hybrid designs in heating systems, presenting an opportunity for eco-friendly and cost-effective solutions in the unit heater market. This example underscores the importance of continuous innovation in meeting sustainability goals and addressing the evolving needs of environmentally conscious consumers in the heating and cooling industry.

As these innovations pave the way for a more sustainable future, integration with traditional systems becomes increasingly important. The central heat system, heat pump system, and HVAC unit are integral components of modern heating and cooling solutions. The central heating system efficiently distributes warmth throughout a building, ensuring comfort during colder seasons. Conversely, the heat pump system utilizes innovative technology to extract heat from the air or ground, offering both heating and cooling capabilities for year-round comfort. Meanwhile, the HVAC unit serves as a versatile system, providing heating, ventilation, and air conditioning functionalities tailored to diverse climate needs. Together, these systems exemplify the advancements in indoor climate control, offering efficient and effective solutions for residential, commercial, and industrial spaces.

Segments Overview

The unit heater market is segmented based on type, installation, application, and region.

On the basis of type, the unit heater market is broken down into gas-fired, electric, hydronic, and others. In 2022, the gas-fired segment held the largest share of the unit heater market due to its cost-effectiveness, high energy efficiency, and the widespread availability of natural gas as a fuel source. Moreover, the hydronic segment is projected to manifest the highest CAGR during the forecast period, owing to its superior energy efficiency and ability to provide consistent and comfortable heating through radiant heat transfer.

On the basis of installation, the market is classified into horizontal, vertical, and suspended. In 2022, the horizontal segment dominated the unit heater market in terms of revenue due to its wide application in commercial and industrial spaces, where efficient space utilization and even heat distribution are crucial. However, the suspended segment is projected to witness the fastest CAGR during the forecast period, owing to its flexibility in installation, allowing for optimal heating solutions in spaces with limited floor space or specific layout requirements.

On the basis of application, the market is fragmented into commercial, industrial, and residential. In 2022, the commercial segment dominated the unit heater industry, holding the largest market share and exhibiting the highest CAGR during the forecast period. This growth is primarily driven by the rising demand for energy-efficient heating solutions in commercial buildings, including offices, malls, and hospitality spaces. The objective is to enhance comfort levels while simultaneously reducing operational costs.

Based on region, the global unit heater market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Chile, Argentina, rest of Latin America ), and Middle East & Africa (UAE, Saudi Arabia, Africa, rest of MEA). In 2022, North America held the largest market share in the unit heater industry due to its harsh winter climates, strong industrial and commercial sectors, and stringent energy efficiency standards driving the demand for advanced heating solutions. However, the Asia-Pacific segment is projected to experience the fastest CAGR during the forecast period, driven by rapid industrialization, urbanization, and increasing adoption of heating solutions in emerging economies like China, India, and South Korea.

In North America, the U.S. stands out as the highest revenue generator in the unit heater market. This prominence is attributed to the country's extensive industrial and commercial sectors, which demand efficient and reliable heating solutions, especially during the colder months. The U.S. market benefits from a robust manufacturing base, technological advancements, and a strong emphasis on energy-efficient systems.

In Europe, Germany holds the maximum share in the unit heater market. Germany's leadership in this market segment is supported by its strong industrial base, stringent energy efficiency regulations, and a focus on sustainable heating solutions. The country's commitment to reducing carbon emissions and its leadership in engineering and innovation further contribute to its dominant position in the European unit heater market.

In the Asia-Pacific region, China emerges as the highest revenue generator for unit heaters. The rapid industrialization, urbanization, and growth in commercial infrastructure in China drive the demand for unit heaters. Additionally, the country's cold climate in several regions necessitates the adoption of effective heating solutions, further bolstering the market.

In Latin America, Brazil holds the maximum share in the unit heater market size by country. Brazil's diverse climate, with cooler temperatures in the south, contributes to the demand for heating solutions. The country's growing industrial sector, along with increased investments in commercial and residential infrastructure, supports the market's expansion.

In the Middle East and Africa (MEA) region, Africa stands out as the highest revenue generator. Despite the continent's generally warm climate, certain areas experience cooler temperatures, requiring heating solutions. The market in Africa benefits from ongoing developments in commercial and industrial sectors, coupled with a growing emphasis on improving indoor air quality and comfort.

Top Impacting Factors

The unit heater market is significantly influenced by a range of factors, among which energy efficiency and technological innovation serve as major drivers. Increasing emphasis on energy-efficient solutions has spurred demand for advanced unit heaters capable of reducing operational costs and environmental impact. Simultaneously, technological advancements, such as IoT integration for smarter control and monitoring, enhance product appeal and functionality. However, the market's expansion is somewhat hindered by the high upfront costs associated with the installation of modern unit heaters, posing a restraint, especially for budget-conscious consumers. Nevertheless, the rising trend of retrofitting older buildings with energy-efficient heating systems presents a lucrative unit heater market opportunity, as this sector demands modern, efficient, and easily integrated heating solutions to replace or upgrade existing infrastructure.

Competitive Analysis

The unit heater market analysis report highlights the highly competitive nature of the unit heater market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing unit heater market demands. The competitive environment in this market is expected to increase as product launches and product expansion kind of strategies adopted by key vendors increase. Competitive analysis and profiles of the major unit heater unit heater companies that have been provided in the report include Modine Manufacturing Company, Reznor, Lennox International Inc., Trane Technologies, Sterling HVAC, Johnson Controls, Marley Engineered Products, King Electric, TPI Corporation, and Qingdao Haier Special Vehicles Co., Ltd.

Recent Developments in the Unit Heater Industry

According to the latest unit heater market overview, Reznor leads the unit heater market share by company, followed closely by Modine Manufacturing Company, Trane Technologies, Lennox International Inc., and Johnson Controls, respectively. The leading companies are adopting strategies such as product launch and product expansion to strengthen their market position.

In October 2023, Modine launched the Amp Dawg™, an electric heater unit for residential use designed for efficient, quiet heating in compact spaces like garages and workshops. This heater features quiet operation, exceptional heat throw, and a slim design, expanding Modine's electric heating product range. The Amp Dawg™ is available in 5.7kW and 9.0kW units and is designed for easy installation and compatibility with low-voltage smart thermostats.

In November 2022, Nortek Global HVAC introduced three new sizes of the Reznor® UEZ condensing gas-fired unit heater, offering 55, 85, and 110 MBH capacities with an impressive 93% fuel efficiency. These models are meticulously designed for both robust industrial/commercial applications and residential non-living spaces, significantly enhancing cost-effectiveness, sustainability, and occupant comfort through advanced heating technology.

Key Benefits for Stakeholders

- The unit heater market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the unit heater market from 2022 to 2032 to identify the prevailing unit heater market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the unit heater market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- · The report includes the analysis of the regional as well as global unit heater market trends, key players, market segments, application areas, and market growth strategies.

Unit Heater Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.7 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 312 |

| By Types |

|

| By Installation |

|

| By Application |

|

| By Region |

|

| Key Market Players | Marley Engineered Products LLC, King Electrical Manufacturing Company, Inc., Modine Manufacturing Company, Inc., Lennox International Inc., TPI Corporation, Qingdao Haier Special Vehicles Co., Ltd., Sterling HVAC, Johnson Controls International plc, Reznor, Trane Technologies plc |

Analyst Review

A unit heater is a standalone heating appliance designed to warm a specific area or room, commonly utilized in commercial, industrial, and residential settings. These heaters can operate on various energy sources, including electricity, natural gas, propane, or oil, and are prized for their efficiency and ease of installation in spaces ranging from garages and workshops to warehouses.

One notable trend in the unit heater market is the increasing integration of smart technology. Modern unit heaters are becoming equipped with connectivity features that allow for remote control, energy consumption monitoring, and integration with building management systems. This trend reflects a broader movement towards smart buildings and energy management practices.

The primary driver behind the growth of the unit heater market is the escalating demand for energy-efficient heating solutions. As energy costs rise and environmental awareness grows, consumers and businesses are seeking heating options that minimize energy consumption and reduce operational expenses. This has led to a surge in the adoption of high-efficiency unit heaters, particularly those certified for their energy-saving capabilities.

However, the market faces a significant restraint due to the high initial cost of these advanced unit heaters. The upfront investment required for energy-efficient or smart heaters can deter price-sensitive consumers, despite the potential for long-term savings on energy bills.

An emerging opportunity within the unit heater market lies in the expansion into residential applications. Traditionally focused on commercial and industrial settings, the market is now seeing growth in the residential sector as homeowners seek efficient, convenient heating solutions for garages, basements, and outdoor spaces. This trend is facilitated by the development of unit heaters that are not only effective but also aesthetically pleasing and easy to install.

North America stands out as the leading region in the unit heater market, driven by its extensive industrial and commercial infrastructure, a wide range of climatic conditions necessitating reliable heating solutions, and a strong emphasis on energy efficiency and sustainability. The region's robust market is further supported by stringent regulations and incentives for the adoption of energy-efficient technologies, ensuring its continued dominance in the global landscape.

The industry size of Unit Heater is estimated to be $4,038.0 million in 2022.

The Unit Heater Market is expected to grow at a CAGR of 5.2% during the period of 2023 to 2032.

North America is the largest regional market for Unit Heaters

The leading application of the Unit Heater Market is in the commercial sector.

The top companies holding significant market share in the unit heater market include User Reznor, Modine Manufacturing Company, Trane Technologies, Lennox International Inc., and Johnson Controls.

Loading Table Of Content...

Loading Research Methodology...