Unmanned Ground Vehicle Market Research, 2030

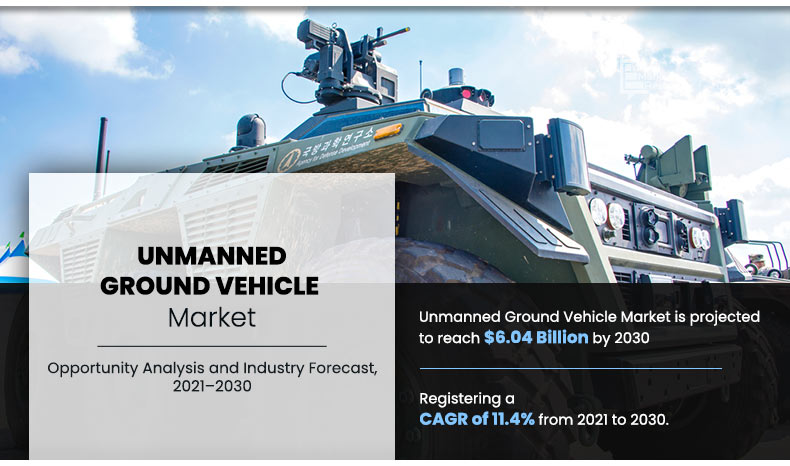

The unmanned ground vehicle market size was valued at $2.12 billion in 2020, and is projected to reach $6.04 billion in 2030, registering a CAGR of 11.4%. The unmanned ground vehicle (UGV) is a mechanical machine that moves along the surface of the ground with a purpose to carry or transport things. In addition, it can be employed in a variety of applications where the presence of a human operator would be inconvenient, dangerous, or impossible. UGV provides a flexible robotic platform along with providing multipurpose mobility support.

The major applications of these vehicles are in the defense sector, which include providing surveillance information, carrying supplies, and assists in explosive activation. Moreover, UGVs are used for civilian applications such as nuclear plant operations, urban research & rescue, agricultural harvesting & spraying, firefighting, and crowd control.

Reduction in risk of human lives and impressive vehicle combat performance in civilian applications, which includes homeland security and commercial purpose are the major market driver for the unmanned ground vehicle market. However, reduction in defense budgets by developed countries, issues related to reliability & bandwidth, and restricted battery life of vehicles are the restraints for the unmanned ground vehicle market. On the contrary, increase in operational efficiency and demand for autonomous control systems are some of the lucrative market opportunities for the growth of unmanned ground vehicle market.

By Application

Commercial is projected as the most lucrative segment

The unmanned ground vehicle market is segmented on the basis of application, size, mode of locomotion, operation, and region. Depending on application, it is categorized into defense and commercial. By size, it is categorized into small, medium, and heavy. By the mode of locomotion, it is classified into tracked, wheeled, and legged. According to operation, it is bifurcated into teleoperated and automated. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include Armtrac Inc., Autonomous Solutions Inc. (ASI), Clearpath Robotics Inc., DOK-ING Ltd., General Dynamics Corporation, GESAR INC., Horiba Mira Ltd., ICOR Technology, Northrop Grumman Corporation, and Teledyne FLIR LLC.

By Size

Heavy is projected as the most lucrative segments

Reduction In Risk Of Human Life

The major use of the UGV is in the defense sector, as these machines can be remotely operated and sent ahead of the army platoon to examine the terrain. This technology allows to spot the enemy targets, thus neutralizing them. In addition, UGVs are used to detect explosives and detonate them, thereby reducing the chances of human casualty and increasing mission performance.

Moreover, autonomous UGVs are commonly used in tough terrains, places with harsh weather conditions, or areas that are inaccessible to humans. In such environments, the usage of these UGVs eliminate the possibility of harm to defensive troops. Thus, most countries are increasing the development & usage of UGVs at the battlefields. For instance, in November 2021, Turkey’s defense announced the mass production of lightweight, medium-class, and heavy-class UGVs.

Increase In Demand For Unmanned Ground Vehicles In Civilian Applications

Civilian operations include home usage and rescue operations. Home usage includes cleaning floors and harvesting crops. UGVs are used in rescue operations such as in case of a disaster. Moreover, the perimeter and border security needs have increased the demand for civilian applications. Furthermore, during search and rescue efforts, autonomous UGVs are utilized to identify people and assess disaster damage.

By Mode Of Locomotion

Legged is projected as the most lucrative segments

Humans can be poisoned by the environment, such as exposure to dangerous substances and radioactive radiation during certain calamities. Such risky situations are successfully addressed with the assistance of autonomous UGVs, which enable the rapid location of victims, rapid assessment of losses, and prompt operations in the affected areas without jeopardizing human safety.

Restricted Battery Life Of Vehicles

unmanned ground vehicles contain multiple power sources such as a battery, fuel-cell, or ultra-capacitor but most of the UGVs are battery-powered. unmanned ground vehicle features a restricted battery life making it a major restraining factor for the market. UGVs are required and equipped with all other components of any vehicle system. In addition, according to applications, sensors, propulsion system, and communication system include tether cable, line-of-sight radio, multihop links, low-bandwidth, or non-line-of-sight radio mounted on UGVs that make the vehicle weight-sensitive, which makes the battery of the vehicle more exhaustive. However, increase in R&D of advanced battery chemistries such as lithium-ion will help to improve the battery life of UGVs in future.

By Operation

Autonomous is projected as the most lucrative segments

Demand For Autonomous Control Systems

The autonomous control system is the one that operates without a human controller, it uses sensors to perform the tasks. Fully autonomous unmanned ground vehicle with artificial intelligence and the ability to carry out operations with minimal human interaction are being developed across the globe. It assists in safety and efficiency of applications ranging from transportation to warfare, which provide opportunities to the market.

In addition, the use of autonomous unmanned ground vehicle by arm forces is expected to enhance their combat capabilities. Moreover, R&D operations are being carried out to innovate or develop autonomous unmanned defense systems & vehicles to improve the safety of forces on the battlefield.

For instance, in January 2022, Defense Advanced Research Projects Agency (DARPA) announced to conduct Robotic Autonomy in Complex Environments with Resiliency (RACER) off-road unmanned ground vehicle program with the goal to develop and demonstrate the ability of autonomous platforms to travel at the speed that maintain pace with crewed vehicles in complex terrain

In addition, in September 2021, Russia’s equivalent of DARPA, the Foundation for Advanced Studies (FPI) developed marker unmanned ground vehicle. Marker unmanned ground vehicle is a Russian combat robot patrolling without human assistance, navigating its way across a 100-kilometer route, and working with a swarm of drones.

By Region

Asia-Pacific would exhibit the highest CAGR of 13.85% during 2021-2030.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global unmanned ground vehicle market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the global unmanned ground vehicle market with a detailed impact analysis.

- The current unmanned ground vehicle market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers in the industry.

Unmanned Ground Vehicle Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Size |

|

| By Mode of Locomotion |

|

| By Operation |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The global unmanned ground vehicle (UGV) market is projected to witness considerable growth, especially in Asia-Pacific and LAMEA, owing to factors such as the reduction in risk to human life and increase in demand in civilian applications.

UGV has wide applications in the defense sector. These are referred to as future as future combat systems for military purposes. For instance, in March 2020, the U.S. Army ordered more than 180 Centaur UGV from Teledyne FLIR LLC. In addition, in November 2020 and May 2021, the U.S. Army ordered FLIR Centaur UGV worth $32 million and $70 million, respectively, from Teledyne FLIR LLC. There are various programs taken up by the defense forces, such as Robotic Follower Advanced Technology, which deals in UGV systems that are capable of following a manned lead vehicle. Moreover, other programs include joint robotic programs, such as man-portable UGVs to support light forces and special operations missions, focusing on reconnaissance during military operations in urban terrain.

The key players tend to spend heavily on R&D for product developments in the UGV market. For instance, in November 2020, ICOR Technology launched newest CALIBER Flex. The Flex has become the fifth member of the CALIBER family of high-quality, innovative, and cost-effective ICOR robot UGVs for bomb disposal missions.

The UGV market is segmented on the basis of application, size, mode of locomotion, operation, and region. Depending on application, it is categorized into defense and commercial. By size, it is categorized into small, medium, and heavy. By the mode of locomotion, it is classified into tracked, wheeled, and legged. According to operation, it is bifurcated into teleoperated and automated. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global unmanned ground vehicle market valued at $2.12 billion in 2020, and is projected to reach $6.04 billion by 2030, registering a CAGR of 11.4% between 2021 and 2030

The global unmanned ground vehicle market to registering a CAGR of 11.4% between 2021 and 2030.

Region wise, Asia-Pacific is anticipated to register the highest CAGR during the forecast period.

Reduction in risk of human lives and impressive vehicle combat performance in civilian applications, which includes homeland security and commercial purpose are the major market driver for the unmanned ground vehicle market.

The leading companies operating in the unmanned ground vehicle market are Autonomous Solutions Inc., DOK-ING Ltd., Teledyne FLIR LLC, and Clearpath Robotics Inc.

Loading Table Of Content...